Charts & Notes: Themes are good, narratives are not

Projecting your own world view on market moves isn't good analysis

Very little to report on relating to actual economics and the business cycle, but what’s new?

Trump’s ongoing prodding of Chair Powell will have the exact effect that Dario points out above, so it clearly emboldens him, and yesterday’s non-farm payrolls print will make that job even easier.

Trump’s methods shouldn’t be a surprise as he was always the man to say what every politician before him thought - why are we paying so much interest? Those that have faith in the central banker and their divine mandate will be shocked of course, but not everyone does.

Of more significance is the combined messaging that Treasury would issue more short-term debt to reduce interest costs while waiting for the Fed to lower rates.

I wrote a thread above on this. Short story is that this will be more pressure on curve steepening, but any ill effects from overheating depend on what the government does with that increased fiscal space. If it results in the primary deficit increasing (as interest costs decrease) then it will result in more stimulus.

The extremely strong narrative in markets now is the whole idea of bond market punishment for fiscal irresponsibility.

I’ve spoken about this before. The “Truss moment” had little to do with fiscal issues and more to do with market structure and regulation interfering with liquidity and causing forced selling.

This has been brought up because of a 15bp sell-off in Gilts this week which captured attention, purely because of the narrative the move was attached to. Those sorts of moves aren’t uncommon.

It also only seems to affect the UK. The divergence in UK and Italian yields suggests that if the narrative exists, it is super selective (or everyone believes the ECB will buy anything it needs to).

Speaking of Italy, unemployment picked up quite a bit and has diverged from Spain.

SLR update

I’ve spoken about changes to the Supplementary Leverage Ratio (SLR) should provide a bullish boost to bonds. The Fed’s analysis of its own proposals sees it resulting in an increase of capacity to buy from $1trn to $2trn, depending on the institution.

General consensus is that the move (in yields and spreads) is baked in already though, so what do I know?

Weekly tariff update

Mainstream media hasn’t been doing a great job of following what’s been going on with negotiations. Luckily Citi provides the below handy table.

Vietnam negotiations are ongoing but seem to be making some progress.

According to Trump, a 20% tariff rate will be placed on “any and all goods” from Vietnam to the US, with a 40% tariff rate on “any transhipping”. While this is lower than the 46% reciprocal tariff announced on Liberation Day, it is still higher than pre-Trump 2.0.

In return, Vietnam seems to have committed to opening up its markets to US imports, with Trump’s social media post saying that there will be “total access” and “zero tariffs” by Vietnam including on Large Engine Vehicles.

Reporting by Bloomberg News just before Trump’s announcement suggested that tariffs will be scaled on Vietnam’s exports depending on the proportion of foreign content, with exports to the US containing the highest proportion of foreign components charged around 20% or above. Meanwhile, according to the news article, products containing a lower percentage of foreign components would face a slightly reduced rate, while those entirely from Vietnam would face the lowest rate potentially the universal 10% levy (for instance agriculture products).

EU negotiations seem to be moving along as well, with (reportedly) the first concessions being readied to avoid the July 9 deadline. Something is happening, at least.

Morgan Stanley is tracking reshoring announcements and things seem to be looking up, with more potential once everyone actually finds out what the resultant tariffs and policy will be.

The USD

Bond yields and currency are the two markets where there is a doom narrative if they do anything but stay at exactly the same level.

The fall in the USD is causing some ongoing concern. From where I sit it is driven mainly by two things:

Interest rate contraction with the RoW

People actually hedging their USD longs

While I disagree with the GDP forecasts above (the US will continue to grow faster than nearly everybody else), yield spreads have still contracted.

