Due to the lack of space last week, I held off on the below chart around the discussion about the Fed’s current stance on policy.

The chart is the difference between the March and June 2026 SOFR futures. It is rare to see such a spread between two contracts this far out, with nearly a full cut priced between the two contracts (from nothing in January 2025).

May 2026 is when we see Jay Powell’s term end and a new Fed chair chosen. Both Trump and Vance’s rhetoric on the matter leaves little to the imagination, the new chair will be cutting rates.

The chart is a better fit for this week’s Charts & Notes because nearly everything this week is tracking the government’s oversized impact on markets. Everything is government.

Low employment and exploding debt (government policy) are consistent with another 20%+ year for US equities. Hitting all-time highs this week still leaves it well short of this target with the S&P500 up 4.4% and we are already halfway through the year.

The bear cases are well known with many calling for a stop at 6000. These are at odds with flows from:

Retail due to a persistently low unemployment rate

A trade deficit that only seems to go in one direction, with the resultant capital flows seeming not to worry about the sudden end to “US exceptionalism”.

The clearest reason for worry is a disruption to this status quo, with ratcheting protectionism putting both of above positive flow effects at risk.

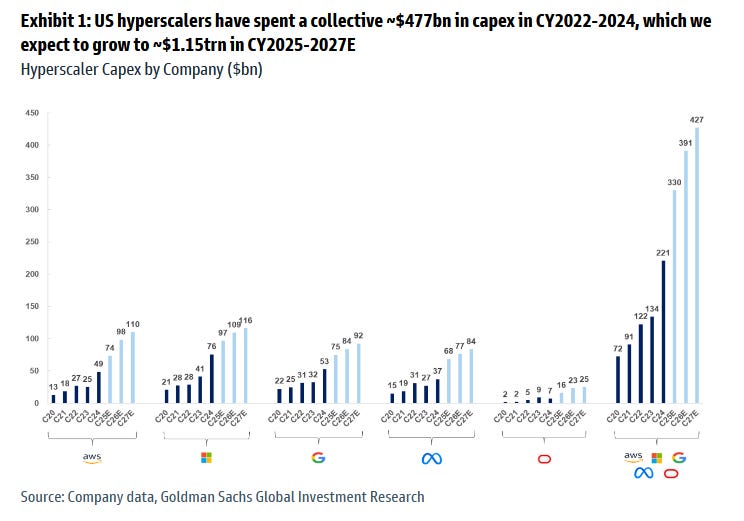

The other driver of 2025 equity weakness was the roll-over in tech earnings, covered extensively in Charts & Notes. This all seemed to abruptly end with Google’s last earnings result and reignited hope and belief in the AI capex trend.

AI (as a product) has shifted some more sceptical opinions recently from some tech-lead firms I follow. Here is Tailwind CSS creator giving his thoughts.

Using AI for coding seems to have the most immediate productivity boost. I’ve detected this perception shift recently regarding the use of AI which is surely feeding back into investor and company sentiment.

While a rollover in AI capex was short-lived, the market likely ignored the delayed negative earnings effect of USD strength in the 4th quarter of last year, something which has fully reversed, as USD plumbs new lows…

…but this time in line with the outperformance in rates in the belly of the US curve outperforming those in Europe.

The (eventual) Israel-Iran ceasefire seem to trigger the green light for rates to rally, a reversal of the role bonds used to play in global conflicts. A little more on this below.

There continues to be a single narrative in global macro, and it has to be respected whenever markets turn substantially, like they did in April.

The whole world is caught in one trade, where continued US economic dominance depends on the suppression of volatility which in turn drives capital flow and accumulation of debt. The appetite for volatility by governments around the world seems to be diminishing, and this is good for risk assets.

There was a case for this changing as the market tested Trump’s appetite for disruption. The market won and learned that Trump’s stomach for volatility is on the intra-day scale, rather than the monthly scale.

Has Trump learned of the trade-off to being aggressive against surplus trading partners (that being US recession and very weak equity markets), or has he just reconsidered the method to get to where he wants to get to? It would be foolish to pretend to know an answer to this question at this point.

