At the worst possible time I published my piece on accelerating US growth based on accelerating debt expansion.

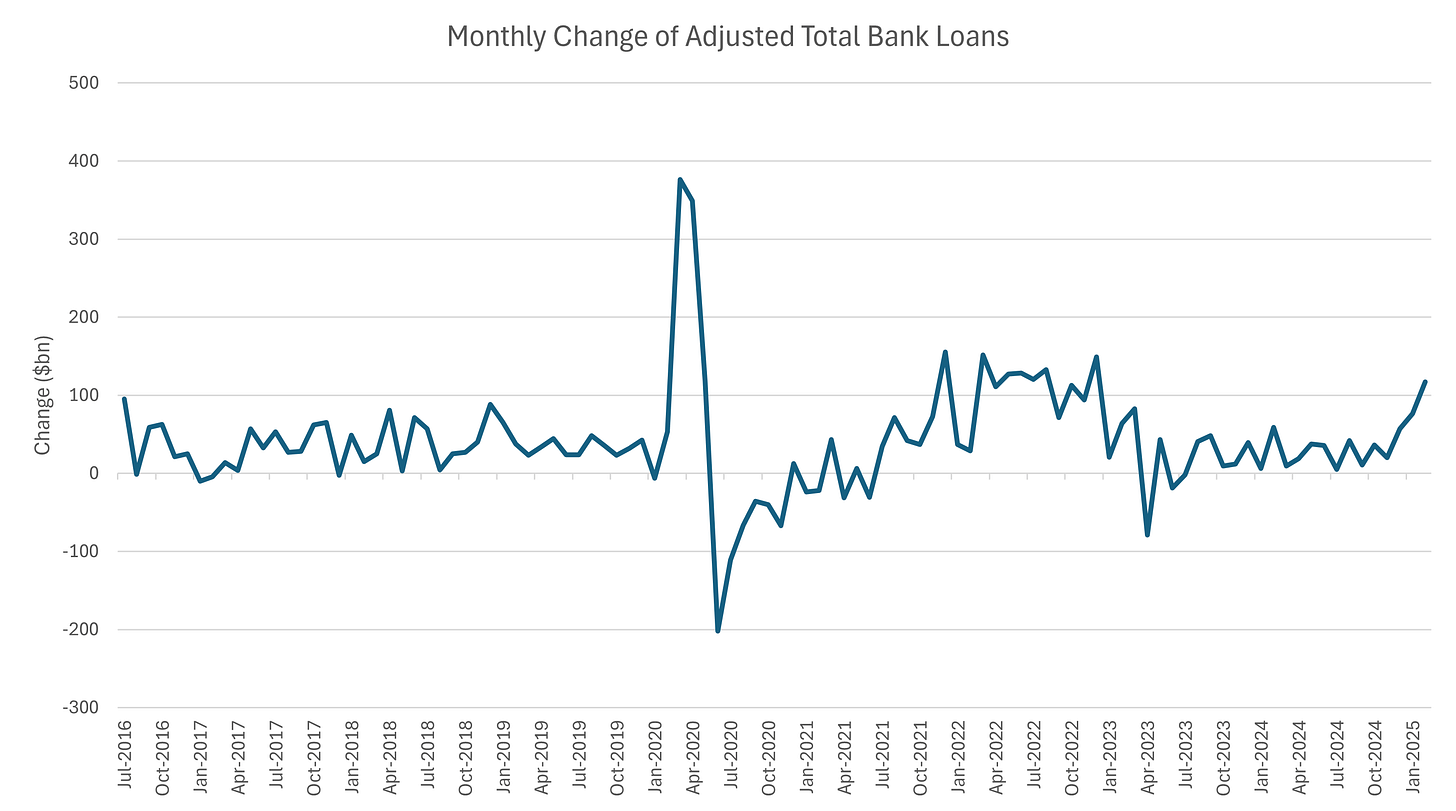

The model correctly forecasted 2024 after strong recession calls. Debt continues to expand…

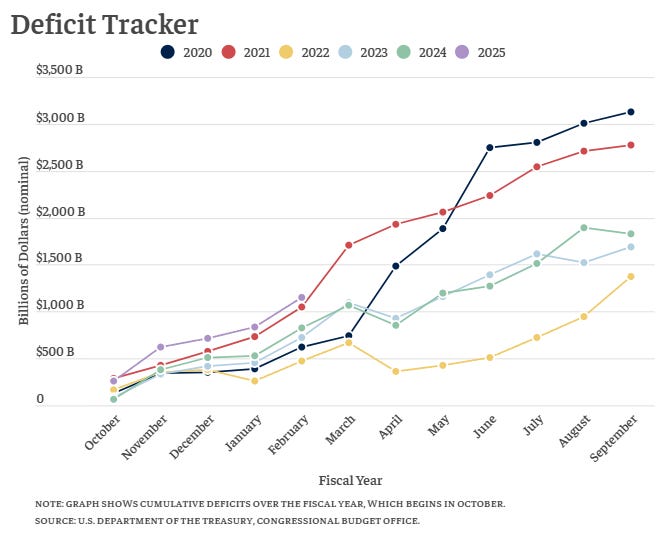

…because despite all the promises the deficit isn’t contracting…

…and private sector credit is expanding fast. This all points to anything but recession, strongly against sentiment in the market and fast-moving forecasts from economists which I go through today.