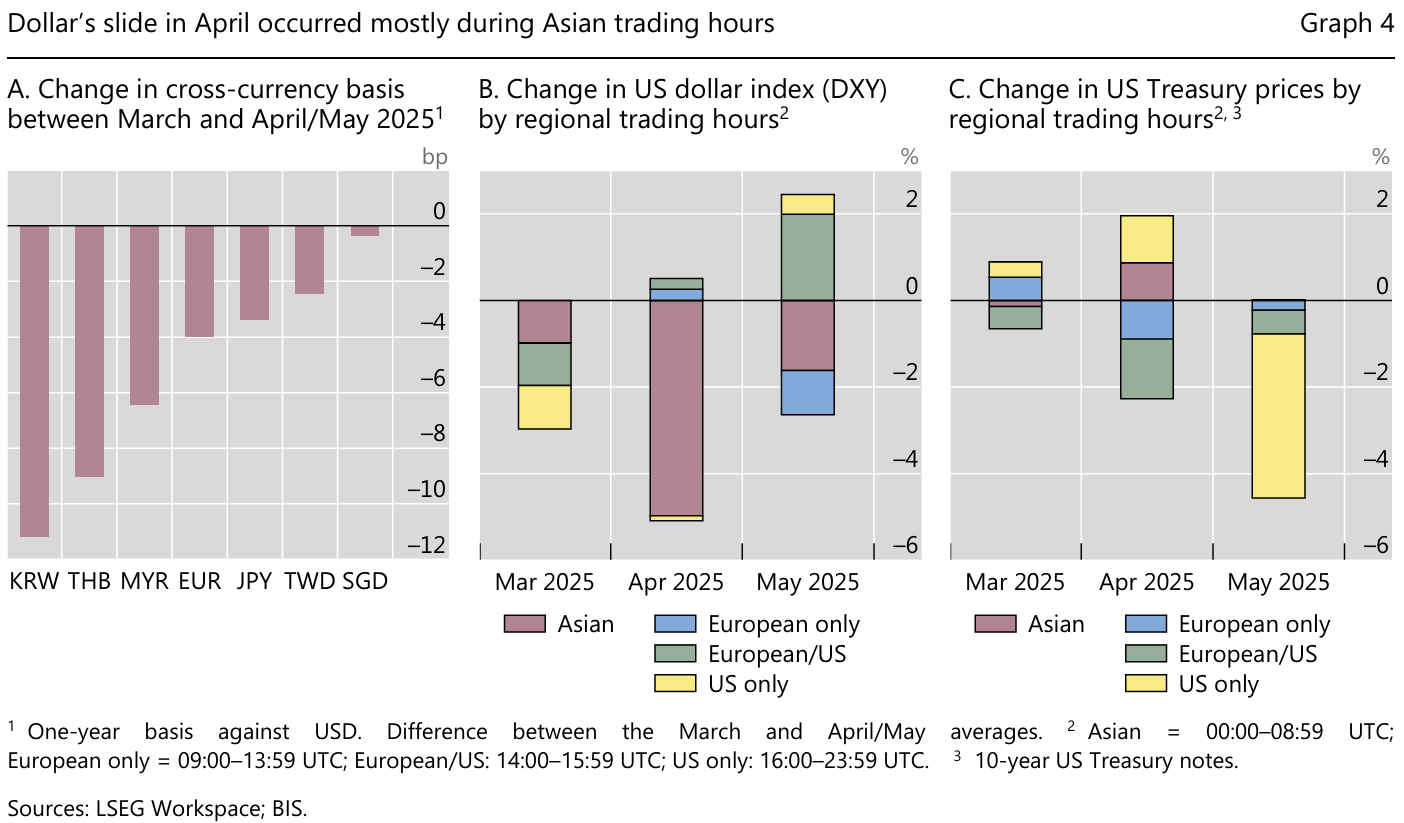

Hedging has been the other big story. A reader sent a review by the BIS entitled “US dollar's slide in April 2025: the role of FX hedging” proving the point, with the biggest effect out of Asia.

There still is plenty of unhedged USD lying around, as you’d expect. Maybe it was the case of a USD being too high previously than one too low now.

A lower USD is good for the aims of the US…

…and not as good for others.

To fully fix the issue a much bigger move will be required.

Chinese “supply side reform”

My last long-form piece considered how tariffs are a way for the US to close their capital account and compete with China on a level playing field.

A big part of this reasoning was the belief that China wasn’t engaging in global trade on an honest basis by subsidising manufacturing to make it appear like it had comparative advantage.

From that piece:

It is almost impossible to tell whether the low price a US consumer purchases goods from China is due to genuine comparative advantage or because the manufacturing capacity that was built to manufacture that good doesn’t need a positive return on capital.

Citi put out research this week asking for “supply side reform” (rolling eyes emoji) as a way for China to get out of “prolonged industrial deflation”. Citi suggests that recent comments by President Xi are leading to Supply Side Reform 2.0, with the first occurring at the last example of significant concern for China’s economy (2015), which has led to a larger and larger export sector. More on the 2015 episode in the newsletter below.

While this is all superficially correct, it misses the reason for why China is in this position to begin with and is bound to fail as the export sector is all China has left now to persist with near 5% growth rates.

