Both equity and rates markets continue to struggle without any clear direction, and the Fed this week didn’t help with that at all.

FOMC

The market originally saw this meeting as a dovish, with equities rallying along with bonds. I don’t see it that way, and it comes down to interpretation of their projections that were released along with the meeting.

2025 growth was revised down heavily, and I’m guessing this is what the market interpreted as dovish, along with the admission by Powell that inflation that may come about due to tariffs is “transitory”. This plays on recessionary concerns which are clearly strong at the moment.

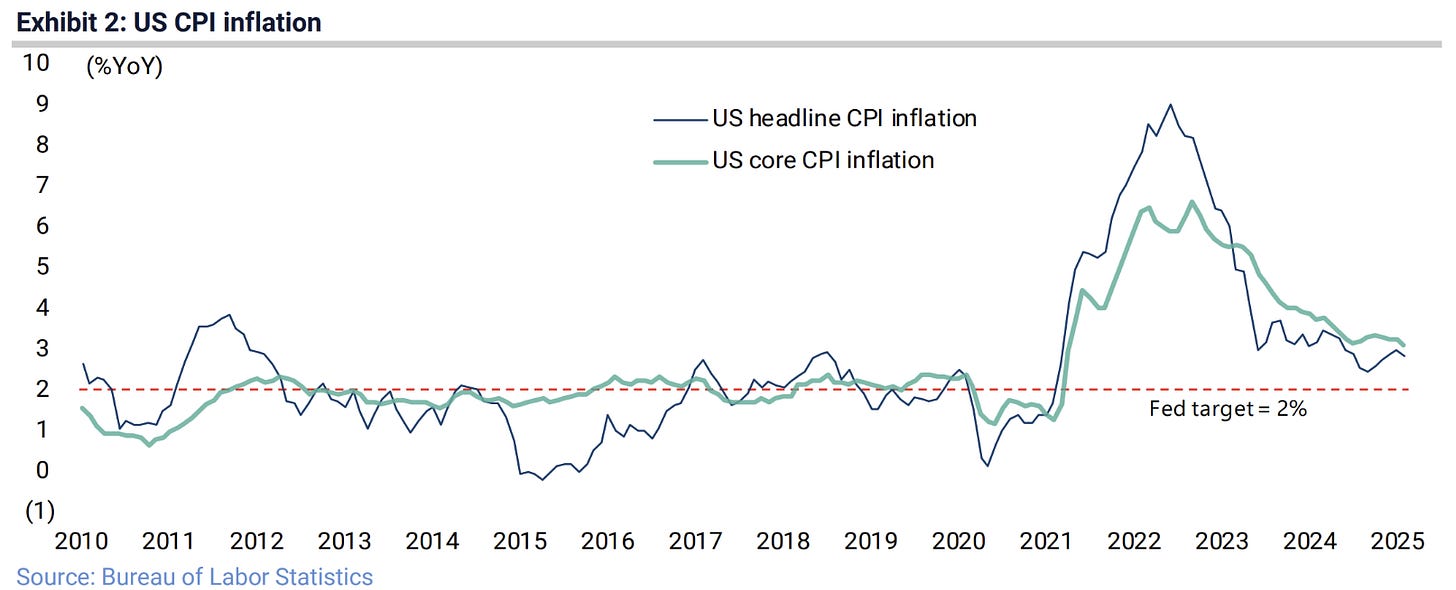

I don’t see it that way. The upgrade to the inflation outlook is far more ominous that growth, and it isn’t just due to tariffs…the Fed is still short of its goal to get inflation down, despite the favourable dynamics in housing inflation and slight momentum downwards

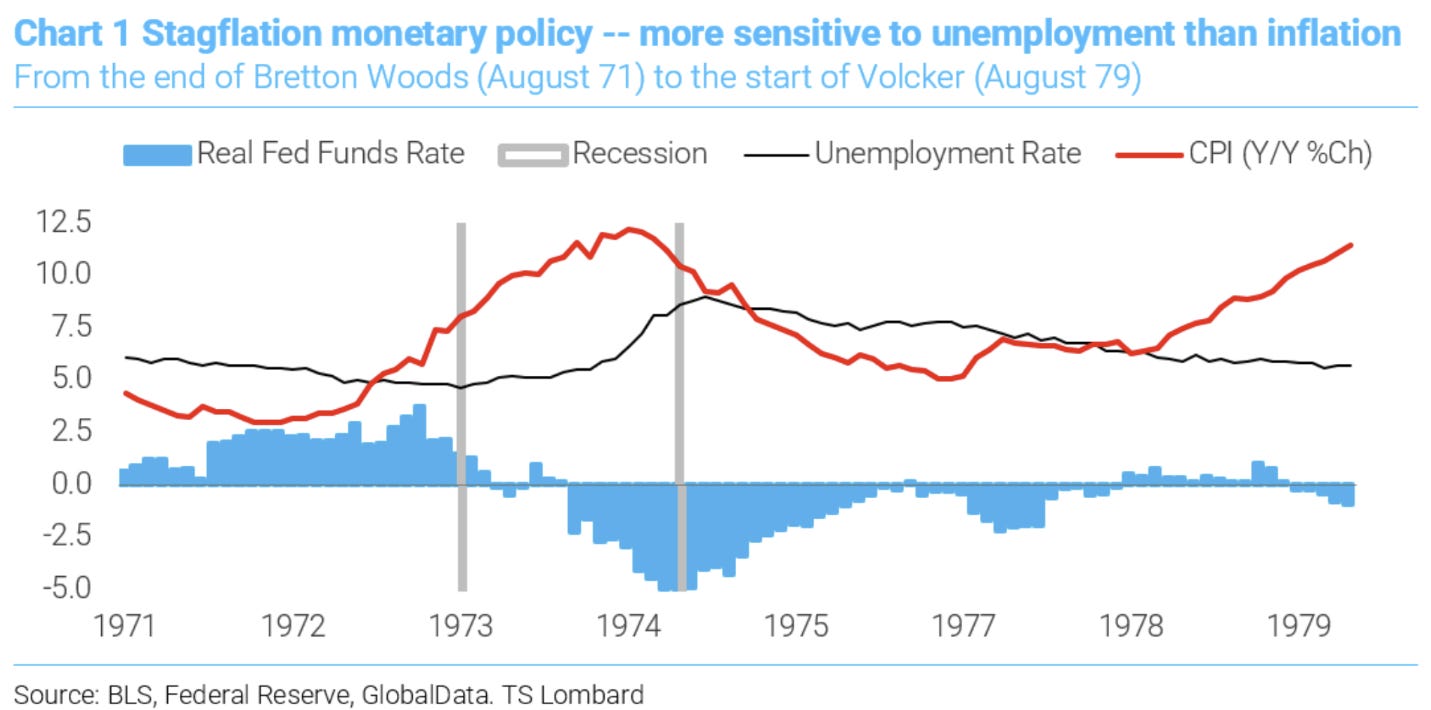

The reason here is tariffs. While Powell is right that the price effect of tariffs is transitory, the entire 21st century up until the pandemic has “low” inflation because of goods deflation. That won’t be the case if tariffs are successful at reshoring.

