Charts & Notes: The Fed is confused

A rudderless, contradictory Fed joins geopolitical uncertainty

I don’t really believe in trying to predict the behaviour of central banks and their bankers, and this week’s FOMC highlights why I don’t.

Chairman Powell mentioned that their policy stance was in a “good place” 4 times during the Q&A part of the press conference despite forecasts by the members of the FOMC that have headed towards a mild form of stagflation and contradicting this by still guiding towards 2 cuts this year.

The FOMC and their forecasts

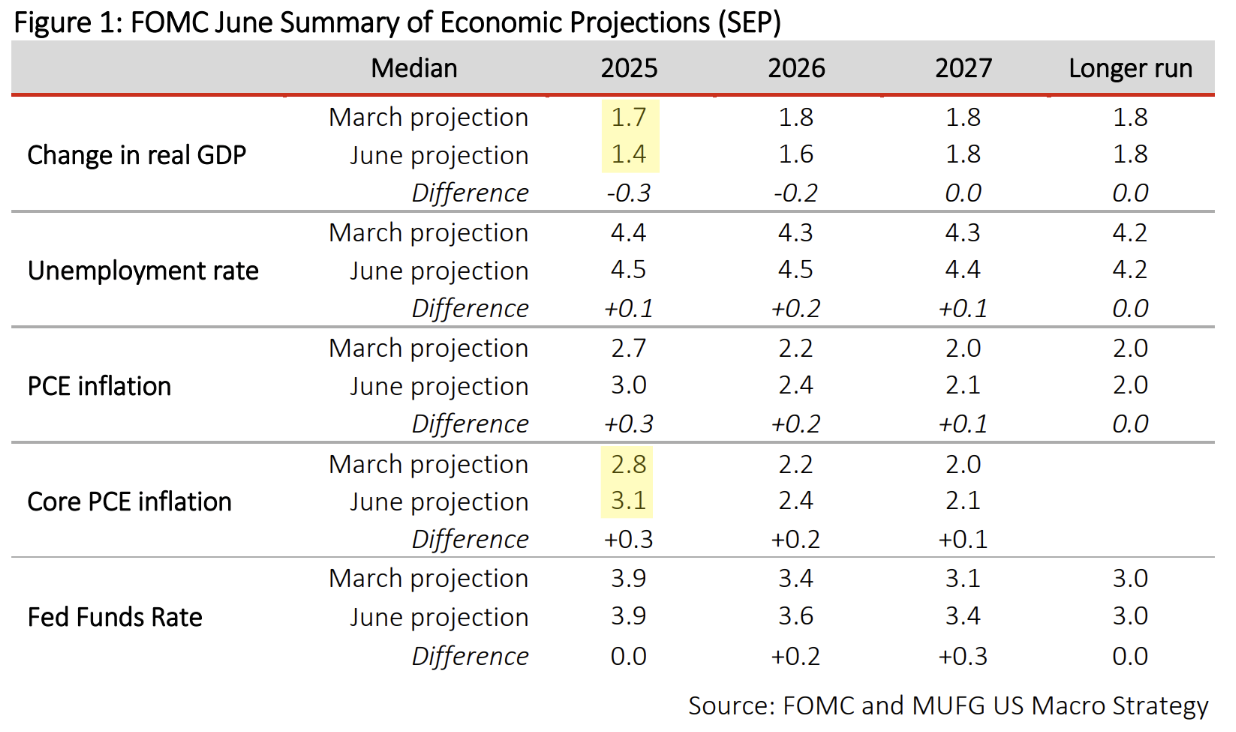

Initially it may just seem mechanical, as this quarter’s forecasts were affected by tariffs that were larger than their previous assumptions. Fair enough, April shocked everybody.

However, the downgrade to growth (1.7 to 1.4%) and upgrade to core inflation (2.8 to 3.1%) are quite extreme in both directions.

A forecast of 1.4% is worse than nearly all the annual real GDP growth prints for the US since the GFC, excluding the pandemic.

