Charts & Notes: Tracking Tariff Effects #2

The inflation print that says everything and nothing at the same time

I’ve had a few days to think about the US inflation print this week, and I’m really no closer at developing a strong opinion one way or the other.

The fence-sitting summary is that:

Tariff induced inflation has started to show, but we don’t really know how the magnitude of the total pass-through yet; and

Disinflation elsewhere makes it all sort of irrelevant.

We’ll get to the data in a second, because it is insightful in understanding how the tariff experiment is actually playing out.

Too many economists are obsessed with Trump to evaluate the experiment well. This affects the quality of their analysis, which has shown both evidence of higher domestic prices within a fairly smooth transition along with some foreign sharing of the tariff burden.

Politicians are politicians of course, and I’m not sure why anyone would expect them to say anything other than they will simultaneously bring in revenue without inflation and bring back jobs through reshoring. Achieving all of these aims simultaneously is impossible.

Tariffs just don’t work unless they cause inflation. A price signal is a necessary condition. More on this below.

June inflation data

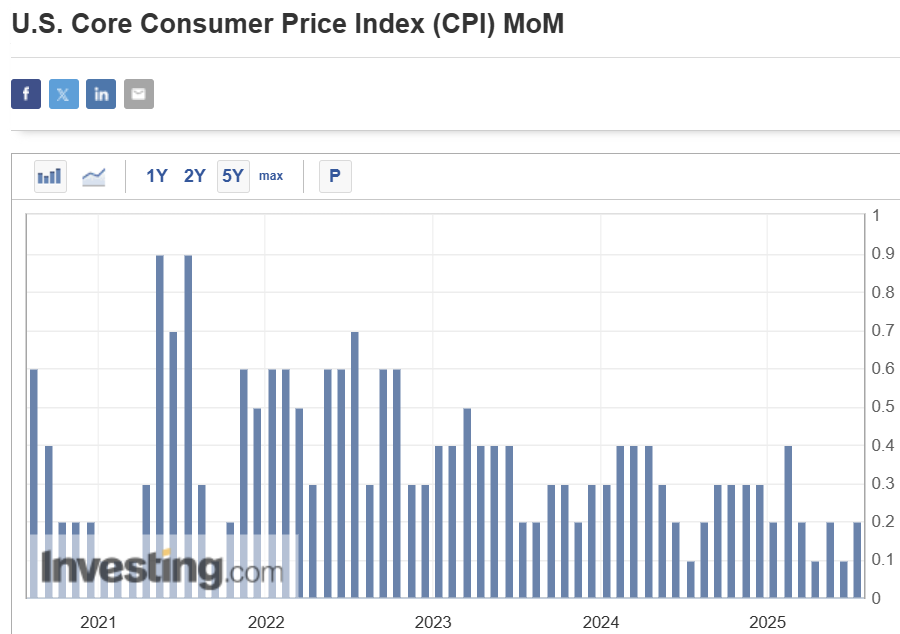

Core CPI came out at 0.23% versus and expectation of 0.3%, well under expectation and continuing a run of below expectation prints.

Despite this, front-end rates sold off a decent amount on the data, suggesting it saw inflation as being “bad”. I can’t say I understood this move, and it may have more to do with positioning because of the string of below consensus outcomes, or just the fact that we still have a decent number of cuts priced for in an economy that continues to grow well.

Some have suggested it is because of the scare of tariff effects coming through. I’m not sure this argument holds up given that the downside surprise in the more persistent category (rents) is more important than a upside surprise in a transitory category (core goods inflation driven by one-off tariffs).

