I keep a notebook of my charts and some I’ve found in research, and I thought why not share this more widely on Substack. I’ll aim to distribute weekly if the content is there.

The takes in here will be a lot spicier than in my long form pieces which I do when I really want to understand a macro topic (and tend to throw in a lot of education as well).

This will also be a forum to air my trading frustrations. With that, we start with European equities.

European Equities

The DAX has put on an astounding performance so far this month, clocking one of the best months ever outside of a drawdown recovery (actually after 2 ~20% years). Day after day the gains have been adding, and this has been replicated in the broader Stoxx and even in France.

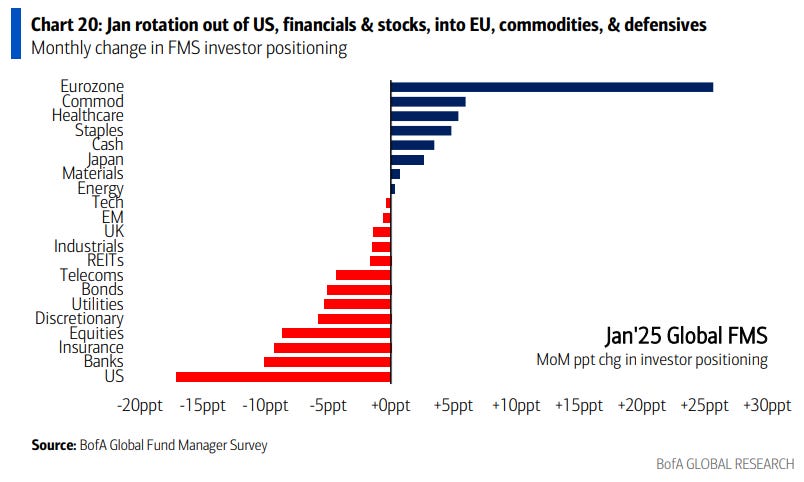

Chatter is that it’s due to a cycling of allocation from the US into Europe, well at least according to BofA. There have been some strong results (Adidas), and it’s worth remembering that the DAX earns >80% of its revenue outside of Germany.

The usual complaints (Germany doesn’t have a government, GDP growth is zero, hollowing out of industrial capacity, horrible productivity growth etc), it doesn’t really apply, and hence the stagnation in the MDAX which has a lot more German exposure.

One for the record books (and one that hurt for me this month - didn’t set those strikes high enough!).

From Albert Edwards, easy to see why a rotation was eventually going to happen, although choosing low liquidity January is an odd one.

BoJ

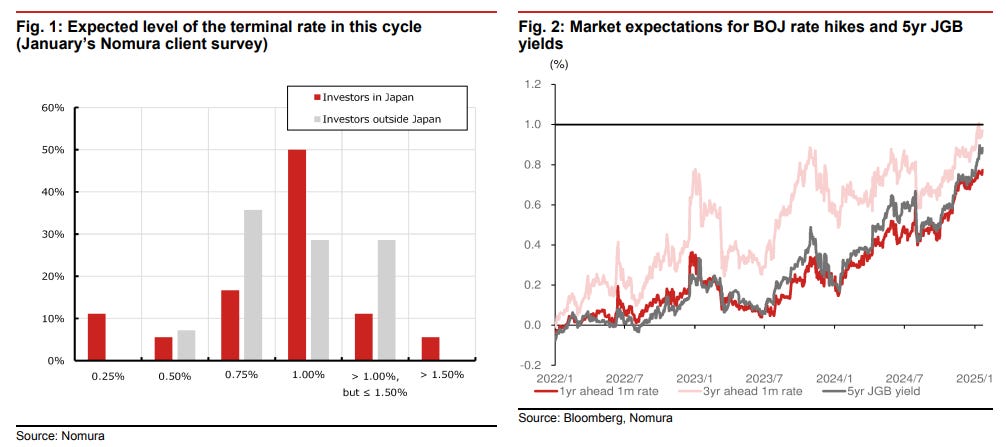

Pricing indicates a near certainty of a hike next week, and the BoJ has indicated as much. USDJPY downside is expected, but I don’t think it will materialise.

The market is still playing catch-up with expectations with the terminal rate (bottom right above and the 2yr yield below) still rising

Commodities

Gold reaching ATHs again. The sanction use of SWIFT and forfeiting Russian assets have woken Gold up again and this continues.

Oil was pushed higher mid-month by US sanctions and very cold weather. The worry around geopolitics last year didn’t generate anywhere near the volatility of January.

Random Charts

Valuations are funny things, but included for long-term context

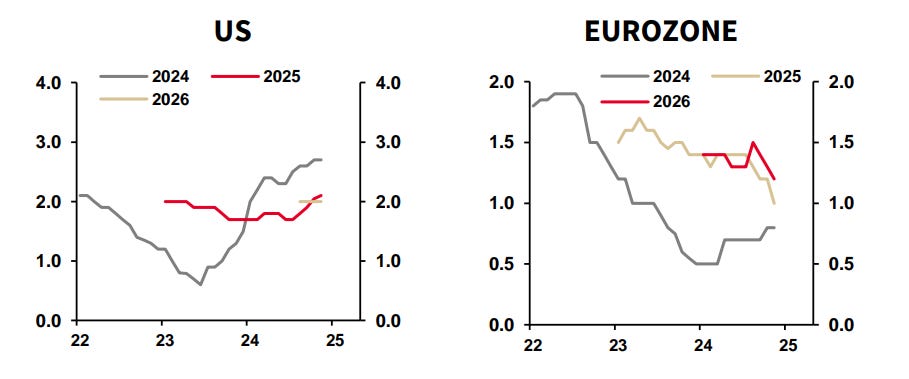

Consensus growth forecasts - heading higher in the US, lower in Europe

Tariffs and reshoring argument in a chart

Deflation is a requirement for negative correlation (my piece on this) - hence why it still lives in China

The World Bank thinks $486bn is needed now to rebuild Ukraine, up from $411bn last year.

Feedback is appreciated on this form of content.

Which publicly traded companies (expert government contract bidders) stand to benefit from the eventual Ukraine rebuild..?