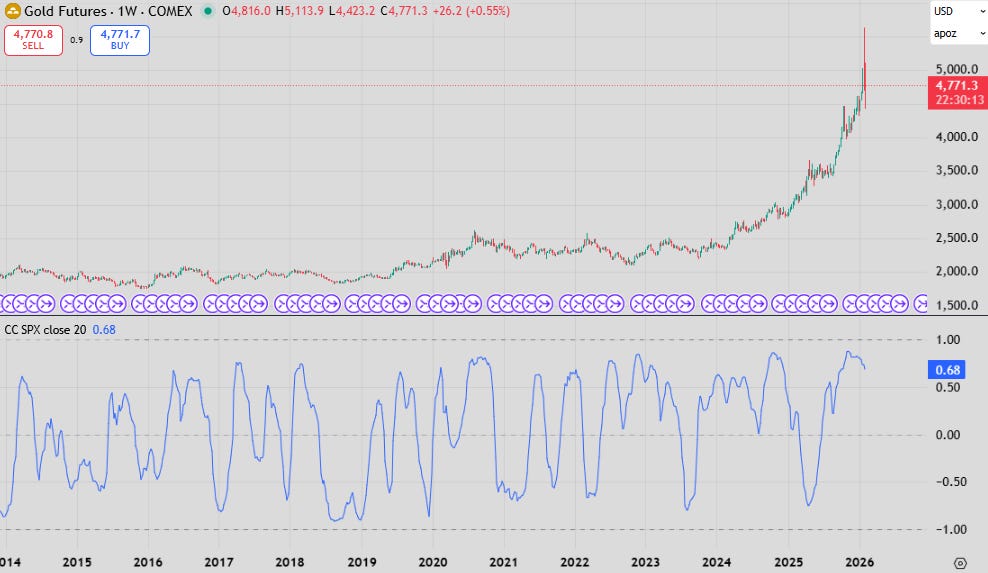

We covered gold and silver last week, which, along with European equities, oil, the US dollar and DDR4/5 prices, caused January to continue the more recent tradition of new year price breakouts (even though Euro equities reversed their strong start to the year on Greenland sabre rattling).

The most tracked macro assets - the S&P500 and US bonds - didn’t really participate in any of this. The S&P500 hasn’t drawn down much greater than 3% even though poor sentiment (which is reflected in elevated implied volatility) was clearly coming from US politics, and despite the move on Thursday’s session.

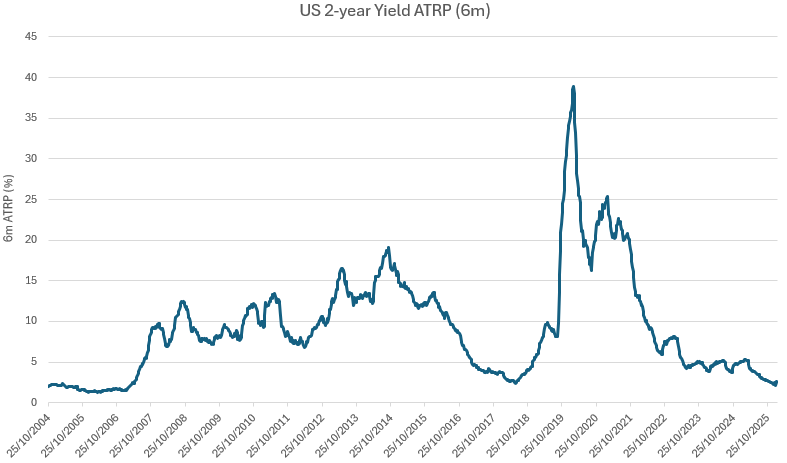

US 2y bonds have traded in a 16bp range for 4 months now, and yesterday’s 2% fall in equities has taken it to the lower end of this range. This is exceptionally low volatility, again despite the fact that there is rare uncertainty about who will be leading the institution and much ink spilt about whether the person that Trump ended up picking would be forced to readopt ZIRP.