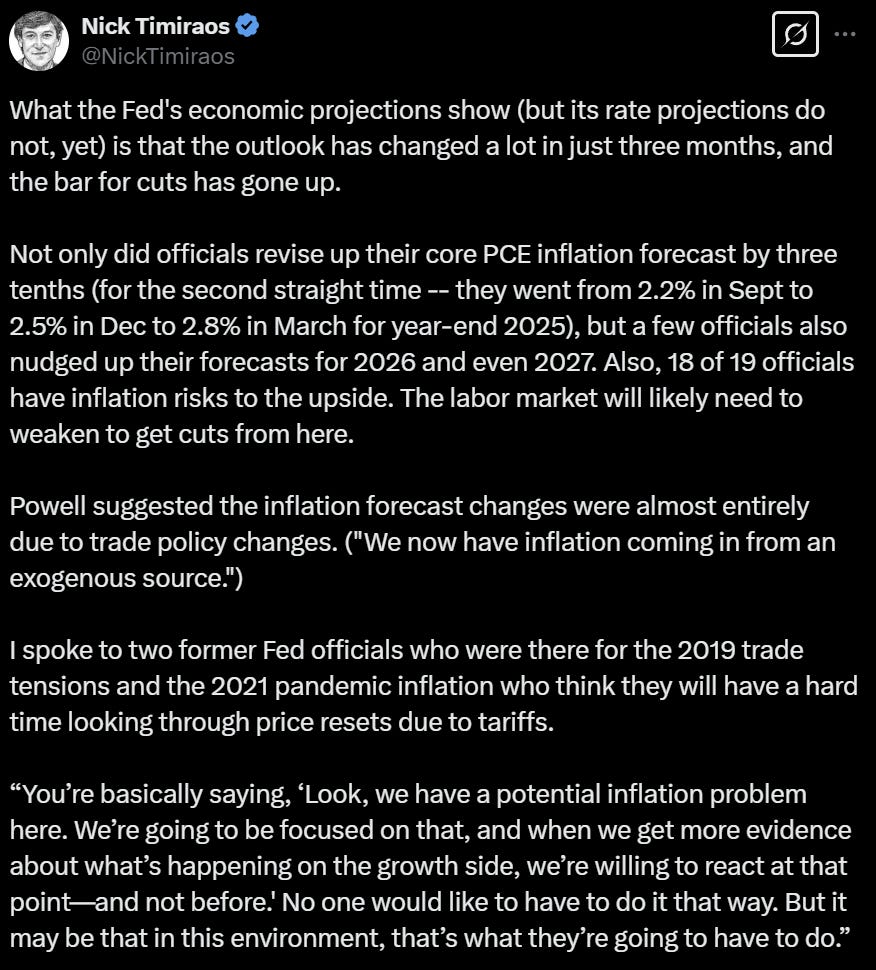

Nick Timiraos, the Fed whisperer, seems to think the same.

Outside of this the QT was slowed to $5bn/month. Typically slowing balance sheet reduction (or quickening of expansion) is bearish bonds and good for equity, again not matching the initial market reaction.

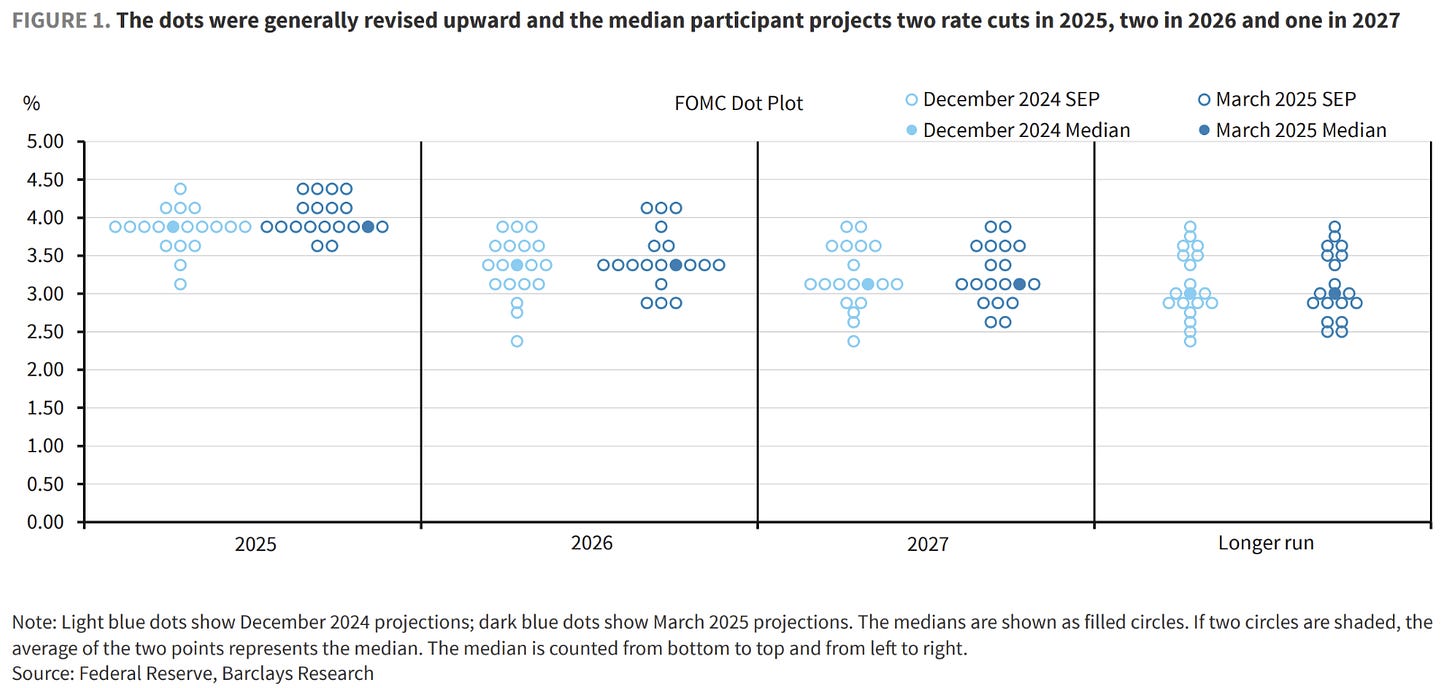

The dots were even revised upwards on the margin.

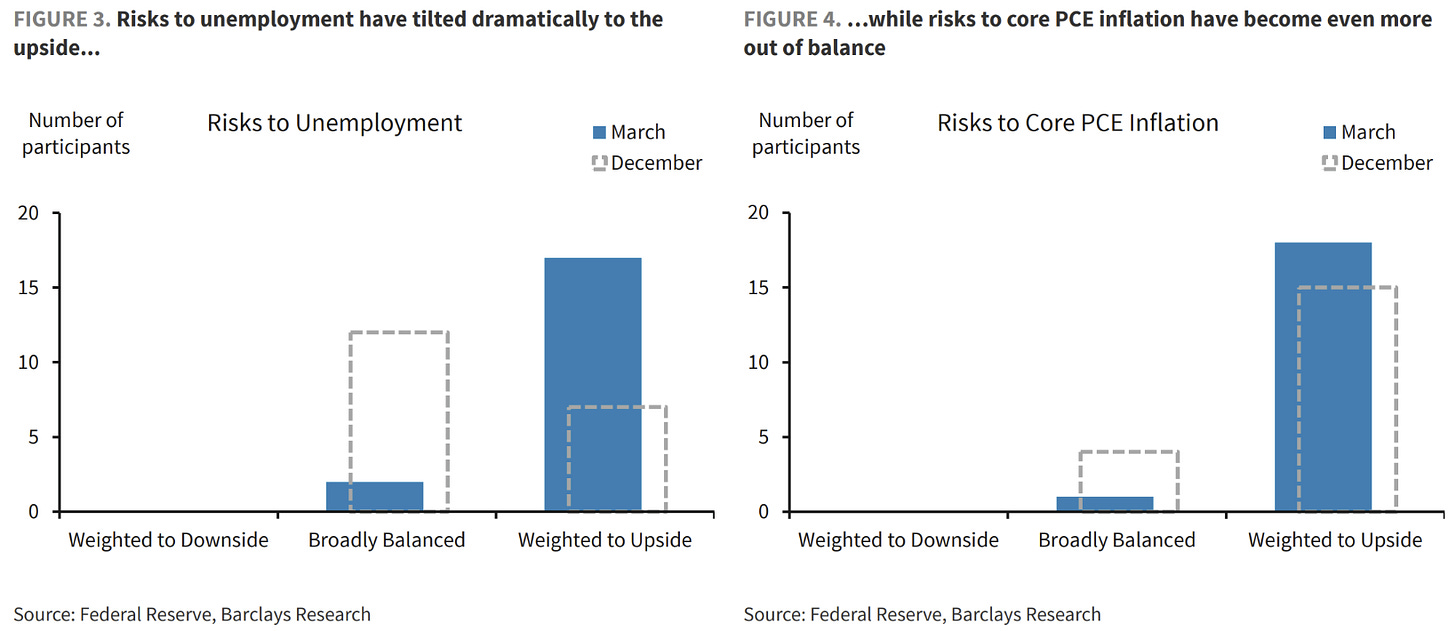

Internal Fed views mirror the market who isn’t dealing well with the wholesale change to the US’ position in the world.

Out of things I hate are the use of the word “stagflation” to describe the current situation because growth is not going to contract meaningfully. Inflation stickiness is a worry though.

