Mutually Assured Economic Destruction

The Cold War, with Chinese characteristics

Thanks to Jack Marinovic for his help on this piece, specifically with research on the Cold War and the economics of the USSR!

In 1961, the Soviet Union detonated the Tsar Bomba, by far the most powerful nuclear device ever detonated.

The size of the device was effective for propaganda. The US then adopted a policy of deterrence through “Mutually Assured Destruction (MAD)”, countering the expected growth in Soviet nuclear devices with a huge stockpile itself.

Despite eventually winning a war that lasted for 44 years, the US were forced to compete due to the effectiveness of the USSR’s economic growth and propaganda model which were enabled by its closed command economy.

The US and China have been tied in a similar economic cold war since around 2015, the date when Chinese policy turned away from the goal of being a more open player in global markets.

It was at this time that Chinese policy shunned any possibility of recession by accelerating state-sponsored debt to build property and infrastructure, and once these options failed, the plan turned to a double-down on debt to expand manufacturing capacity. Chinese supply-side expansion worked extremely well since the pandemic, growing outright exports strongly.

Importantly, the US participated in this dance. Instead of accepting recession, the US has chosen to expand the fiscal deficit and grew debt to pay for the economic drag that greater imports and less domestic production imparted. It may not have been a conscious decision, but at the macro level this link is crucial.

In an attempt to maintain the status quo of economic growth for both internal and external reasons, both countries are amassing warheads of economic destruction in the form of a growing unsustainable debt burden to persist with the status quo.

The fissile material can grow, but what is the trigger? Trump’s China tariffs are the big red button. Pressing the button deploys the ICBM which results in an instant volley back, lighting the fuse on both the US and Chinese debt piles.

What makes today’s economic war scarier than the Cold War is that while warheads which can be dismantled after de-escalation, the debt is here forever and just becomes a bigger problem until something is done, while imparting a heavy cost on both countries in the meantime.

Trump’s tariffs will trigger the recession that both sides have sought to avoid. Tariffs will lower consumption in the US which, in turn, will lower production in China, and both will certainly suffer recession.

The fact remains that doing anything to stop China producing more and the US consuming it ensures the Mutually Assured Destruction of both the Chinese and US economies.

Once the warheads fall, the winner will be the one that can climb out of nuclear winter the fastest and reclaim the remaining aggregate demand for manufacturing left from the ashes.

Open vs closed

I believe that free and open markets are better for the human civilisation in the long-run, and while the US embraces this mantra imperfectly, it certainly does more than China.

If you disagree and think China’s closed command economy is a better way to do things, then try to view my arguments from this lens. I will make the point that the command economy has certain advantages, especially in this current battle started by tariffs that China is most certainly winning.

The economic dance that the two behemoths are tied in are due to the ease by which the command economy system can exploit the weaknesses of the free market system. The US, bound by profit and consumption maximisation as a result of the free market system, is being walked around by China like a dog on a leash.

Any attempt by the dog to escape the leash risks it being run over by a car; such is the economic cost for either the US or China from breaking the current system.

How did it get to the point where the tariff man had to hold up his tariff sign showing everyone his tariffs?

Exploiting the weaknesses of the free market

China has learned the pitfalls of the free market well and has perfected its responses to volatility in its own domestic markets over the last 15 years by making most of them closed and controlled.

There was a time in the early 2010s where western markets would be on edge as Chinese money markets showed instability. When was the last time this happened?

China has also learned how to exploit the flaws of the free markets of the west for its own benefit. It has used these learnings effectively to make up for falling consumer aggregate demand at home by:

Building masses of infrastructure with debt issued by the state or state aligned entities;

“Extracting” further demand externally, mostly from the US.

China can persistently “extract” demand externally because of its size and its closed nature. An open economy could do this for a while but cannot do so indefinitely as the market would rebalance to correct it, with the primary avenue being a move in exchange rates that makes exports more expensive in foreign currency.

What are the “flaws” of the free market, and how does China exploit them? Since free markets and capitalism go hand-in-hand, the exploitable attributes exist in both.

Capitalism is a system where profit is maximised in the short-term through the provision of goods and services where demand is present.

Maximising profit is not only the job of the corporate entity, as it optimises the relationship between volume and price. It is also done at the consumer, or household, level.