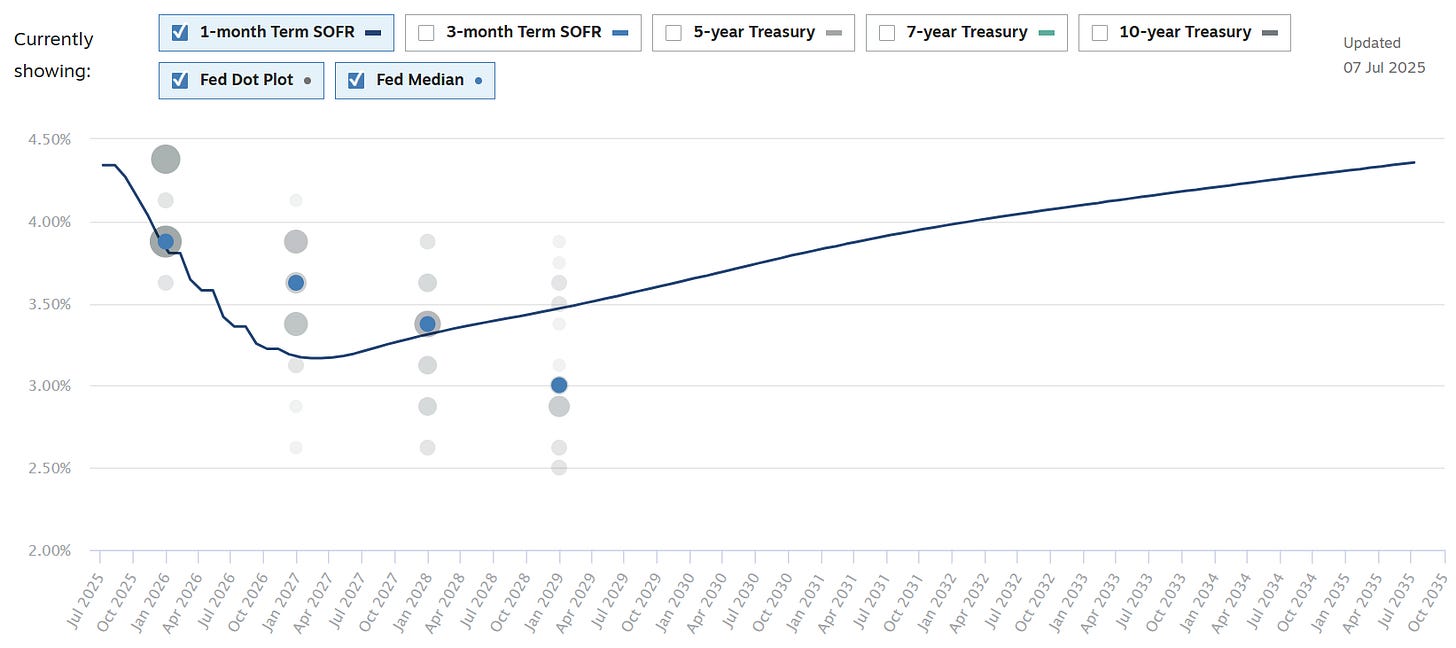

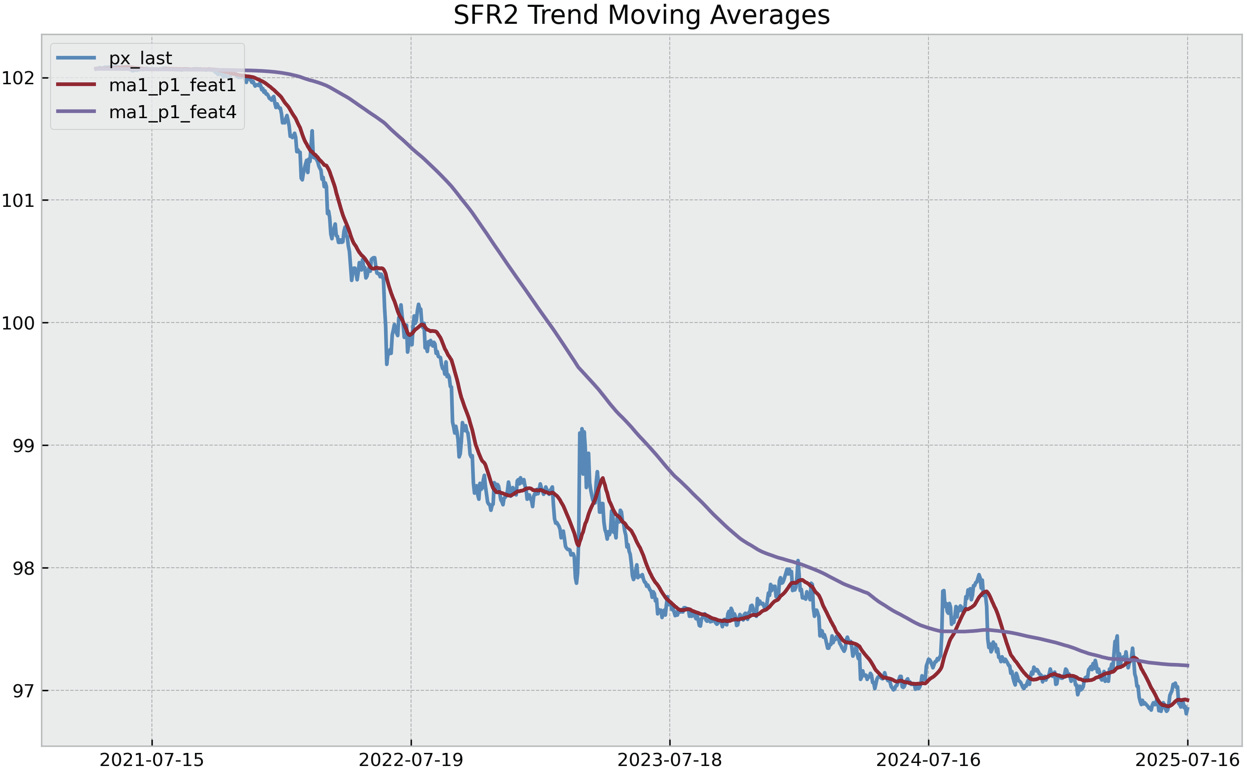

Either way the moves leave rates range bound with the December 2025 SOFR future trading in a 1% range for 2 years now.

If we fix the price to the second SOFR future the picture becomes clearer - the bear market in rates isn’t over and the roll up the curve will continue to cause losses for bond longs.

Onto tariff effects.