More US growth/equities watch

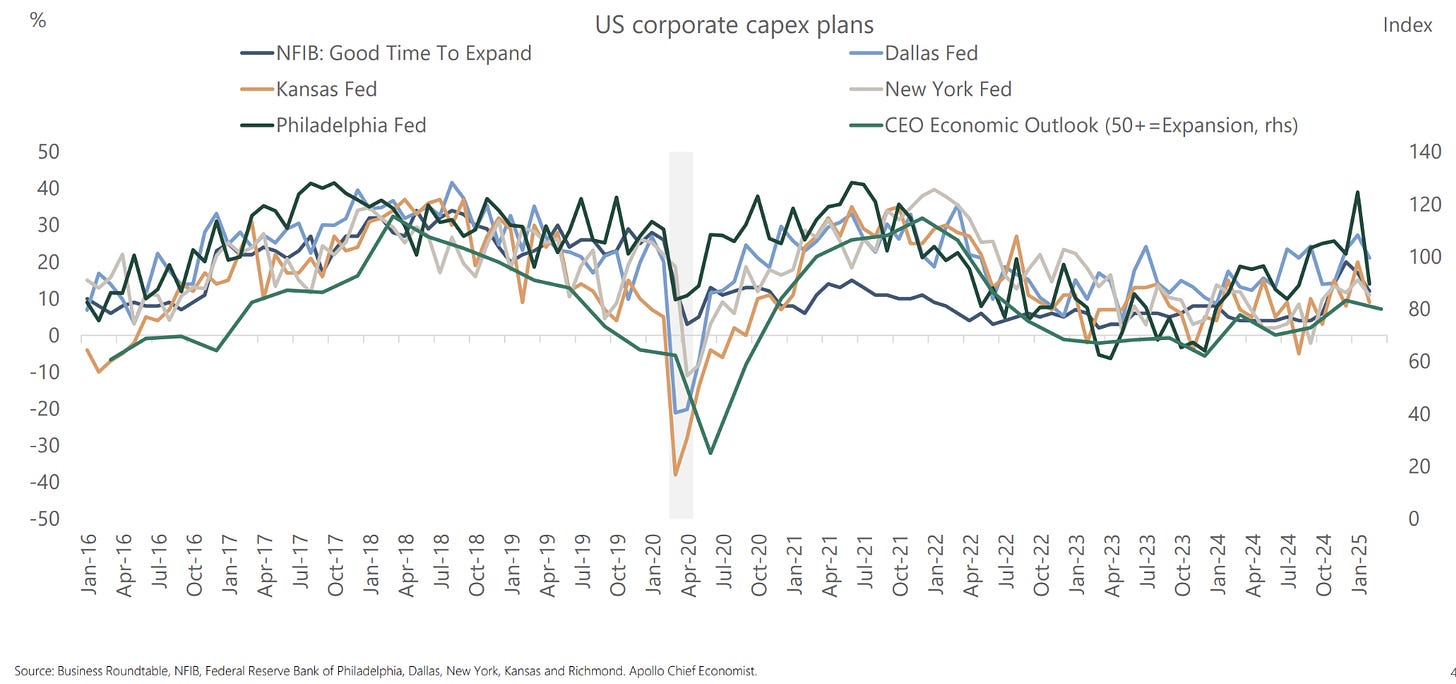

Corporate capex intentions have slowed over a group of indicators but are still positive.

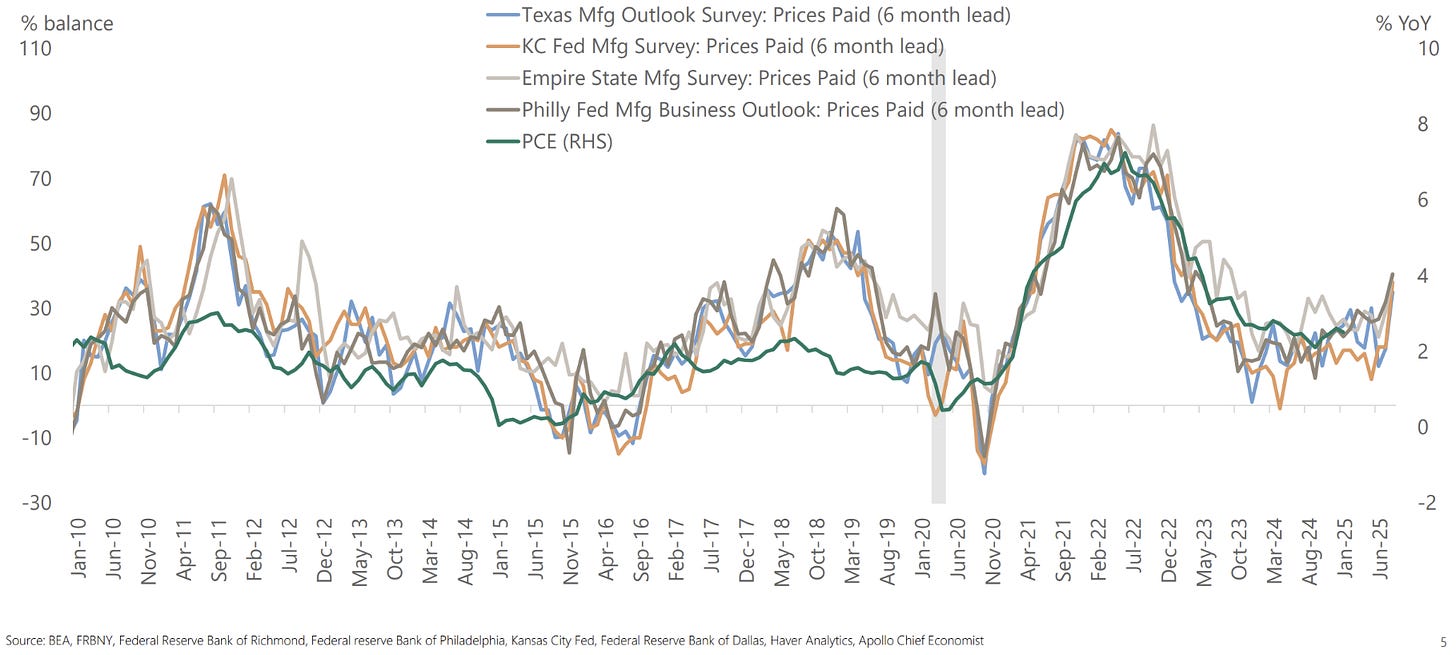

The inflation outlook isn’t that great for goods. Two competing forces will play out here - tariffs versus the need of China to keep the US consuming its product.

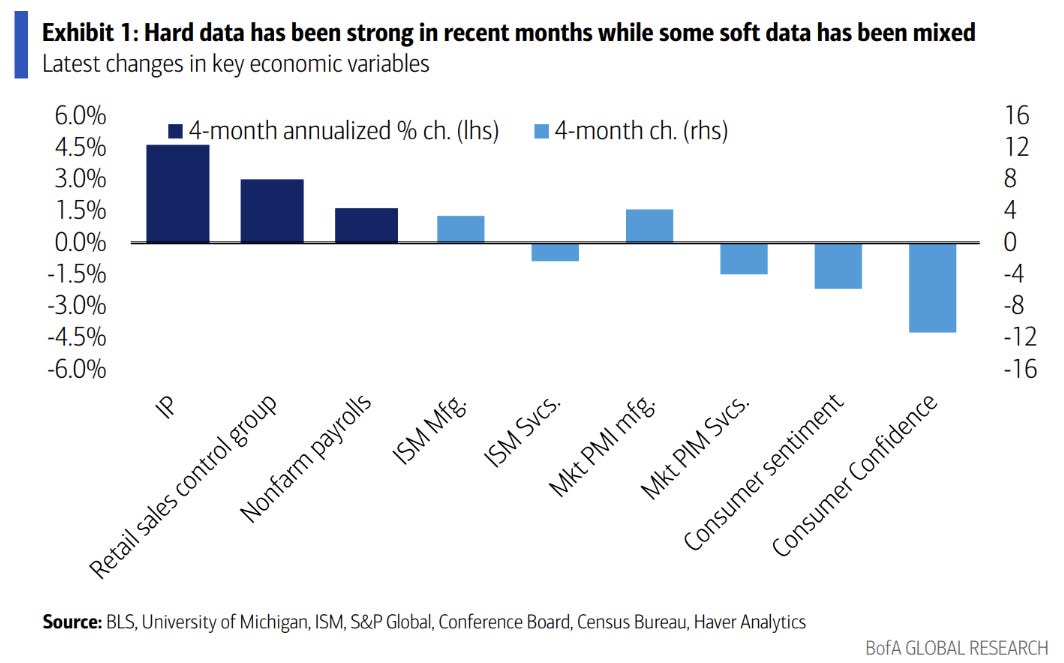

Survey based measures aren’t playing out in actual economic data. The industrial production number this month was very encouraging. Sentiment can infect a lot…