US equities

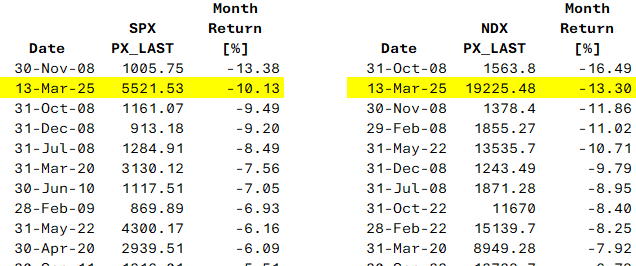

So, the numbers don’t look that good as at the close of the 13th…you’d think we were in the middle of a financial crisis!

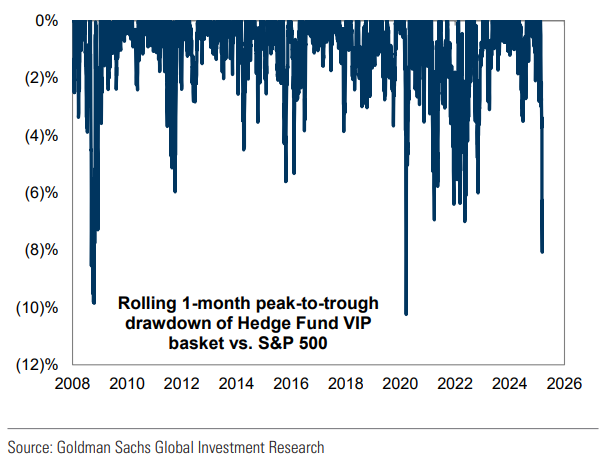

This drawdown is about the same size as the end of 2023, just playing out much faster than it did then.

The speed of the correction has meant that the multi-strat “pod” style funds have had to reduce risk aggressively because they all use basically the same rules for risk reduction (2.5% drawdown = half risk, 5% you’re lucky to keep your job).