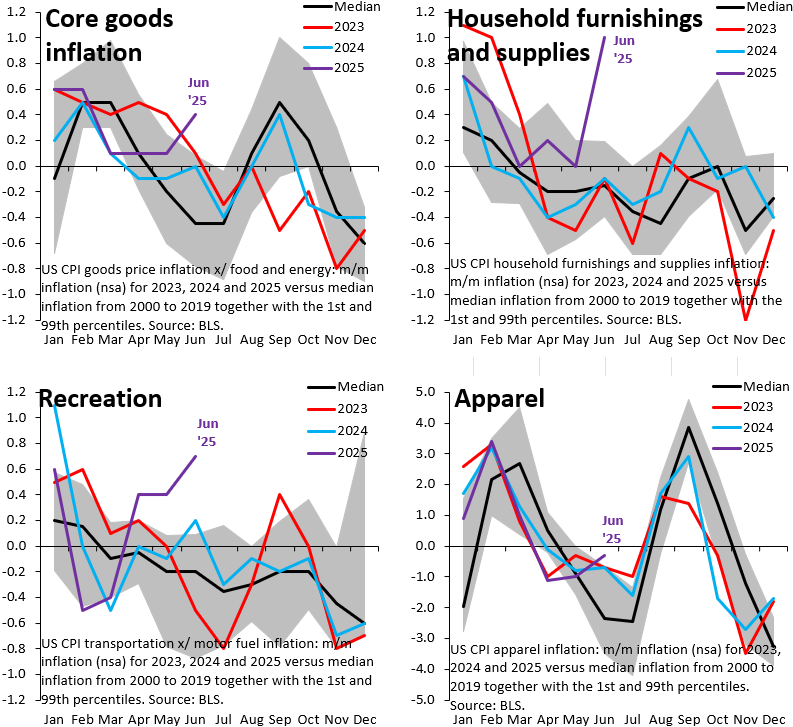

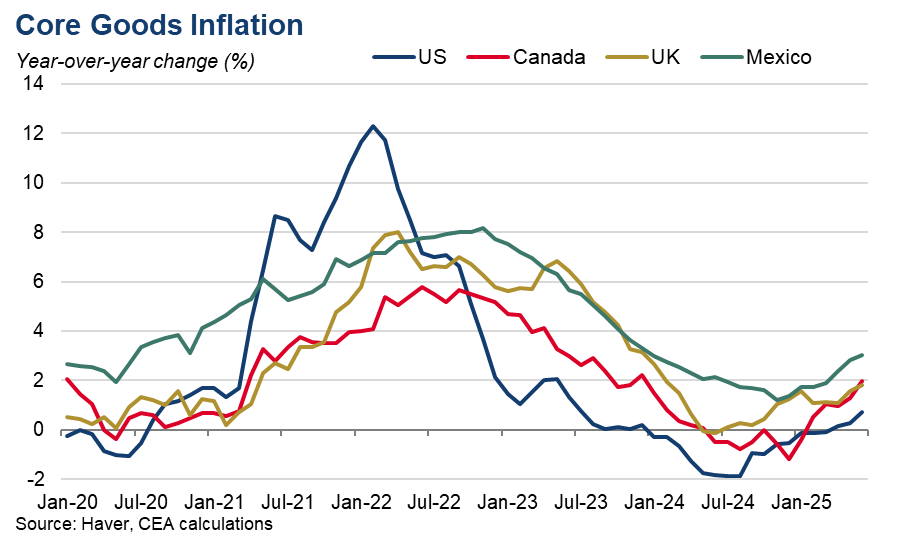

Robin Brooks presents this excellent non-seasonally adjusted chart for core goods. The June print shows that there has been an oversized move higher in goods prices from tariffs.

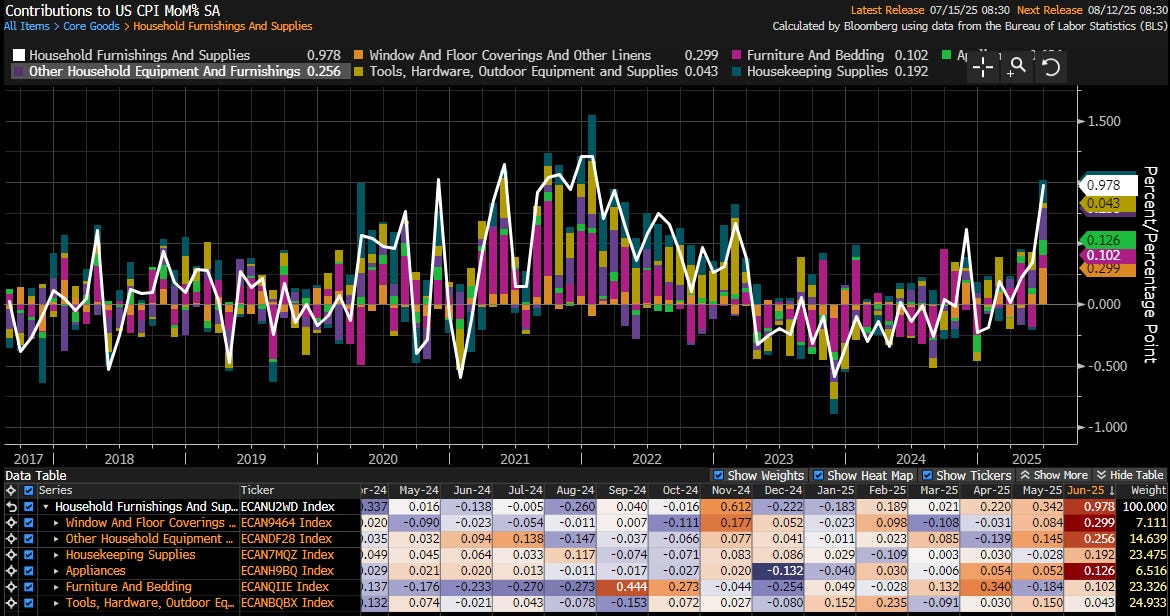

Looking at the most affected categories it is even clearer.

Core goods in aggregate rose ~1% last month, which was generally above expectations, but total core CPI came in below because of rents disinflation.

