Oh boy. The Fed resumed cutting interest rates this week, cutting rates by 25bp to the 4%-4.25% band. The meeting that justified it was so full of contradictions it would make your head spin.

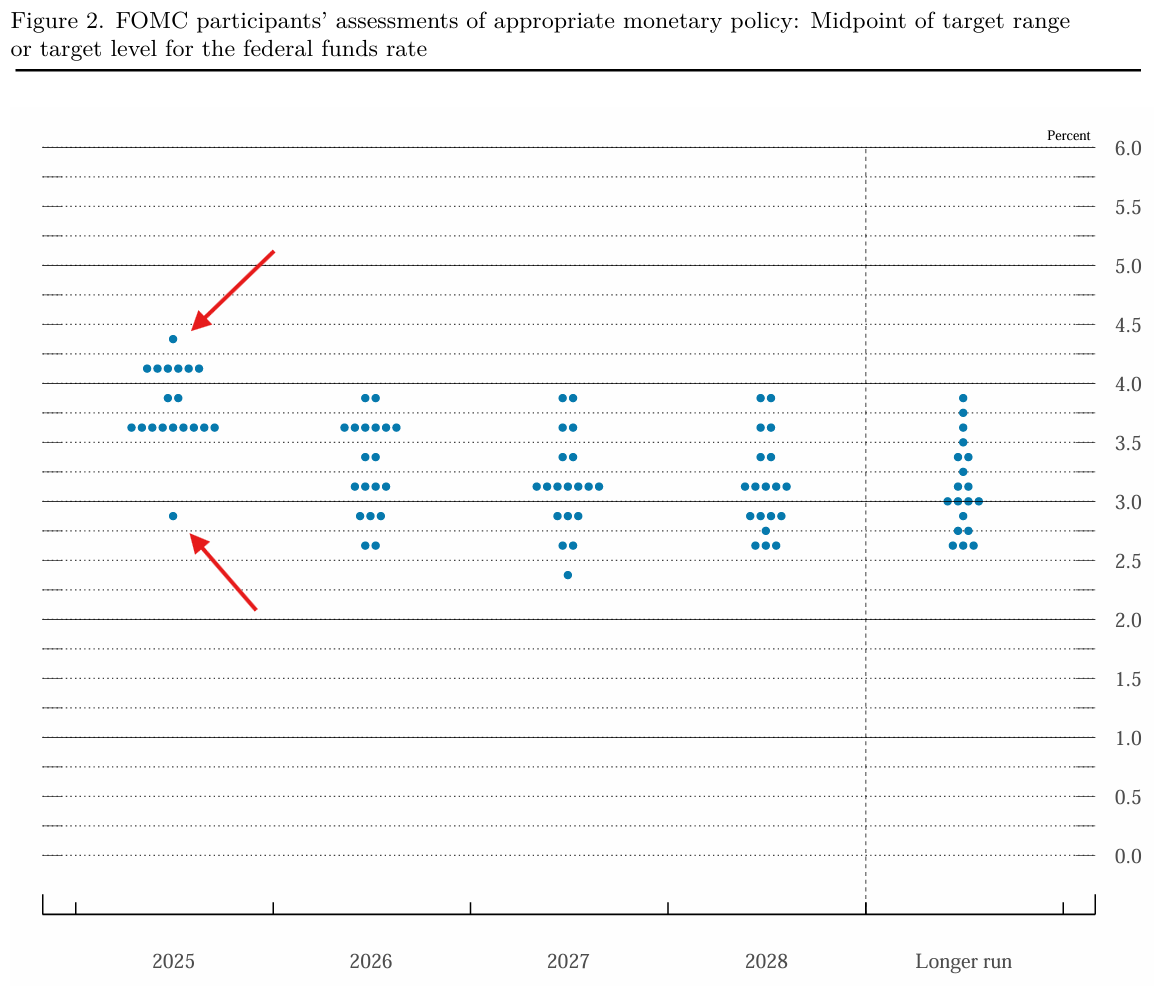

Some will attribute it to Trump’s influence, and as we’ll see Stephen Miran’s first meeting, and first contribution to the venerable dot plot.

Knowing what we know about Trump’s and Miran’s biases, it’s not hard to guess which dot belongs to Miran. That lowest 2025 dot implies a 50bp cut at every remaining meeting this year.

