Crypto & moonshots: the "FU" trade

Why empathy is the best model for rationalising crypto pricing

While trawling some questionable internet forums in my late-20s, I came across something called “Bitcoin”. I read a little about it, downloaded a mining application, and set my 2000’s era desktop to create Bitcoin which was (then) worth very little money. Those Bitcoin ended up in a wallet that lived on that hard disk, which is now in a dump somewhere, never to be seen again. Who knows what they are worth today.

Feeling regretful now, what I distinctly remember from that experience is the few in that thread who were already religious about the idea of a currency which didn’t rely on trust of the banking system to exist. The GFC had just demonstrated the problems with these institutions, leading many just giving up on them. Fair enough, I got that part.

Where I missed the value in crypto was thinking that trust would be regained in the banking system as the wounds from the GFC healed. It wasn’t, and because of other numerous other macroeconomic trends, the mistrust only got worse. The ideology that crypto currencies have the power to free humanity from the tyranny of these corrupt institutions was ultimately the force that lifted crypto from obscurity to its position today. You don’t have to look much farther than the “laser eyes” trend to see the desire people have to be part of a movement that’s based in a little bit more than the idea that Blockchain technology is innovative and probably has many other useful applications.1

This force could also be explained by the power it gave to the disaffected and those distrustful of the system. These people wanted to participate in a way of saying “F*** You” to those who control and benefit from the system in its current form.

The “F*** You” trade is the flow of capital that seeks to disrupt of the current norms and upset a system that is just deemed to be unfair by those who are entering it. Crypto is not the only outlet for this trade. It is also not a trade that should be underestimated.

The rise of the ‘moonshot’ asset

A zero-income ‘moonshot’ asset confiscates your capital but pays no income in return. All of the ‘legitimate’2 crypto coins currently being traded are zero-income assets. NFTs, which spawn from crypto, are similarly zero-income. Countless tech “startups” (that you shouldn’t really call startups anymore) are also zero-income. These assets dominate popular culture and the attention of the media. Their very success has encouraged many more individual traders, who are mostly young traders, to come into the market, looking for a repetition of the gains that an early Dogecoin investor experienced.

The dot-com boom of the late 90s, where a large capital allocation towards the supposed “new economy” of the Internet occurred, is the obvious comparison to the current time. This difference to now is that the dot-com boom reversed quite quickly and the capital dried up for those companies that had no immediate path to profitability.

When comparing the two periods, the right question to ask is: “Are companies similar to Pets.com able to exist for a longer period of time now than they could in the past?”

Observing companies such as Uber that, despite their massive size, have continued to lose money and require fresh investor capital to keep trading suggests that they can3. These businesses truck on, taking more and more capital from a market that just can’t help itself.

‘Startup’ companies like Uber have received all of the attention for a number of reasons. Most are names that we all are familiar with as they are used on a daily basis. New technology is able to capture the attention of people far more effectively than old, boring assets. I believe that the dominant reason is that the barrier to entry to purchasing these assets and expressing a view on this narrative has fallen significantly. This allows everyone to participate in the “next big thing”.

What makes a new world zero-income asset cool

Zero-income isn’t necessarily considered on a like-by-like basis, meaning that an asset doesn’t just attract capital because it doesn’t make money. The asset has to have a certain set of attributes that cause it to attract capital.

For now however, the Venn diagram of attributes goes something like this:

The ultimate zero-income company includes aspects of “tech” (this can mean anything really and has more to do with the narrative than any actual technology), “disruption” (this also includes breaking the law) and the secret sauce, a charismatic cult-leader type icon that either runs the company or spruiks for the company.

The cult leader is vital because they are responsible for crafting the narrative that can:

Convince you the business really is tech-related;

Convince you on how world-changing this tech is; and

Convince you on much better your life will be as a result of this tech.

Combine all of this and you’ve got the formula for a company that can seemingly attract capital forever, no matter how bad the fundamentals of the company are. I suspect it is down to the cult-leader being technically proficient or not whether the company is successful (Tesla) or a total fraud (Theranos, Nikola, WeWork etc).

These type of assets create another factor which is key to the desirability of these zero-income assets. Volatility. Having little to no earnings, or even worse, require constant injections of capital, make the stock value highly reliant on the perceived future value which is entirely dependent on how good this cult-leader is at selling “the vision”. Volatility equals huge upside potential, giving these assets a “lottery ticket” type feel, but with more of an appealing narrative than a lottery ticket.

Crypto could not fit any better into the middle of that Venn diagram, and has the volatility to boot. The “tech” is innovative and works, it has a gaggle of cult-leader icons spruiking for it, and it is desirable because it disrupts those same people and institutions that have earned the ire of younger people that distrust the “system”.