Anyway, onto the charts…

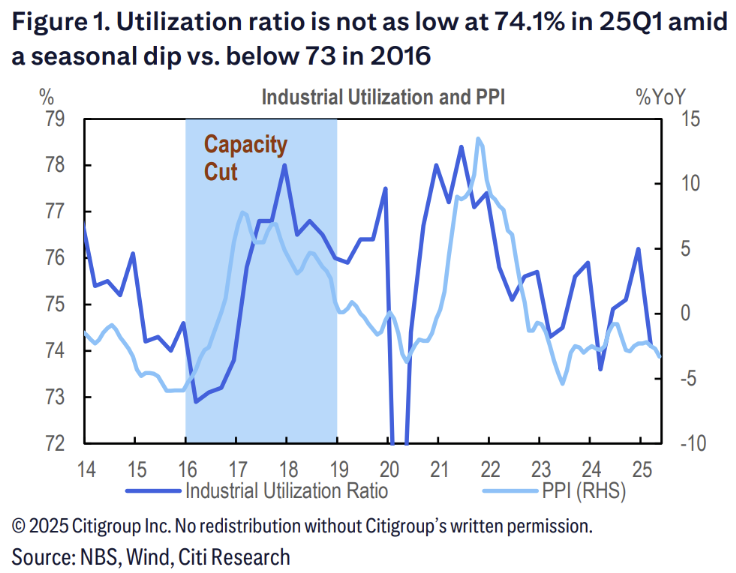

Citi notes the environment isn’t as bad as in 2015/16. The Chinese likely realise that stimulus will have a much smaller effect now, so it has to start on reforms earlier.

Steel and steel-related pricing is also not ringing alarm bells like in 2015 either.

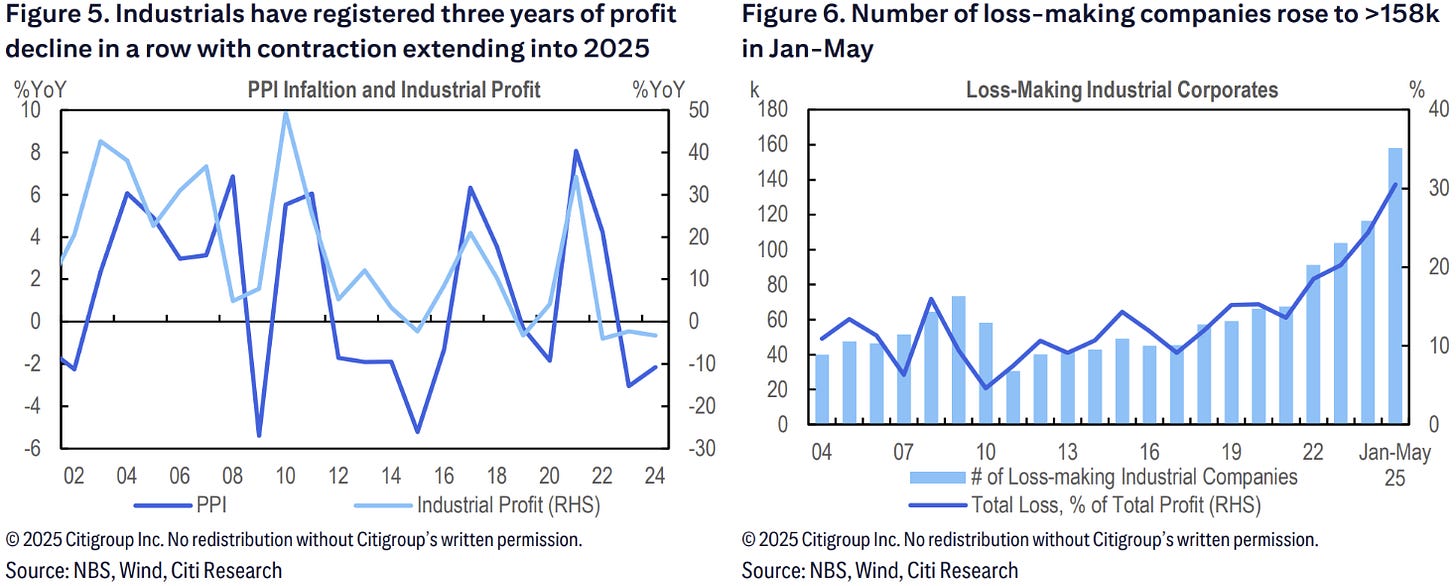

This is really the key chart. Profit declines have persisted for 3 years, while the number of loss-making corporates has climbed to 35% of the total.

Industrial production has continued to growth at above 5% annually. Is it to be expected that this is an environment in which profit is under pressure? Or is it evidence that more firms are buying global market share?

EV is the most visible, and the price discounts against western competitors are large. From Reuters:

The chart representation of that article.

A step back from autos is battery output and CATL has been dominating here.

On an absolute basis, profit margins are lower than pre-pandemic (despite the huge market share win) and its hurting tax revenues.

Bulls point to a better consumer…

… but when it comes to short-term economic performance, trade-in subsidies are quite popular and doing well. Retail sales should continue to do well as highlighted in last week’s Charts & Notes.

