Charts & Notes: Amazing growth revisions

Upgrades to US Q2 growth match a recovery in debt growth

Once again, we are faced with another US government shutdown. After countless previous episodes, the market has mostly learned just to ignore it.

Like with most things these days, the market has grown tired of trying to predict downturns in macro data which never arrive, constantly papered over with more and more…well…paper (government debt).

While the S&P500 only experienced a miniscule 1.8% drawdown this week, I think the stars are aligning for another go at the Europe trade.

While the DAX is still trading sideways, the Eurostoxx 50 has broken February/March highs after a 7-month consolidation. One to take a shot at, I would say.

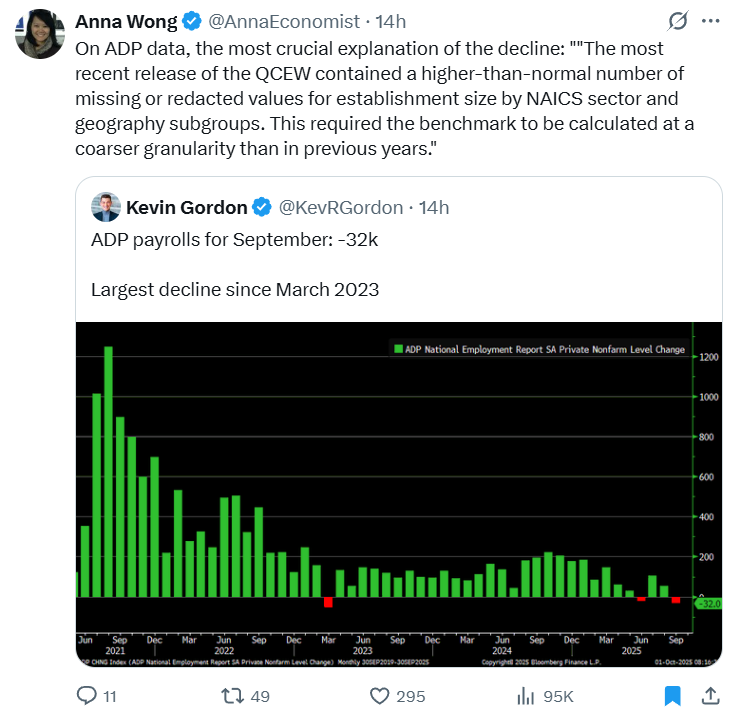

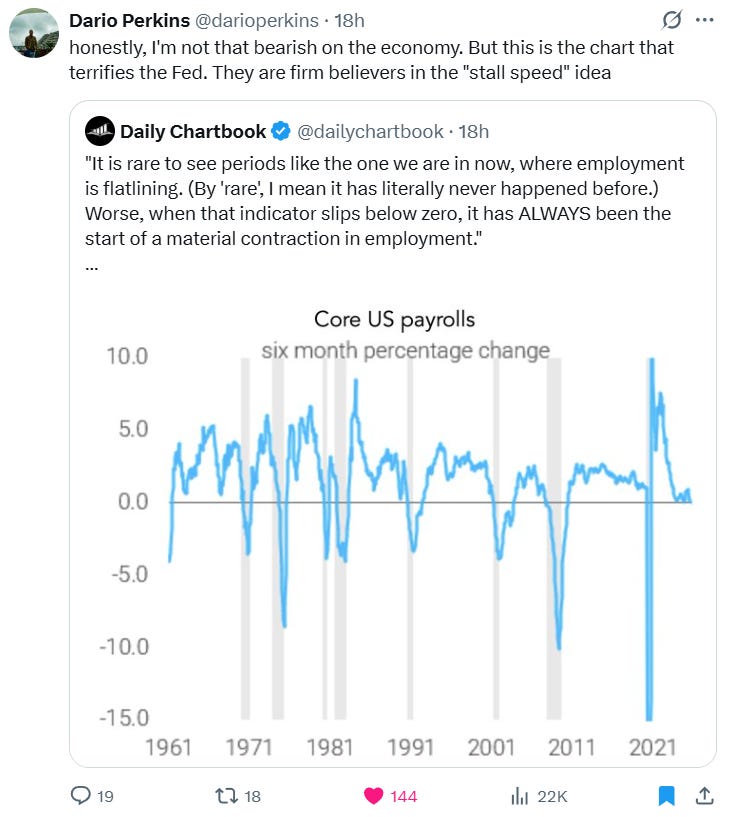

Bonds have traded OK since the S&P500 came under a bit of pressure and popped on a negative ADP employment print. Anna provides her thoughts above on the validity of that.