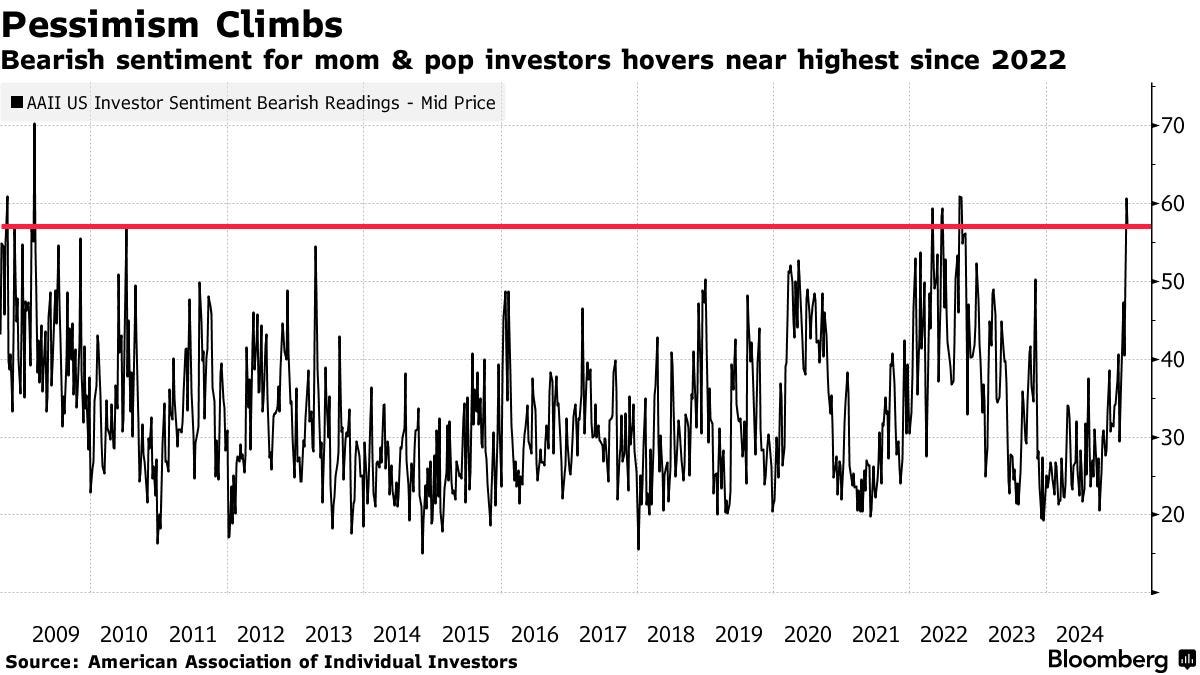

Sentiment is in the garbage and the surveys read the same. Browsing X right now confirms that. Feelings are important, and there are a lot of those at the moment.

Tariffs and the chaos around that is still irrelevant to me. Tariffs were always coming, and chaos was always the method that was going to be employed. Look through it.

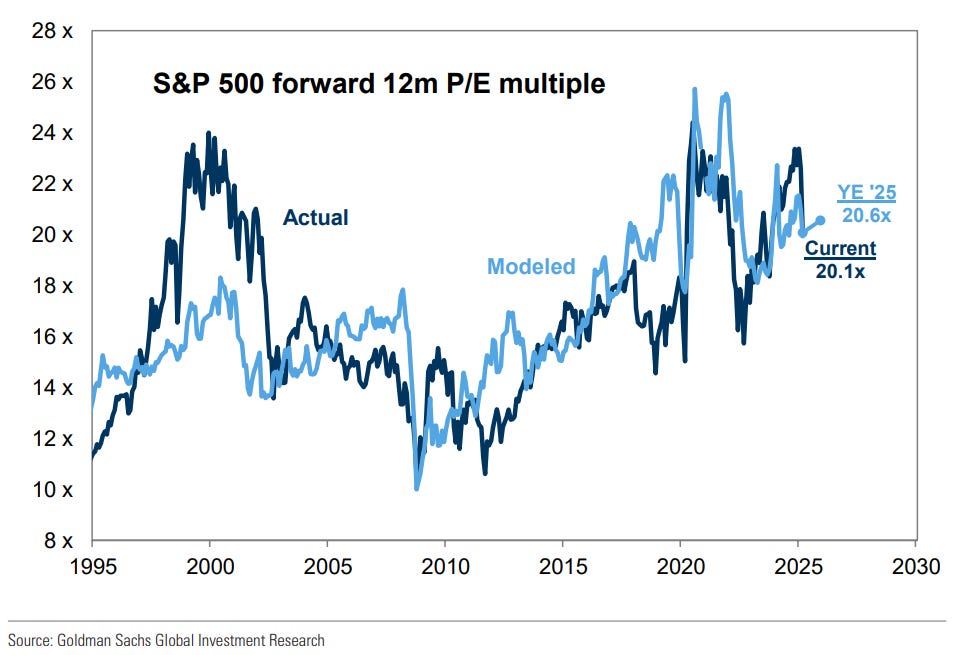

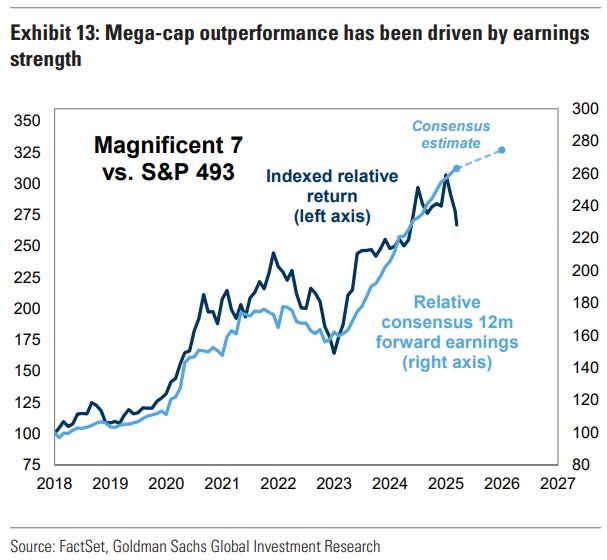

However, I don’t think this market has much of a bounce in it. There is a real earnings expectations problem that was built into tech that was also met with a high multiple. The S&P500 multiple issue has corrected itself somewhat, but the earnings revisions are yet to come through.

GS has started to revise down earnings forecasts for the S&P500, pricing in 7% now versus consensus of 10%. The sensitivity of Mag7 to the same forecasts is seen clearly in the chart above. They last upgraded their forecasts to 11% growth in June 2024.

Poor sentiment means it will overshoot as the process is starting. Some certainty on tariffs or Ukraine or Europe will buy the market some reprieve, but the earnings problem is one that needs some time to work through.