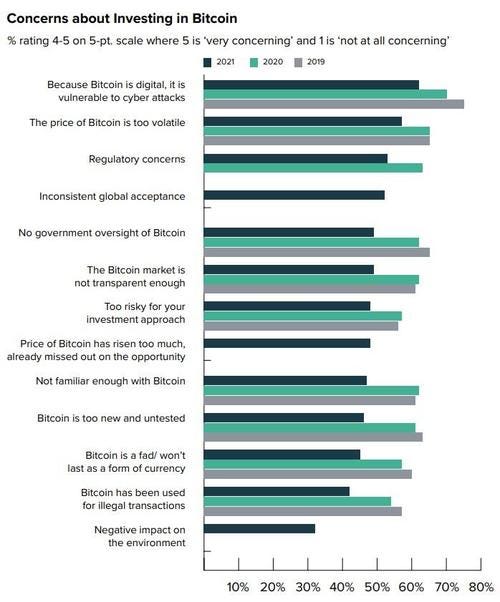

The desire to be involved in crypto is so strong that the community is happy with accepting an unregulated Wild West market in which scams are rife and billions are stolen from exchanges with alarming frequency. Not to mention the high cost of transactions and large environmental footprint for proof-of-work coins. These issues and more aren’t even lost on those that own cryptocurrencies, with a majority being of owners being concerned about them.

While presented somewhat tongue-in-cheek, this combination of attributes captures important aspects that all work in unison to appeal to those seeking their riches. Young people today are no less smart or more greedy than at any other time in history, despite the opinions that suggest that the millennial generation is more demanding, less willing to work or more selfish. The commonality between generations goes further than the dismissive fallacy of saying that the new generation just isn’t like the old.

Like all humans since the dawn of time, the current young (millennial) generation has wants and needs and responds to incentives that dominate the environment at the time they move into being adults. Their hardships may not be the same as the hardships of the last generation, but they are no less real. And like every generation before them, some will seek out a messiah that they believe can help end their hardships, making the cult-leader type appealing.

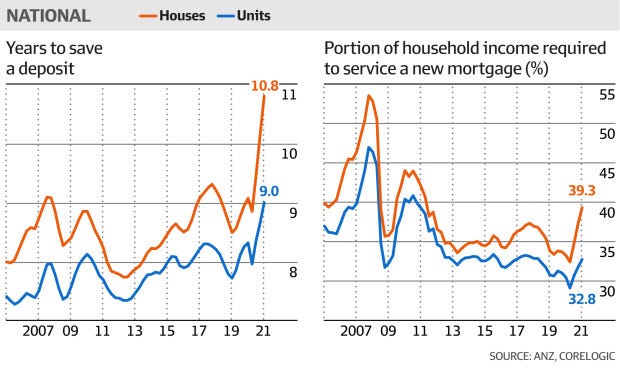

The data reveals that the average age of direct equity investors continues to fall (and becomes more female). In the past, people in the younger age groups didn’t trade because of the lack of capital. This capital had generally gone towards housing or a car, but maybe not anymore.

The oldest zero-income asset - your primary residence

As with new-world zero-income assets, housing prices have also been moving aggressively higher in the last few years. These trends have been repeated in most developed countries, but I’ll concentrate on the US here.

Median house prices are always difficult to summarise in one number, but it seems that they may be roughly 50% higher today than what we saw in the debt-fuelled housing boom of 2005 to 2007 (chart 1). Interest rates are lower meaning repayments have fallen, but the principal of a mortgage still has to repaid no matter which way you look at it.

I don’t think there is a coincidence that we’ve seen housing prices shoot higher in the same period that Bitcoin has more than quadrupled in value. Despite record low interest rates, affordability has cratered recently as interest rates just cannot do the work of keeping monthly repayments down to make up for price rises anymore. The Atlanta Fed HOAM index (chart 2) tracks the effect of each component on affordability. The red bars above zero are the move in interest rates helping affordability. The blue bars below zero are house price moves hurting affordability.

The price moves in housing aren’t anywhere near as remarkable as those we’ve seen in more speculative assets. A housing asset differs in that there is a low chance that your investment will go to zero in comparison to the more speculative new-world assets, as a house clearly has a significant amount of utility. I would argue, however, that this move in house prices is one of the main culprits proliferating the “F*** You” trade.

A disaffected generation

Very few people would argue that housing ranks more as a need rather than a want. Of course, rentals are available to fulfil a need, but prices here are rising too. Research is split on the benefits of home ownership versus renting. What is clear from the data, however, is that the attitude towards home ownership, something that has stayed fairly static in the past, is now changing. Chart 3 highlights this reduction in ownership for the millennial generation versus prior generations.

Not being able to own a home has also been shown to increase anxiety amongst those that consider it important. In the past those that never own their own home end up being significantly poorer than those that do. This will only continue to be the case if house prices keep increasing.

From the linked article:

In 2019, homeowners in the U.S. had a median net worth of $255,000, while renters had a net worth of just $6,300. That’s a difference of 40x between the two groups.

The anxiety caused by these trends are felt as a genuine hardship amongst the current generations. Hardship can spur some to work harder. Hardship can cause others to become bitter, angry and disconnected. Hardship can also leave people praying for someone who can offer a solution. However anyone chooses to deal with this hardship, there is invariably a strong desire to attribute blame for the unfair situation one finds themselves in.

