Charts & Notes: More growth, just not in the US?

More fiscal and a still unconvincing growth scare

The US is still very much at the mercy of political volatility and is underperforming - but that same politics is driving global growth forward.

Sell the rumour still in control in equity markets. Certainty around trade policy will allow volatility to subside. Quietness during Asian hours suggests there is no crisis.

German fiscal pump

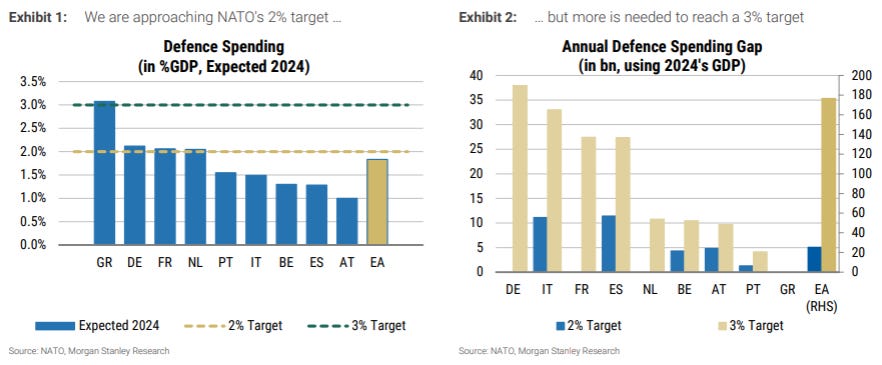

After covering European rates for a large part of my career I never thought the promises made by Germany’s new chancellor Merz this week would ever come to fruition, but it seems to be very quickly heading in that direction.

The plan is to make three material changes to the debt brake in the very near term, convening the outgoing parliament in which the centrist parties still hold a constitutional majority (from DB):

A EUR 500bn special purpose vehicle for infrastructure investment, of which EUR 100bn will be allocated to the federal states.

A reform of the debt brake to exempt any defence spending over and above 1% of GDP, effectively permitting open-ended borrowing for defence.

A reform of the debt brake at the Länder level to raise their net borrowing cap from 0% to 0.35% of GDP, as at the federal level.

Bigger deficits, but if implemented well, not a lot more debt. Defence spending can be a productivity boost as much is spent in the private sector, something Europe sorely needs.

Gaps are large and bigger for countries like Italy.

Chinese fiscal pump

The Chinese NPC was this week. While the official 5% GDP target (the input rather than output to policy) isn’t much higher, it was met with promises of fiscal expansion. This reveal has been very quiet compared to the exitement about it late last year.

The “broad” deficit measure includes provincial spending which, depending on how well the provinces are doing, may be funded at the central level, or through one of its banks.

1Q US growth

This topic is still causing a panic local to US markets with bonds rallying and equities under pressure.

The comments I flagged last week still hold true. Downgrades to GDPnow (above) are primarily driven by trade, but the lull in the consumer demand is also a factor.

Other trackers (GS above, NY Fed below) are incredibly detached from the Atlanta Fed measure.

Investment components of GDP aren’t showing much concern, and these components are more likely to swing heavily if recession is on the horizon.

This month’s ISM retreated somewhat, with survey respondents noting the uncertainty around tariffs affecting business.

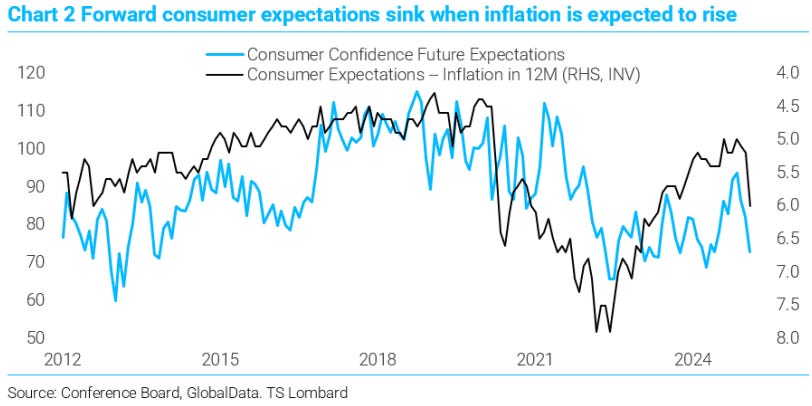

Other uncertainties have also affected consumer perceptions.

The consumer board data referenced last week has an interesting correlation with inflation perceptions (above).

Housing is also part of the chatter. I find it hard to get excited here. The drop in bond yields has driven mortgage applications, but other factors including affordability and a peak in construction of multi-family driving bearish views.

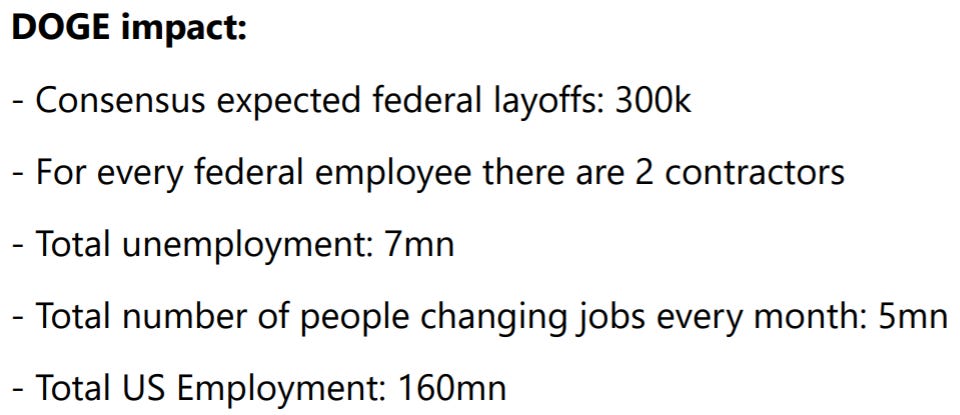

Employment is important this week. Like with growth it may seem that bad weather and fires have had a bigger effect than thought, but this is obscured by the political volatility.

Lower-tier employment data (Challenger job cuts) look horrendous, but initial claims (ex-government figures) look good.

The chart above says a lot about why the politics is where it is right now.

I’m still unconvinced that the US has set upon a slower trajectory of growth. The main drivers since the pandemic are still in place and will only change if any actual progress is made on reducing the deficit.

The extension of the TCJA (Tax Cuts for Jobs Act) without a solid plan to pay for it is more important than temporary politically induced volatility.

ECB & Euro inflation

The ECB cut rates this week as expected. The press conference was dull but highlighted the two forces that Ms Lagarde is bound by, being poor growth now versus the prospect of growth driven by fiscal expansion in the future.

Inflation numbers from the EZ this week were a little disappointing for progress, but not game changing.

Markets

I made an updated thread on the moves in European bonds as a result of the fiscal pump news. Click through to see a run-down on yields, curves and spreads.

The periphery tightened to German bonds on the news. This was expected but is a concern of mine given the sensitivity of peripheral markets to similar increases in issuance, and the optical effect on higher rates on their budgets.