2022 is the model for this year. A similar shape, with a smaller magnitude.

Credit spreads are finally responding to equity weakness but not as much as you’d expect.

Recession? C’mon…

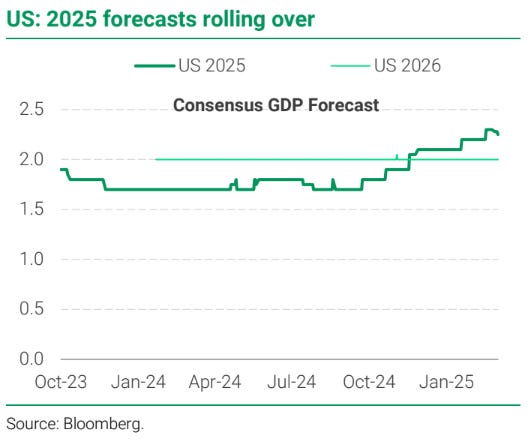

Poor sentiment is leaking into forward views of the US economy as well.

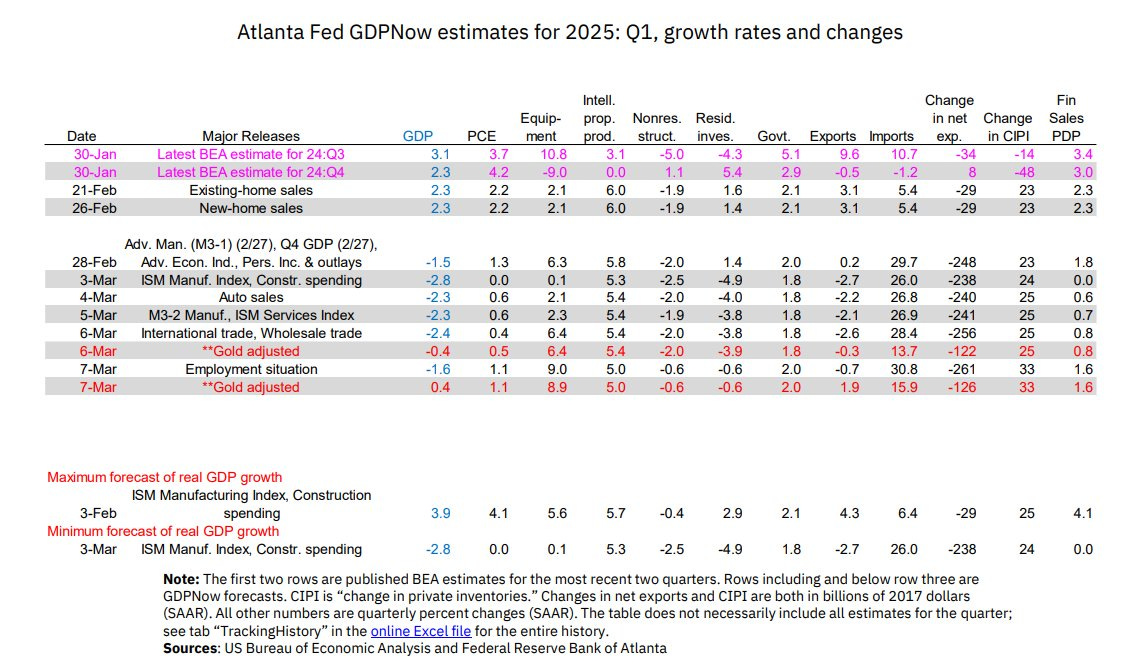

First up is an article addressing the huge contraction in GDP predicted by the Atlanta Fed GDPnow model. Turns out this was due to gold imports incorrectly affecting the forecast. The current gold adjusted model sits at +0.4% after adjusting for 2% of gold imports. This includes -1.89% from net imports from dragged forward demand from tariffs.

So, this means the neutral forecast for this quarter is 2.2% real GDP growth. A minor slowing (mostly from consumer).