Will this change on July 9 as delayed tariffs reappear? Some developments this week suggest that the administration are going to take a very different approach moving forward.

Delayed tariffs (?) and Section 899

While there have been some rumours about the delay on the July 9 deadline, Steve Miran’s comments to Yahoo Finance seems to suggest it is a done deal.

"I mean, you don't blow up a deal that's in process and making really good faith, sincere, authentic progress by dropping a tariff bomb in it," Miran told Yahoo Finance's Brian Sozzi.

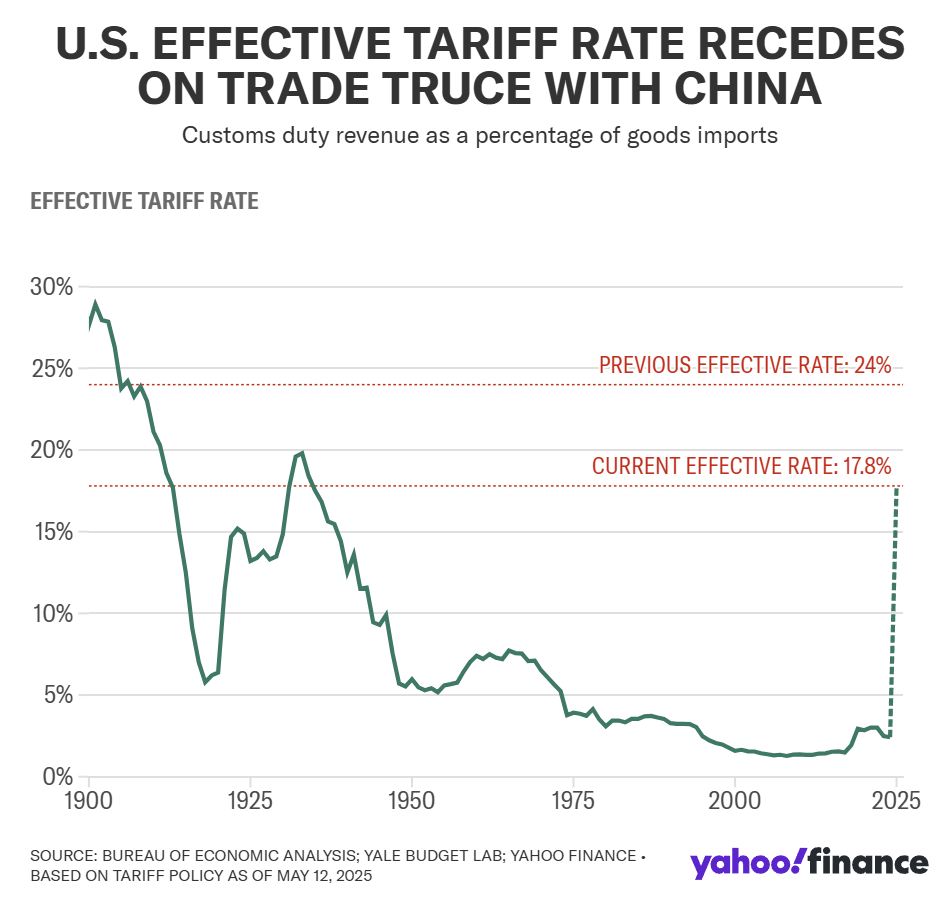

Further they see the current 10% aggregate tariff rate as the minimum, and all negotiations are to avoid higher tariffs than this.

Trump and officials have warned that he could soon simply tell countries their tariff rates, raising questions about the status of negotiations. Miran said that he doesn't see the aggregate tariff rate falling materially below the 10% level in the long run, but some countries may negotiate more favorable duties while others will see a return of the steeper "Liberation Day" tariffs.

Rumours of a deal with China are still swirling, but I’ll believe it when I see it.

Do higher tariffs await us but just arrive in a quieter and slower way?