The consumer will maximise utility per dollar spend, to get the most amount of “consumption” they can for the least cost.

An entire free market economy will rebalance around these desires as each independent actor in maximises its own profit or consumption function.

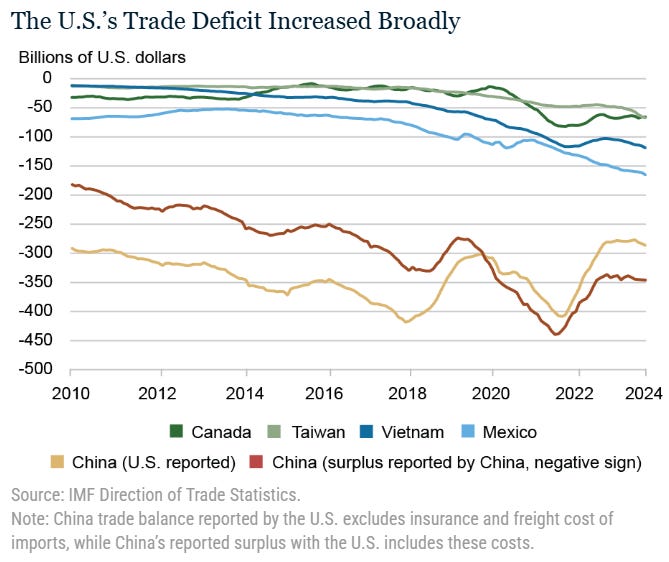

The bilateral trade deficit between the US and China has increased since 2000 purely from these two exploitable attributes. This trend has accelerated rapidly since the pandemic as China’s internal methods of demand creation - building infrastructure and property - have stalled.

China has managed to take advantage of these maximisation functions partially through genuine comparative advantages, and partially through debt-funded investment expanding capacity and acting as a subsidy in a way that essentially just “buys” global export market share.

It is almost impossible to tell whether the low price a US consumer purchases goods from China is due to genuine comparative advantage or because the manufacturing capacity that was built to manufacture that good doesn’t need a positive return on capital.

The latter is the prominent feature of closed markets. Closed markets mean that there a fewer pressure points on an asset to prove itself to have to deliver a market rate of return on the investment used to create it.

When the system is closed and financial consequences are put off indefinitely, an uneconomic activity is allowed to persist and those in free markets will find it difficult (or impossible) to compete.

Buying market share in this way can be very profitable in the long-term if you become the monopoly provider, of course1. The monopoly is one of the main reasons capitalist economies have governments which limit pure capitalism.

A government can police this within its own borders, but this is much more difficult to do when the monopolistic impulse comes from a foreign power.

Tariffs are one of the few solutions that a free-market government can offset these exploits, in the same way as anti-trust law helps to dismantle monopoly industries. There are other ways a government could do this, which I go through below, but essentially all valid paths result in the same two outcomes:

A less free market;

Recession for both the importer and the exporter.

This isn’t the first time in history a free market has found itself under assault. What makes the US/China battle so ferocious is that previous matchups have never been so large in size or equal in capability.

The Cold War

Both the size factor and capability factor are equally as important when comparing the US versus China economic war to similar episodes in the past.

The Cold War was fought just as much economically as it was militarily. The economic war had similarities to what we see now. The USSR, with a closed capital account, invested heavily in the development of technologies and industries at home, growing swiftly and matching the US for big technological developments over that time including most famously getting to space first, something which focused American interests in deploying the same tactics to ensure that it wasn’t beaten by the USSR in the space race.

Militarily the race was both about absolute size of the military, technology, and their respective stocks of ICBM’s and nuclear warheads. Estimates are that the USSR spent 15% of GDP on their military versus the US at 5%. Khrushchev famously boasted during the 50s and 60s about how much further ahead the Russians were ahead of the US in reference to missiles (a boast that didn’t end up being true with the benefit of hindsight).

Economic boasts were also common and worked well as an estimate of real activity was almost impossible to impute. Official statistics put the USSR economy at three-quarters the size of the US economy at its largest, something that is tough to believe today. Obviously, the USSR covered a much larger land mass and had a higher population than modern-day Russia, with total population size matched closely between the two powers.

