Charts & Notes: Small number no good

Low outright payrolls numbers won't be explained away with falling employment breakevens

Standard Chartered are out with their “base case” for a 50bp cut by the Fed in September. Jefferies are looking for 75bp!

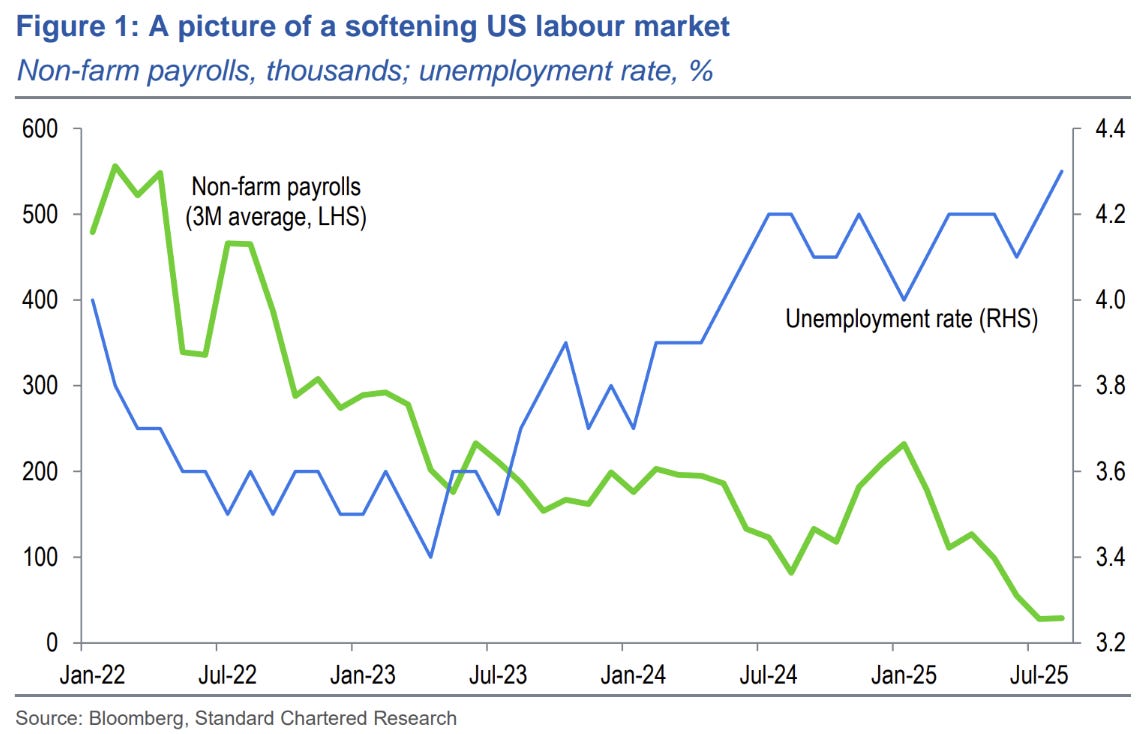

As I’ve warned over the last few months that smaller payrolls prints - while totally appropriate given the lower breakeven employment rate due to a lower level of immigration - will still make economists, and the Fed, nervous.

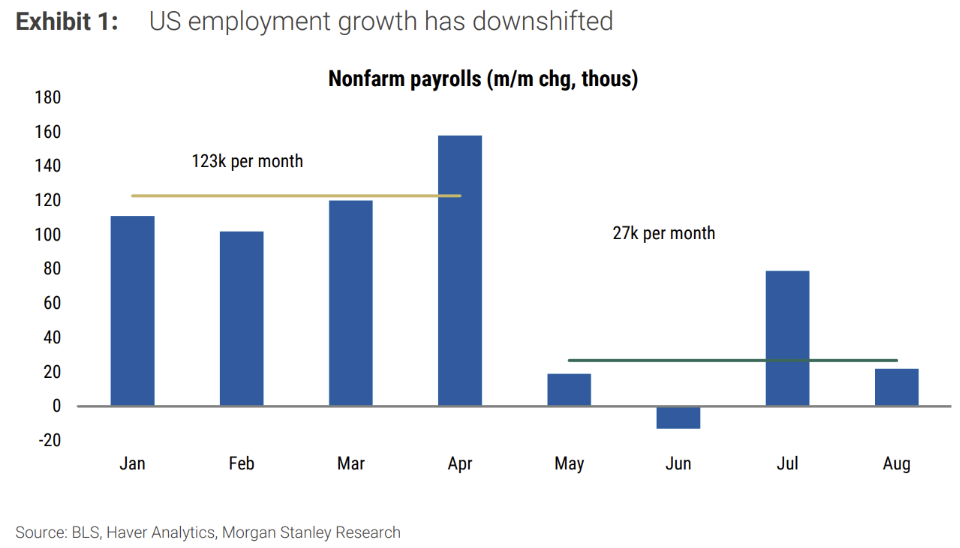

In August, nonfarm payrolls increased by 22k, falling short of forecasts. July's payroll growth saw an upward revision of 6k, bringing it to 79k, while June's was adjusted downward by 27k to -13k. The three-month average for payroll growth currently sits at 29k.

The 3-month average was 127k per month between January and April.