Dario mirrors what I have been saying about the Fed’s propensity to panic at a perceived “stall” speed for employment. Clean ADP print or not this will put a floor on front-end pricing.

Why are we so confident on the economy though?

Q2 GDP revisions

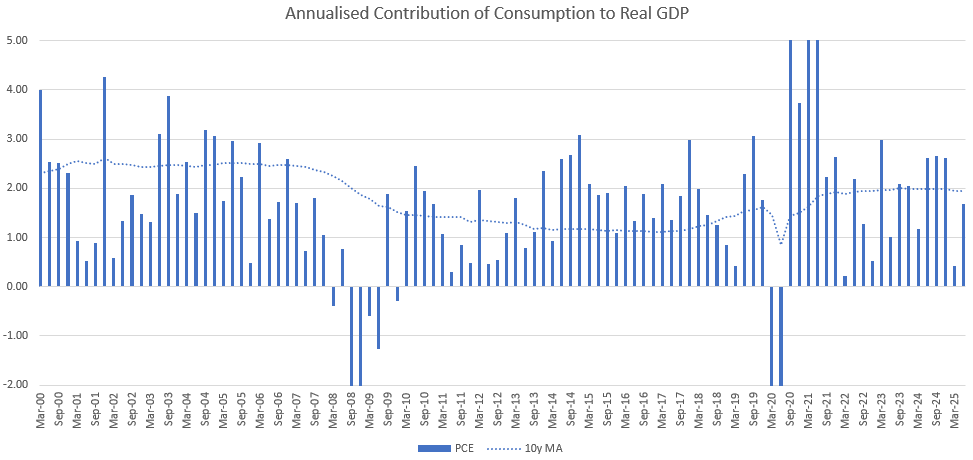

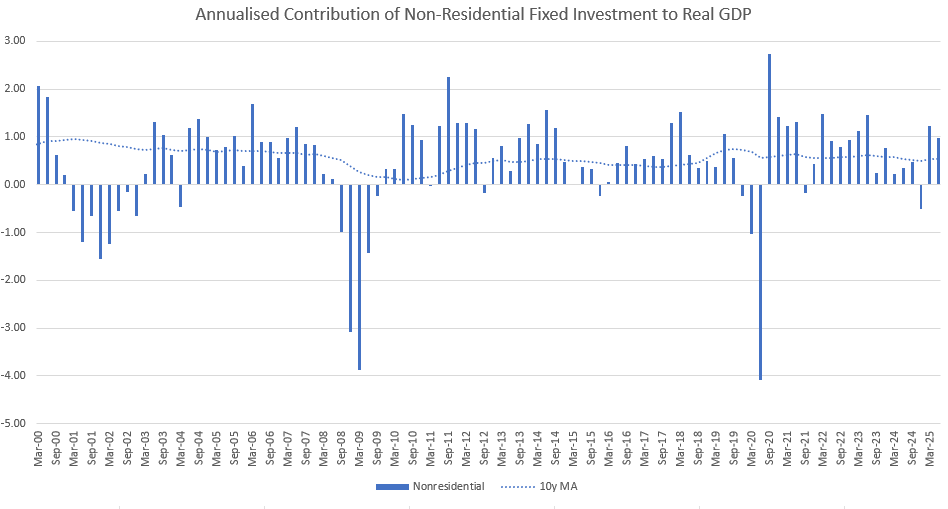

Significant revisions to Q2 GDP came in the week before last. They partially beefed up a theme we knew of already - AI-related investment - but corrected weakness in consumption.

Consumption improved by 0.7% and non-residential investment by 0.6%. These were offset by about a 0.5% drag through imports and inventory drawdowns, as you would expect.

Real GDP for the 2nd quarter bumped up to 3.8%, an impressive turn but still a slowing on aggregate over 2025 versus 2024.