It’s worth noting that during this period of time the Fed ran zero or near-zero interest rate policy specifically because of low and uncertain GDP growth.

The inflation forecasts are more reasonable given the uncertainty of the sensitivity of tariff to CPI pass-through. Given the weakness of last month’s core CPI print (covered in last week’s ‘Charts & Notes’) and the slow speed of already established tariffs passing through, 3.1% (the mid of the range of forecasts with the low being 2.9%) seems high. Powell said that without tariffs, inflation would be coming down.

Compared to December’s forecasts above, GDP growth is down 0.7% and inflation up 0.6% for 2025. With new revised tariff levels does this sound reasonable? Sure, but this has to be taken into context of a Fed which has persistently under forecasted growth as the sizeable revision above from 2% to 2.5% for 2024 (when already three quarters through GDP reporting for the year) highlights.

The absurdity of the dots

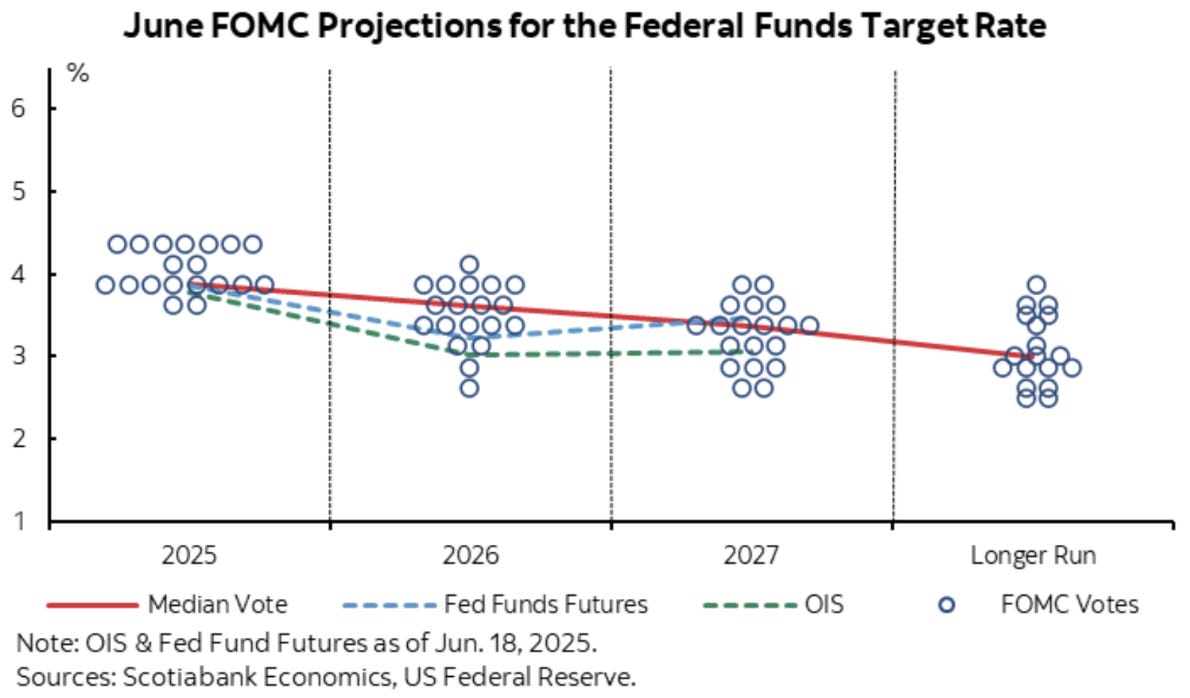

Then you have “the dots”, with the median “dot” guiding towards the median expectation of FOMC members for forward policy rates. “The dots” are absurd and this month’s FOMC meeting shows why.