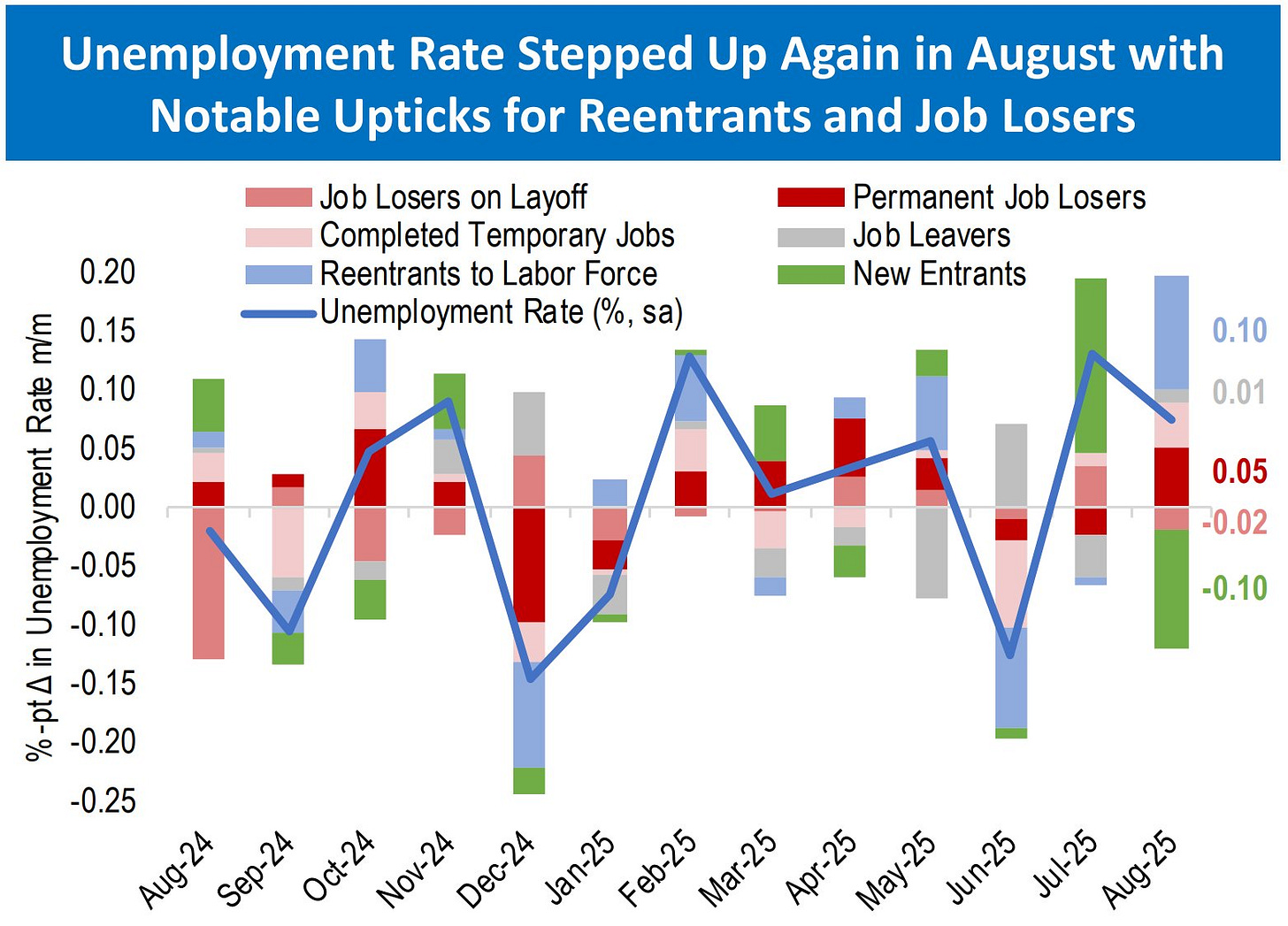

The unemployment rate ticked up to 4.3% from 4.2%. Job losers and re-entrants to the job market accounted for the rise which are both a change in trend over the previous months.

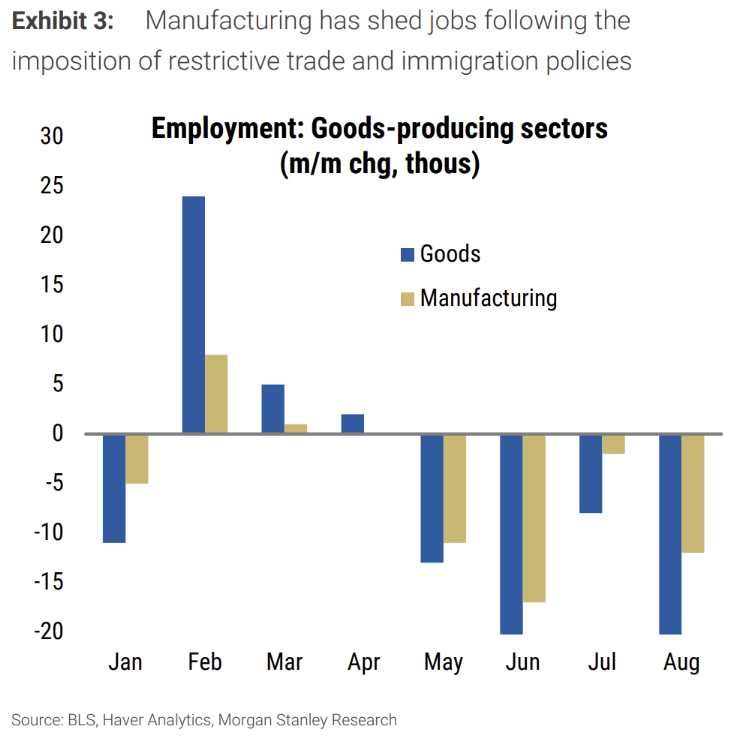

The goods sector has been shedding jobs, particularly in manufacturing, where employment has fallen by 42k over four months.

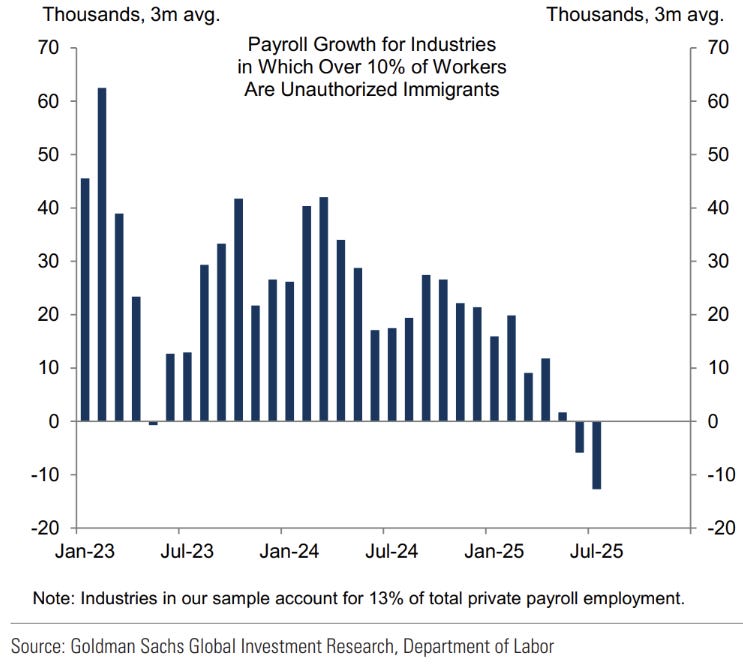

The fall in these sectors may be driven by the supply side - payroll growth in industries with a high share of illegal immigrants seem to have been slowing from before the Liberation day tariffs.