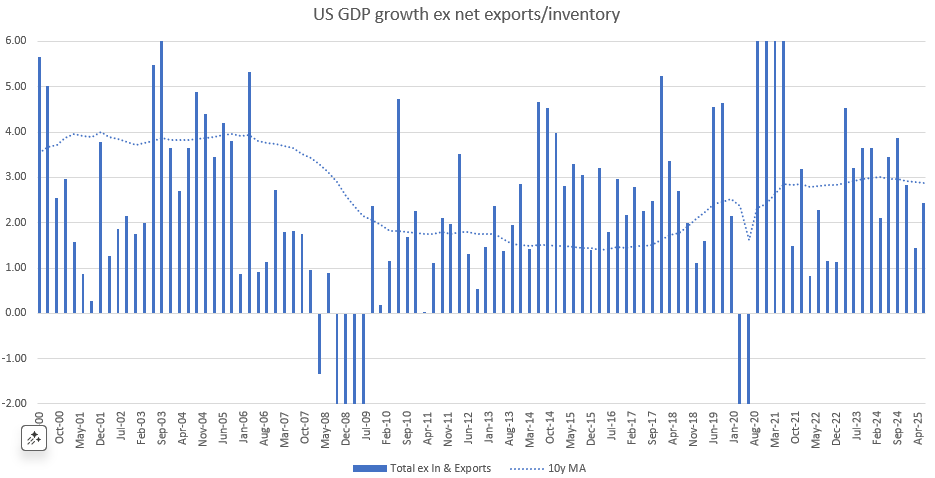

Real GDP ex imports and inventories is tracking more like 2-2.5%.

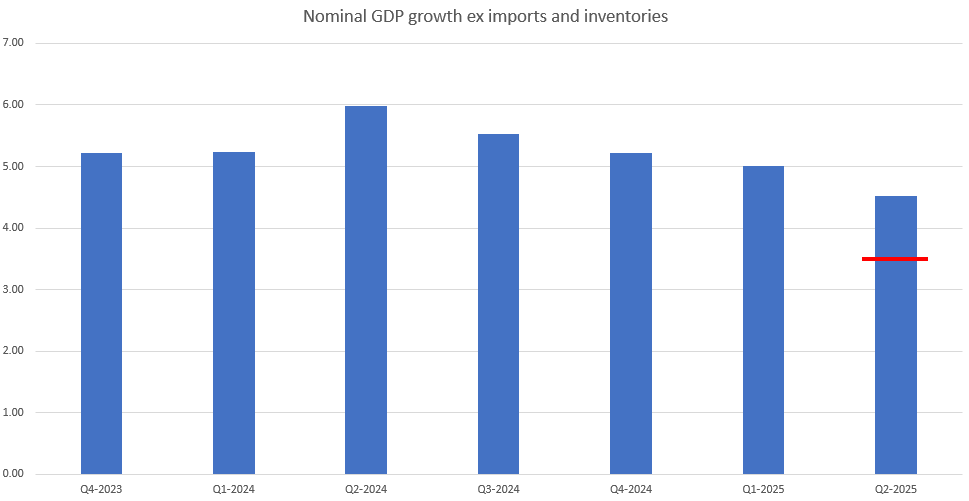

The measure most useful for domestic assets is nominal GDP ex imports and inventory. This measure has improved significantly and once again puts the nominal expansion of the economy more in line with the size of the budget deficit. The US probably isn’t a >5% nominal growth economy anymore, but it isn’t far off.

Revised consumption reverted to nearer the 10-year trend line. Q1 2025 could very well be an anomaly.