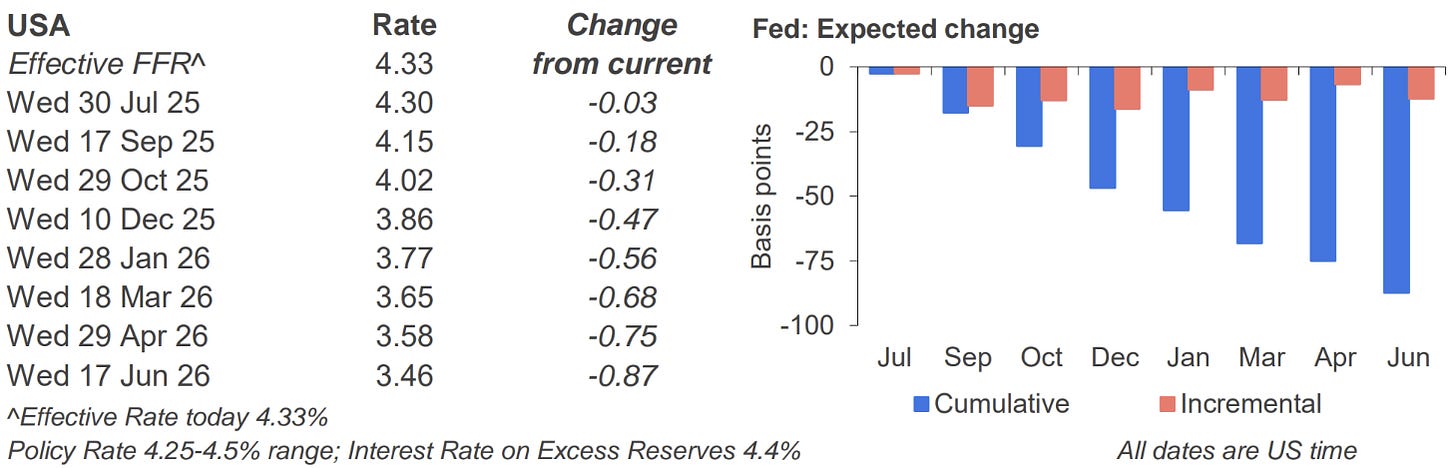

In the press conference Powell highlighted a high degree of uncertainty in terms of forecasting economic data and the rate path, putting more of a focus on near term projections. He continued to say the Fed is well-positioned to wait to learn more (especially since nothing has broken yet) about the likely course of the economy before considering any adjustments to the policy stance.

The median expects 2 more cuts this year, and one next. The market continues to trade for lower rates than the median for 2026, reconciling after that.

To be fair, there is a problem with presenting a median, with those forecasters who expected higher inflation expecting fewer cuts, so they are at least consistent.

Chairman Powell mentioned that given the high level of uncertainty that forecasting was difficult. This is probably the kicker for me, and highlights how much the Fed has changed since the 2010’s.

Given that the Fed is data-dependent, why wouldn't it be better to have rates that are more neutral as the economy heads into a period of very high uncertainty? Apparently not, for it is better to wait until things aren’t as uncertain (and hopefully not worse).

My view is that this is nothing but procrastination and defence against Trump’s accusations towards “too late” Powell along with a Fed that pretends to but doesn’t care about growth risks. They are still tormented by risks to inflation. If they believed their growth forecasts, they would be cutting now. But they don’t.

Everything else is a charade, which is why it’s so hard to predict what is going to happen.

From this point of view, the Fed will be praying that inflation stays contained so that they can deliver on their sticky “dots”, because if they don’t then market pricing for 2026 will back out its premium quick smart.

