There is one thing that is true in every bond market - the 30-year point on the government yield curve is its own beast driven by buyers that aren’t dictated by price but rather than need to hedge their liabilities.

For Europe, US, UK and Japan, the dominant player is usually pension and insurance funds who are looking to hedge long liabilities. Large moves in 30-year yields relative to the rest of the curve usually indicate a change in behaviour from these players.

The big 30-year JGB move

Of course, this doesn’t stop the market forming pessimistic narratives around the rise in JGB yields.

For the most part, these narratives can be ignored. Are higher yields negative for financial conditions? Yes, but this just reflects higher inflation expectations and global fiscal easing, which require higher equilibrium rates. Long-end rates will continue to rise if economies continue to “run hot”, and if this continues central banks will have to review their positioning towards rate cuts.

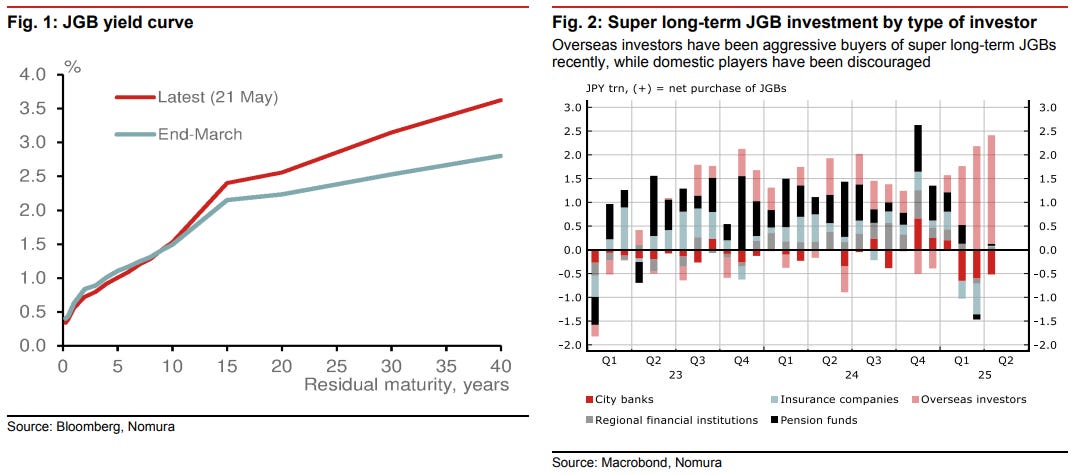

However, for the 30-year JGB technicals dominate. Domestic demand has explained a lot of the steepening (note that 10-year yields are only barely above their previous high in March while the 30-year is 70bp higher in yield). The buyer base is shifting and yields are accommodating.

In Japan, as in other markets, demand for long-dated duration has fallen from asset-liability matching investors. Liabilities have shrink with higher rates, which in turn requires less buying to cover those liabilities.

The right-side chart highlights:

How insurance, pension funds and banks have pulled back their demand to buy long-term JGBs

How foreign investors have recently stepped in to replace them.

This is for good reason. Buying a 30-year JGB fully hedged, a foreign investor can earn 1.5-2% higher yields than on Bunds or UST.

Foreigners have ignored JGBs for a while now. This is changing. The bust in UK bonds on account of pension fund collateral calls (it wasn’t a “Truss” moment, sorry), brought in foreigners as well.

The BoJ has been tapering their buying, which has offered another source of weakness.

The table above highlights the smaller share of BoJ buying for the very long-end, coupled with greater selling into their buying programmes.

While this chart is a little old, the effect of the BoJ reducing purchases is obvious against the trend of the 2010s.

Deeply negative 30-year swap spreads show the supply-demand imbalance well.

The US long bond

Globally, curves have steepened in sympathy with Japan with similar ALM demand issues, but also likely reflect growing fiscal deficits and a brisk pace of nominal GDP growth.

The US 30-year bond briefly traded above the 2023 high after the passing of the “Big Beautiful Bill” on Thursday. They settled below the previous high, but I suspect they will find a new range between 5 & 6%.

Higher long yields will continue to have effects on US housing.

US 30-year swap spreads are again breaching their lows. This chart plots the relative yield of 30-year bonds (which require capital to buy) and an interest rate swap (which doesn’t). Strong supply and capital constraints for buying will drive this more negative. The April lows were driven by an unwinding of the “basis trade” (more here).

Taiwan continues to retreat as a buyer. Addressing global imbalances will have differing effects on bond demand. In this case, it is clearly a negative.