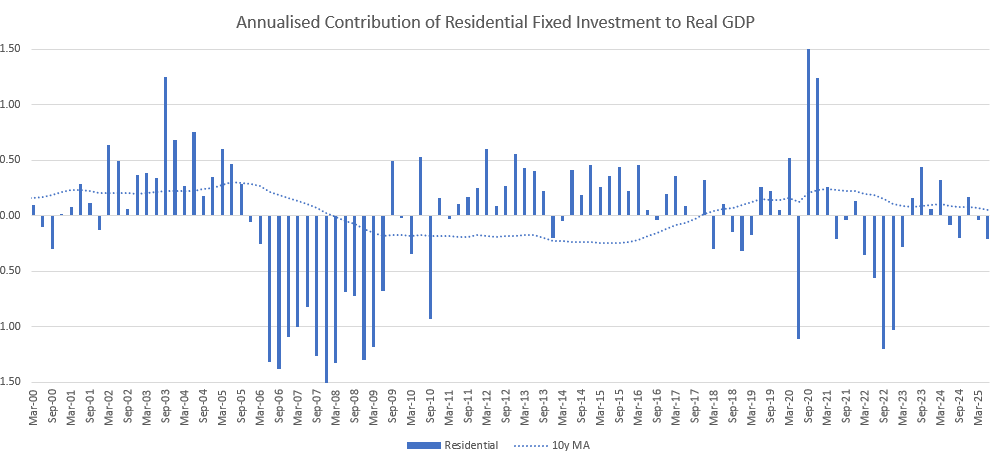

Housing investment continues to struggle.