Back to zero

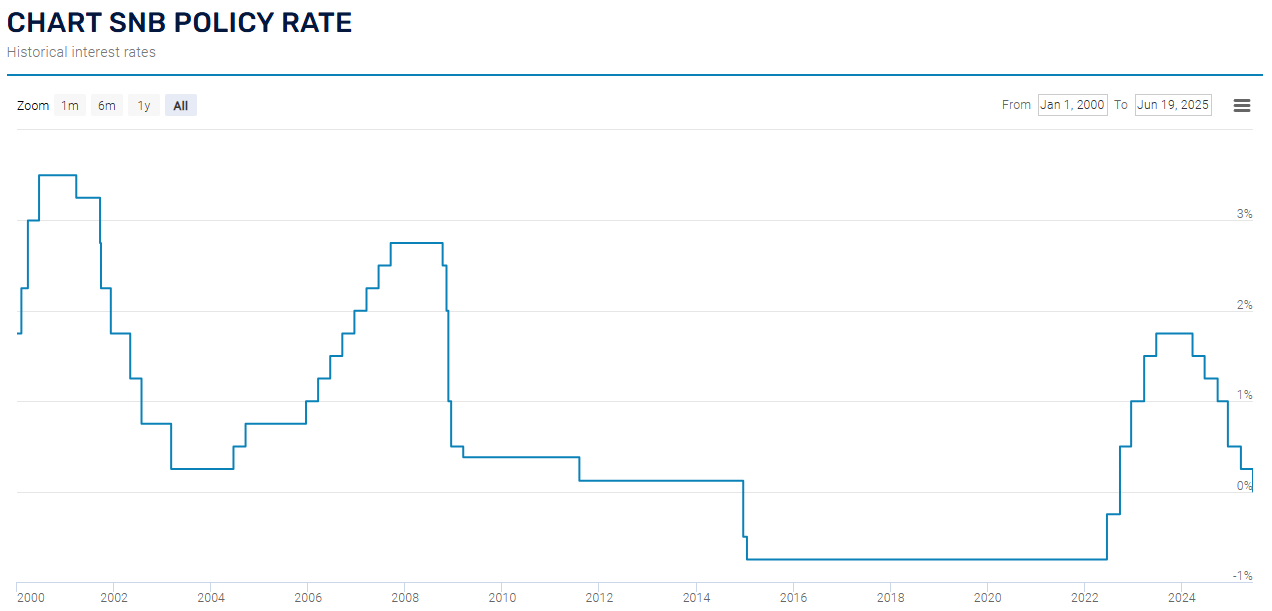

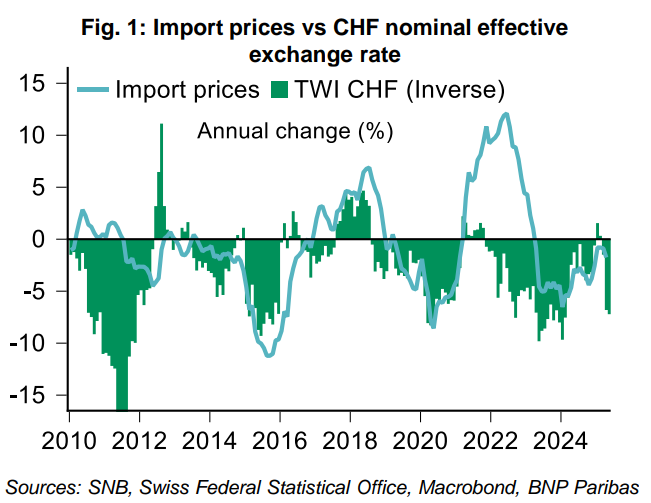

Turning to a central bank with (for good or for bad) conviction, the SNB got back to zero rates yesterday.

In a constant battle to stop currency appreciation that embeds deflation, the SNB has no choice but to run dovish monetary policy.