None of this adds up. Is it time to spend on puts?

Firstly, I want to advertise my latest mainline Macro Is Dead piece:

This piece talks about how a hard default for a country like the US is only possible if she so chooses - but this doesn’t mean that bondholders are immune from default-like capital losses.

The interaction between forward inflation and the Fed’s monetary policy has caused real capital losses for bondholders. I quantify this and show that despite pandemic-era inflation being far more subdued than in the 70s, losses for bondholders were far higher.

Stop he’s already dead

Volatility on the 2-year T-note contract is now in the mid-range of what persisted during ZIRP, while 2-year rates are at 3.5% and all the aforementioned worries persist in the market.

In 10s the story is even worse. Realised volatility is as lower than during ZIRP and as low as just before the pandemic and during the “eye of the storm” moment before the Fed realised it had an inflation problem on its hands. This also includes the “Liberation Day” drawdown in equities!

When measuring the true range (capturing highs and lows and not just close) and expressed as a percentage of outright rates, the picture is even worse. It’s tough work being a bond trader now.

What’s going on? Why do we read of panicking about Fed independence in deciding terminal rates, yet markets continue to print lower and lower vol?

Add to this the break between the US Dollar and rate differentials (illustrated last week) and the breakout in gold prices, the puzzle deepens.

There are a few possible explanations for this:

The market is already priced for perfection against two highly divergent paths for rates

The market has no idea how to price two highly divergent paths for rates and is just sitting on its hands (i.e. it is asking questions first and trading later which is not usually how things work)

The market has given up expecting any negative correlation to equities out of rates given the strong growth/inflation backdrop so no rush to safety ever happens.

The third explanation is likely the most accurate given that bonds really didn’t participate is the persistent jump of implied volatility in equities from ~14v to ~20v.

No bond vol, no equity vol (but insurance is expensive)

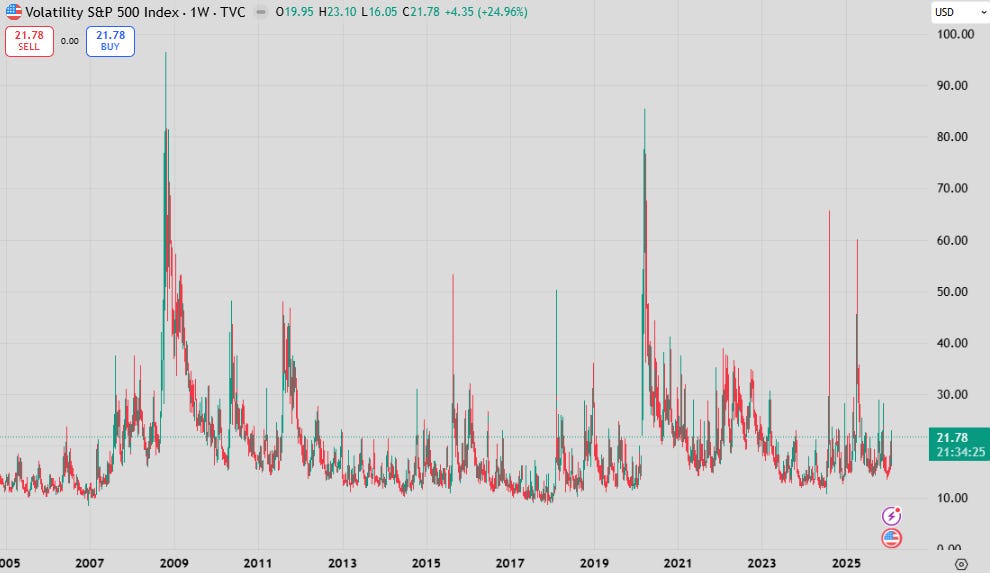

So, US equity and bond realised volatility is low. However, the VIX has stayed stubbornly high since the market was triggered by Greenland.