Gold is quiet, let’s talk gold

China gold ETFs now hold over 200 tons of gold, or about 6% of global ETFs.

While I’ve pointed out China’s investor gold demand before, this chart above is new. The SGE is challenging COMEX for traded volume!

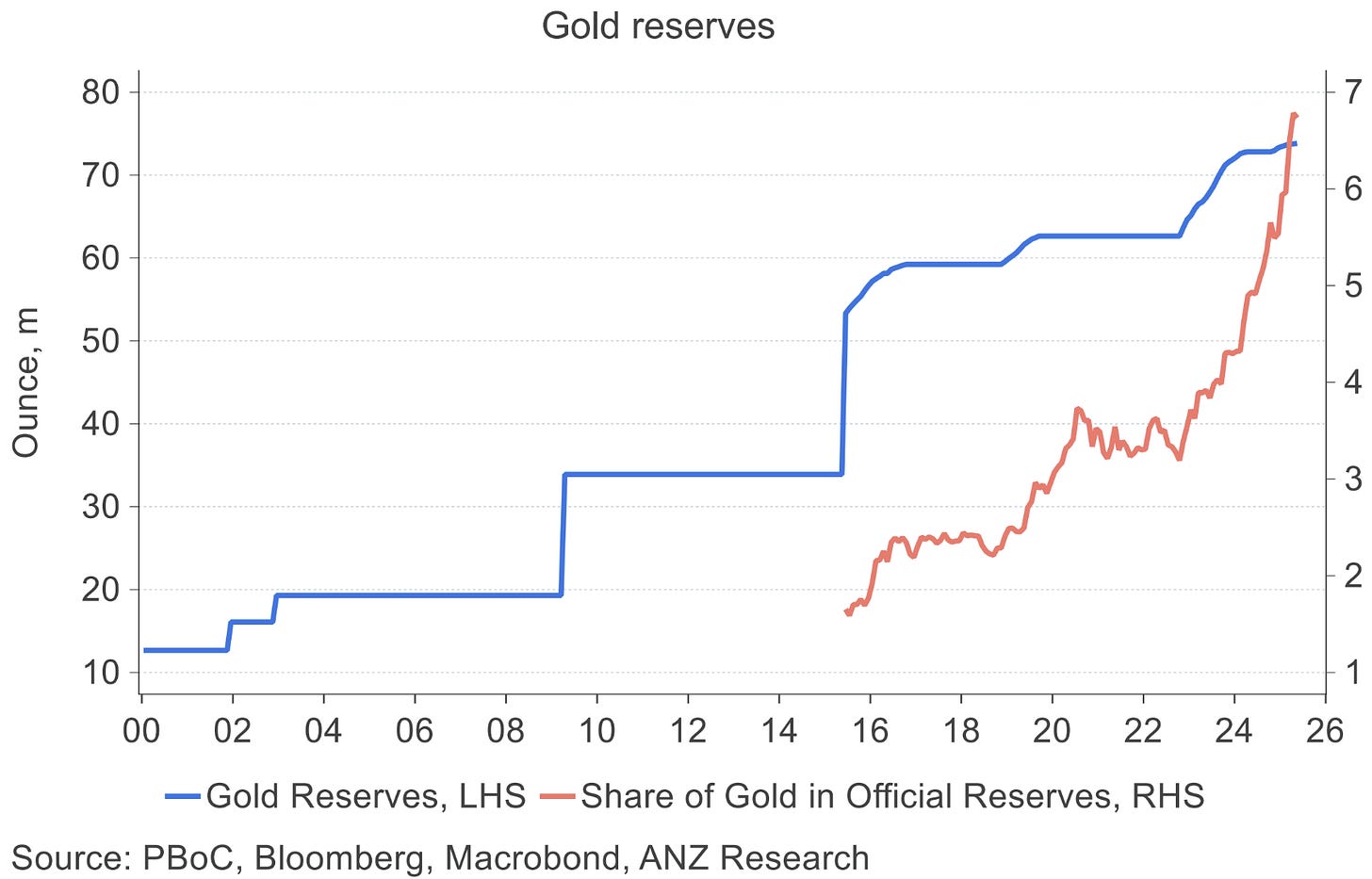

I’ve concentrated on ETFs, but official reserves also started picking up around the time of the start of the gold rally in around 2023.

HSBC did a bigger fundamental piece on gold.

Also aligned with government debt. But you could really put any line that goes up and to the right alongside that one!

"Here against real rates which many forget are lower than they were during ZIRP."

The chart is inverted, no?

I guess judging by the picture everything is just the opposite. "HSBC did a bigger fundamental piece on gold. Here against real rates which many forget are lower than they were during ZIRP."