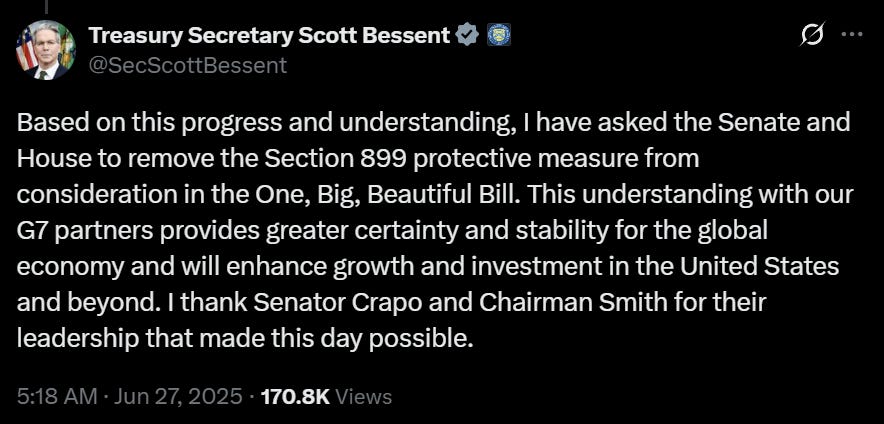

Scott Bessent has also indicated that the administration will peel back on levies on inbound capital as well.

Section 899 looked to tax inbound capital flow from countries that were deemed to have unfair taxation policy against the US. Importantly, this excluded Treasury securities so was never really that big of a deal, and now we will have to await a confirmation on whether it exists at all.

I’m a fan of taxing capital flow as a solution to a trade imbalance, as are many others.

A generous reading of this latest withdrawal is that the Trump administration has worked out that trying to fight too many fights at once is a recipe for disaster. The other is that they only just discovered what the short-term cost of fighting trade imbalances is, no matter the long-term gain.

The negotiating partner

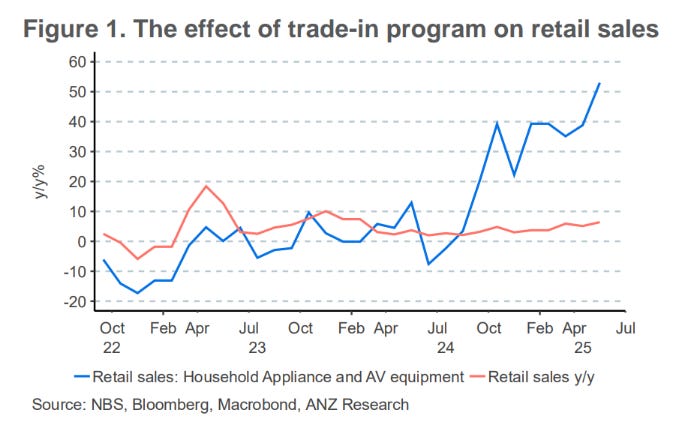

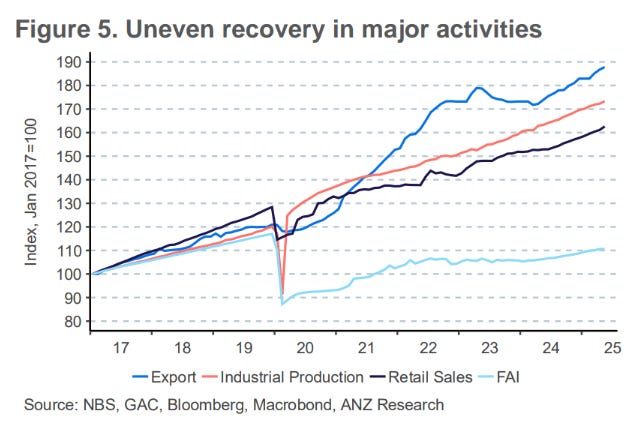

Despite the show of weakness from the US side it seems that even current tariff rates are contributing to a not so rosy picture in China either. Headlines of a large pop in retail sales (most of macro deals in headlines when it comes to China) aren’t really indicative of the economics.

After a little sputter in Q1, government subsidies are entirely responsible for driving retail sales.