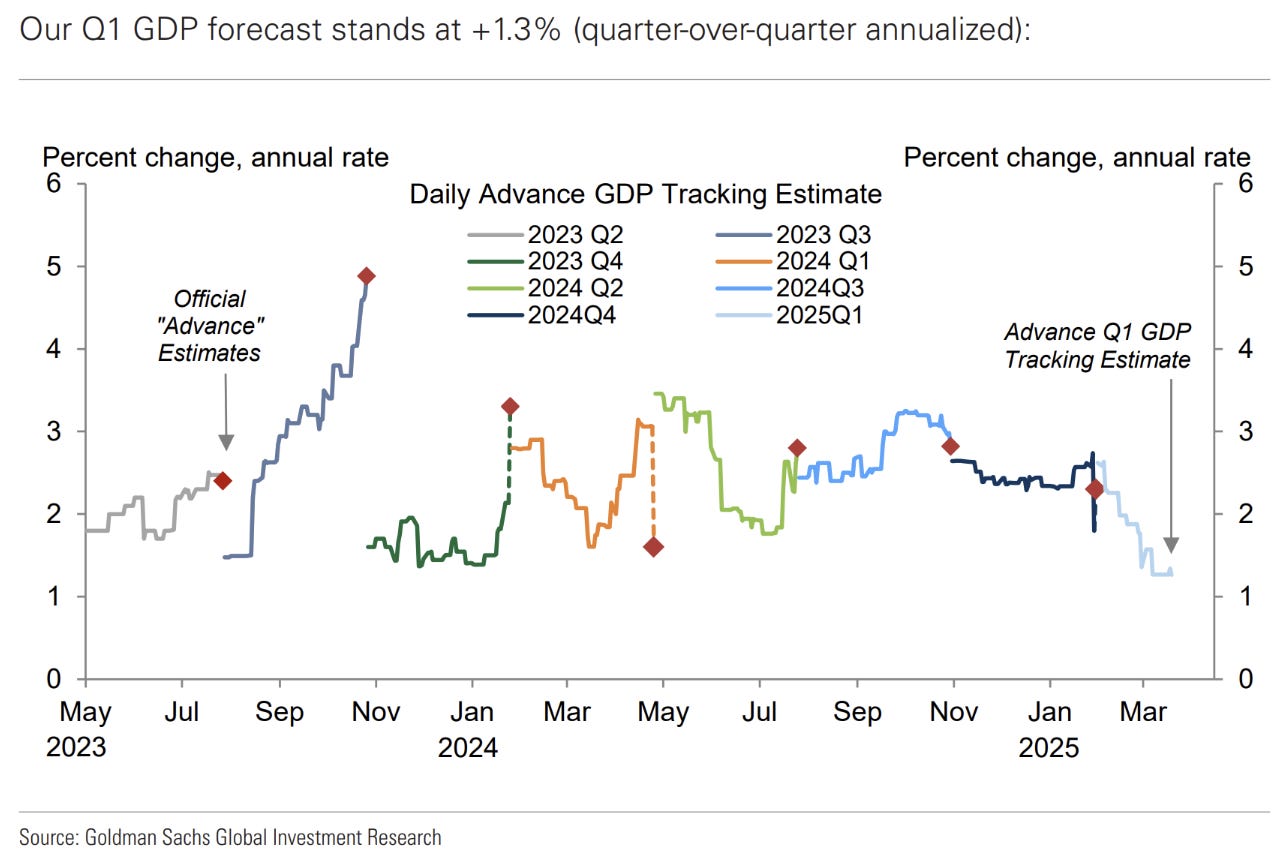

…as the wide range of GDP forecasts show. GS above is at the midpoint and the best place to put your bets for Q1.

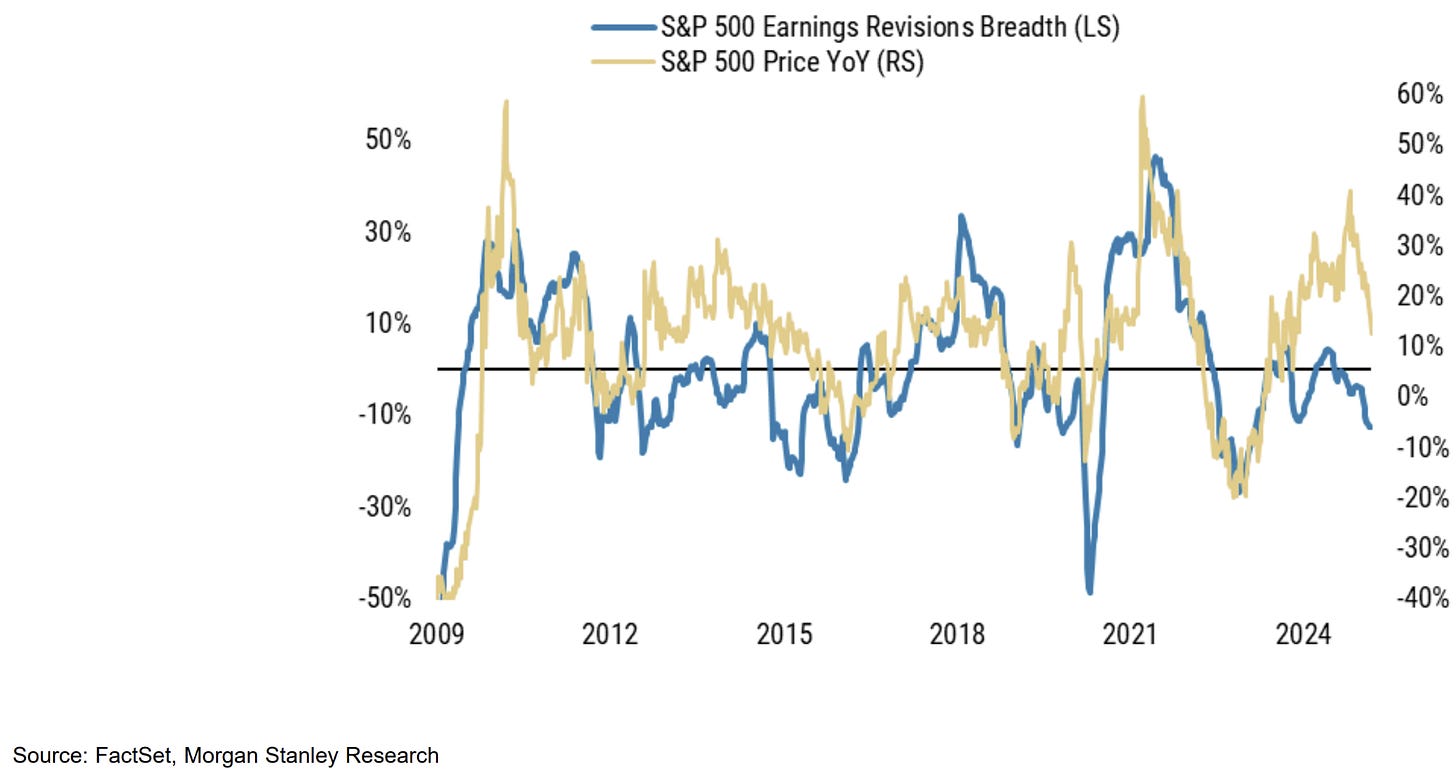

I still strongly suggest that equity weakness is an earnings (and earnings forecast) story…

