The return of the weekly "Charts & Notes” was delayed a week purely because of the utter insanity of markets in another very eventful January.

To cover:

Gold & silver: The driver (China) hasn’t changed but has just supercharged

Dollar & Yen: The US is getting what it wants

Firstly, I want to advertise my latest mainline Macro Is Dead piece:

This piece talks about how a hard default for a country like the US is only possible if she so chooses - but this doesn’t mean that bondholders are immune from default-like capital losses.

The interaction between forward inflation and the Fed’s monetary policy has caused real capital losses for bondholders. I quantify this and show that despite pandemic-era inflation being far more subdued than in the 70s, losses for bondholders were far higher.

Precious metals

At time of writing, gold has so far posted a +26% return for January, and silver an incredible +66%. On my measures it puts gold for its best monthly gain since the just before the end of the 1970s inflationary period, and for silver it is the best monthly gain ever on my data (which goes back to 1970).

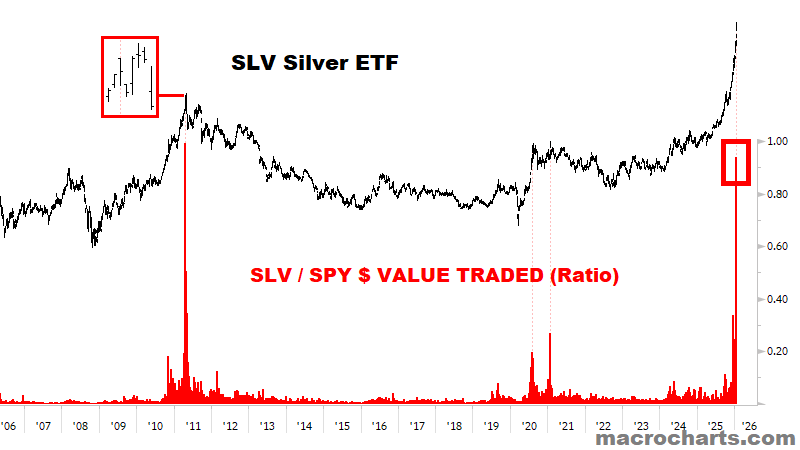

This has been matched with enormous traded volumes for ETFs that offer exposure to both metals.

I am not a metals expert, and for this reason I approach all research I read on the matter from a neutral position. I have read everything I could get my hands on and the only consensus I have been able to establish is that nobody really knows what is going on.

I would link some of these pieces, but since there are so many contradicting pieces of information about key pieces of the puzzle, I would be doing more harm than good directing you to them. There is also a “crypto-esque” type vibe about silver as an asset class which makes it even more difficult to discern what is relevant, and what isn’t.

Here’s a summary of the arguments made for why we’re here and why it will/won’t keep going. I’ll concentrate on silver since disciplined tick watching has silver driving gold (up until two days ago), rather than the other way around but many of the same arguments work for each.

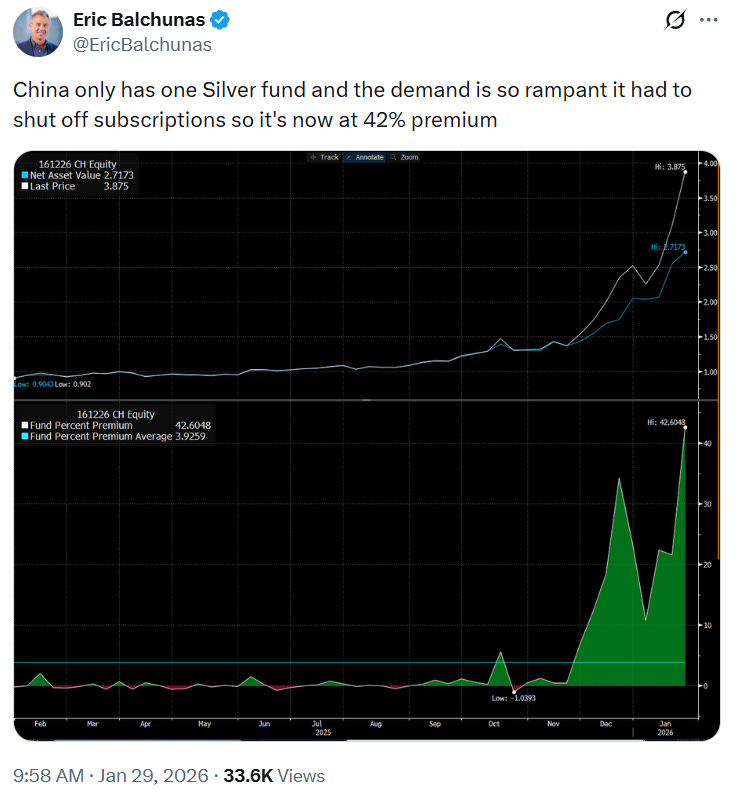

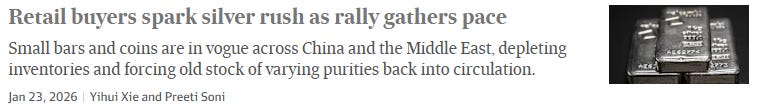

1. Chinese retail buying of silver as the core driver of the rally

This isn’t agreed fully between everyone, but it does sound like the most likely explanation for prices being where they are.