The propaganda coupled with opaque reporting convinced many in the west that the USSR was accelerating or had overtaken the US in several categories.

The West’s perception

You don’t have to look far to find some heated disagreements around the current application of tariffs. Most of the arguments dismissing their use revolve around the view that tariffs are always bad policy and that China is operating as a reliable actor and is being honest in its interactions with the rest of the world. Its system is just better, people argue.

These arguments assume that China approaches global trade in the same way the US does, and its closed capital account offers no advantage.

Certainly, the same argument was applied to the USSR. The (perceived) economic and military superiority that came from the closed and commanded nature of these systems were seen as superior to the western world by many economists.

On economics, Paul A. Samuelson (advisor to JFK and LBJ) wrote Economics, An Introductory Analysis in 1948, which remained a major Economics textbook for ~50 years.

Printed in the 7th edition of Economics (1961):

The Soviet economy is growing at a rate of 2 to 3 times that of the U.S. If this trend continues, then the USSR will surpass the U.S. in per capita output within a few decades.

These viewpoints, even if they are from Nobel prize winning economists like Samuelson, revealed bias in their analysis as these pro-Soviet viewpoints carried on even close to the collapse of the Soviet Union. From Larry White, quoted by Don Boudreaux on Samuelson:

As late as the 1989 edition [of his textbook, Paul Samuelson] and coauthor William Nordhaus wrote: “The Soviet economy is proof that, contrary to what many skeptics had earlier believed, a socialist command economy can function and even thrive.”

Joan Robinson, who coined the phrase “monopsony” in her 1933 book The Economics of Imperfect Competition, wrote Contributions to Modern Economics, in which she praised centrally governed economies:

It is a popular error that bureaucracy is less flexible than private enterprise. It may be so in detail, but when large scale adaptations have to be made, central control is far more flexible. It may take two months to get an answer to a letter from a government department, but it takes twenty years for an industry under private enterprise to readjust itself to a fall in demand

George F Kennan was a US diplomat who served as ambassador to the USSR. In July 1947, he published an article (The Sources of Soviet conduct) under a pseudonym in Foreign Affairs where he laid out the US strategy of containment.

The Soviet system is an effective and efficient form of government, able to make rapid decisions and marshal its resources. The Western democracies face a long struggle, not one that will be won easily.

Whilst correct about the “long struggle” of the Cold War, it is interesting to note how despite his acclaimed understanding of the inner workings of the Soviet State, Kennan failed to account for the systemic failures of the Soviet political system and bureaucracy, which slowly eroded away at the nation’s structure until its collapse.

There were others who recognised the Soviet military superiority but criticised the choice of the diplomatic approach over a more assertive one.

Defending the West by Winston S. Churchill (junior) expressed this view, and it is likely he would be a proponent of tariffs in the modern world.

Churchill appreciated the superiority of the USSR’s military build-up, and bemoaned the policy of “détente”, including the misjudgement by Jimmy Carter about the Soviet ambitions and the constant desire for Europe to approach tensions with diplomacy. How history repeats itself!

Beyond military metrics, Churchill Jr. believed the West lacked the resolve to confront Soviet aggression. He saw the US as weakened by internal divisions (post-Vietnam War malaise, economic struggles, and the Iran hostage crisis) and criticized European allies for their reluctance to increase defence spending. How history repeats itself!

A centrally planned economy worked extremely well to foster these external beliefs, bolstered by decades of uninterrupted economic growth. In the end, economic reality will always bite no matter how much you try to control around it.

Opinions on why the USSR fell differ, but I prefer the most boring one - the simple depreciation of physical and human capital.

Building industrial and military capacity by spending self-created money to grow GDP is the easy part. Maintaining those assets as they get larger in number and then deteriorate gets progressively more difficult and expensive as time passes. The effort required by human capital increases as well, which is even more difficult when the government’s supply chain focus is for guns over grain.

Depreciation becomes an exponentially growing problem as more and more capital is dumped into assets that aren’t economically value additive.

The Chernobyl disaster signalled that this deterioration in asset maintenance had already advanced to a state destroying level. It wasn’t long after this happened that the USSR was no longer, with Gorbachev’s perestroika directly addressing military spending to demilitarise and end the game of doubling down.