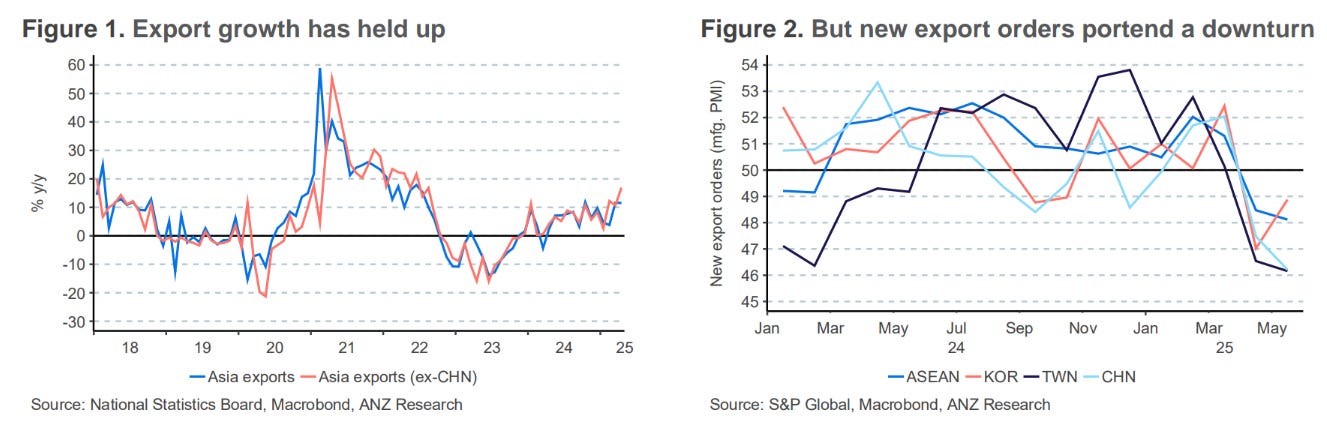

Export growth has held up as front-running tariffs generally boosted trade, but the outlook is not as good.

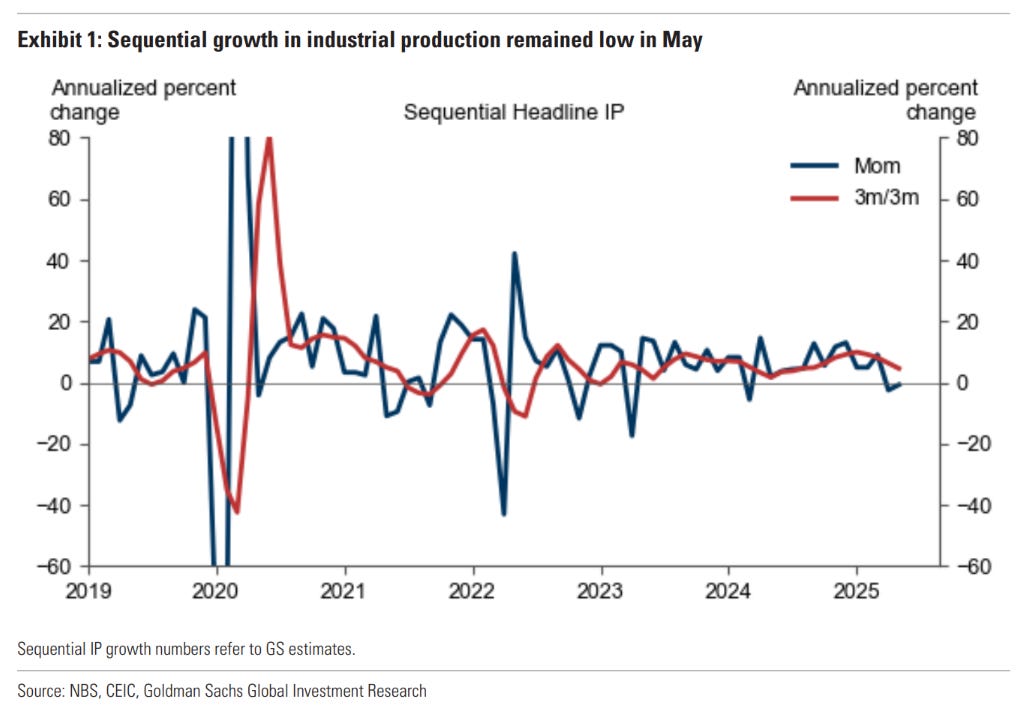

Industrial production is another indicator that the export picture is worsening.