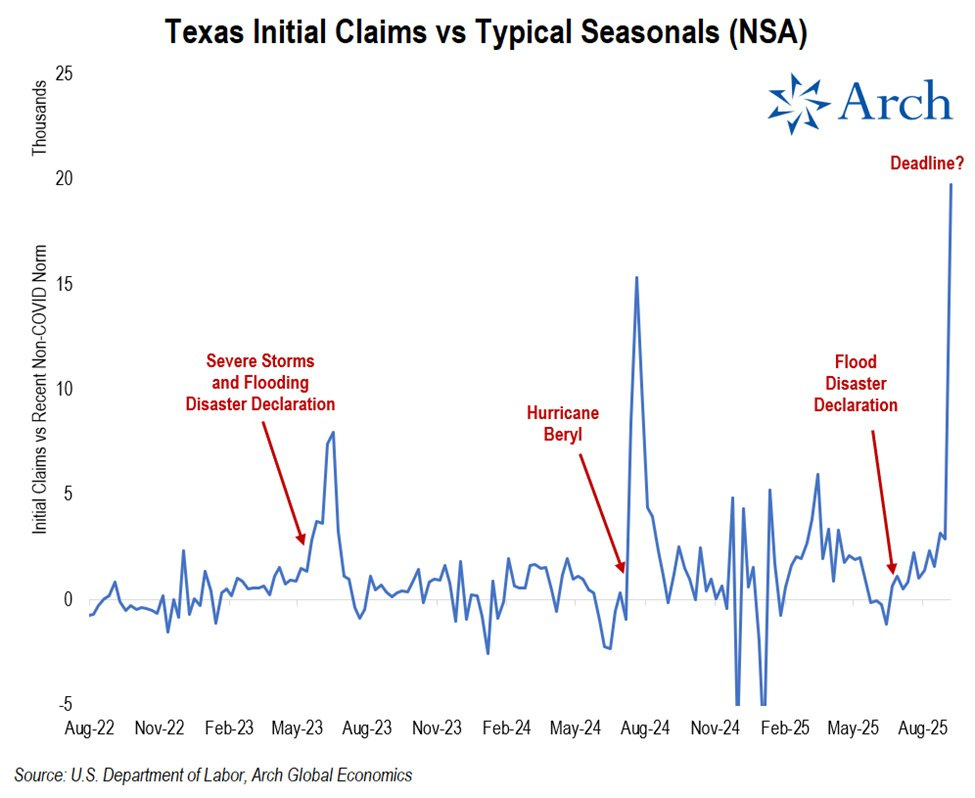

As an aside, ignore the most recent initial claims print. They were affected by Texas flood related claims.

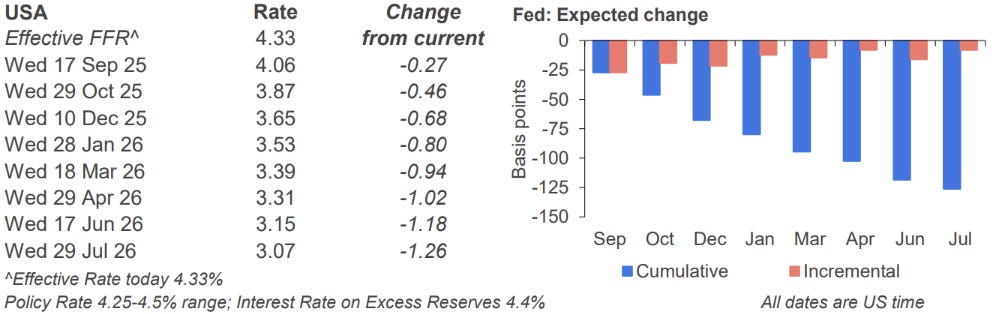

Payrolls jerked US rates into action, pricing just about 100% of 2 full rate cuts over the next 2 meetings. Pricing to this level of certainty is rare, indicating that the market is ascribing some probability of a 50bp cut at the September meeting.

According to the forward curve, we get 4 rate cuts by March/April next year.

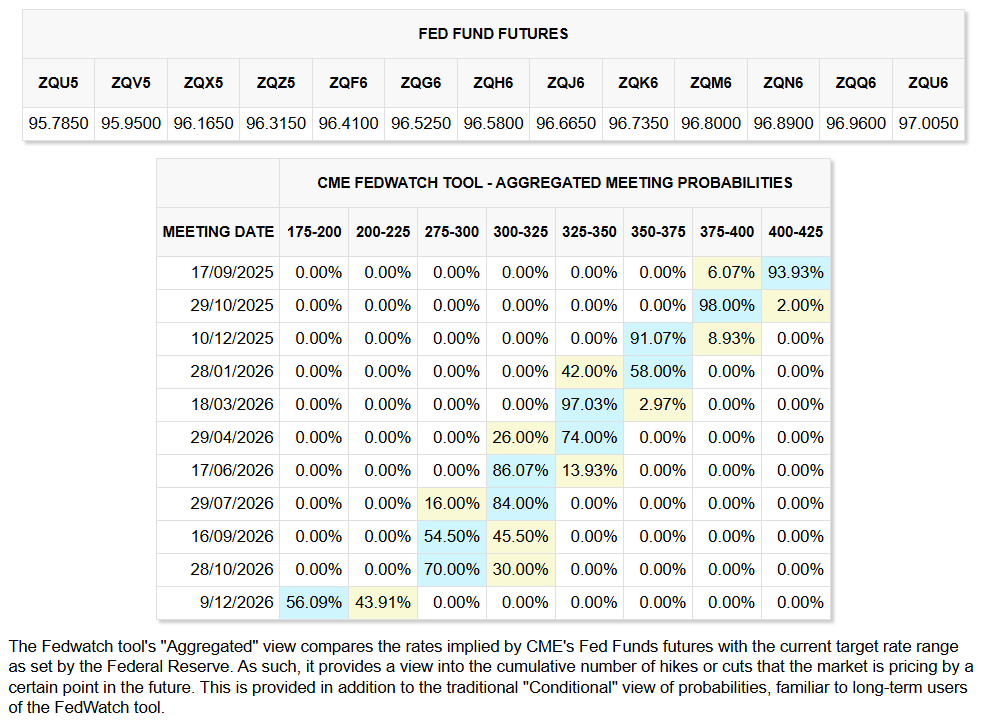

FWIW, the CME’s FedWatch tool has the chance of a 50bp cut in September at 6%. (I’m not interested in engaging in arguments about the validity of their calculations!)

August and September will define growth and inflation

Last month of the quarter will solidify Q3 GDP forecasts, and August/September CPI was meant to be the peak of the tariff effects.