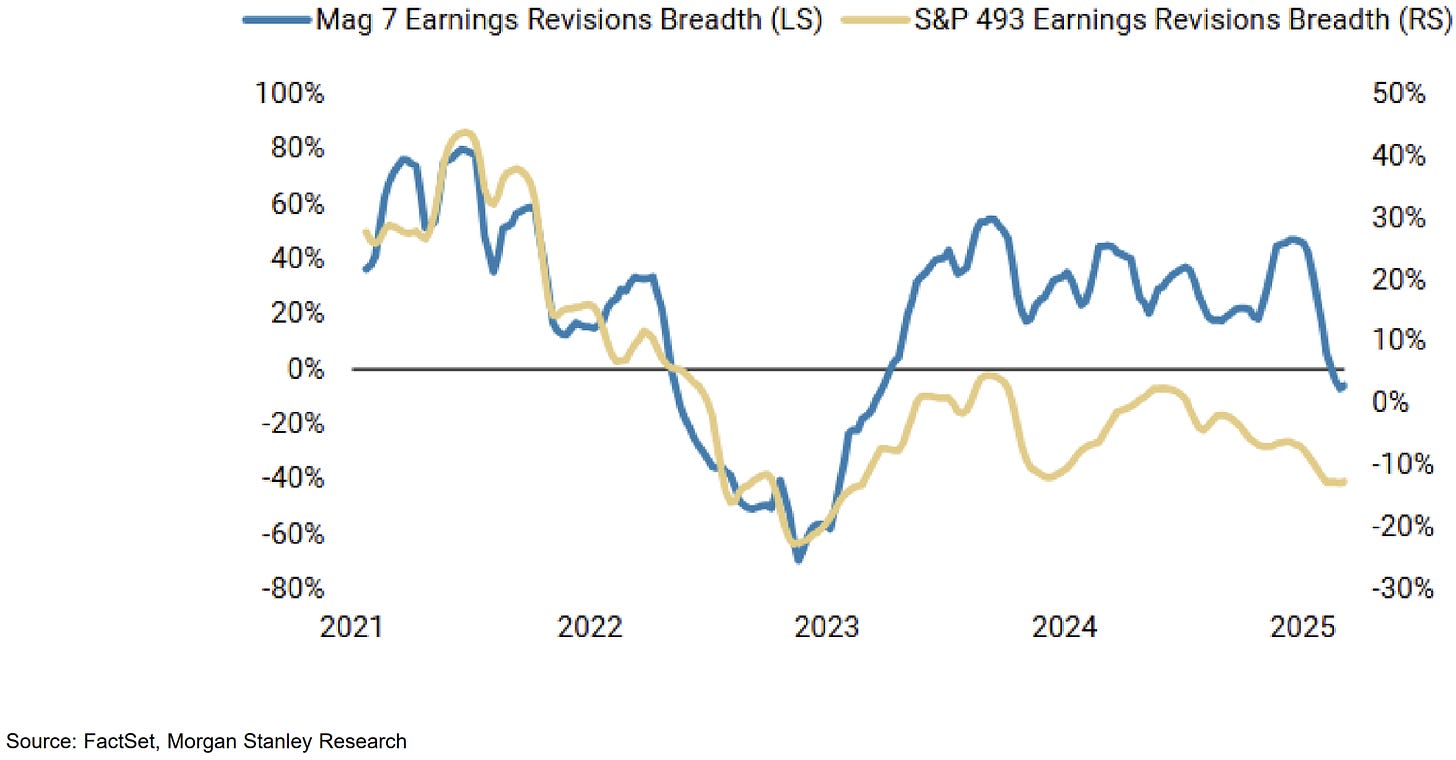

…with mag7 leading the charge. I’m not expecting an equity bounce.

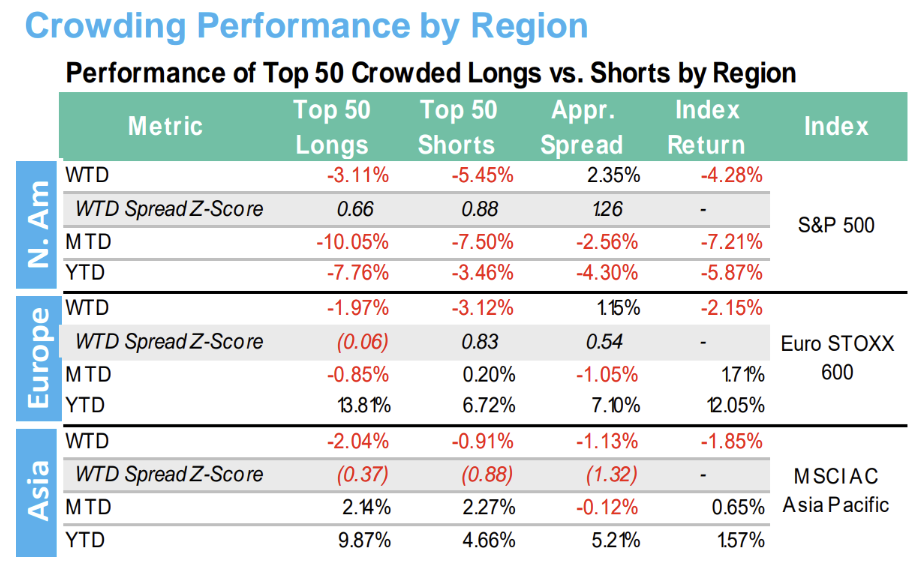

Most successful 2024 strategies will be in real pain come March performance reporting.

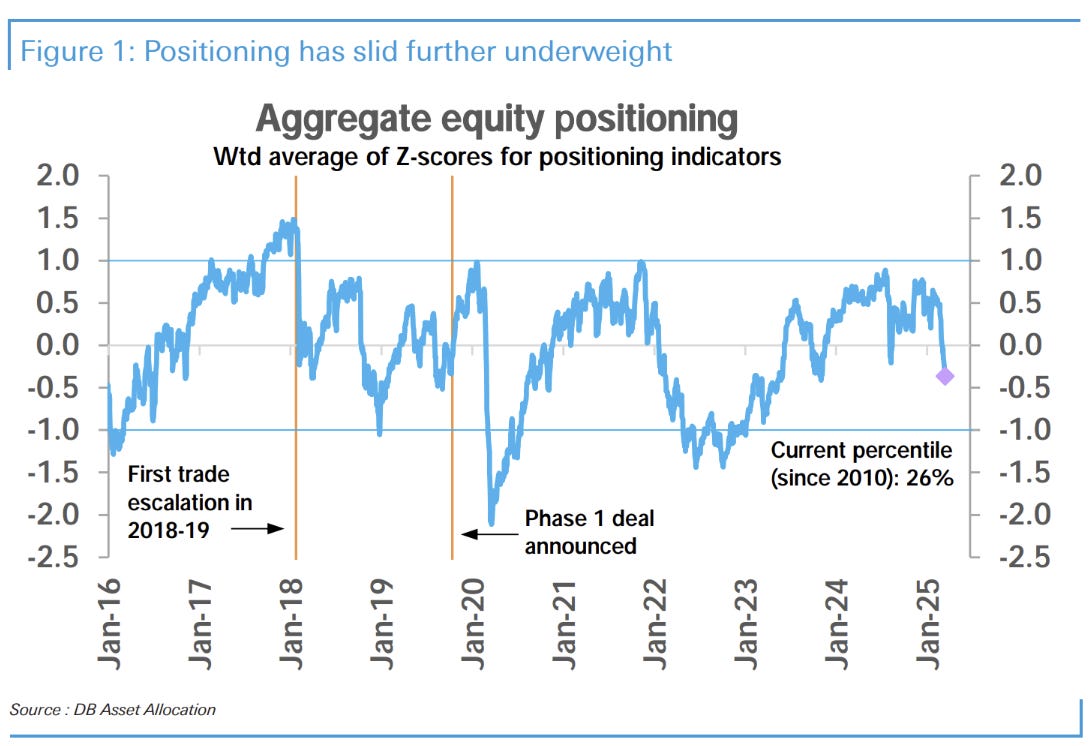

Equity positioning normalising…

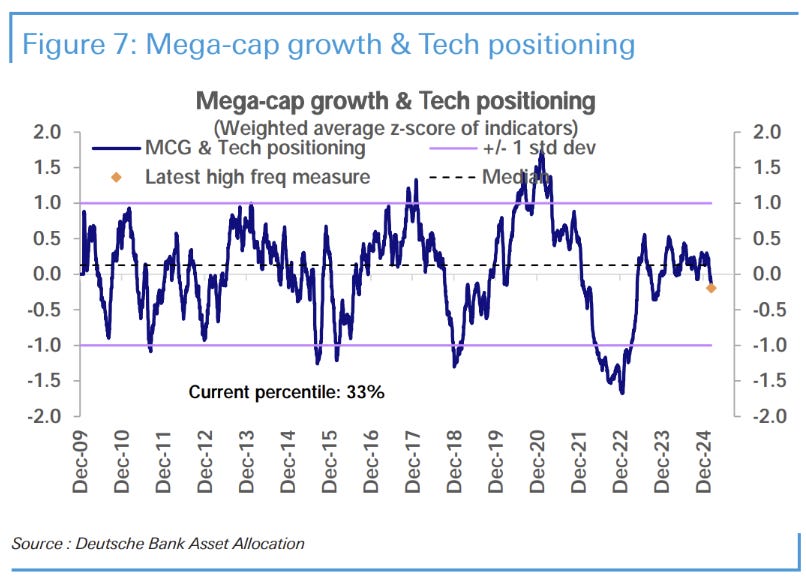

…but tech positioning still too long.