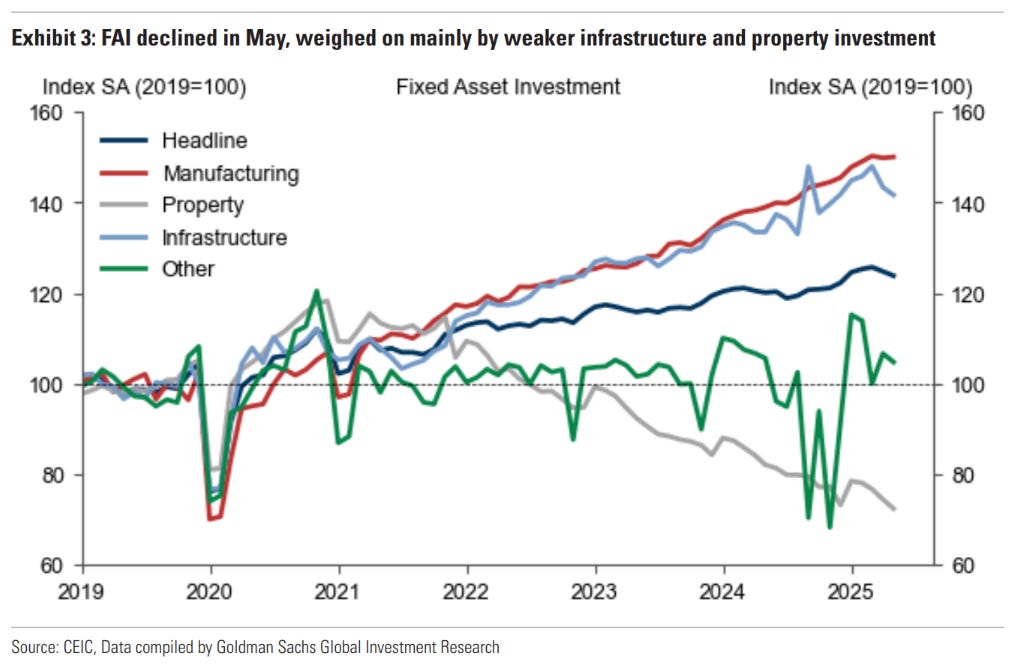

While investment is faltering nearly everywhere.