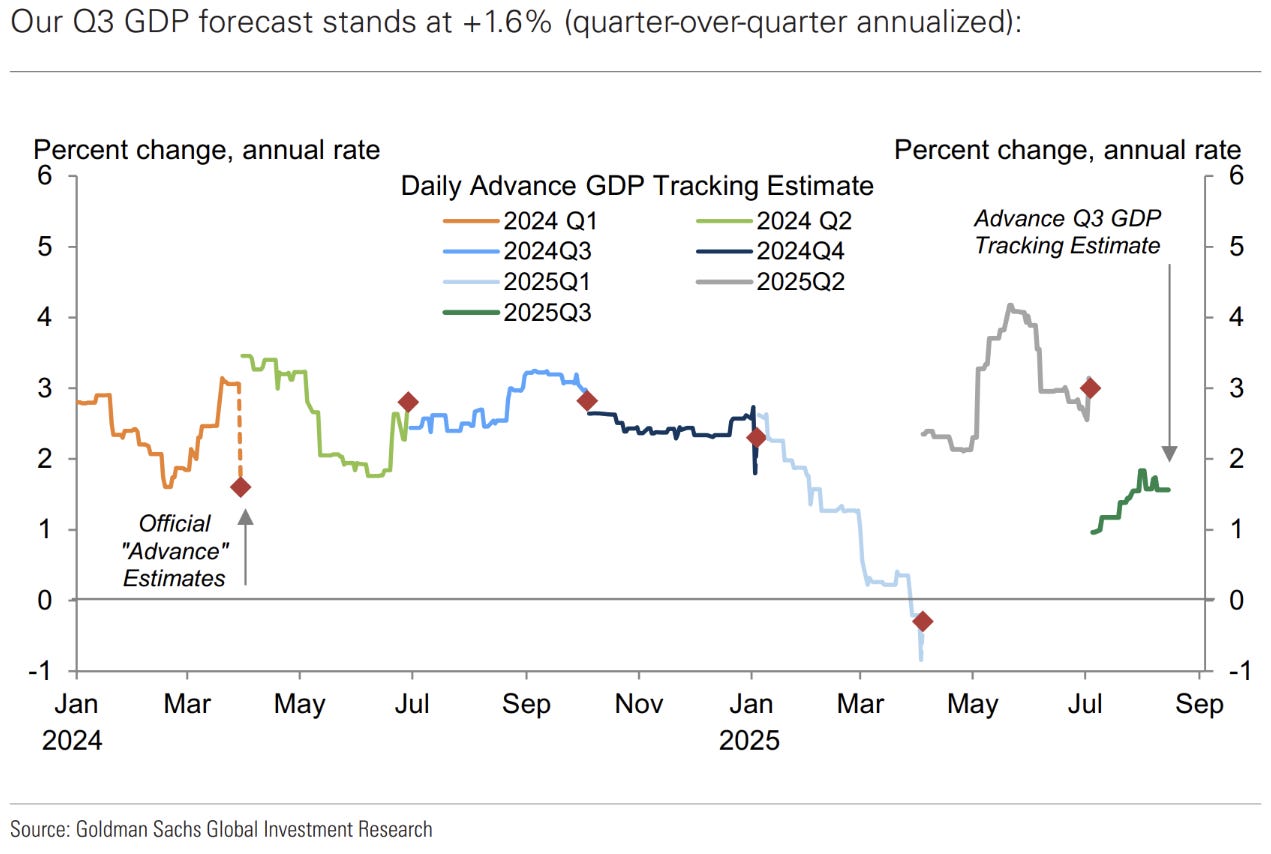

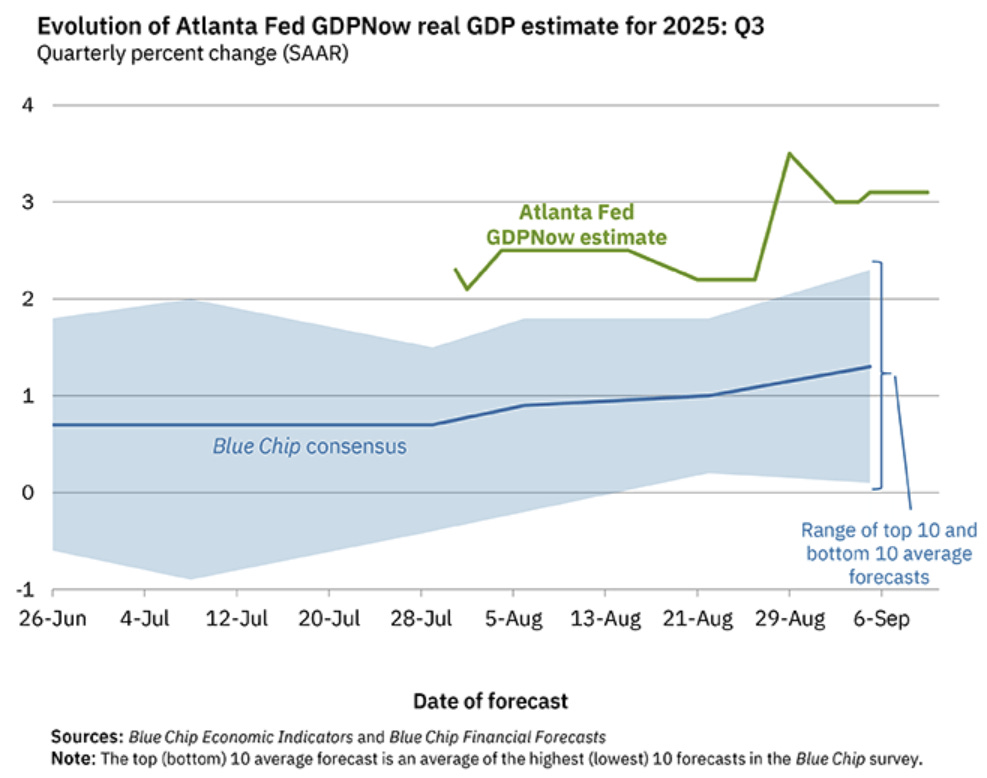

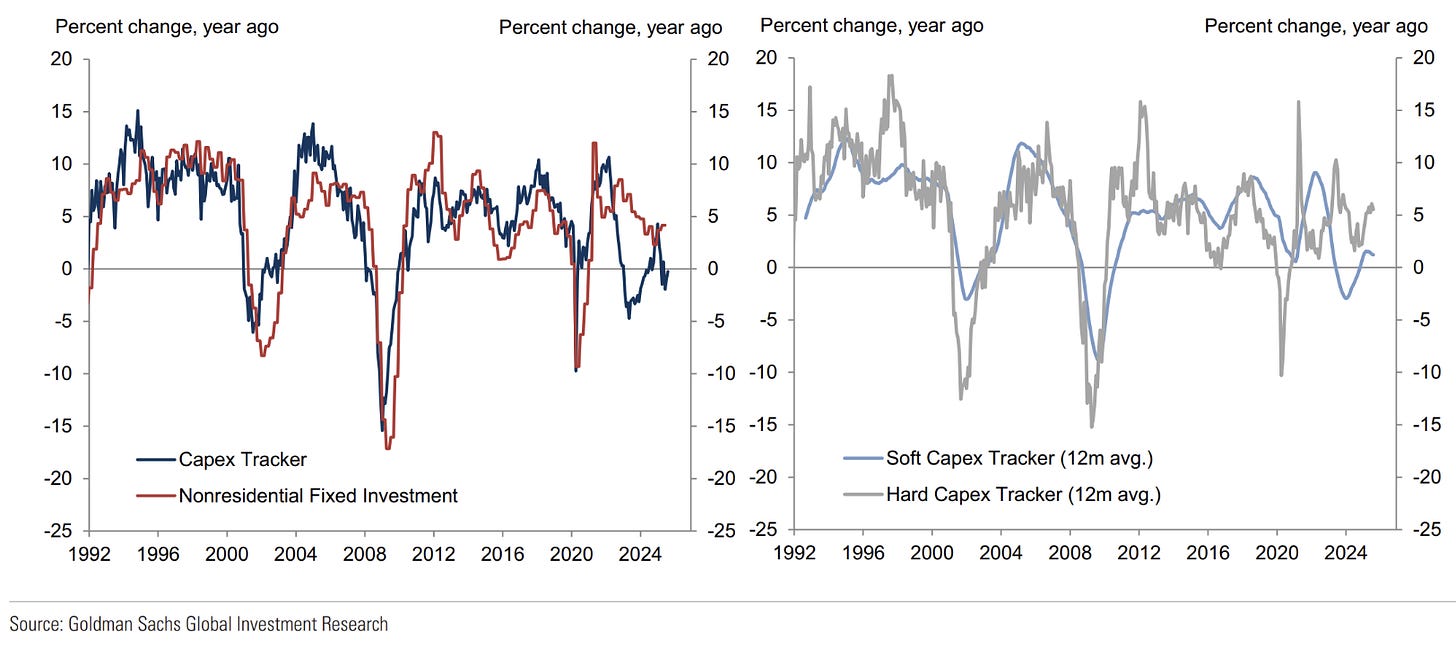

Q3 GDP tracking has been broadly upgraded from better capex data recently, but forecasts are differing between the sell-side and Atlanta Fed.