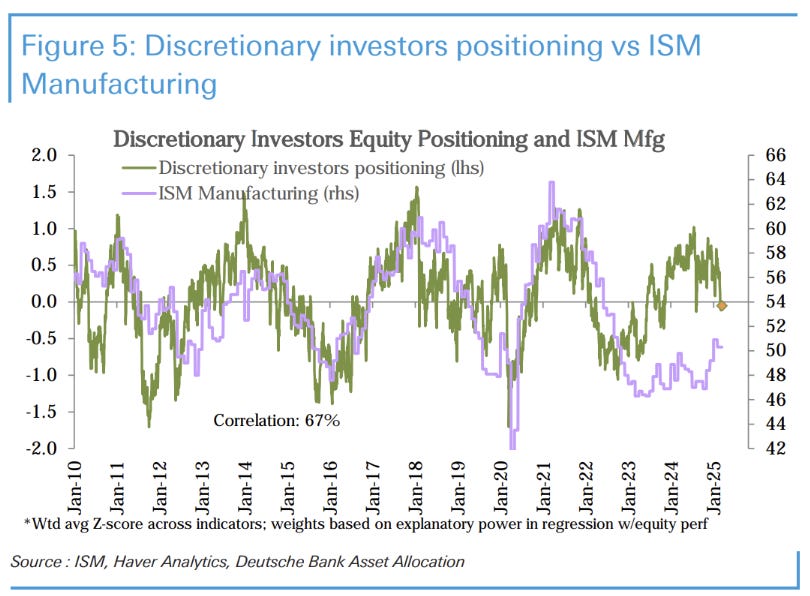

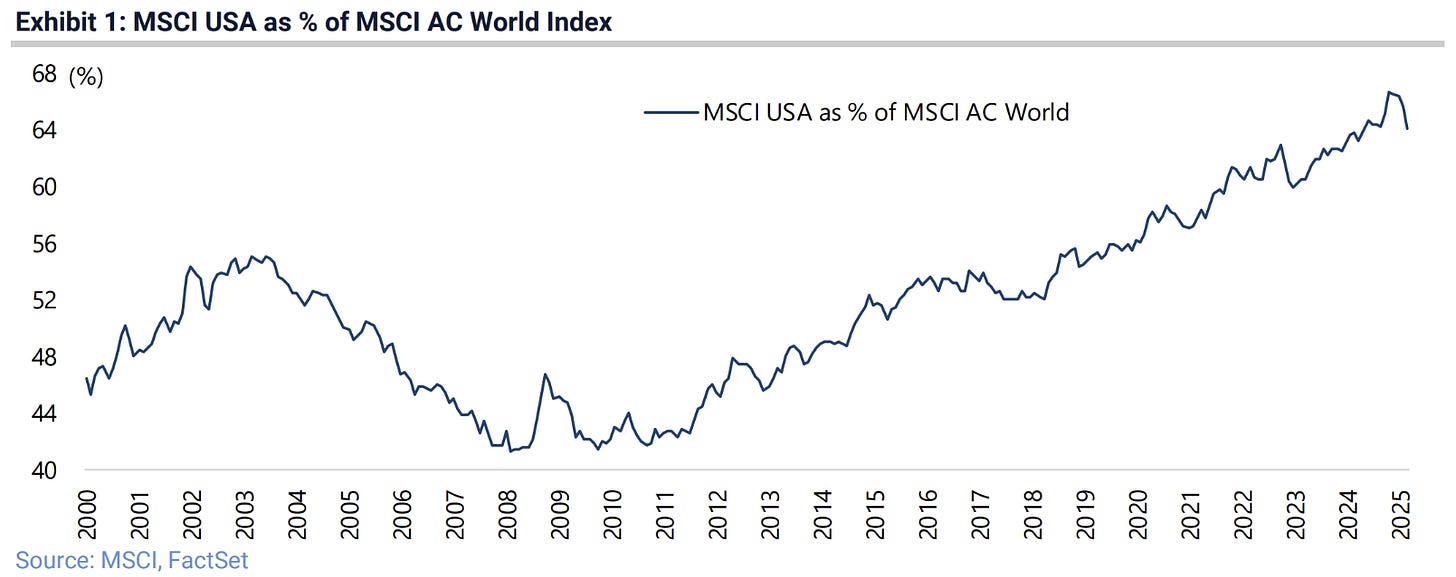

This chart is the perfect illustration of why “Macro is Dead”. A total disconnect from the business cycle.

The US as a destination for capital won’t change if debt keeps growing and the trade deficit remains large.

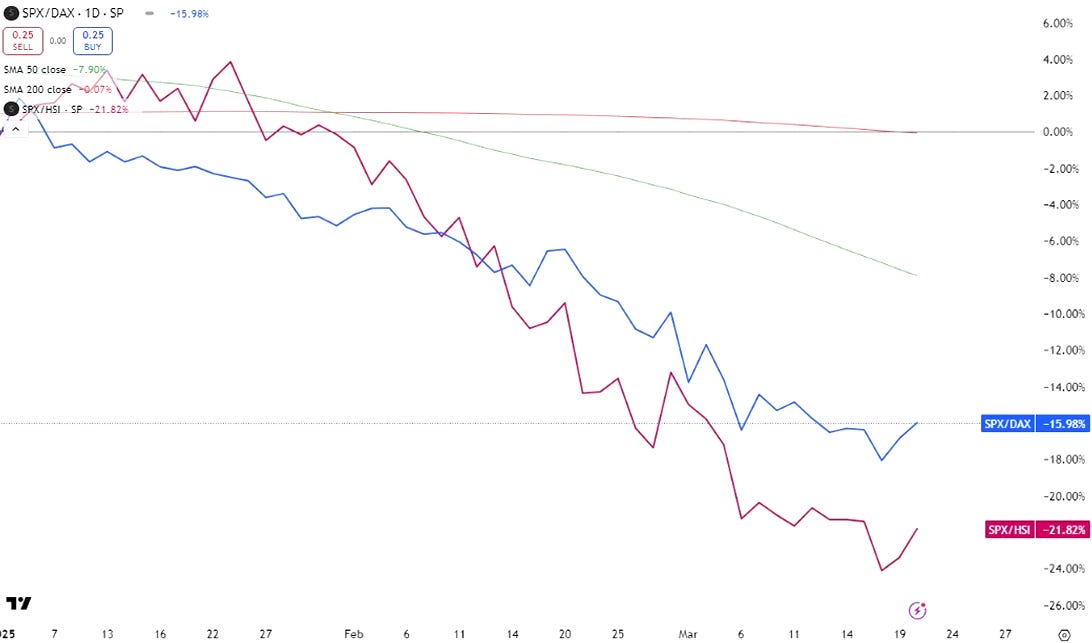

Yesterday saw some reversal in the short US-long German/China trade. JPM reports rotation flows into Europe have stopped. Time for pause.