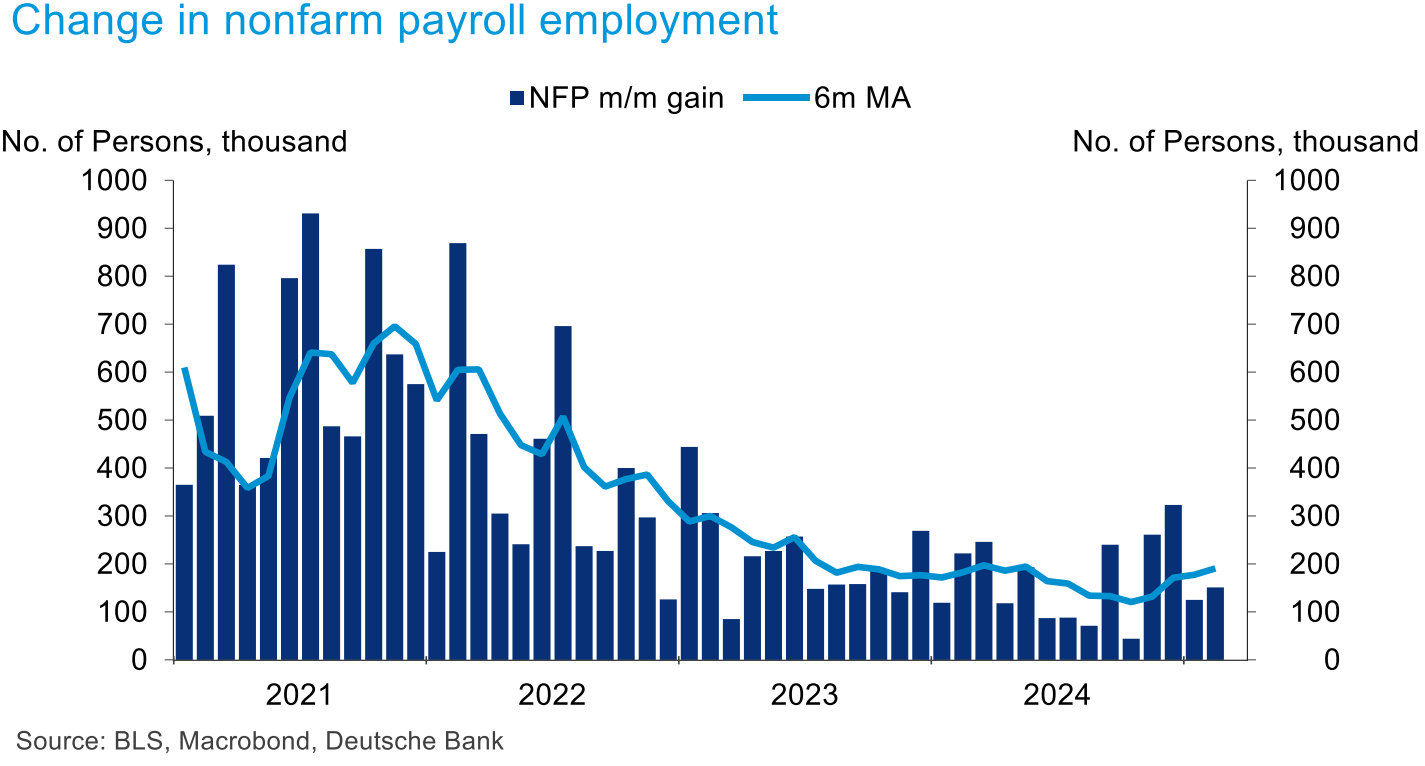

Payrolls last Friday were just fine.