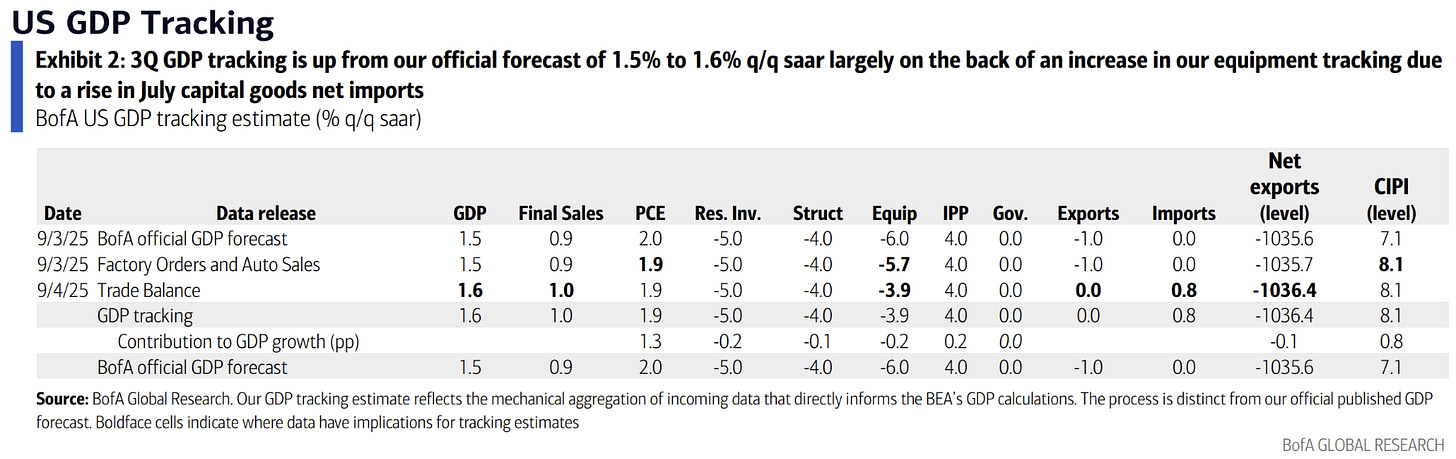

BofA, 1.6%:

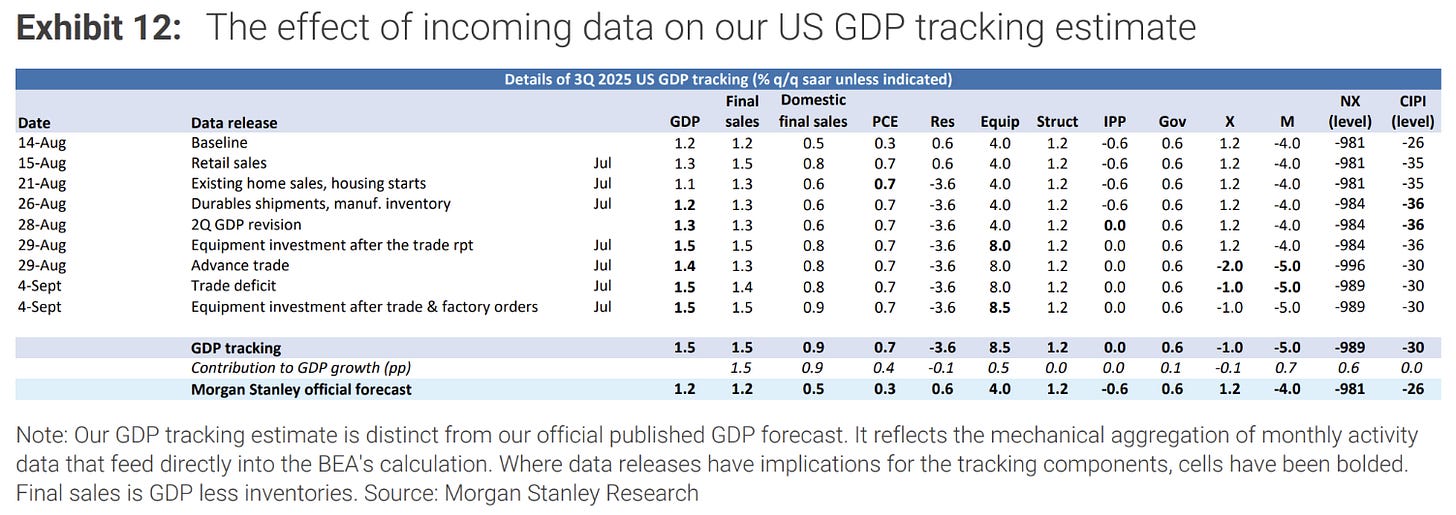

Morgan Stanley, 1.5%:

Goldman, 1.6%:

Atlanta Fed, >3%!

Capex is still looking OK. Just because it’s AI driven, it doesn’t invalidate it. No recession.

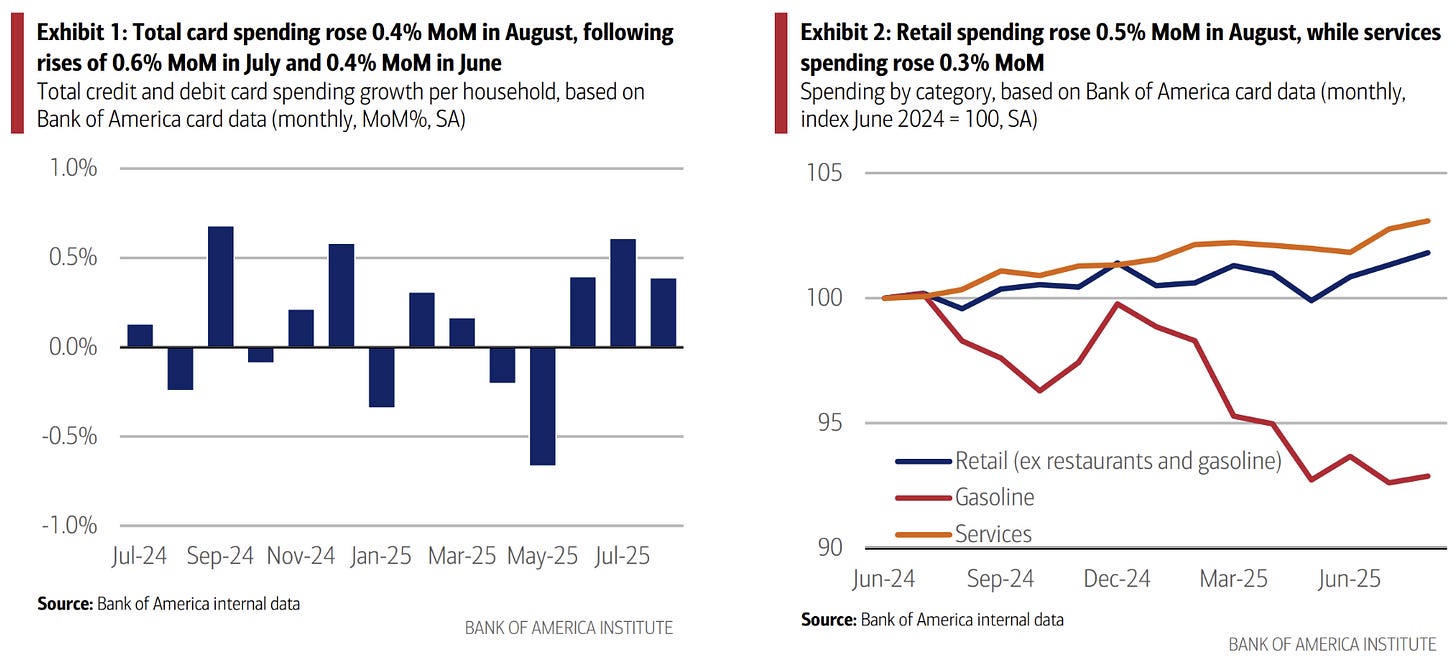

Consumer strength on alternate measures continue to surprise me.