This persistent elevation in the cost of downside protection just doesn’t match with low realised volatility, which is at historical lows. This is saying that volatility risk premium is high, and the market is expecting a sharp rise in realised volatility in the future.

There is some memory present here. It seemed like traders couldn’t get a weekend without worry in January. From Greenland to Japanese FX intervention to Iran - the standard trade is to bid up vol into the weekend because the market at least has an idea of Trump’s preferences for timing of announcements now.

Each of these events ended up being largely irrelevant, hence why realised volatility has stayed so low.

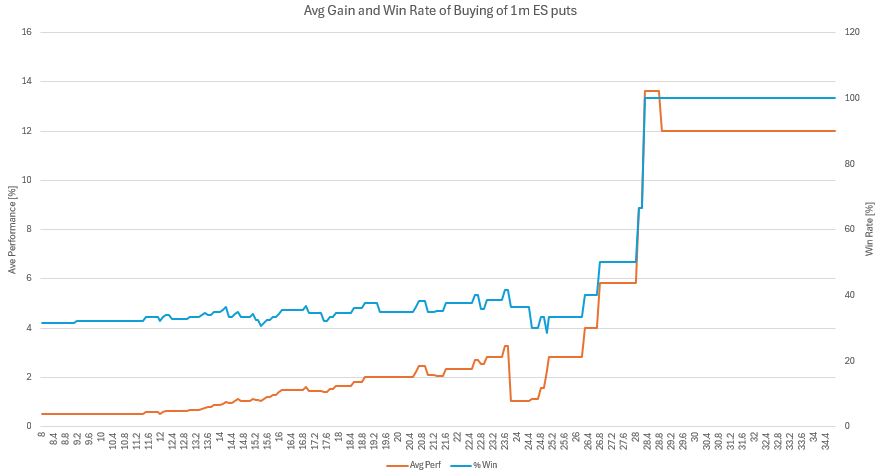

Another underappreciated effect is how falling slowing upward momentum in stocks triggers put buying in quant programmes. Adding to this is the positive historical relationship between the success of put buying and the level of implied volatility.

Odd as it sounds, buying puts works far less when implied volatility is low and puts are cheap. Most success occurs when volatility is moderate and high. Cross-validate this with high realised volatility and rate of success increases. It is still rare to have puts pay off because of a persistent volatility risk premium in equities, but it does happen.