No wonder there is a desire to search out such riches as have befallen others who have invested in the disruptive space. Nobody investing in utilities, banks, or retailers has made 10x their money in recent history - but in crypto and tech, the story is vastly different. You need to get 10x your money to just catch up with those that only entered home ownership just 20 years ago.

Some blame this older generation who benefitted from attaining home ownership at a time when prices were lower. Others blame the politicians who still tailor policy towards home owners and the aforementioned older generation. Corporate interests have attracted blame for financialising our entire economy and enabling those who are capital-rich to benefit far more than those who aren’t.

It’s not hard to see how these attitudes come to manifest themselves in anti-capitalism, anti-government or other behaviour that is “disruptive”.

Crypto and the promise of disruption

It is probably impossible for anyone to know if crypto will actually disrupt traditional banking. The future utility of any cryptocurrency will be entirely dependent on the path that society takes and the institutions that survive. If there is a significant event which changes how the world’s economy currently works, crypto might form the base of the new system.

However, whether cryptocurrency will actually disrupt or not is irrelevant here.

What is relevant is that the themes and trends that are leading to a large group of people seeking to support disruption aren’t abating and are, in fact, accelerating. The narrative of crypto being disruptive to central banks, governments, the old-money economy and so forth has validity, and very strong buy-in. The cult leaders that push these ideas (mostly for their own personal benefit rather than some greater good) continue to spruik the possibility for crypto to provide a more fair and just future, just because this message resonates extremely well with the disaffected, young person.

In the end, this is the essence of the “F*** You” trade. Young people that are most energised and direct the most capital towards crypto, meme stocks and tech stocks, see the way things worked as not working anymore and are designing the future as they want it to be; decentralised and free of the traditional institutions which they perceive as been corrupt. If the system doesn’t work for you, then change it. Political change has throughout history arisen from the youth starting revolution.

Housing and crypto are merely a single example. Similar trends are observed in far more undesirable human behaviour such as crime. Crime doesn’t correlate with the absolute level of wealth, but is more associated with inequality of wealth.

Crypto’s potential future success is a balance of two things. The advantage of the old-system of fiat currency are cheap transactions, convenience and efficiency. Crypto fails on these points, but offers an advantage far harder to quantify - the value of freedom, without the necessity of trust.

The desire for freedom is very human. If the desire for freedom is high enough, then it doesn’t matter that crypto doesn’t work as well as the old system. If the desire for freedom continues to rise, then anything can happen.

Investigating inequality

The “F*** You” trade can only exist in an environment where a lot has gone wrong over a very long period of time. All the usual suspects are involved - central banks, politicians, corporates - but no single group or entity is responsible for it.

The answer is that all of these groups and more have acted poorly because of structures being in place that have perverse incentives and insufficient accountability. These structures have worsened over time due to innate human behaviours that, unfortunately, affect all of us.

These structures and behaviours can bring the worst out of a powerful tool such as debt. Debt can bring forward the future’s productivity to today, allowing us to spend what hasn’t been earned. Spend the money created from debt on the right things and we can supercharge society’s development. Spend it on the wrong things and we will be working for many years for nothing to pay back this foolish spending.

Debt has grown exponentially, and while we don’t fully know if it’s being spent on the right thing or not at this point in time, our system has not allowed the wrong decisions to result in collapse which would wipe out the debt where necessary. Putting off problems for another day can have serious unintended consequences, which may be presenting themselves today in assets such as housing, and therefore has led to the rise of crypto, something which has the potential to destroy how the current system works.

Setting interest rates at zero forever may have also simply forced people to give up on traditional income generating assets and turn instead towards crypto. Why are interest rates at zero? Because of the immense debt load.

The aim of this newsletter is to investigate these ideas and more in depth in the future.

Empathise with the drivers, and the prices make more sense

Wealth inequality continues to rise, and as a result the capital that is finding its way into stocks and cryptos is going to keep on searching for more upside and volatility. The only way you’ll buy that house is if you ‘bet the house’ now. Wealth inequality is not just a concern for the poor anymore, it’s a concern for young people that aspire to be the middle class.

Comparing growth versus value stocks in chart 6 shows where the weight of money is headed, and it continues to point to further strengthening of the trend. All zero-income assets are ‘growth’ assets by definition.

I don’t own crypto yet, and I’ve clearly missed the run up to this point. I’m sceptical of what utility it can provide within the current system. However, the “F*** You” trade has the power to drive prices to places old-fashioned analysis can’t justify, and possibly even change the very working of the system itself. Even if you don’t agree with the desire to disrupt, owning crypto is a way to hedge against these impossible to predict changes from happening.

There are plenty of crypto-currencies that purport to pay “interest”. These all pay interest by just issuing more coins which dilutes existing holders. This is indistinguishable to how a Ponzi scheme operates.

Yves Smith had a fantastic series on why she thinks Uber will struggle to ever be profitable, highlighting some key issues with maintaining a competitive cost-base when Uber’s indirect fleet is a mish-mash of vehicles that don’t benefit from economies of scale in maintenance and repair like a taxis' fleet does.