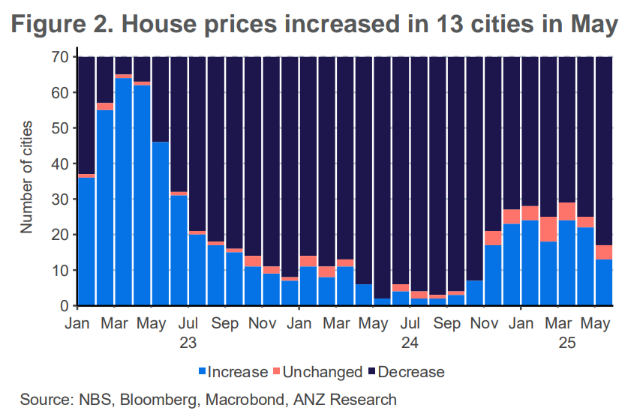

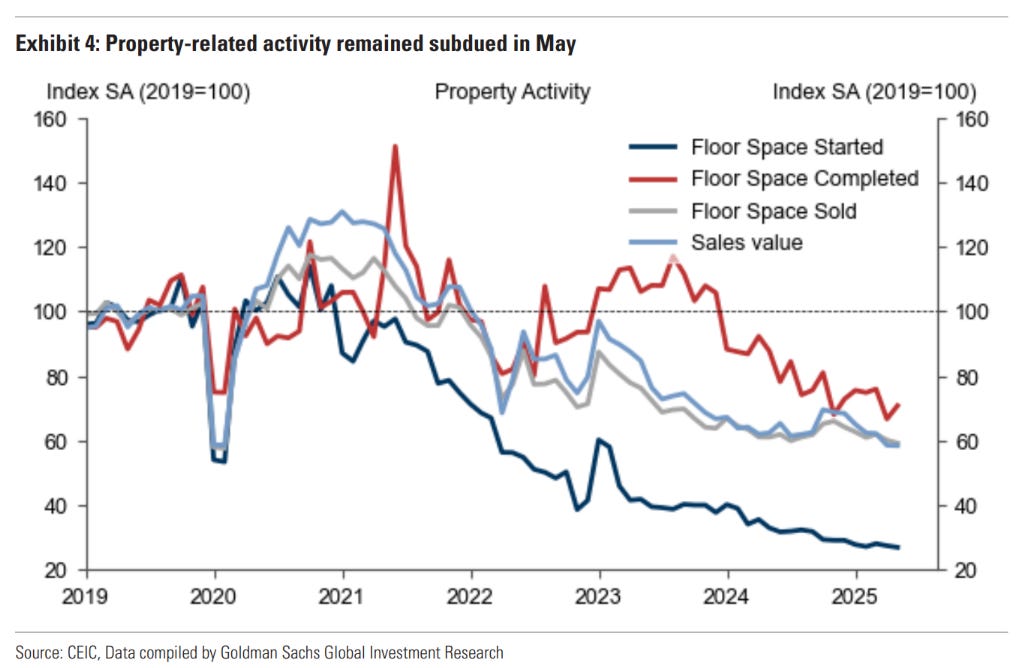

Property has resumed its struggled after a better end to 2024…

…with nearly all activity indicators lagging.

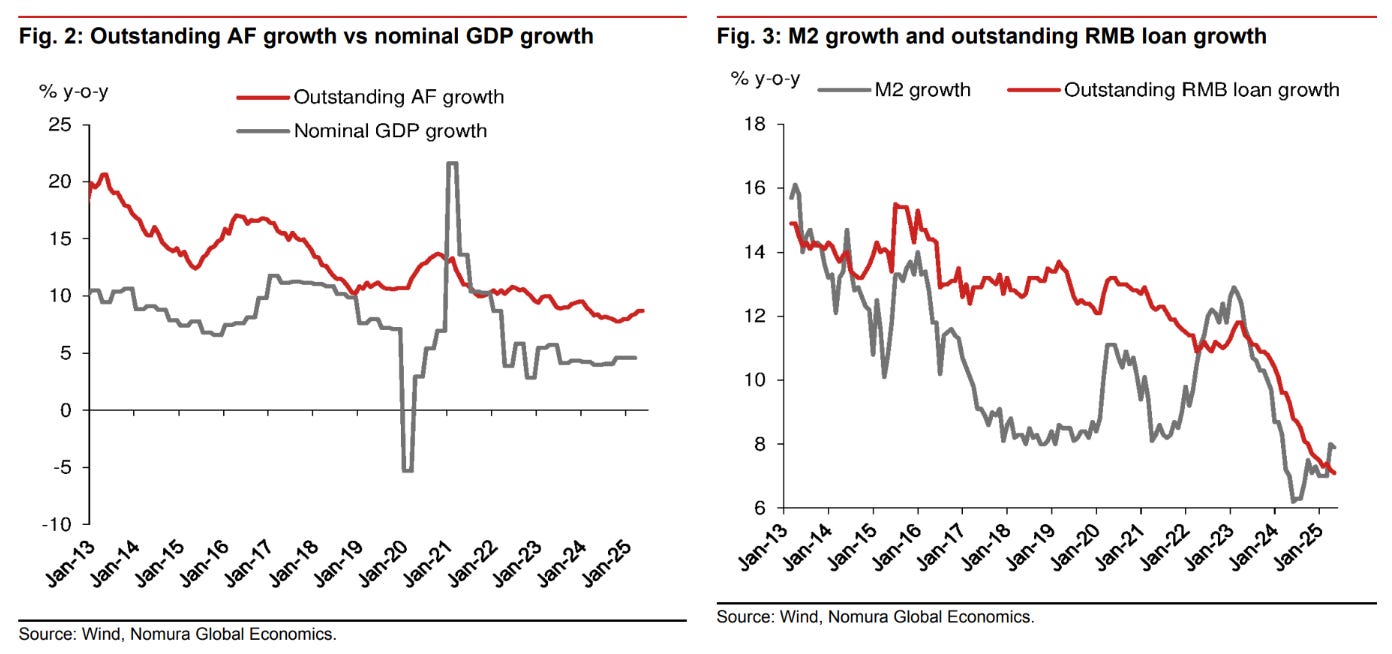

Even debt growth is struggling outside of government debt continues to settle in the doldrums.