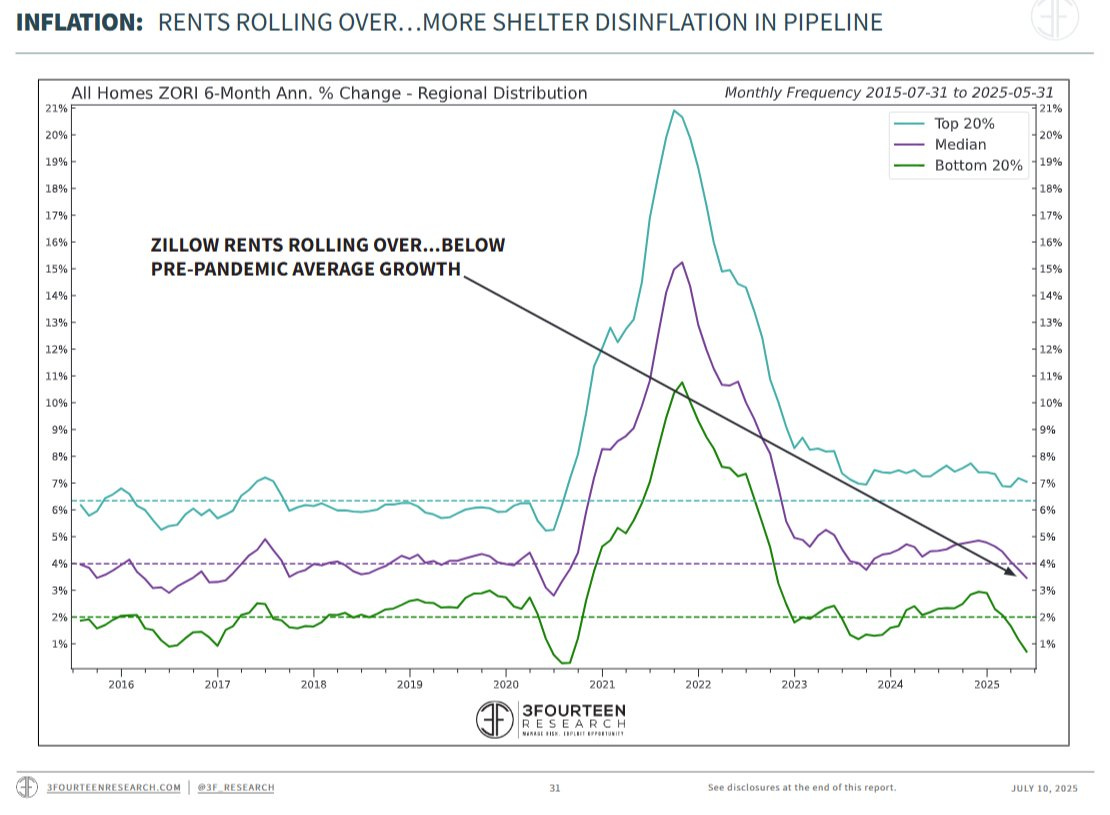

Continued weakness in rents (summarised by the Zillow rent index above) overcame the upward move in core goods pricing and creating a situation which is making the politicians look “right” (and is likely adding to everyone’s anger!).

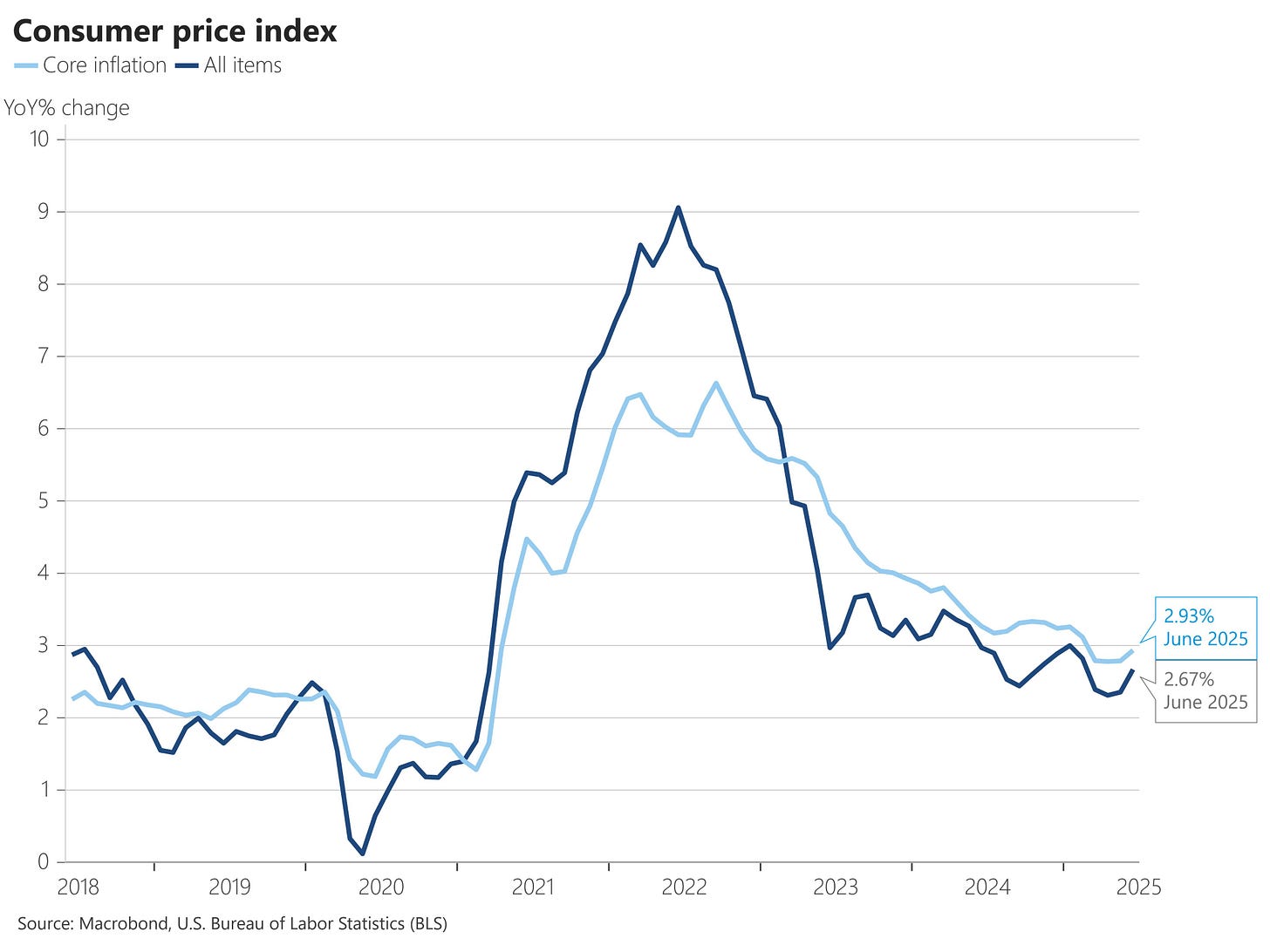

Taking the raw figures on their own it wouldn’t seem like inflation is a problem, complicating the picture for all.