Note that some commentators have suggested the top dot represented a hike when placed against the newly lower rate, however this dot represented a view that rates should remain on hold for the rest of the year.

Interestingly, Miran’s dots beyond 2025 aren’t as obvious. Presumably they are roughly only another cut lower than where he is at the end of 2025, so he is essentially just front-loading the cuts but suggesting a terminal rate that isn’t necessarily much lower than what segments of the board had already thought was appropriate.

If I was guessing, I wouldn’t have expected this. The Miran plan may have more to do with speed of adjustment rather than magnitude.

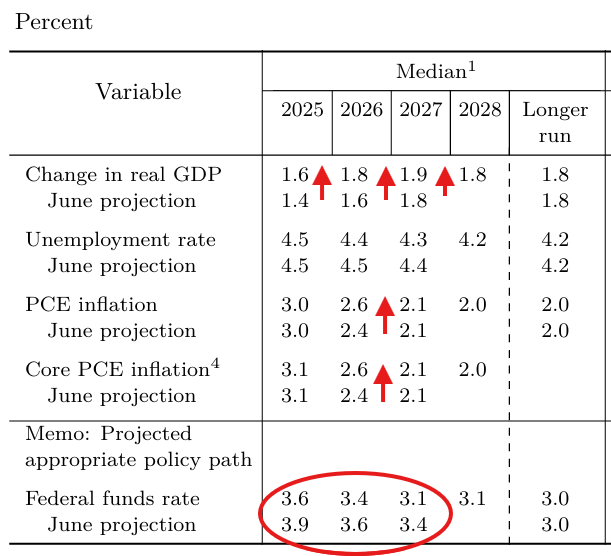

Leaving aside Miran’s contribution, the Fed still cut rates by 25bp. The main contradictions start when you look at staff projections versus June.

Growth across 2025, 2026 and 2027 were all revised up.

Despite the negativity regarding labour markets, unemployment rate expectations were rounded down.

Finally, and most damning, inflation forecasts for next year took a leg up. Personally, I’ve always struggled with the interaction of interest rate policy and staff forecasts - they are done before the cut in rates, but do they include the median path of Fed Funds as an assumption in the forecast? Does this mean that rates weren’t cut they wouldn’t revise up inflation? It seems very circular and impossible to dissect exogenous variables, and how much a poor forecast will have on the interest rate path, which then will affect the forecasts.

Staff projections were one thing, but the most disappointing part was Powell’s assertion that the rate cut was done for “risk management” purposes, destroying the “data dependence” story that started to be dismantled at Jackson Hole.