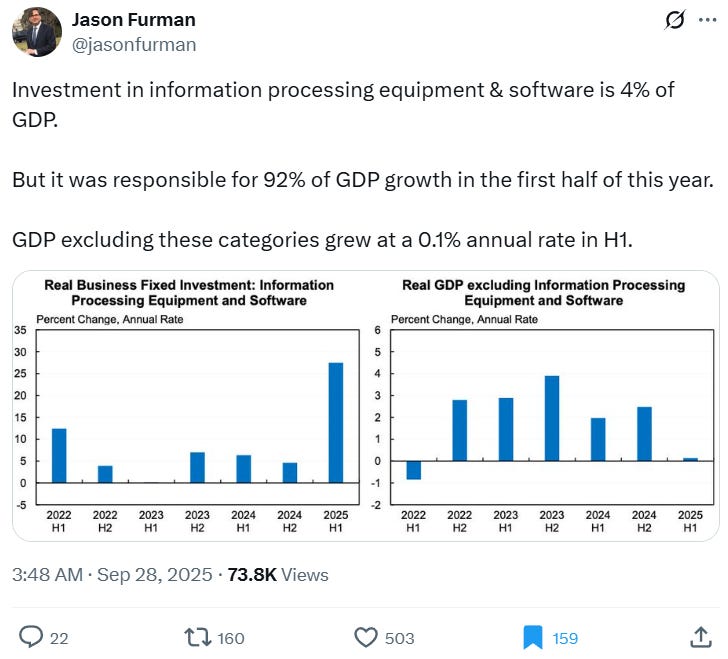

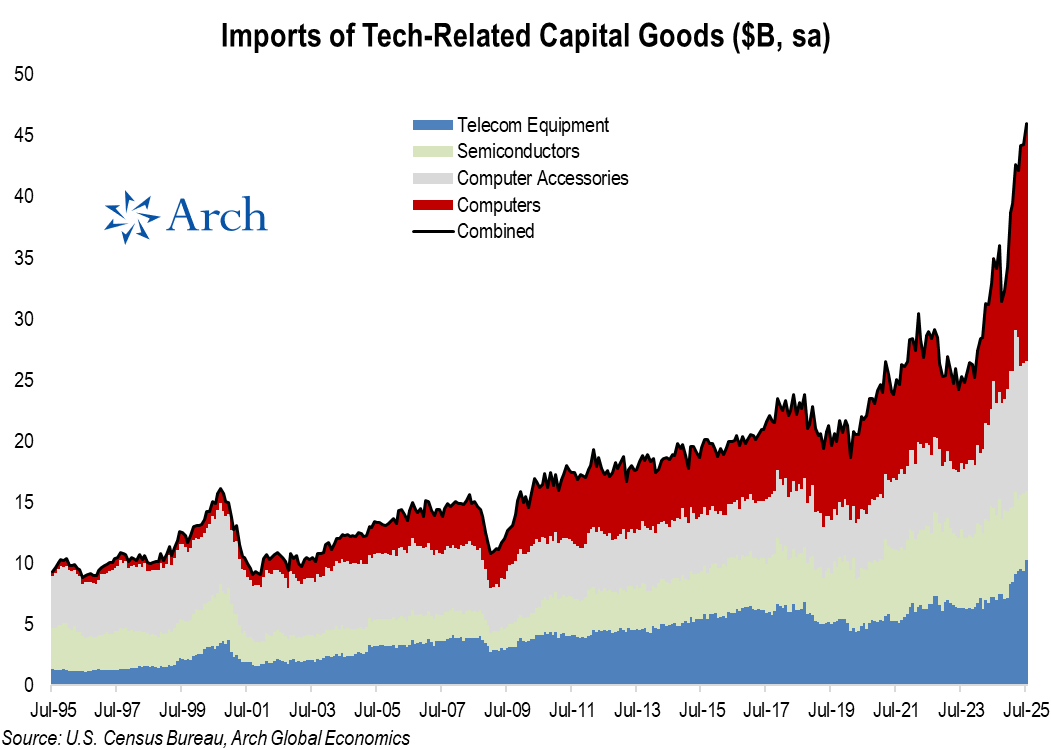

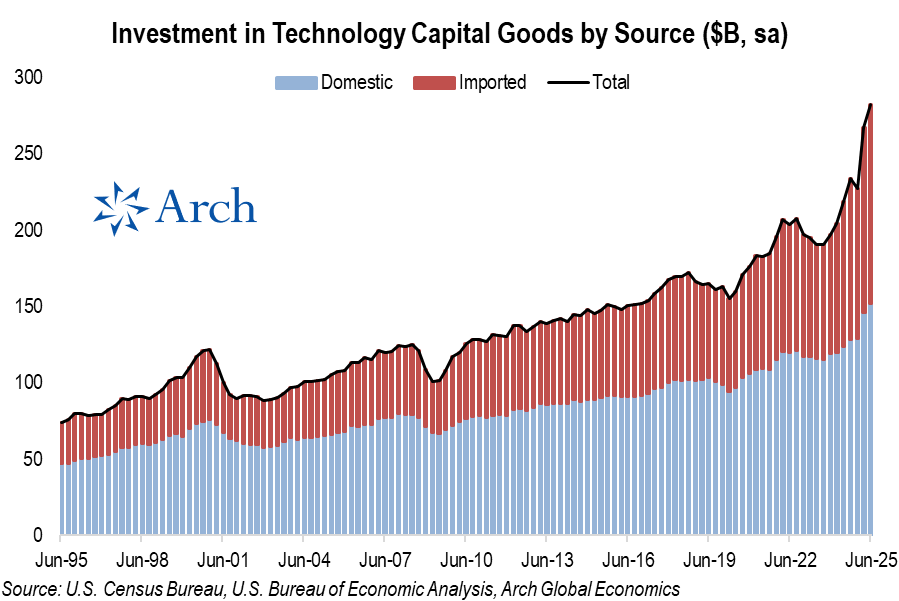

Now onto non-residential investment. Last 2 quarters show ~1% contribution each…very strong. Much has been written here, like the below…