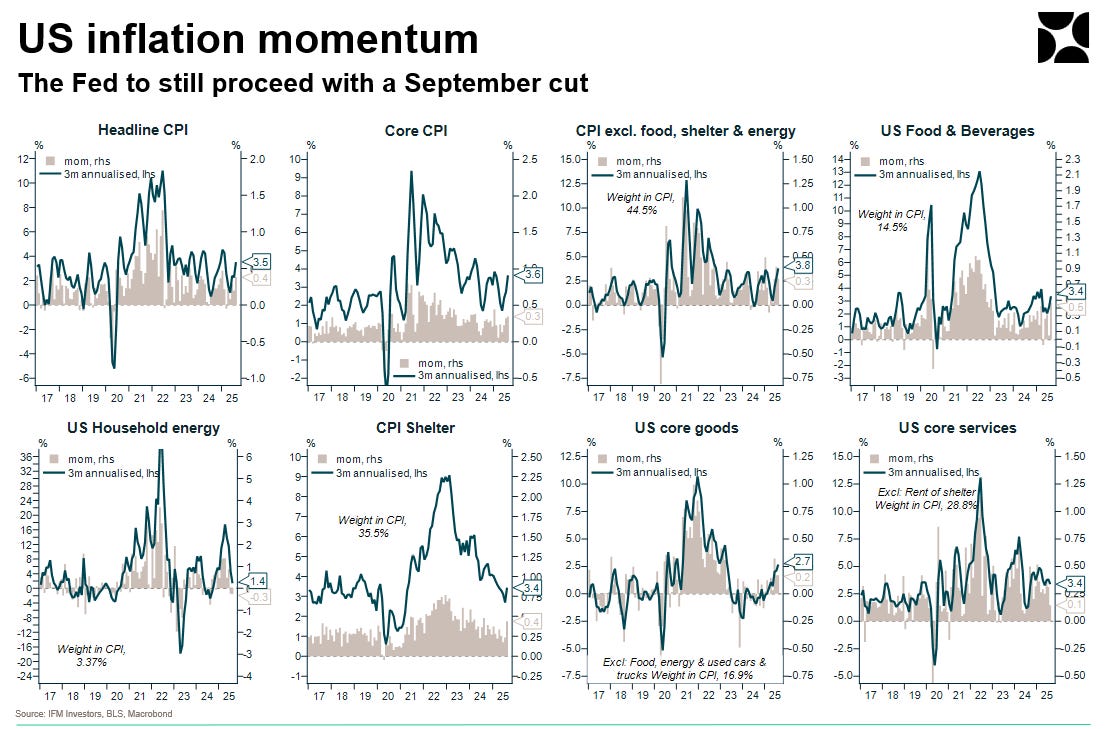

Now, onto August’s CPI.

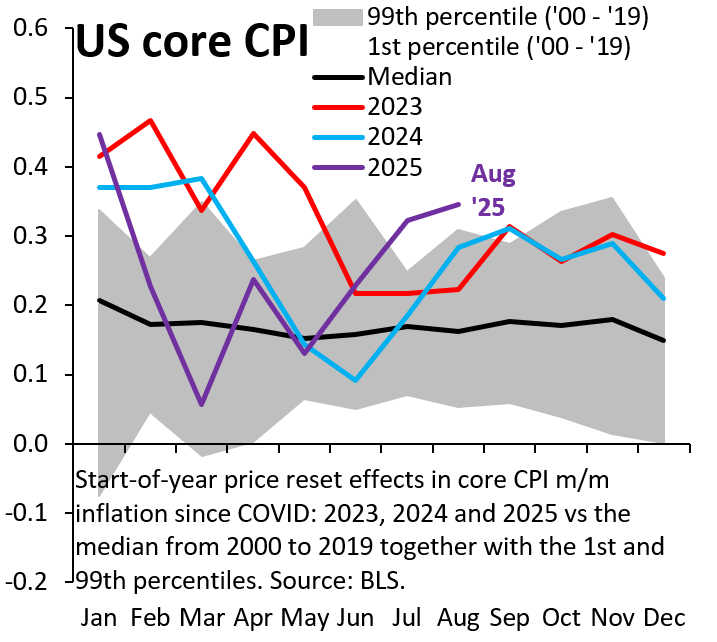

Yesterday’s core CPI printed at 0.346%, only just rounding to the consensus of 0.3%.

Expectations were for around 14-15bp of the 30bp+ consensus for tariff effects, but this didn’t happen. The acceleration in inflation last month was mostly from shelter, which was large enough to offset a slowing in services inflation. This is the opposite of this year’s trends and could highlight ongoing issues with seasonality calculations.

I was going to leave the CPI analysis to a “tracking tariff effects” edition but there is little to track. So much for August (along with September) being the expected peak of tariff inflation.