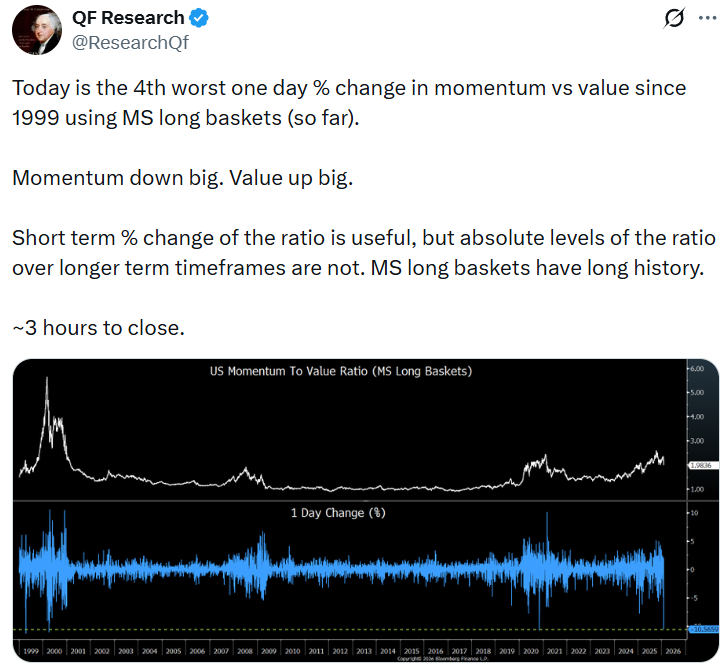

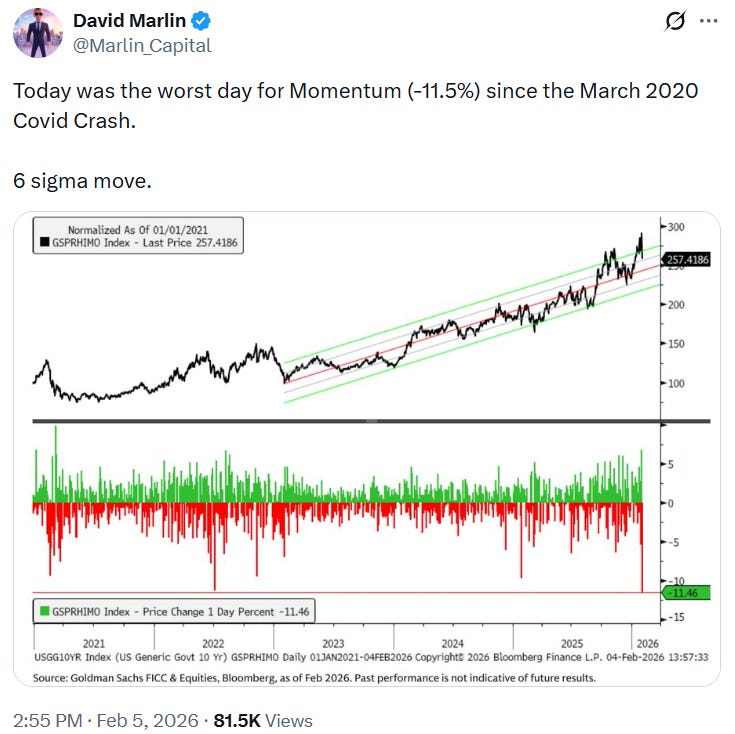

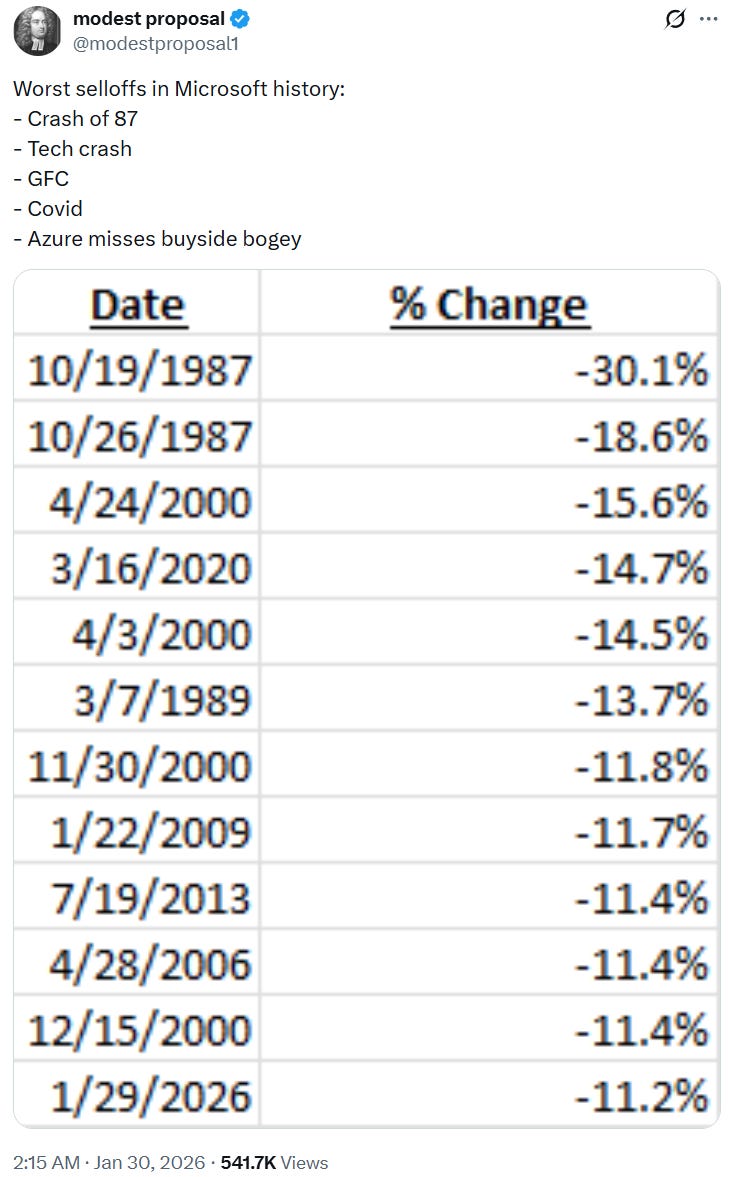

In a similar story to the start of 2022, what might be driving index level vol buying is the amount of volatility under the hood, especially in tech.

Being a pure macro enjoyer, I don’t pay too much attention to stock reporting as these outcomes are generally wrapped up in the risk premium a certain market offers. If results are too volatile, it will manifest itself in a change in return distribution at the index level. From a 1000ft view, things don’t seem to be going too well for the markets favourite sector momentum trades.

There is a narrative attached to this, as there always is. Once again worry has set in about the volume of capex attached to infrastructure and (more importantly) the morphing of cash-flow generation to consumption. This has an obvious flow on effect on semiconductor companies which have been the strong momentum trade. Amazon reported an expected $200bn capex bill versus expectations of $141bn! Truly a turning point when it comes to the view of the future.

Another factor to consider is the rotation that is happening within US equities at the moment as well. Software, which was only a few years ago one of the largest sectors within the S&P500, has drawn down more than 30%, while small caps and the rest of the S&P have outperformed!

The narrative for this rotation seems to be at odds with that of infrastructure - how can AI supplant software if the market is saying no to more spending in the sector? The answer is that the rotation is driven by hedge funds running for the doors at once. This seems to an annual occurrence and is expected when gross long/short exposures are so large.

Volatile rotation has the ability to also make managers nervous and cause persistently higher implied vol. On top of this is the exposure of the jumbo private credit funds to software, of which some have exposure of 20%.