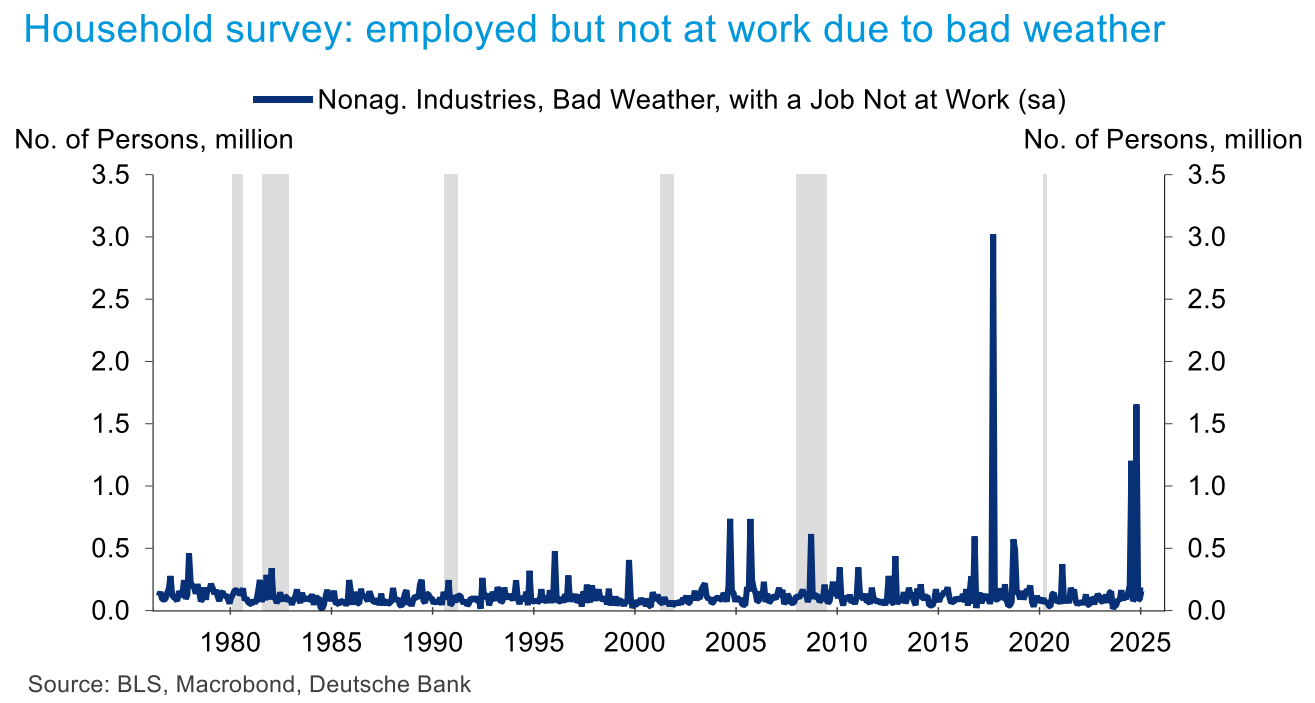

The market didn’t like average hours being down, but weather could have been a factor.