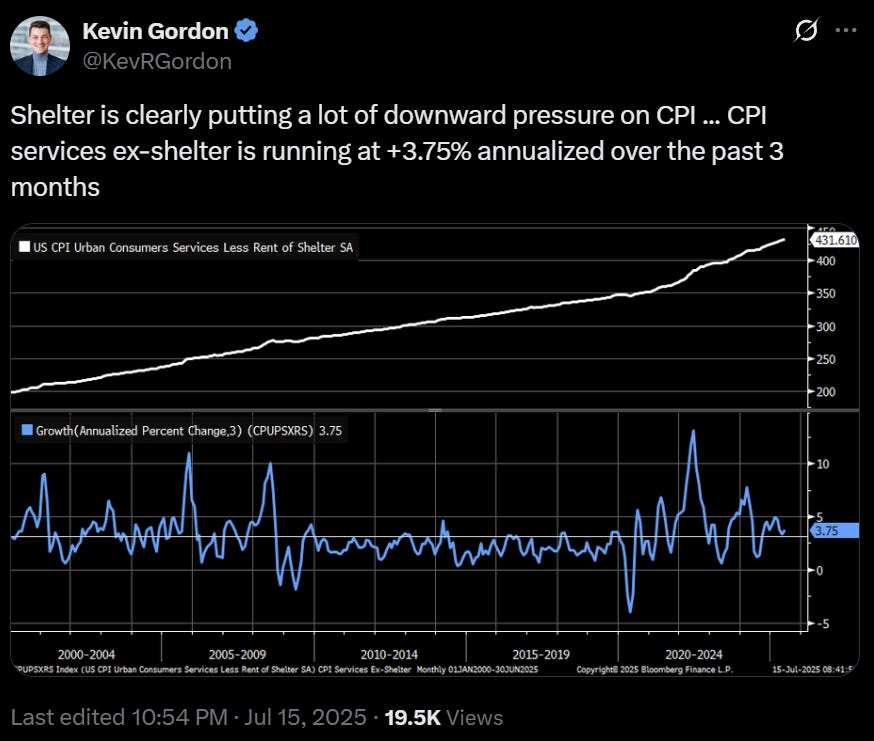

You can divide up inflation to get any answer you want. Taking out shelter leaves inflation running at 3.75% when annualised over the last 3 months.

Taking all items there has been a slight tick up to 2.93% core over the year. Pre-tariffs this level was my expectation as the Fed really didn’t feel like it had to stamp out the last bit of inflation with last year’s rate cuts.

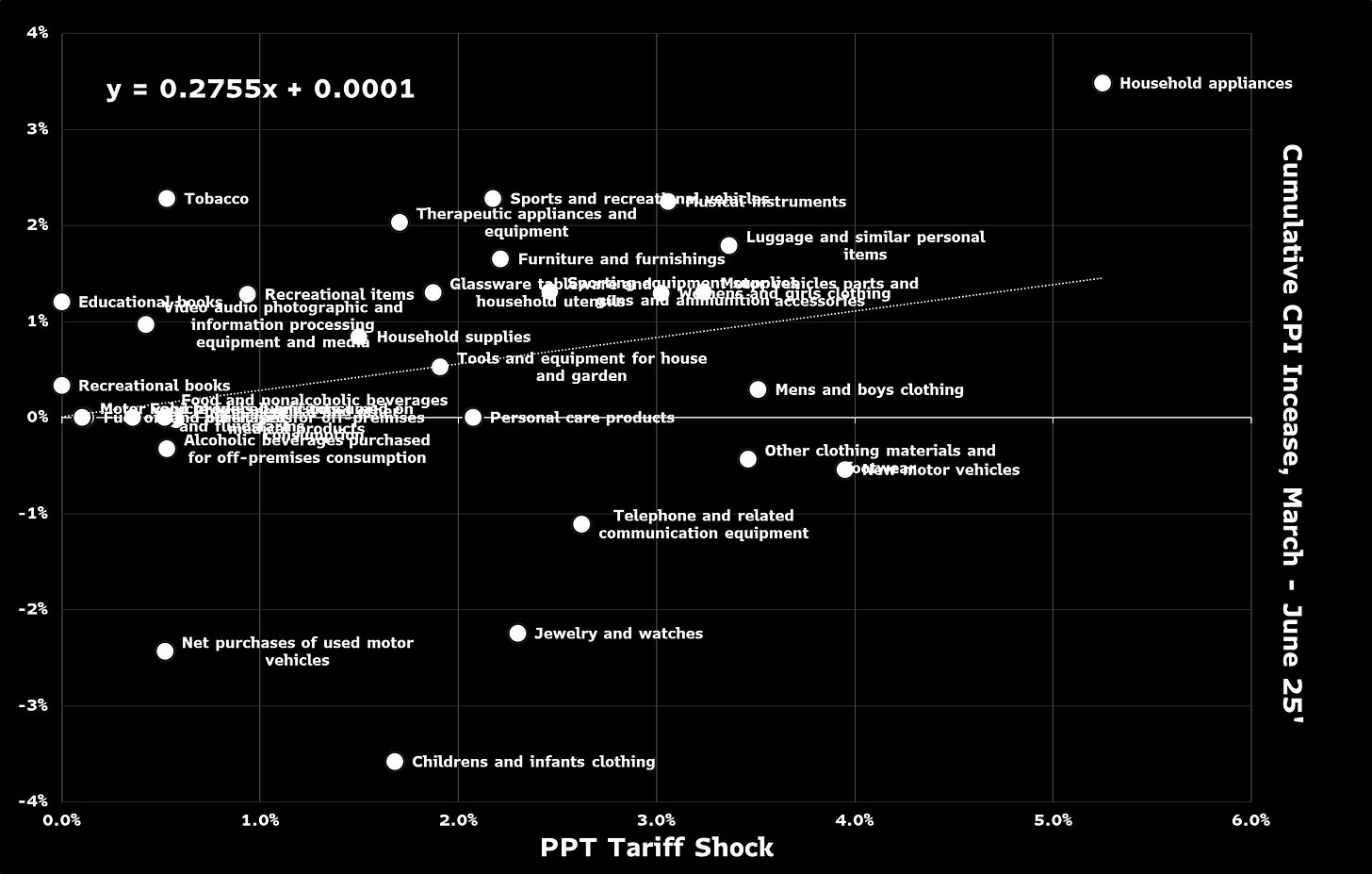

Anna Wong presents a regression of cumulative price rises in tariff affected categories versus the headline tariff change. Over June the pass-through rate increased from 20% to 28% with either importers or exporters taking most of the hit for now. We will need to see how this plays out as the year progresses and front-running effects (if present) work their way through.

Using the midpoint of the brackets above, the average pass-through for manufacturers is 44% if the survey ends up reflecting to reality. So, on this basis we are over halfway through the cumulative tariff effect.

I lean towards there being less pass-through because of the stress apparent on Chinese producers and their dangerous leverage to lower volumes. Prices other countries should rise in sympathy to try to recover reduced margins of selling in the US. This isn’t consensus.