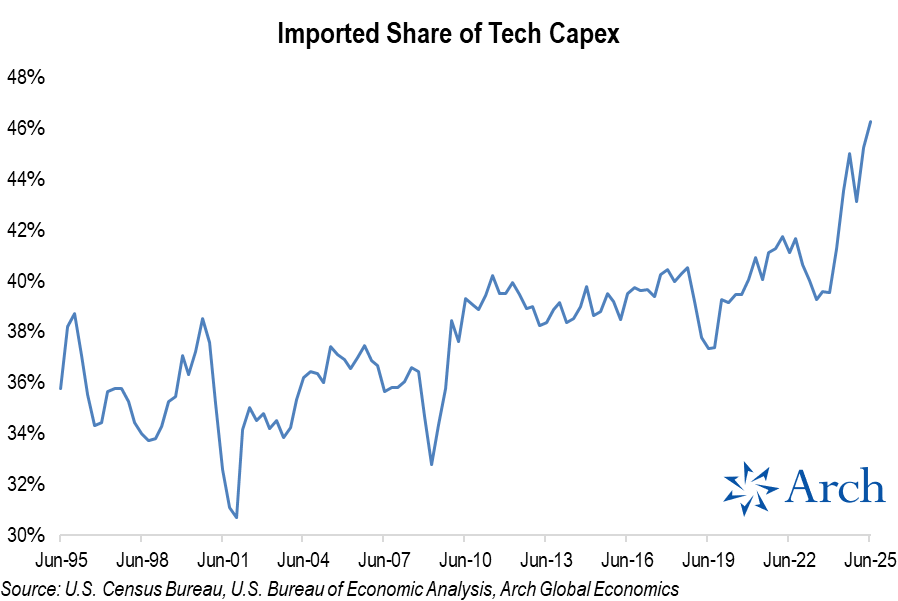

This only captures one side of the ledger. A large portion of that investment would have occurred with imports, so if you took away that investment you would have to add back the imports that wouldn’t have happened, so it isn’t as bad as Jason suggests.

Jason makes the point in the follow-on post about the freeing-up of resources would encourage growth elsewhere, and this is correct, but imports would be at least 50% of it as well.

Parker illustrates this effect in the linked post.

With that capex driving to near the 50% number I quoted above.

Interaction with tariffs

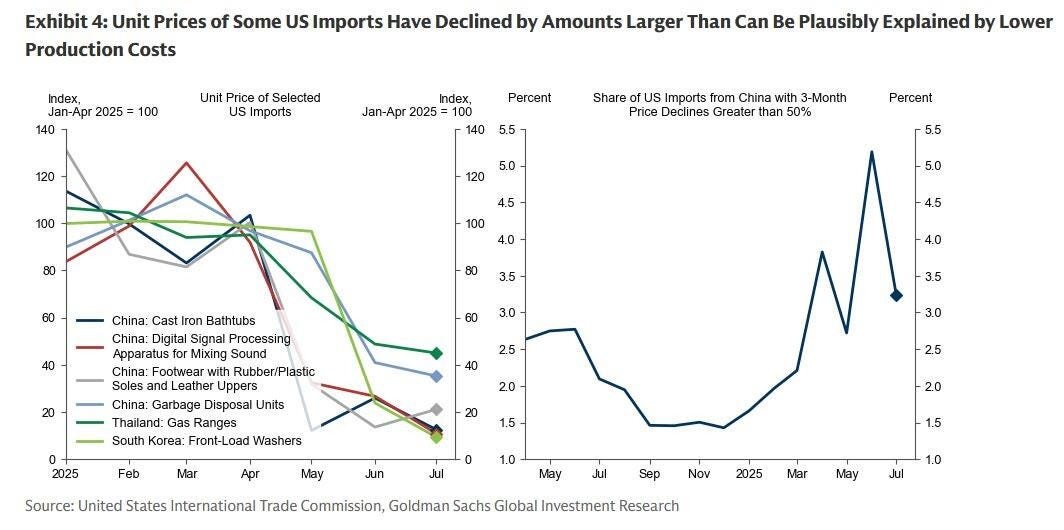

It is curious that the import surge has coincided with the imposition of tariffs and the disruption of Liberation Day.

The above chart from Goldmans is peculiar - it shows that import prices (prices before tariffs are applied) are falling fast for some types of imports from China, Thailand and South Korea.

It is curious that washing machines have turned up again as an item that is falling in price. This was the topic on my case study of the effect tariffs have on prices and reshoring. Link below.

The magnitude of these falls is suspect, however. This may suggest that under invoicing is becoming more prominent as a way to avoid tariffs.