Private credit is still the left-tail risk. The post above details the corner they’ve painted themselves in.

They’ll work out one way or the other

These divergences in volatility between US assets is also replicated in FX markets as I posted last week.

The sharp move in the Dollar seemed to replicate fear rather than fundamentals. A lower Dollar should see relatively lower US rates, but this hasn’t materialised.

This isn’t true across the board, however. The RBA hiked interest rates at their meeting this week, ending one of the shortest easing cycles in western central banking history.

In this case the rise in the AUD had a delayed reaction to interest rate differentials, and likely won’t need the sort of adjustment like we see in the EUR.

The divergence will have to work its way out. If the protection buyers in equities are right and we get the explosion in equity realised vol, then maybe rates can close the gap on the US Dollar. It might not be enough though.

If they’re wrong and equities resume upward momentum, then vol returns to the typical 14-16 range and the Dollar may end up filling the gap while bonds continue to do absolutely nothing.

The only emergent theme in US macro seems to be concern once again about employment. I haven’t seen enough top-tier data to suggest this is actually happening, but we get the delayed payrolls number on Tuesday.

The only trade that keeps on going is my favourite - 2s10s. No reason to see this changing anytime soon.

There’s little solace in gold at the moment, with correlations to equity being as positive as they ever are.

This next week will sort it out one way or the other. Be careful!

Enjoyable and insightful read as always, thanks Peter!

Another great one, also thanks for linking to your private credit piece!