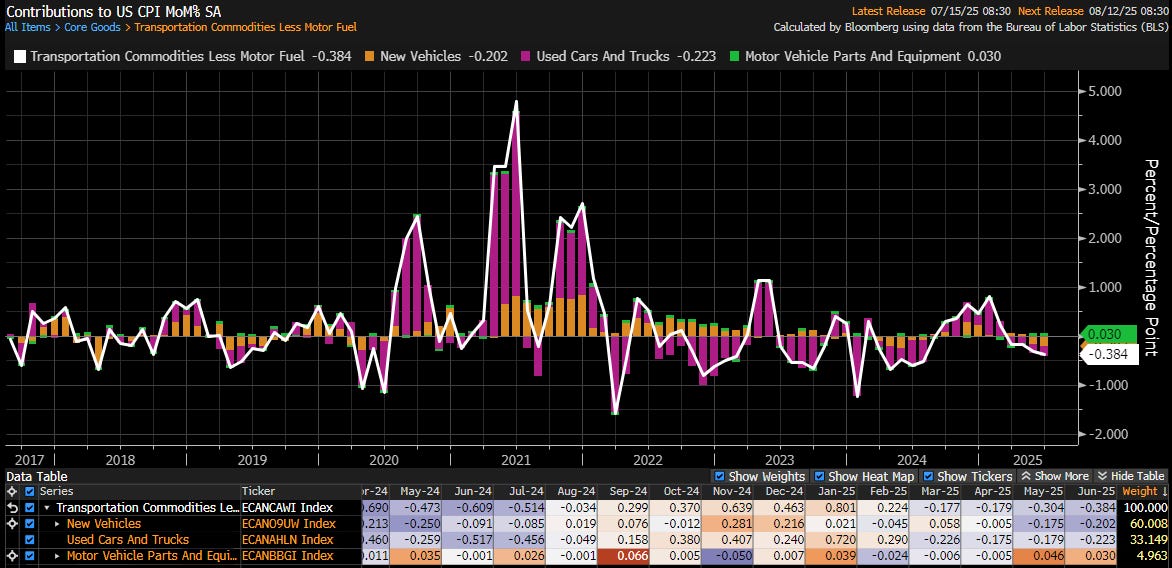

The biggest surprise (and an outlier on Anna’s chart) would have to be the continued deflation both in new and used cars which has been a direct target of tariffs.

In their CPI preview, GS outlines why it expected this. Tariff pass-through will take a while.

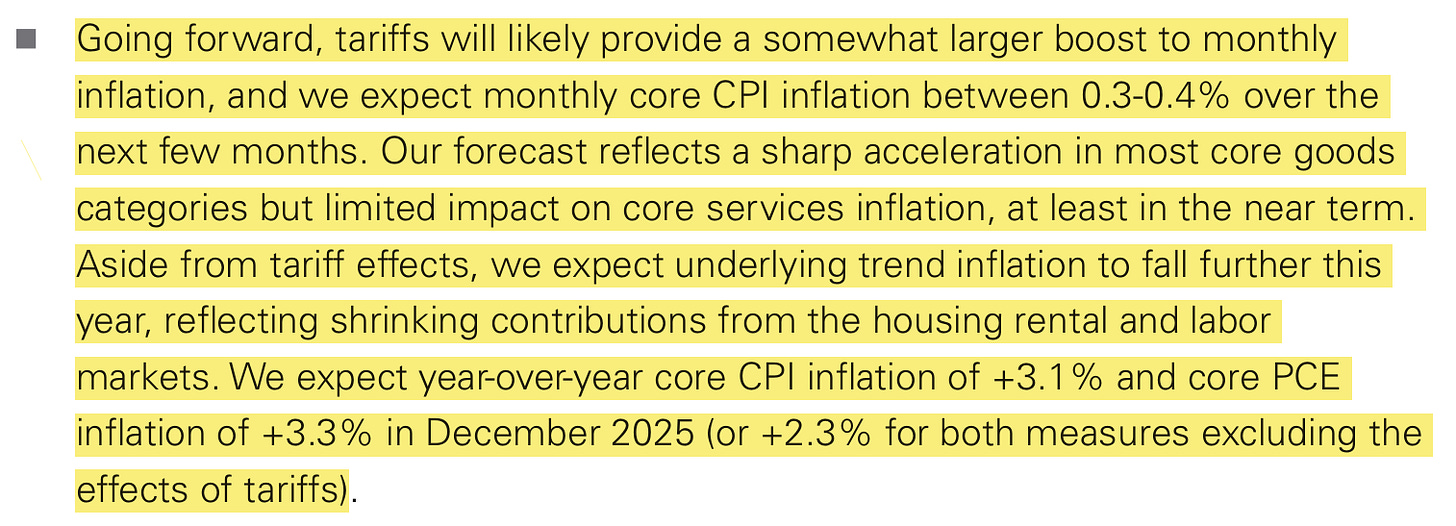

They also expect forward core inflation to be between 0.3% and 0.4%.

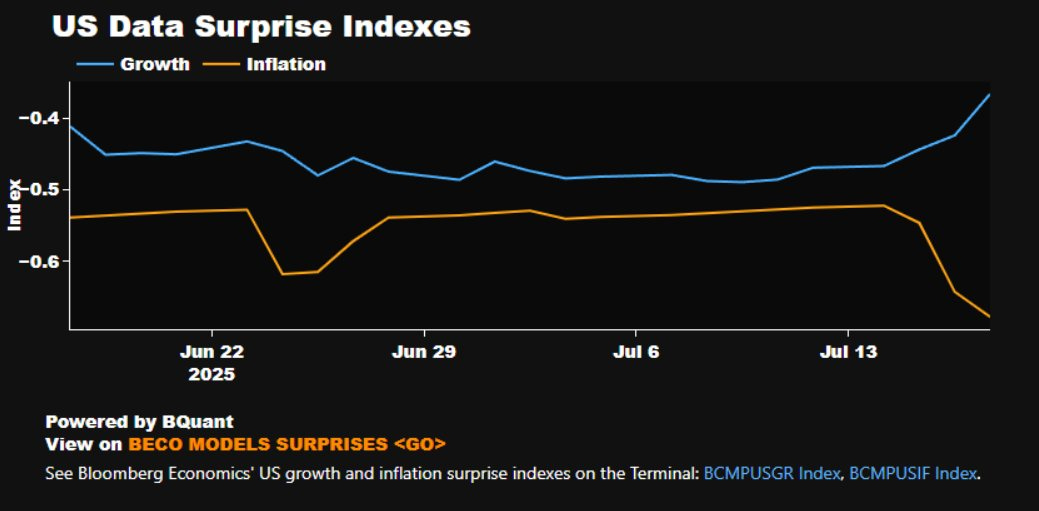

This Bloomberg chart is such a great summary of what has happened recently. The rising blue line has probably been more important than the falling orange line.