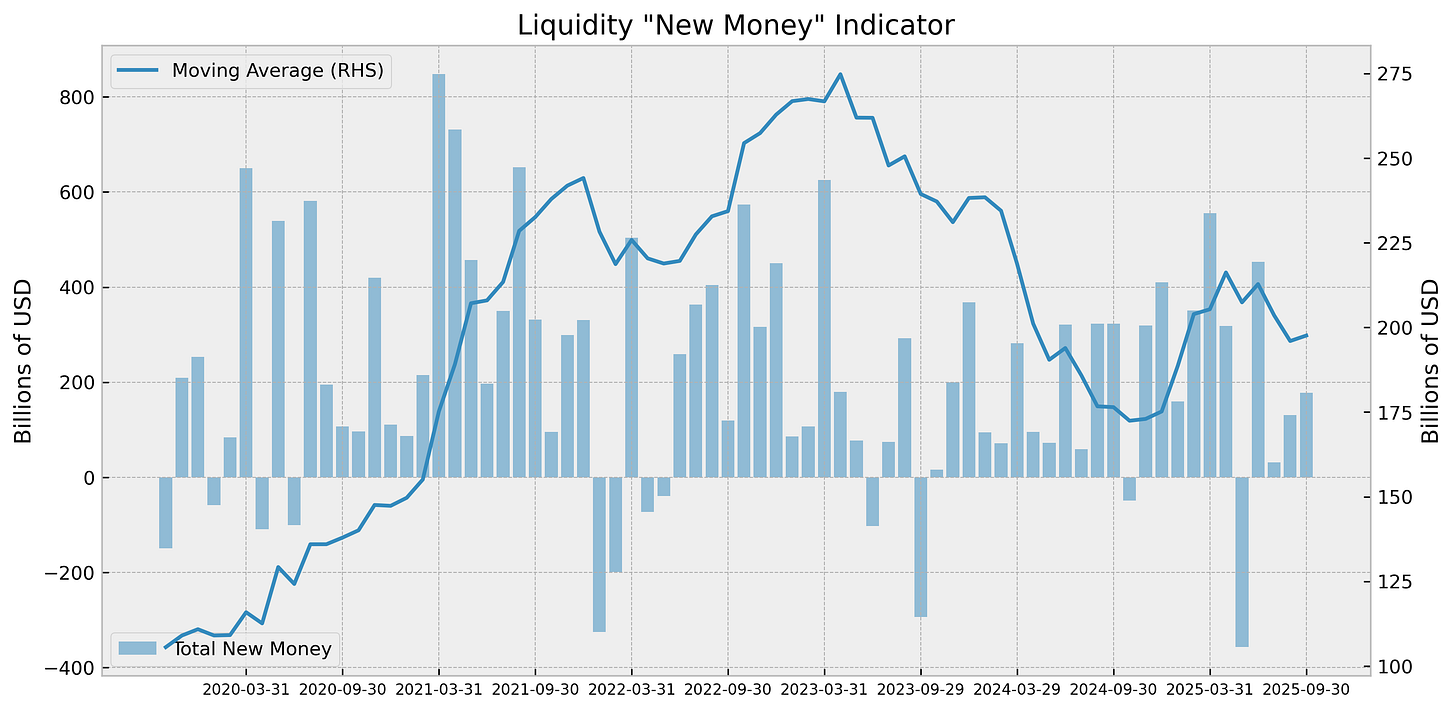

The ramp-up in collection of tariffs (along with April’s market volatility) slowed new debt accumulation in the US earlier this year.

This is now starting to correct. New debt accumulation is reverting to the $200bn/month average that has been associated with 20% annual gains in the S&P500.

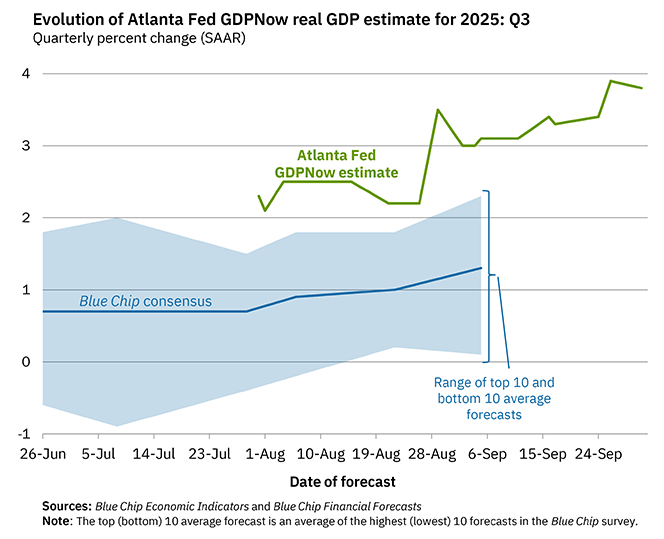

This is being reflected in forecast growth for Q3 as well. While the sell-side is looking for a more conservative 2%, if consumption has truly recovered then this might not be out of the ballpark.