Oil

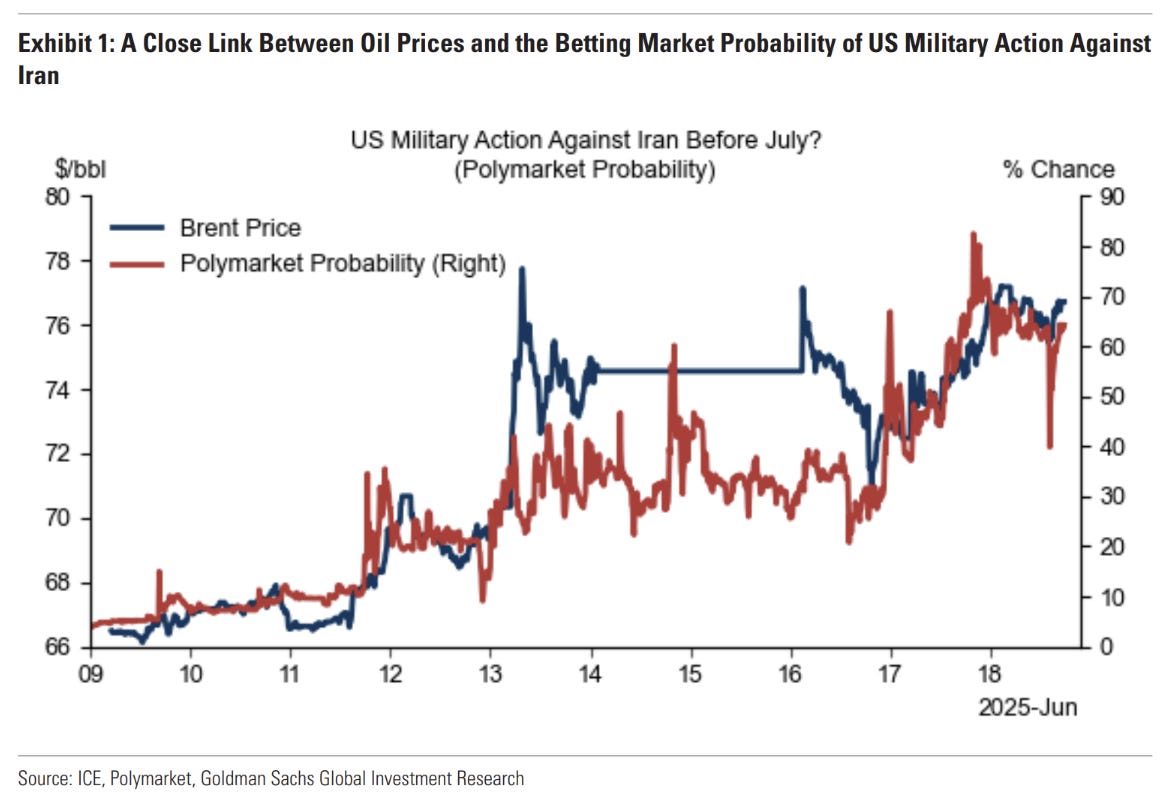

Oil has roughly a $10 premium for the uncertainty of the current conflict.

Currently July (expiring today) and August contracts are trading with the probability of US involvement.

The threat that will move oil above $80 will be something that results in the blockade of the Strait of Hormuz. I don’t think this can happen logistically while still letting through Iranian ships…

…which are mostly destined for China.

A direct strike on Kharg island (where most Iranian oil exports leave) is another possible catalyst.