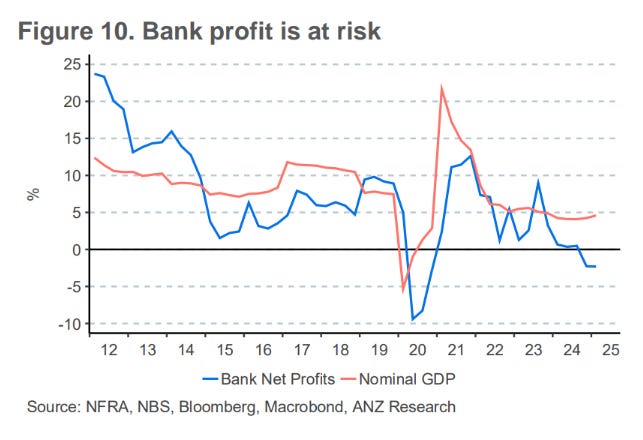

This is a chart the global economy doesn’t want to really know about. Zero tail risk is assigned to banking stress in China because everyone just assumes that they will just clean it up.

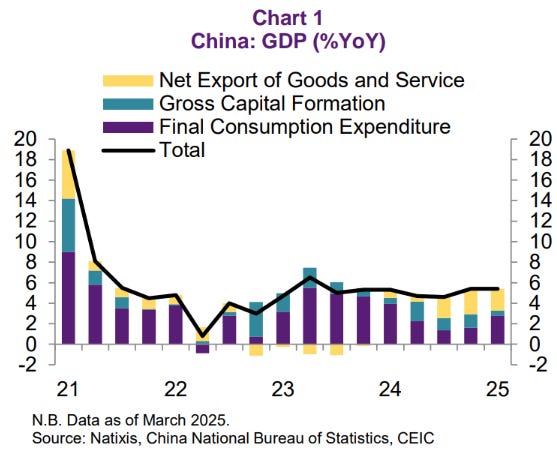

If there is any doubt about what is now driving the Chinese economy, please inspect the simple chart above…

…or this one.

While there haven’t been any large moves to speak of, prices for steel rebar and hot-rolled coil steel slowly sink…

…along with iron ore pricing.

Nobody is in a good position as trade imbalances are still argued about. Don’t write off Trump as the loser on this - China has arguably more incentive to maintain political stability that Trump does.

Bonds still suck

There wasn’t one perceptible pop in bonds yields over the entirety of the 12-day Israel-Iran war.

Bonds traded higher in yield with the spike in oil prices, mechanically transmitting the inflationary impact of higher oil, and reversing as they fell the ~$10 premium amount on the ceasefire news. Once upon a time bonds would rally hard on these sorts of headlines. Not anymore. There is no justification to own them in this environment, and 60/40 is still dead.

In more “everything is government” news, the Fed’s plan to cut the SLR (and thus allowing banks to reduce the limit on the amount of bonds they can own on their balance sheets) finally allowed bonds to rally into the end of the month.

The curve still steepened though. Look for a breakout higher soon.

Reading any further into any economic developments over this time to try and explain the bond rally is misguided.

To a certain extent this is true in general for interest rates. The politics is for lower rates, something we’ve continued to see calls for no matter the political leaning. As long as that is the case, short-end will be bid, long-end will languish, and the curve will steepen.

“Everything is government” will return to Europe

The DAX felt a little more from the conflict, where a 5% drawdown was driven by a reversal in defence stocks, the main European trading theme this year. This is more likely from overextended positioning than fundamentals.