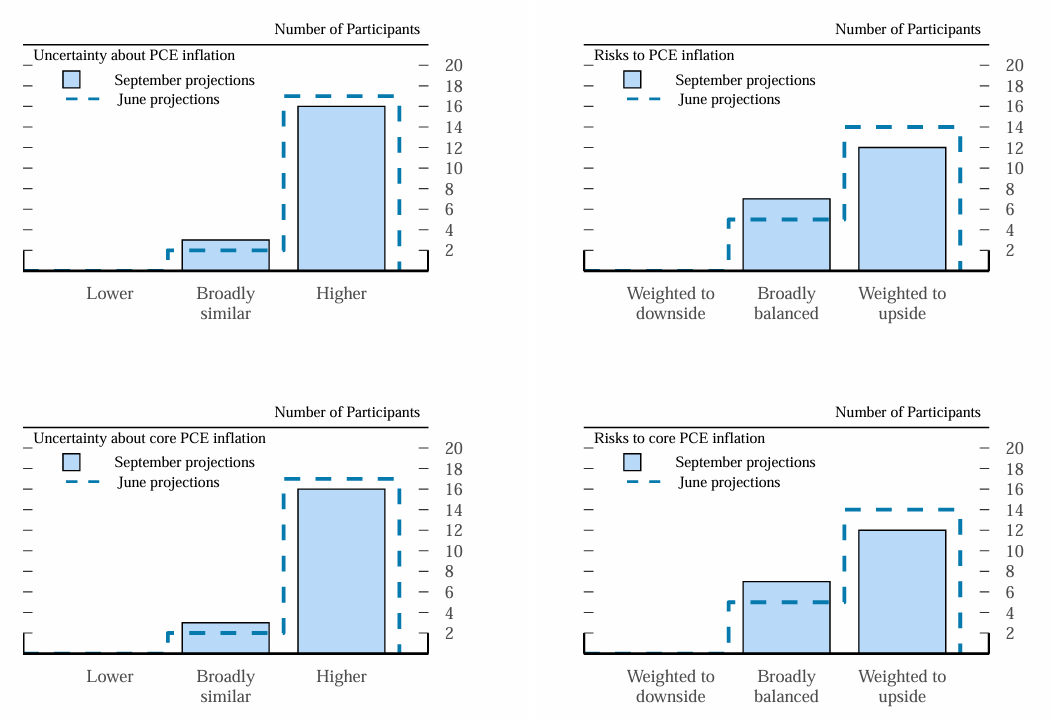

While the board are a negative bunch and seem to always be down on growth and employment, their perceived risks of inflation should be more important.

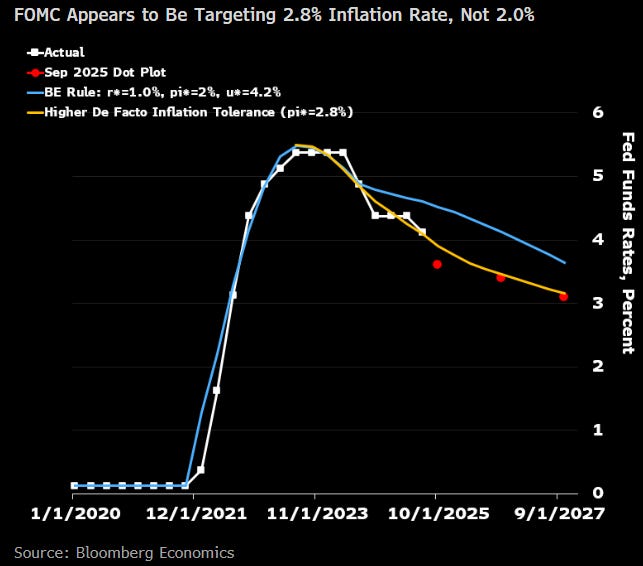

While there is a bit of economist black magic in the above chart, this is an alternative to projections by instead backing out inflation targeting using the forward rate path implied by the dots. It is sitting where I would expect - closer to 3%.

While many get upset about the Fed’s shift, we should just analyse it and leave opinions to others. As I’ve written before, the central bank is always political. It just depends on the degree.

Pricing

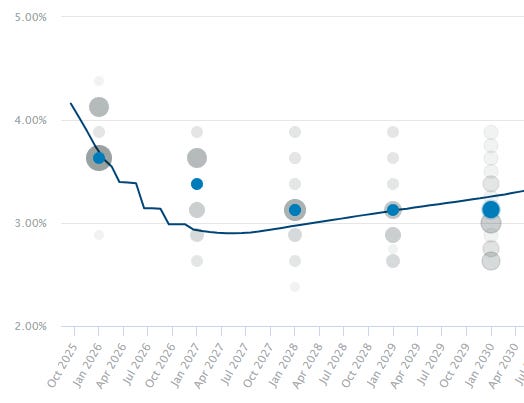

The new Miran-influenced dot moves the median in line with market pricing.

Further out, the market generally agrees with the dots as well, with the exception of next year where the market is pricing a 0.5% premium to the median dot.

If the projected nadir of the Fed Funds rate in the first quarter of 2027 comes true, then it would’ve been predicted only once in the last 2 years after the 2024 pre-election rate cut. We have to go back to early 2023 to see a more reliable prediction. Since then, the market has generally expected a higher terminal rate, sometimes up to 1.4% higher.

The chances of the current path for pricing coming true is higher than it has been at all in the cycle. We can say with a fair amount of confidence that the Fed’s growth forecasts will be beaten, while the lower breakeven level for employment will generate disconcertingly low payrolls numbers.

Yesterday’s rate cut has shown the market that the Fed is OK with inflation closer to 3% than 2%. This was the final nail in the coffin.

Ironically, this makes holding longs in STIR futures more difficult. With the Fed cutting, perceived tail risks lessen, which necessitates a lower premium in pricing across the 2026 expiries which already have too much priced in.

They might be cutting, but rates pricing isn’t cheap (and hasn’t been for a long time).