The Cold War: Rebooted

The parallels between the Soviet conflict and the modern Chinese version are unmissable. The control over the capital account and thus their currency is a necessary condition for a command economy to exist. Both the USSR and China were able to build vast infrastructure and industry to supply themselves internally and to grow the economy to hit production targets.

However, despite its closed capital account, China is not closed off from the world like the USSR was. Since 2001, China has been a member of the WTO and has risen to take the title of the world’s largest exporter of manufactured goods.

Contrast this with the USSR. It was closed off from the world and was left with little ability to import technologically superior items from the West with the only supply of hard currency from the sale of oil.

China, on the other hand, imports what it needs and eventually reproduces it locally, amassing huge reserves of foreign currency while still being self-sufficient.

Local industry in China is wide reaching and world-class, unlike the Soviet comparison. This leaves the country much more self-sufficient than the USSR could ever have been.

China has partially managed to pull this off by partnering with other countries rather than making the focus the military like the USSR did. The military really hasn’t been a focus of China up until recently.

Advantage also comes from a huge population advantage for China, at 1 billion people versus 330 million of the US. The USSR and the US had around 250 million people a piece at the time they were head-to-head.

Prior to 2015 I believe China had the intention to get to the point where it was a more open economy on the world stage. Under President Xi however the intention has shifted and every move since has been to remain closed off. He has likely considered the financial risks and opening up magnifies those.

Global partnering and strong business ties through trade links and supply chains has meant that the likelihood of the West to oppose China is much weaker than it was for the USSR, especially in Europe. A united front against China won’t be easy for the US to achieve.

China is larger, more formidable, and smarter than the USSR ever was. The USSR relied on rudimentary propaganda without a plan to expand its command economy advantages by integrating with the rest of the world to pay for its large domestic investments. China doesn’t have such vulnerabilities, but even with them the Cold War managed to last more than 40 years.

Tariffs are turning the US into China

During the Cold War the US had no choice but to replicate the tactics of the USSR to at least seem like it wasn’t being outcompeted.

With the announcement of the initial >100% tariffs, Donald Trump is replicating the tactics of China by becoming a closed economy. Tariffs this large are effectively a way of closing the capital account of the US off to China, protecting itself from further exploitation.

Closing your capital account means that the US is moving more towards being a command economy and further away from being free. Free markets do not like this - it is against everything they try to “solve” for.

This manifested itself into April’s drawdown in equity and bond markets, and the temporary walk back on tariffs. Temporary is all it is, though.

For someone who is a believer in free markets this is obviously a bad thing. A closed capital account allows the government to participate in manipulating prices to achieve the outcome that it wants.

Tariffs manipulate the price of imported goods. This is the entire point of course, being an override to free markets pricing to intentionally discourage consumption of goods that the government has deemed to be “bad for your country” in the same way they tax cigarettes or alcohol because they are “bad for your health”.

China’s closed capital account also allows it to manipulate prices, although not in such an obvious and direct way as tariffs do.

A closed capital account forces down the price of exports by allowing China to:

Run perpetually weak currency policy, reducing the foreign cost of manufactured goods;

Amass debt uncontested to continue with policy that results in supply-side expansion.

The second point is slightly more nuanced. A closed capital account helps with debt accumulation as locals can’t shift their capital offshore which removes the main vector for instability. Losses can be papered over while deposits remain in the system.

Tariffs are the key to the lock that puts the US down the same path. Closing the capital account allows the US to fight on the same terms, for better or for worse.

If you support tariffs, you must simultaneously believe that the current path for the US is unwinnable and will cause great pain for her in the future.

The fissile debt pile grows

Pressing >100% China tariffs was equivalent to pushing the red button. Neither economy would have survived for long, but this was the point - flip the lifeboat and see who can swim.

The stakes between the US and the USSR were high at certain points, with the Cuban missile crisis likely being the peak.

Stepping back and de-escalating from nuclear brinksmanship can happen, and nuclear devices can be dismantled. Unfortunately, the same can’t be said for the build-up in fissile debt pile in this contest.

Tariffs are the big red button that ignite the debt pile that both sides have amassed. The US, in trying to maintain its consumption and thus quality of life, has accumulated debt to fund a trade deficit. China has amassed debt to ensure that they can grow exports and no global replacement for its manufactured goods can be found.