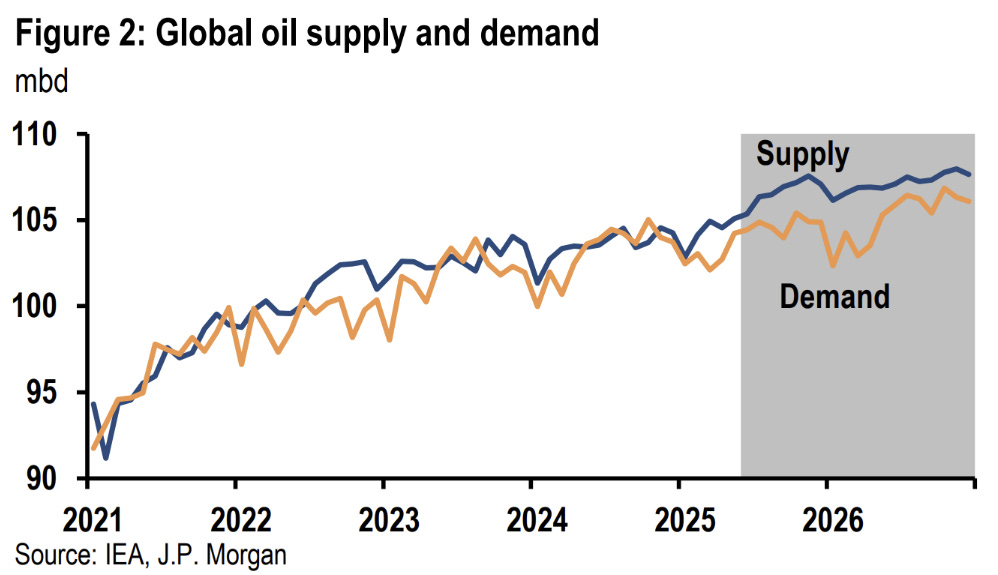

Outside of this, the market is oversupplied with the Saudis running a surplus to demand…

…resulting in strong backwardation in the WTI futures curve (helped by the precedent for these conflicts never lasting all that long).

US Deportations

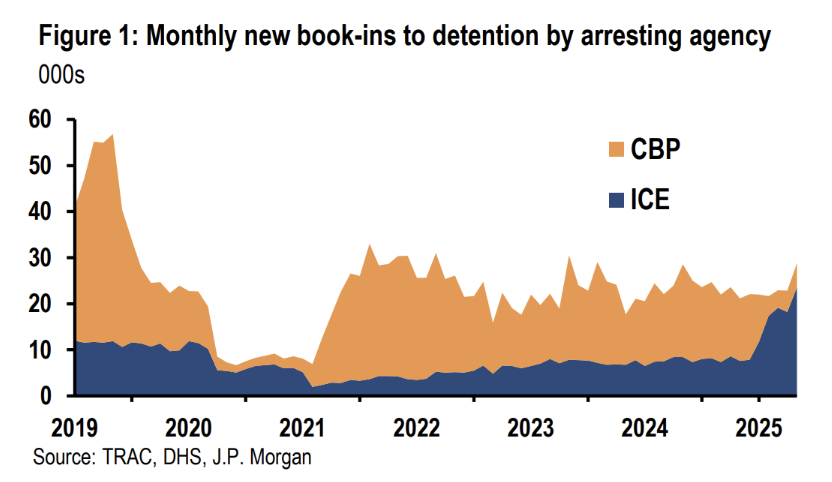

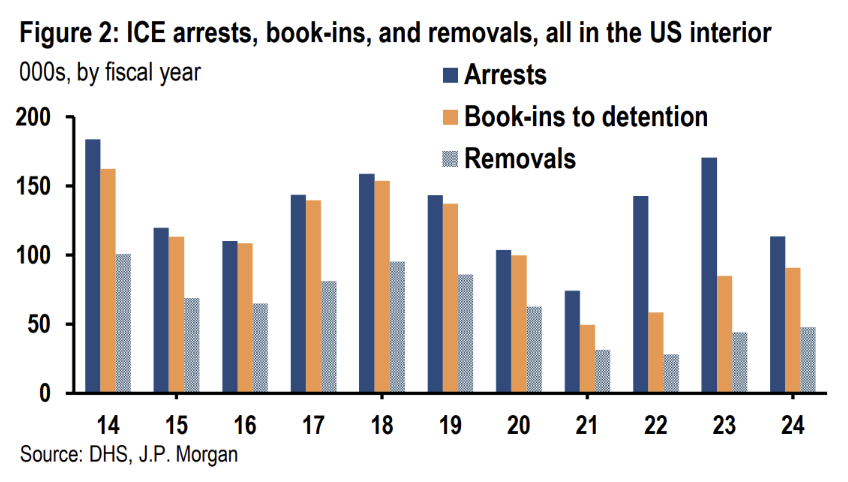

JPM put together a piece on how deportations of illegals are progressing in the US.

The answer is they aren’t meaningfully higher than the last administration yet…

…even when measured over different stages.

"If they believed their growth forecasts, they would be cutting now. But they don’t." 🤷🏽♂️

https://open.substack.com/pub/johnhcochrane/p/interest-on-reserves?r=1z5qli&utm_medium=ios