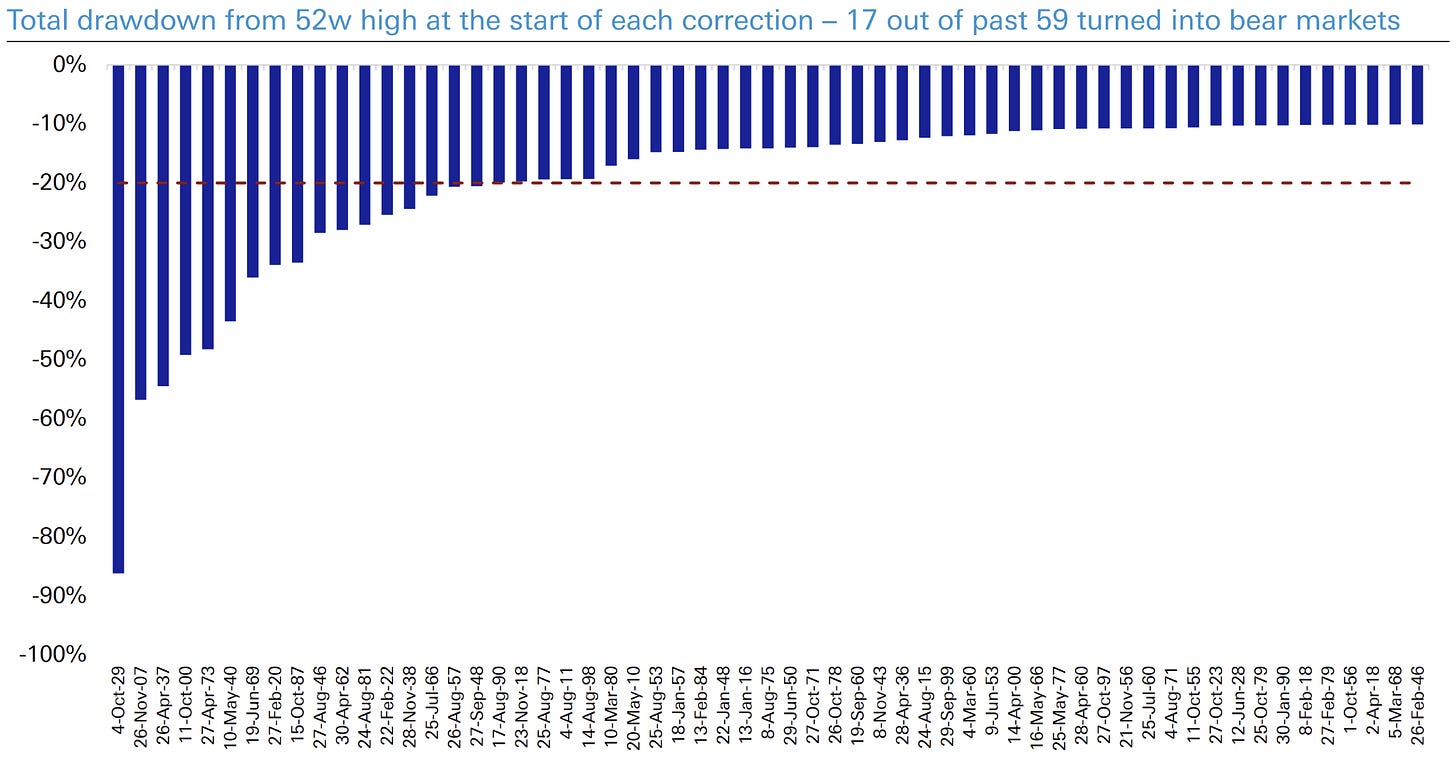

Interesting chart from DB. 29% of >10% drawdowns have turned into full bear markets.

Ex-US fiscal update

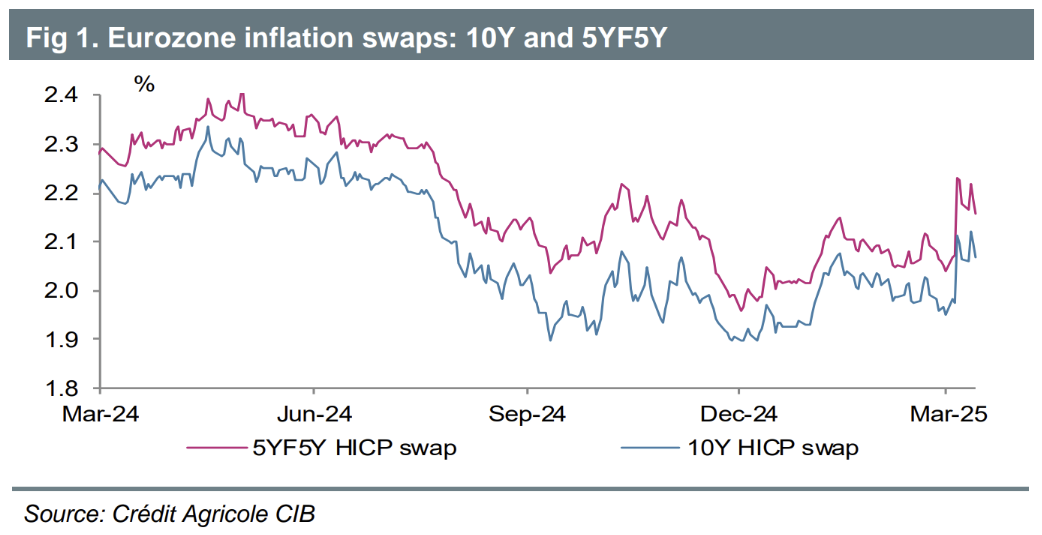

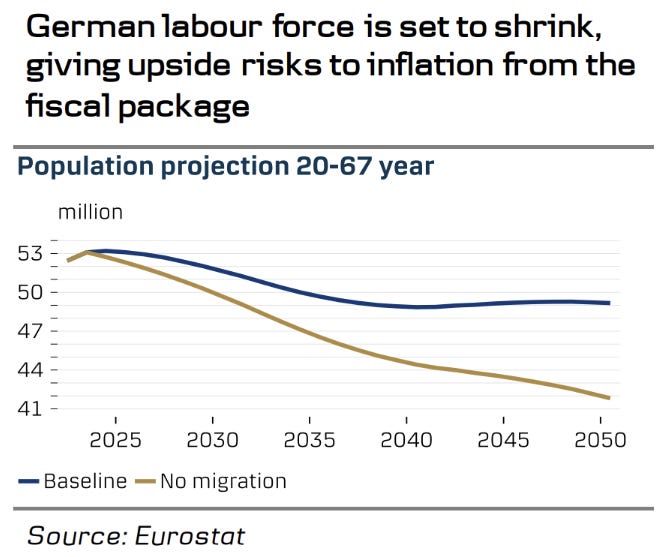

A large part of the Bund sell-off has been from the inflation component of nominal bond yields. I’m more confident in the increase in real yields rather than inflation here…

…largely because the longer-term European trends are still challenging. There is plenty of excess industrial capacity as well.

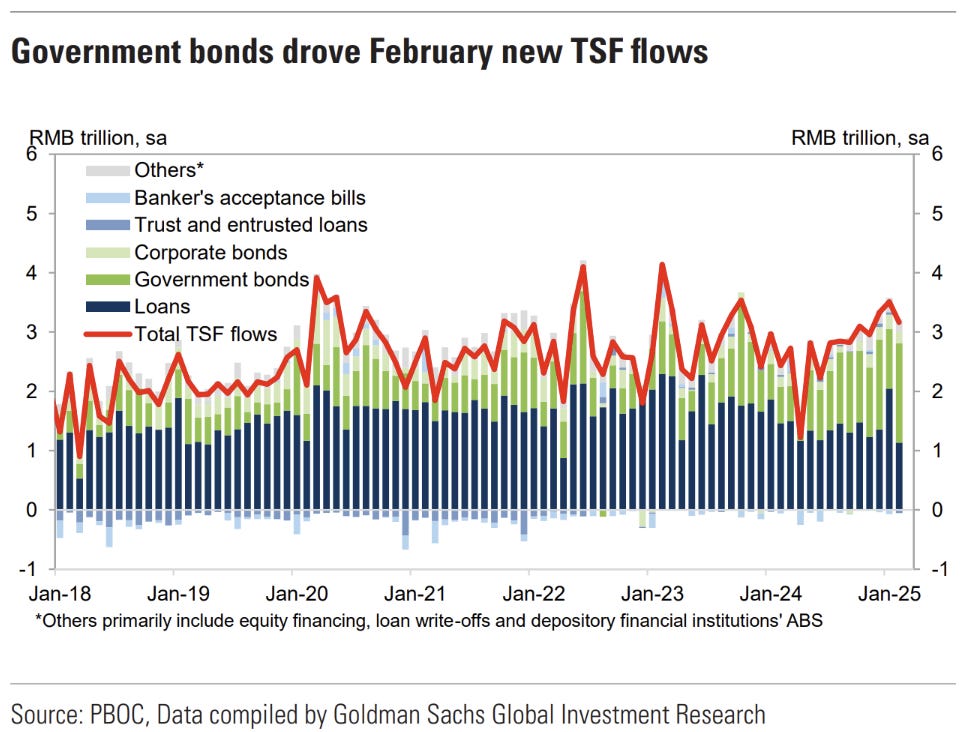

China debt growth is government-led as well, but falling short of market expectations.