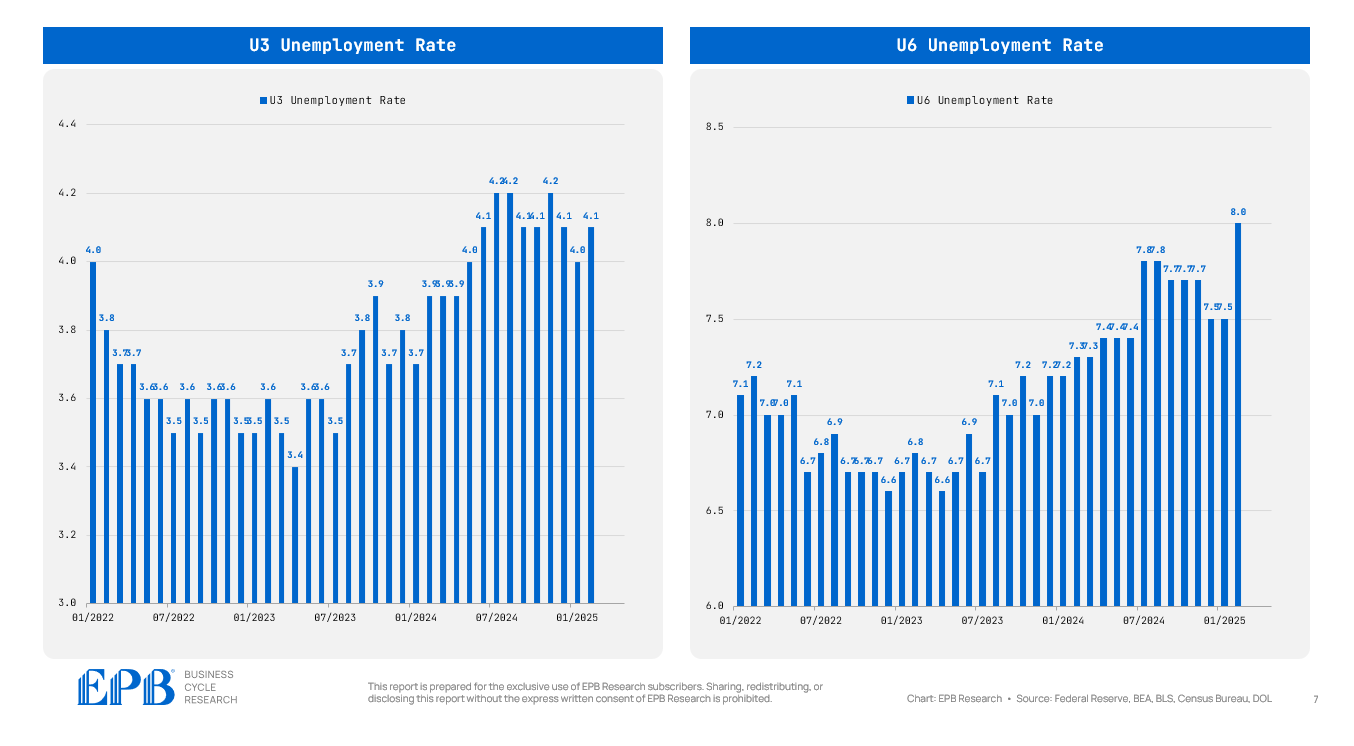

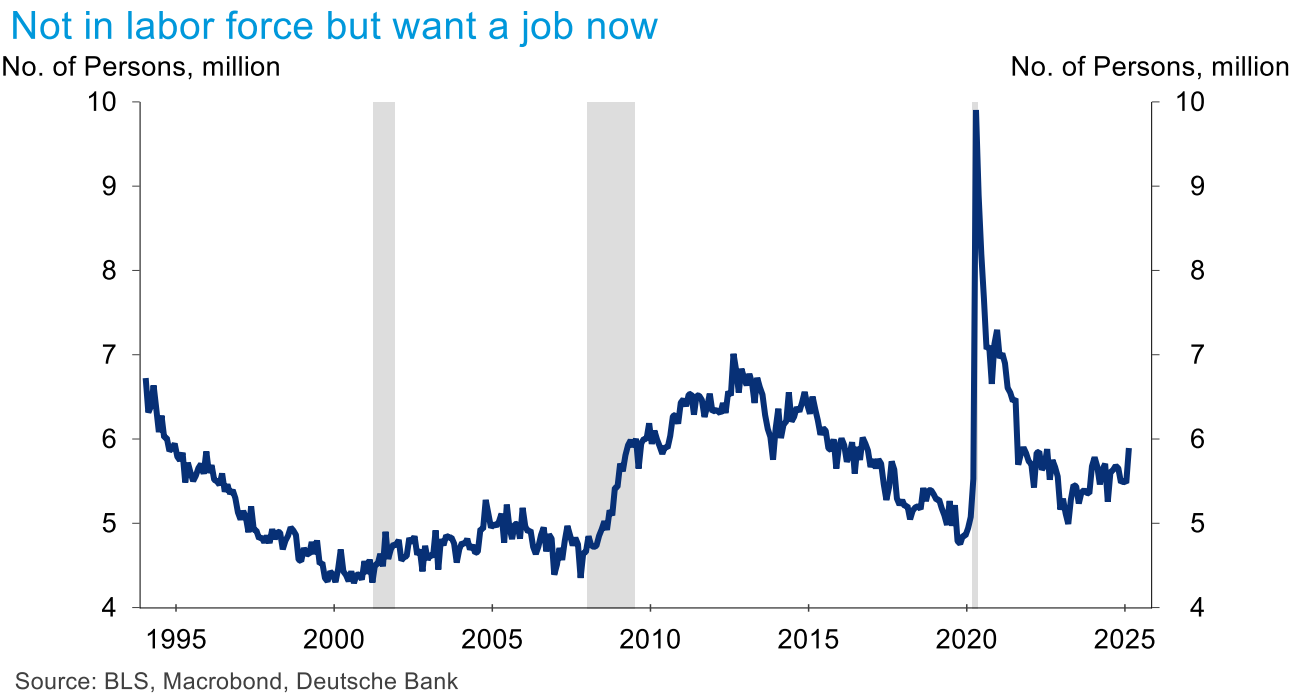

U-6 (underemployment) hit a new cycle high and highest since 2021.

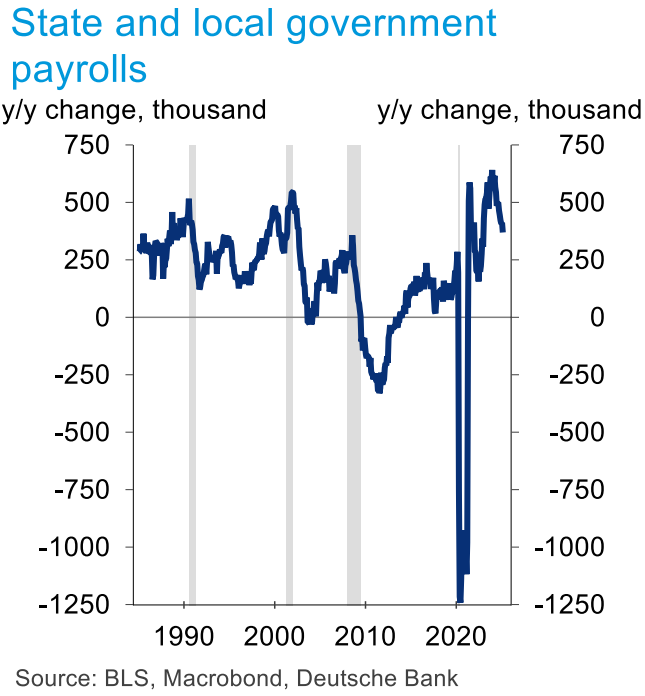

Federal payrolls down 10k on DOGE effect; but state is more than picking up the slack.

Uptick in the unemployment rate to 4.1% driven by people wanting to come back into the labour force. A positive sign?