I wrote about this as a driver of gold prices in April of last year and it is likely it has had a similar effect on silver as well despite its more plentiful nature.

The reason that it has still been powerful is because US-China tariffs have led to the weaponisation of rare earth elements and now have extended into silver as well. Similar to the case of REE’s, a large amount of refining capacity is in China.

So, Chinese retail buying due to CNY devaluation risk and a banking system under pressure from continuing problems in property, supercharged by lack on silver imports due to a standoff on trade in the metal.

I like this theory and it seems to be well supported by the data and policy changes (especially in China with their new export policy licensing requirements which changed this month).

For further evidence of both technical drivers and the blind demand for silver out of China, please see the above post.

2. Silver market technicals

The arguments surrounding the technicalities of the silver market (including paper-physical spreads, refining margins, COMEX inventories, producer hedging and the spread between Chinese and US exchanges) were much harder to get a handle on and had the most convincing arguments one way or the other.

COMEX inventories: Several “the sky is falling” accounts on X are starting to panic about silver inventories available for delivery are falling and could be consumed within 6 months. This idea here is that shorts wouldn’t be able to deliver physical and therefore need to buy back, driving the price higher.

While there doesn’t seem to be much disagreement about cause and effect here, with the volatility that silver trades with, 6 months is a very long time.

Producer hedging: Positioning data reveals that it seems to be the hedged producers who are buying back, likely due to margin calls on one side of that trade. Likely a real effect.

Shanghai spread: Participants looking at the premium of Shanghai traded silver to COMEX traded note the stretched spread of about $20/oz ($130 vs. $110), arguing that COMEX traded should lift to where Shanghai pricing is.

Where the argument becomes muddy is that some believe that this is the effect of VAT (16%) on deliveries in China, but others say it shouldn’t be in the price as it only applies at the point of delivery. They present the lack of a spread as 6 months ago as proof it doesn’t exist. Yet the “cheapest to deliver” of any futures contract should have delivery effects integrated into the price.

This one ends up in the unsure bucket with fights ongoing on X over this.

3. Industrial demand

Some claim a spike in industrial demand is behind the price rises. I couldn’t find much evidence to support this. As of 2024, industrials uses of the metal totalled around 60% of production.

The story of a new Samsung battery made with a high silver content is a story doing the rounds which doesn’t seem to have any basis in reality.

4. Conspiracies

Banks have to cover shorts! No, they don’t

The banks have stopped supressing the silver price! No, they never did

Central banks are secretly buying silver along with gold! No, they aren’t.

Stepping back from the fundamental drivers, there is no denying a huge move that is supported by record breaking traded volumes. The trader’s rule is that volume confirms a trend, and on this measure, we don’t have a sell-off coming (yet).

For gold, my favoured measure of the trend since the start of the rally in 2024 has busted the upside of the channel, indicating that there a breakdown in the previous trend, which makes the “pick a number” forecasts from banks somewhat believable.

The problem here is that you can be bullish on gold, but the price action has now made it a gamble rather than “investing”.

In other words, the confidence that forward returns fit within the empirically observed return distribution for gold has vanished. Once it went parabolic, all bets are off, and even if you think gold can go higher (I actually do), if you are running a portfolio it is going to be difficult to warehouse an asset that can whip around 10% a day without any reliable correlation with anything else you trade.

It is now time for the degens and true believers and the market makers (who will win out of this) to take over.