The Big Beautiful Bill (BBB)

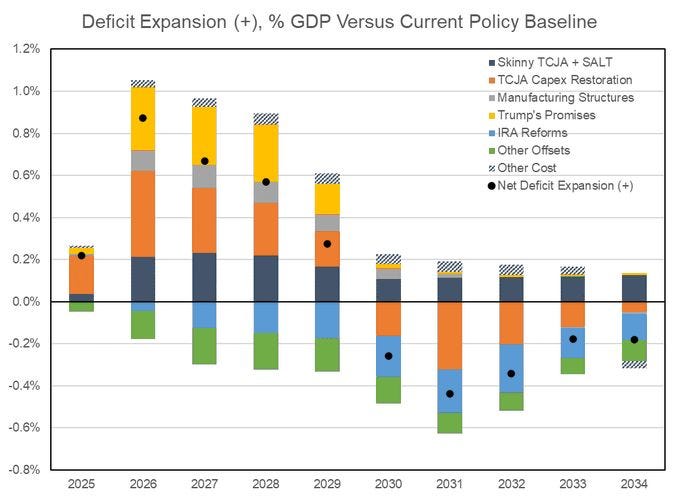

The BB was passed in the house on the 22nd. Depending on who you ask, the projected deficit impact is negligible to an increase of around $180bn a year (or about a 10% increase in the annual deficit).

The chart above reflects this expectation.

When you include tariff revenues however, the fiscal impulse may be zero. TSLombard above…

…and DB.

MS sees a bigger increase to the deficit once you include a slowdown in the economy. I’m not suggesting this will be the case, but knowing the sensitivities is important.

Despite the volatility of April, this is all leading to Q2 GDP tracking well.

Moody’s downgrade

I can’t imagine anything worse than being a developed market credit ratings analyst. The downgrade (to the S&P equivalent of AA+ from AAA), left little mark on markets, surprising nobody.

However, it is still interesting to see where Moody’s forecasts are versus the CBO, and they aren’t out of the realm of possibility. Moody’s see the deficit in 10 years at -9%…

…with debt climbing to 134% of GDP from about 100% today.

China data dump

First was April credit data, followed by GDP components.

The Chinese credit impulse has accelerated…

…with government issuance doing all the heavy lifting. Private credit demand remains weak.

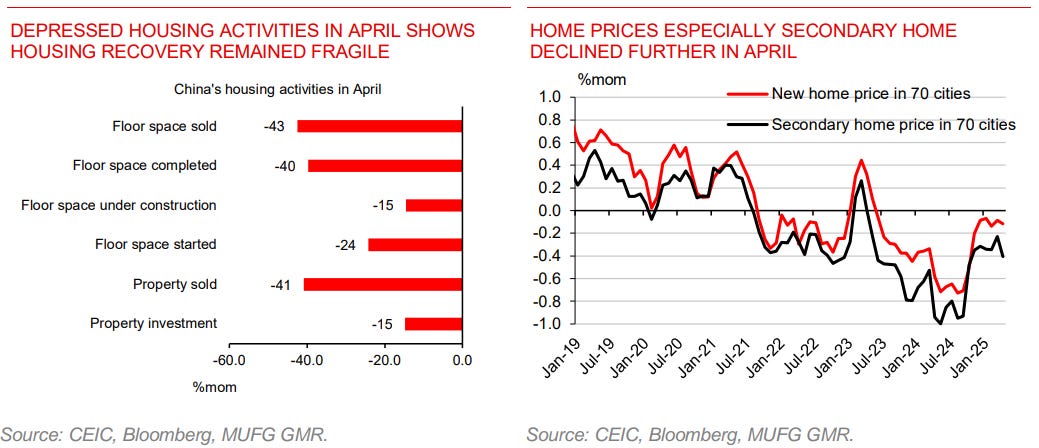

Activity data was really quite weak, showing an economy growing below 5%. There will be some urgency to get stimulus up and running fast.

Above, a slowdown in export growth matched a slowdown in industrial production growth.

Housing, which was looking quite good, slowed.

Same story in retail which was looking positive last quarter. This will be disappointing to leadership after the implementation of several initiatives to boost household demand of durables.

Bonus chart

A reminder of how important growth in the working age population is to outright GDP growth. DB produces this chart for the last 25 years and it is remarkable how well it holds.

Everyone wants to be well above the line. Given this chart it’s either trade (HK, Singapore) or tax cheating (Ireland) that gets you there.

Great post as always! Considering the net effect of "BBB" not as dramatic, would you say the market overhyped on the bond vigilante narrative? I'm torn. The US UK JP long bond auction did not going well and swap spread widening as you highlighted obviously suggested investors' need of higher risk premium. Hence, curve steepener, bearish dollar. But isn't such analysis/concern/doom all over people's inboxes and minds now? I don't know if it's fully crowded, but consensus for sure. In short term, I'd rather trade against it. In mid-to-long term, would you say this is a macro theme just getting started and has more legs to run? Thank you!

Great post Peter, looking forward to more of Steepening Bear’s Visit bedtime stories :)