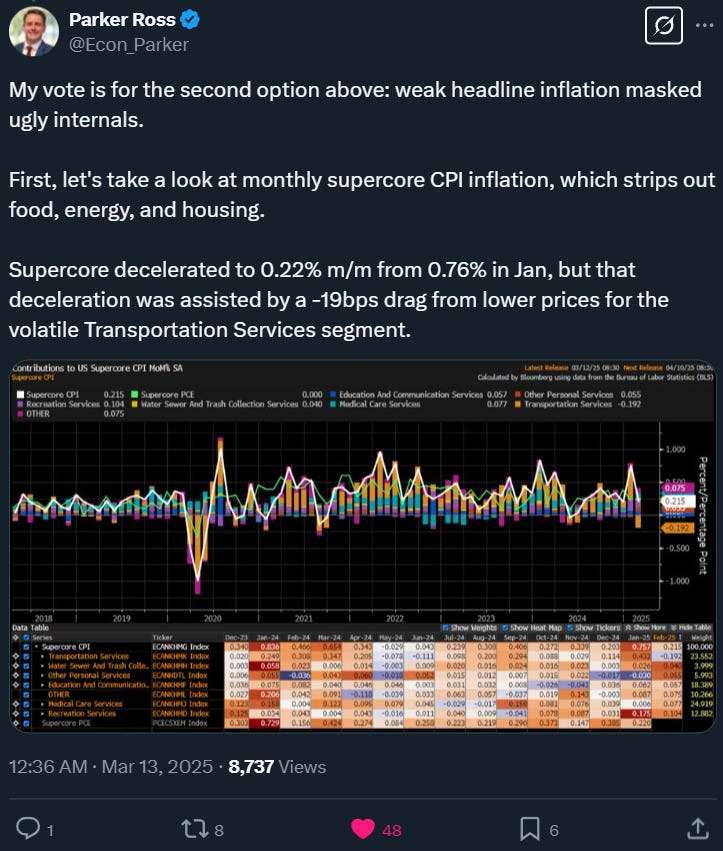

Inflation printed low in what seemed like a very soft print. Bonds rallied but quickly reversed as it hid a nasty composition. Well worth going through Parker’s thread for a breakdown.

BCA hasn’t had the best record the last few years but is representative of some very loud voices. They’ve lifted their recession probability to 75%. I couldn’t find any charts in this piece that solidly supported their point, although they did mention that the increase in PMIs globally were likely from the tariff pull-forward effect. This may have some merit.

In a similar way to earnings forecasts, this probably has a bit further to go before things start to stabilise.

German “whatever it takes”

Bunds cooled roughly 7bp from their highs of 2.85% while the infrastructure and defence plan goes through the process. The Greens have already pledged to stop it, but this is likely a negotiating tactic for more climate related spending.

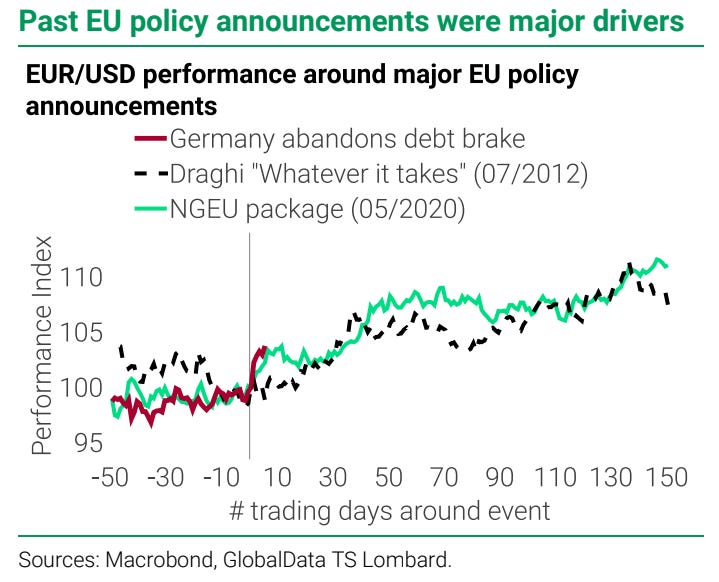

Interesting chart here about the response of the Euro after large announcements. It certainly was as depressed heading into to it from those other episodes.

Similar to the US trend, credit growth is picking up after a long lull.

Thanks Peter. Somehow this seems orderly, telegraphed, and hedged by professionals.

As you note: “Credit spreads are finally responding to equity weakness but not as much as you’d expect.”

When credit cracks and cascades, truth is revealed.

Number Go Up :) http://www.sca.isr.umich.edu/files/tbcpx1px5.pdf