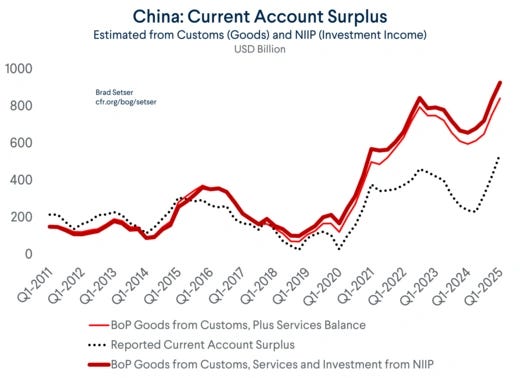

For China, the 2015 turning point is easy to pinpoint. Deficits started to increase, accelerating again as the Trump tariffs of his first term took effect.

Economic weakness prior to the announcement of tariffs driven by continuing weakness in property only set the stage for greater stimulus when they were dropped on the world.

Goldman Sachs forecasts the broad deficit expanding to 15% of GDP on the back of more stimulus promises. This is more than double the current extreme war-time sized US budget deficits.

This deficit at least makes some sense. With the leaky hole that is the trade deficit, domestic activity would fall unless something was propping up spending.

For China the rise in debt accumulation and deficits is much harder to square. Why is the world’s premier manufacturer of goods, on which there are supposedly good profits, and with full employment, borrowing more than anyone else in the world to keep the economy growing? It just doesn’t add up.

Mutually Assured Economic Destruction

An across-the-board tariff on goods from industries the US can’t reshore are a way to stop the free market from maximising utility and profit by shifting production to China. It is an intervention that makes the US markets less free than before.

In this way, the US is making itself into a China clone, replicating the tactics of China to try and compete with it. This should tell you all the need to know about the advantages and disadvantages of either system. In the Cold War the US only had to compete on propaganda and size of the nuclear arsenal, but to protect itself, it had to compete.

In this war, the US is fighting the battle of trying to shift production away from China to compete by starting its own widespread form of price controls to repel the advantages offered by China’s closed system.

Both sides will accelerate debt to put off any economic weakness as the head-to-head intensifies. The politics, similar to the sabre rattling of the Cold War, won’t allow it to be any other way.

This occurs in open markets as well. Companies with near unlimited VC funding can “buy” market share by pricing a good or service under the marginal cost of production, wearing losses until scale is achieved and pricing power is earned.

Great post Peter. Especially noteworthy section on the economics profession’s perennial infatuation with and marriage to socialist command and control economics, and monetary policy. Makes one think again of all that has been gained and lost forever since 2008– great monetary crisis. As to China’s debt pile funded economic growth model you note “It just doesn’t add up”, yet the problem on both sides is that — It Does Add Up ! :) Exhibit A 36 Trillion US debt pile. Questions remain as to where and when the fissures may emerge triggering the cascade through and across markets inflated in price and leverage.

Looking closely at China over the last decade and a half, it seems very clear that the open economy model is vastly better for ordinary people excepting a relatively brief phase in developing economies when fiscal repression and industrial subsidy is the only way to produce durable comparative advantages beyond just "cheap labor," which historically is insufficient to attract capital and its know-how on its own.

Once that window closes, the only durable way to facilitate productive investment and enhance productivity is to closely align output to demand, which means curtailing fiscal repression, aligning infrastructure spending to the needs of the citizenry, transferring income to broad-based social programs in a progressive fashion...

But doing that in a world where major economic/security competitors do not, you cede a form of comparative advantage to them.

It would be better for the US and its developed-world allies to systemically decouple from China if it allowed them to maintain the open nature of their economies internally and in trade relationships with countries other than China, than to adopt the China playbook wholesale in their trade relations with everyone.

It's the only way to inoculate ourselves against being systemically deindustrialized and denuded of advanced services enterprises while not just embracing full autarky, and probably the only way to break the vicious cycle of debt accumulation.

That it would force the Party-state to completely reevaluate their own development strategy and finally invest in my friends and family at home instead of propping up negative ROIC enterprises to capture export market share... is just icing on the cake.