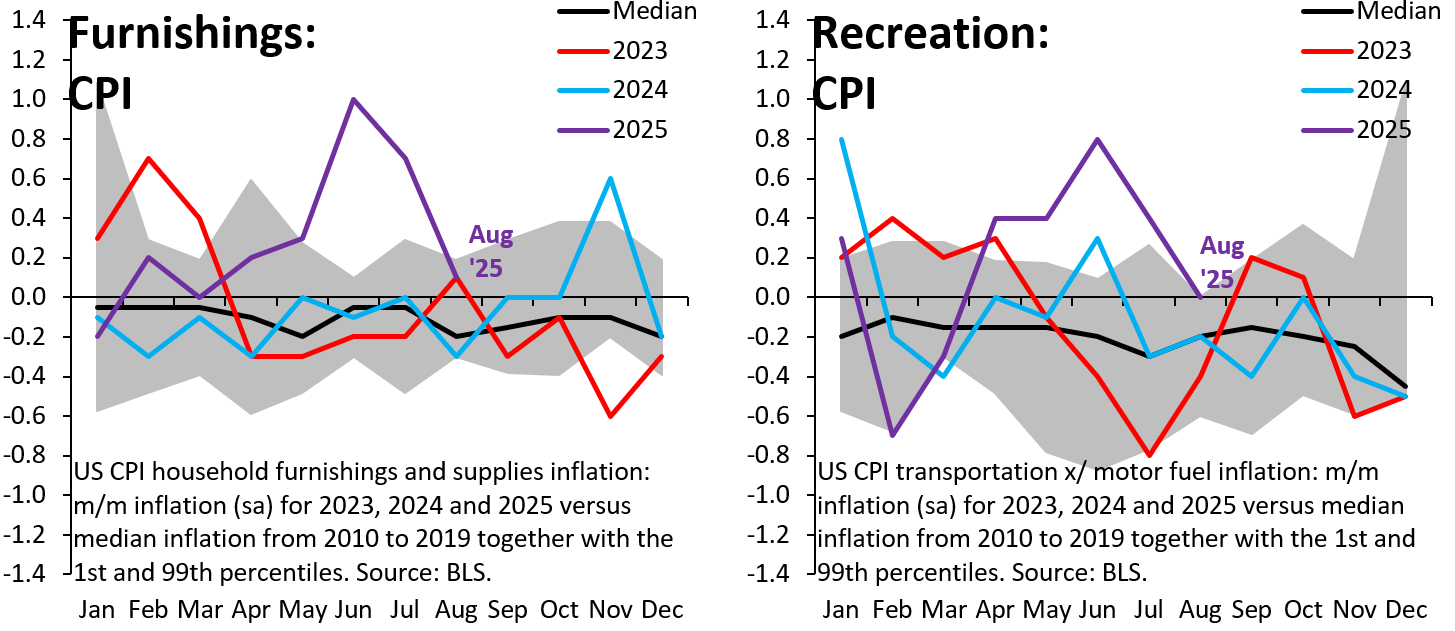

In an attempt to take out seasonality, Robin puts 2025 inflation up against 2024 shows minimal effect from tariffs after the August result.

Short of it is that inflation likely won’t stop the Fed cutting.

US equities

Some interesting charts on US equities.

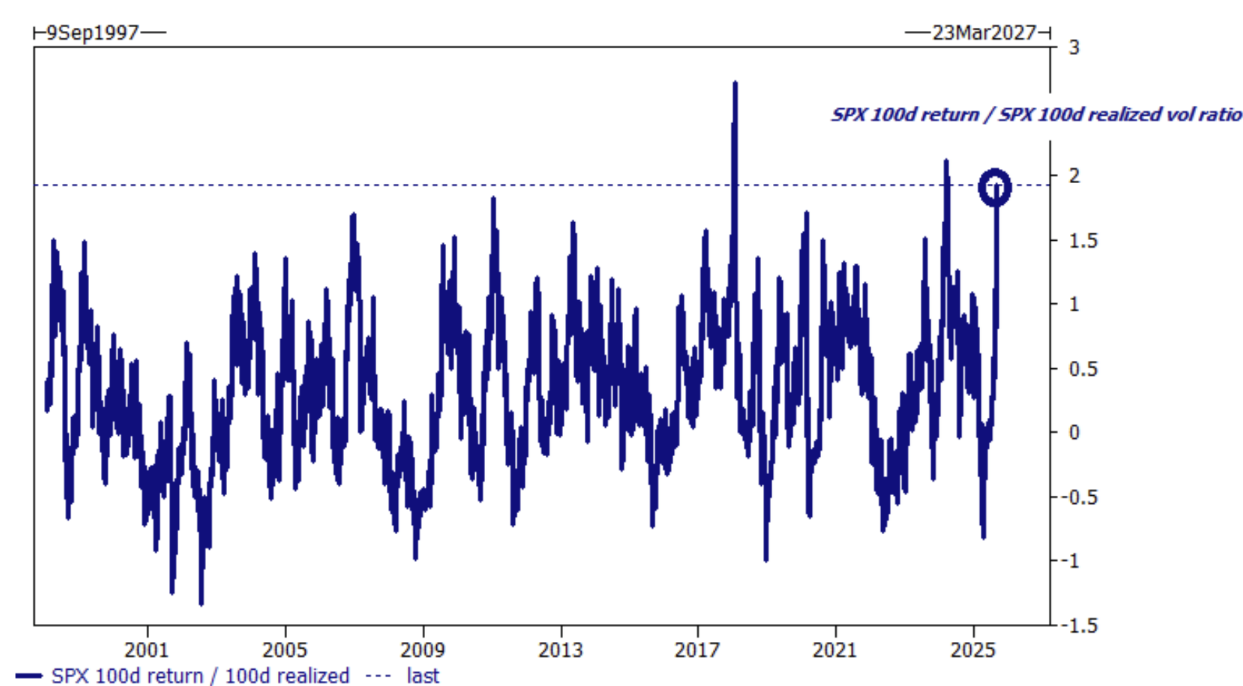

100-day S&P500 return to realised volatility one of the highest ever…

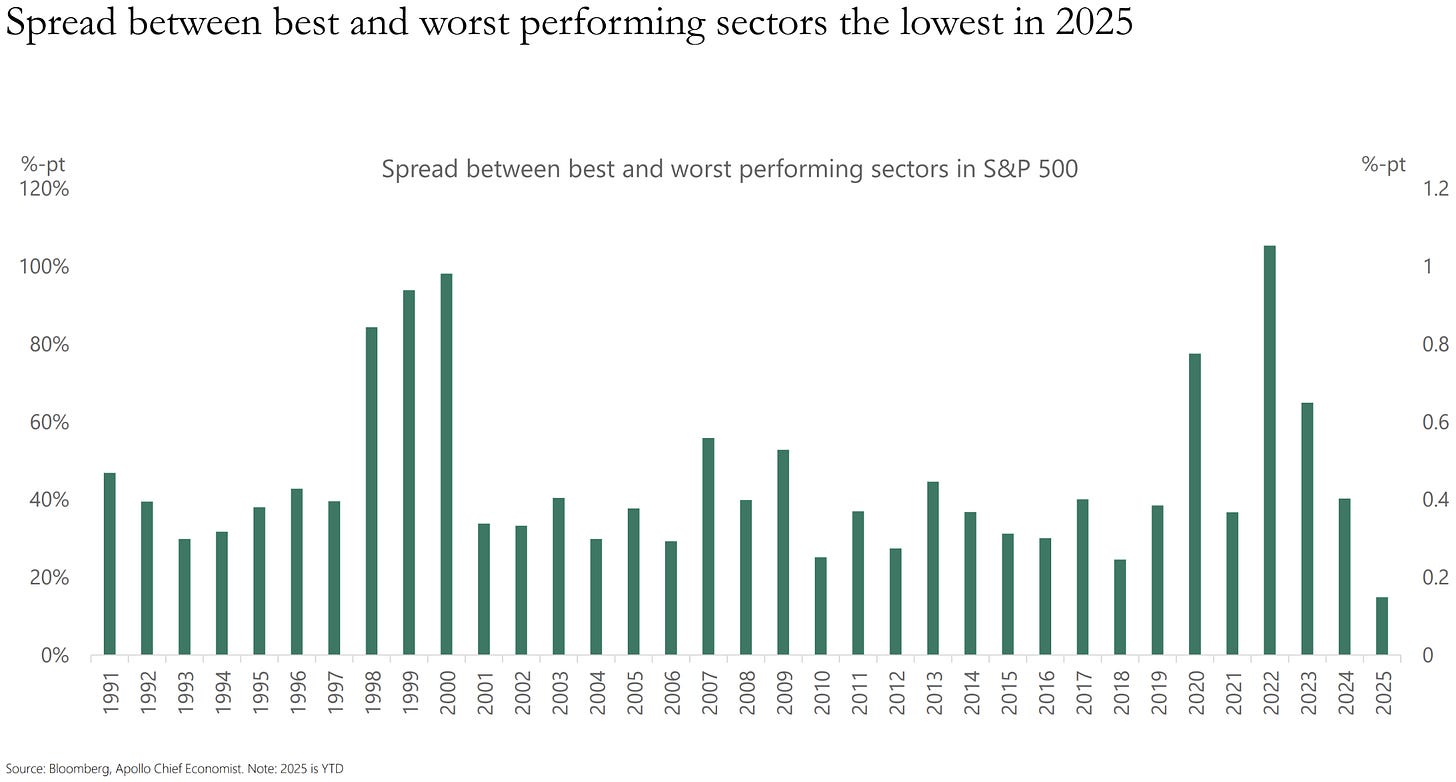

…without much sectoral dispersion either.