To confuse things a little more, US core goods inflation year-on-year is lower than some other (handpicked by the CEA) countries. This probably won’t look as good in 6 months’ time, however.

Trade health

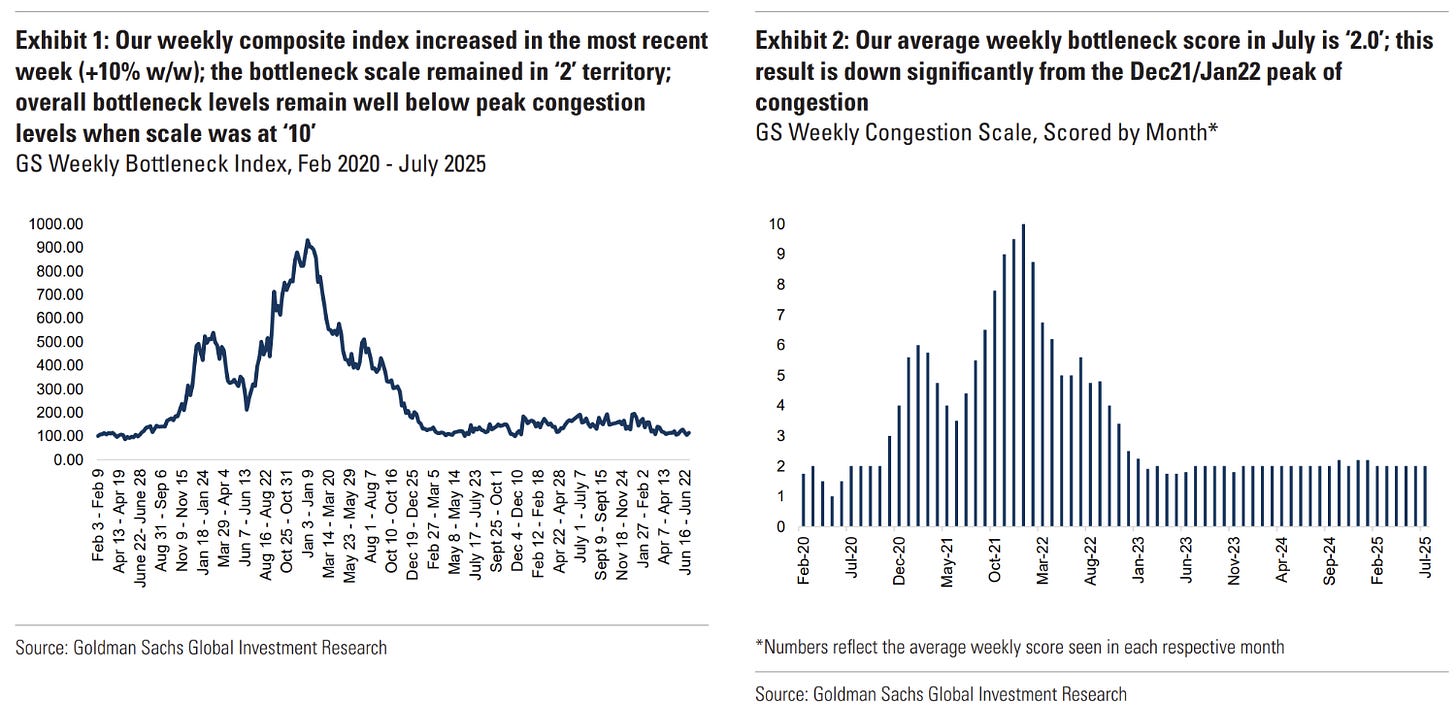

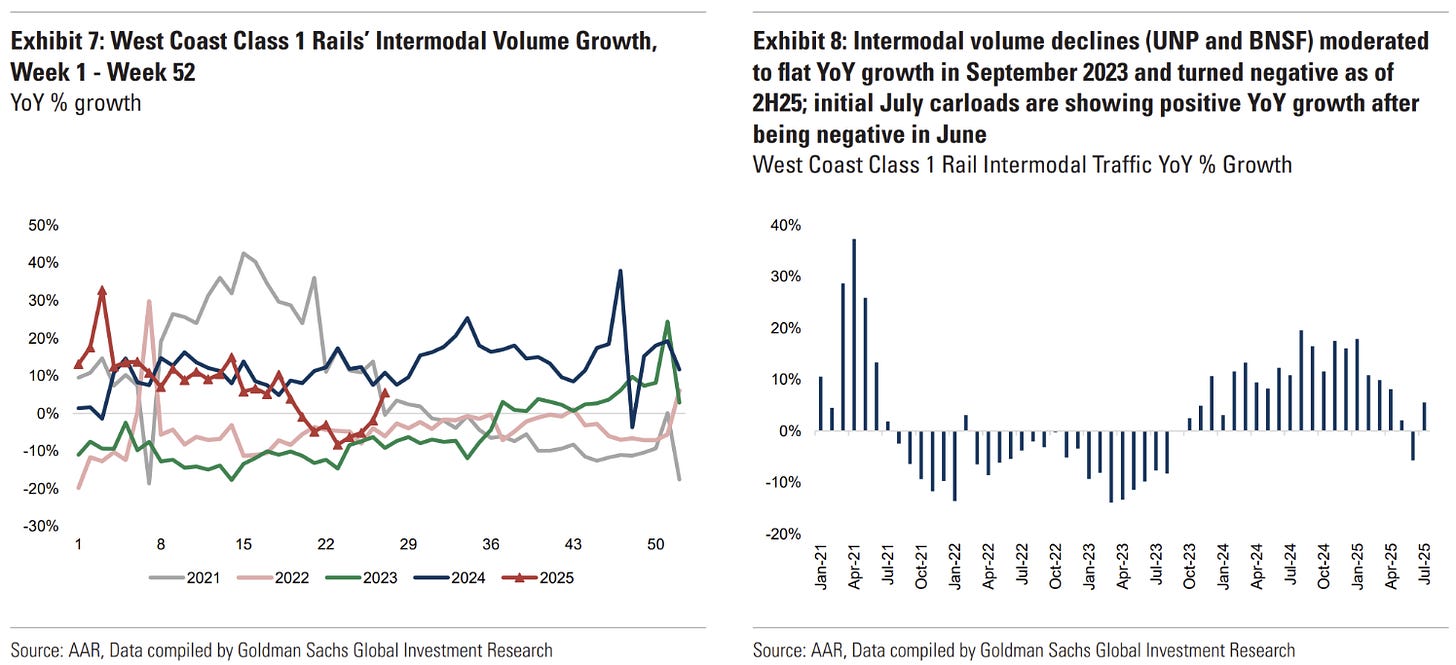

Tariffs haven’t seemed to have much of an effect on global trade health at this point.

The slight hiccup over April has seemed to have worked itself out and things have got back to normal.

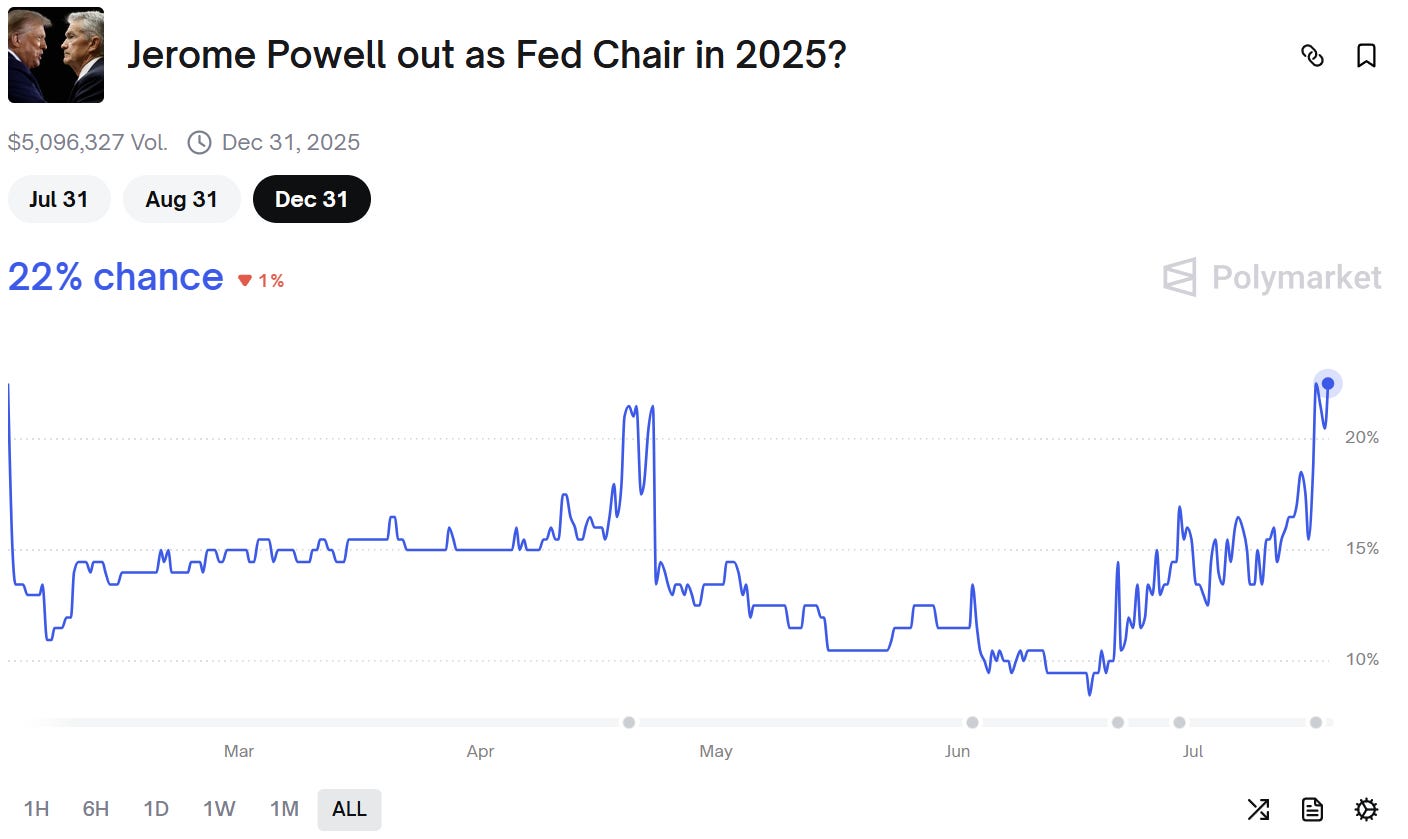

Schrodinger’s Powell

The drama of the “will he or won’t he” fire Powell was the only other relevant happening to rates markets last week.

Betting markets still think it will happen but I’m very doubtful and am ignoring it all together.

JPM outlines how it could happen if it were to happen. May 2026 isn’t that far away, and Trump knows this.

Let’s keep on watching

With the deadline moved out to 1 August in most cases we still sit in a holding pattern in regard to getting the final view of how the new tariff system will work.

There are movements occurring in rare earths. I covered rare earth elements last week.

When it comes to the effect on the US economy, this week’s retail sales data summarised things nicely. Nominal growth continues to print strongly with an alternating contribution between real growth and inflation.

I’m concentrating on the effect of the government’s tariff take and if it meaningfully changes my nominal GDP forecasts. Once we are through the goods inflation hump, I am leaning towards tariffs being nominal growth negative no matter how much is passed through to US consumers. You just can’t reduce net spending equal to ~1% of GDP and see no effects on growth. Even if borne by foreigners, they will affect trade and growth in an indirect manner.

More on this soon. Subscibe!

Is currency somehow playing a role? Curious what you think of this blog post below. Ignore the political hogwash.

https://gnosticcapital.com/2025/07/14/us-government-import-tariff-receipts-now-exceed-5-3-of-net-revenues/