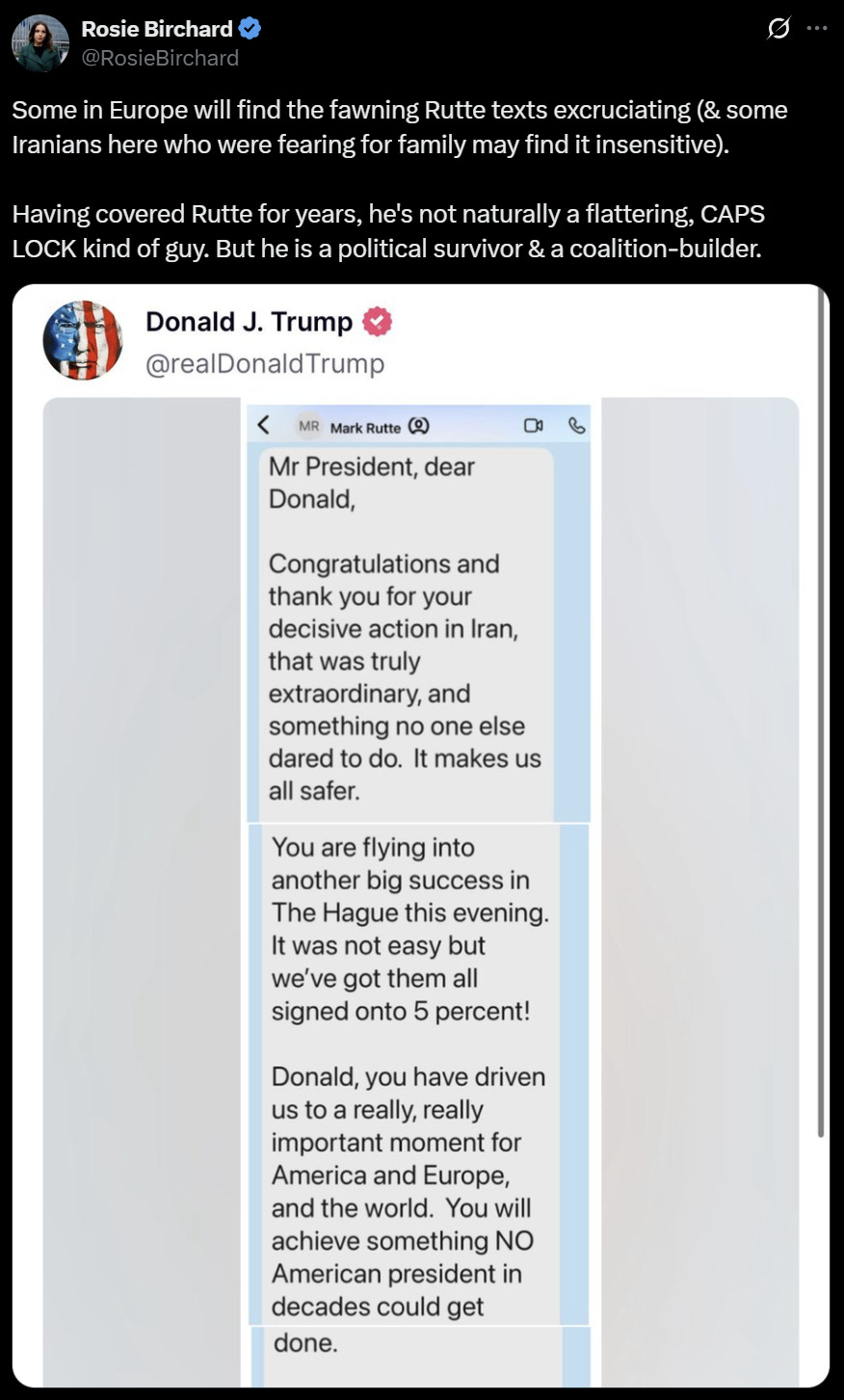

The week’s NATO summit firmed the resolve for 5% of GDP spending on defence…

…and everyone found this out in the best way possible!

Amazing graphs on China...Kudos!

You mentioned about Chinese banking at risk. I've read elsewhere NIMs are collapsing for Chinese banks.

How do you think it will play out? We all know China's growing debt pile and economic imbalances are unsustainable. But how will it play out and what likely is to trigger alarm? Shouldn't it fall under its own weight?