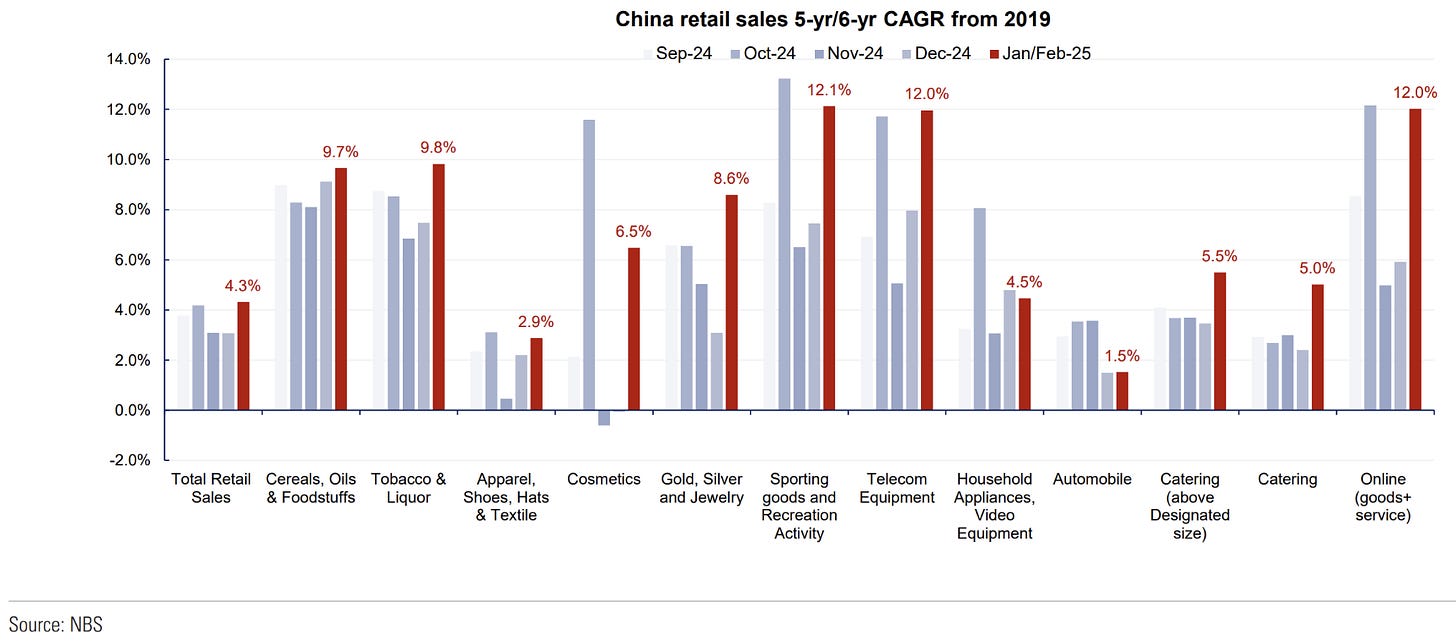

Not many real signs of economic improvement despite the sentiment, but the consumer likely bottomed-out in December.

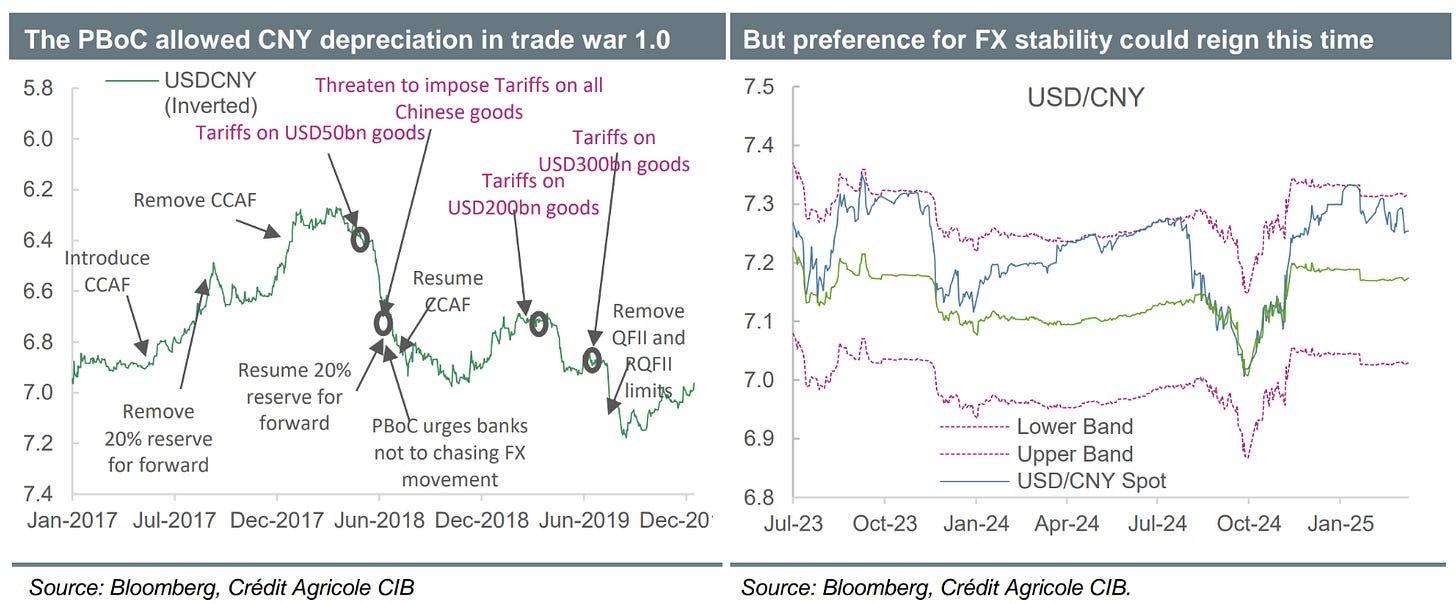

China’s reaction to tariffs this time around has been to ignore it. They haven’t poked the bear by depreciating.

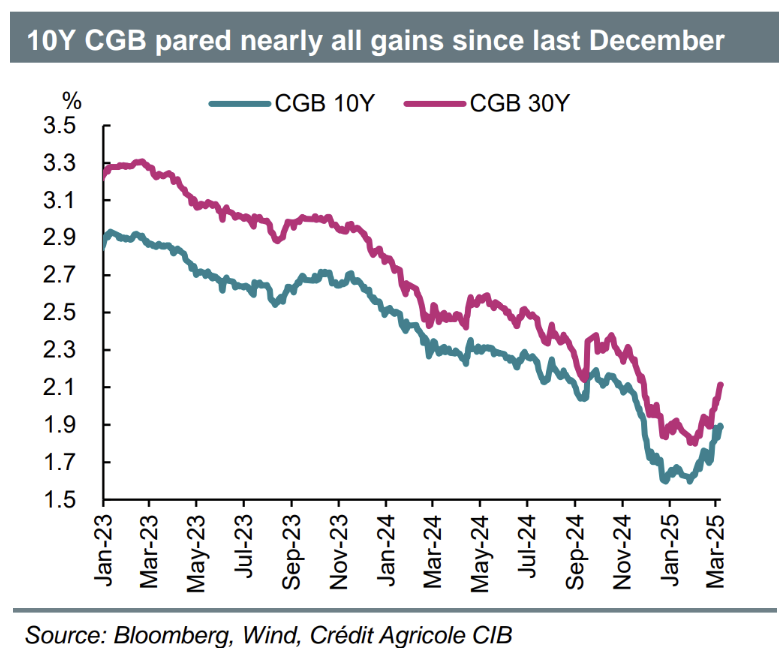

The China bond yield doomers have been quiet this year!

Something from left field

Rabobank have highlighted risks in the Balkans, which have been brewing for a while. Add Serbian protests to this and the parallels (while tongue in cheek) aren’t hard to make.

Read my latest piece on why US economic growth is unlikely to be a concern for 2025.

Greatly appreciated as always, thanks 🙏