Le Democracy

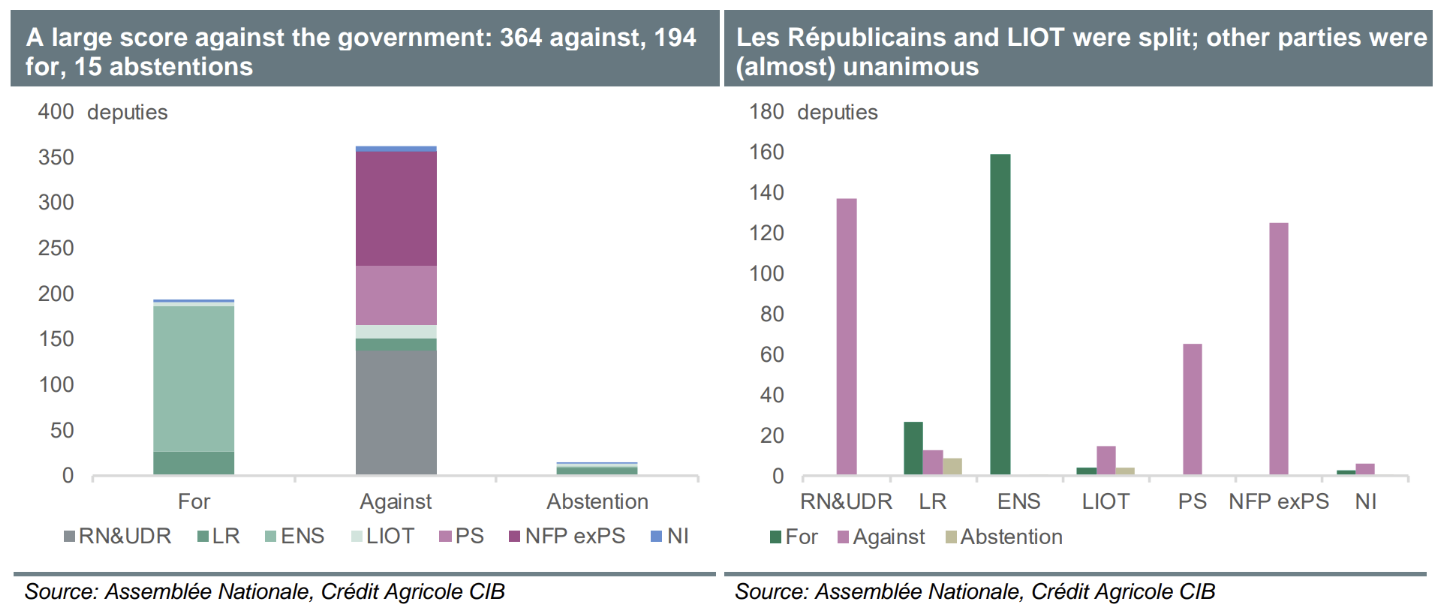

The French Prime Minister was expected to get a vote of no-confidence, and this did indeed happen…

…but with a stronger vote than expected.

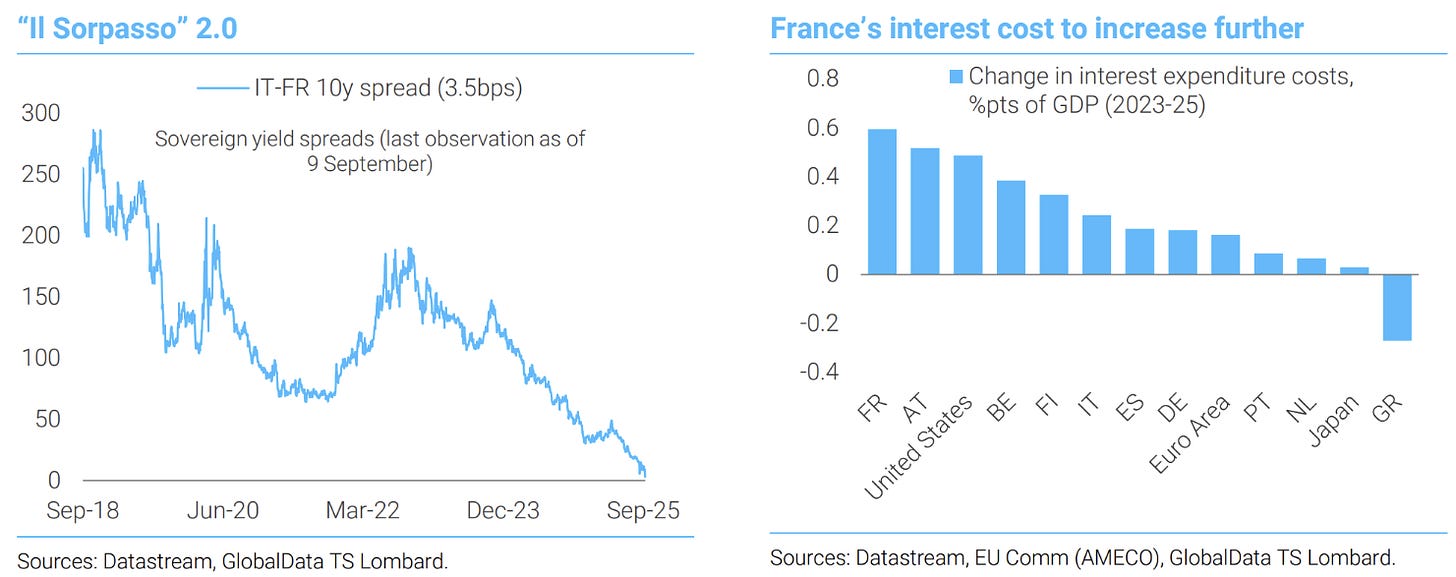

This has driven the French/Italy (OAT/BTP) spread to flat, an amazing achievement. So, where to from here?

The main, if not the only, aim for the new PM will be preparing and then discussing the budget.

It’s unlikely that a government with no majority can pass a budget with a public deficit smaller than ~5% as the measures would be too controversial for one of the parties of the coalition, whatever it is. A newly appointed Prime Minister will find it impossible to take any serious measures as that happened to Bayrou, who made almost no fiscal consolidation for the 2025 budget.

The spending continues.

Youtube of the week

A great (if long) documentary on the finances and economics of global public transit systems with the challenges each has and how they deal with it. This mostly does away with the usual reasons for poorer public transit outcomes in the States.