USD, JPY, AUD, CNY

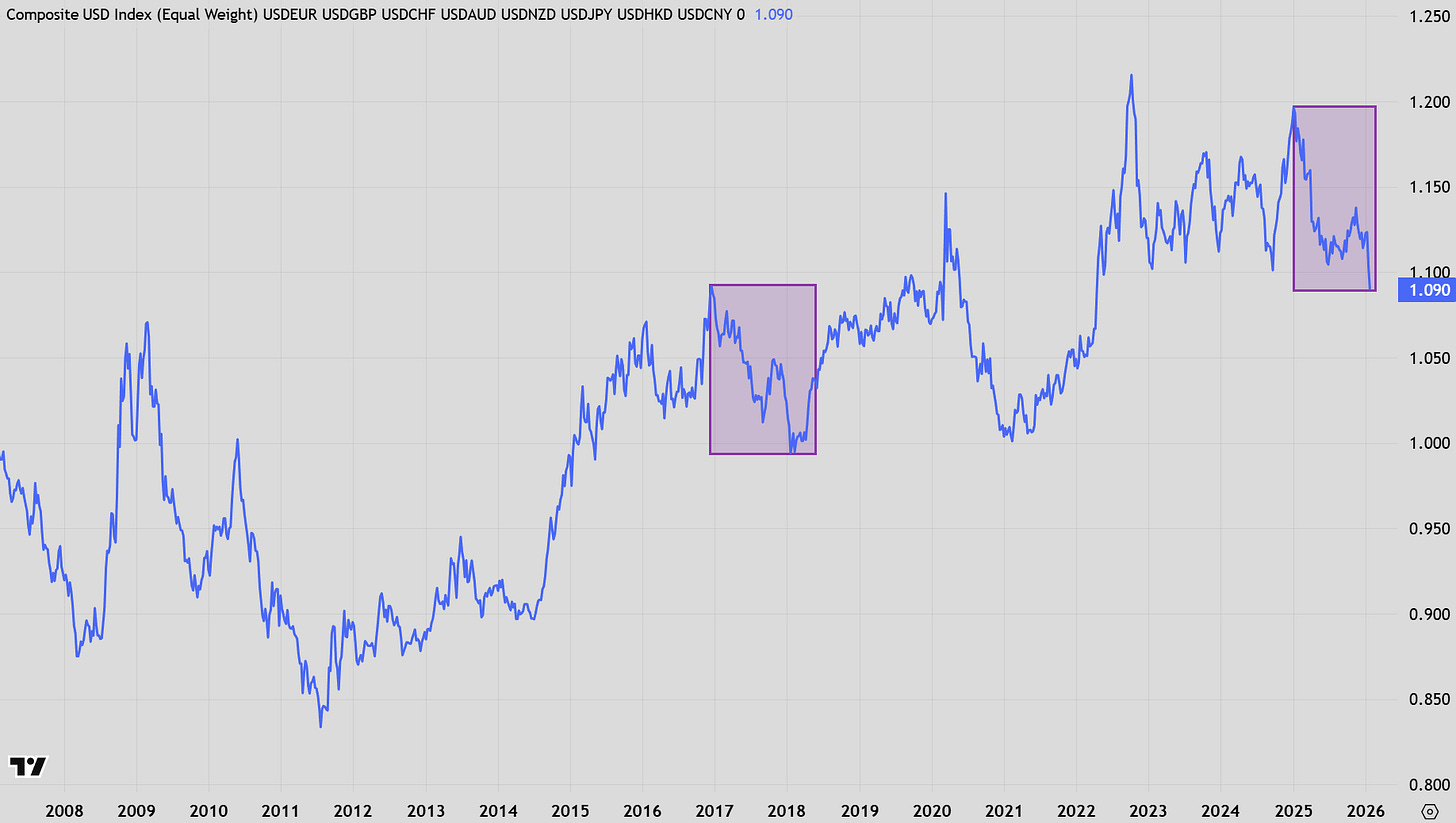

There’s no other way to put it - the move in the Dollar this month has been swift and judging by how it has traded, painful for a lot of option desks after a decent break in support seen in the chart below.

My first impressions here are that this is just another indicator of the end of the pandemic inflation cycle where elevated rates kept the USD bid. This was eventually set to crumble.

The second is the interesting mirror image with the Trump 1.0 term which I’ve highlighted with the boxes above. The total downward move during Trump 1.0 was just under 10%; the current move is just over 9% down.

So, the USD should bounce soon, right? No, this is the part most miss. 2018 was defined by a Fed that was hiking rates more aggressively away from the zero-bound (even though this did start in 2016 and paused in 2017). It’s unlikely we’ll see the same thing this time around, especially with the noise around the new Fed chair.

Funnily, this isn’t what actual rates markets are doing though. Markets have projected a higher forward rates curve for the US against Europe.

The chart above shows the more recent divergence between rates differentials and EUR/USD. This is evidence that the “sell US” trade is back, but narrative trades like this can only be temporary unless justified by fundamentals. The Dollar move will be either confirmed through a lower rates track or will bounce to define the reality. To be fair it is more binary than it usually is with the uncertainty around the new Fed chair.

You can’t forget gold here either. Strong gold generally equals a weak USD, all else equal.

Within the broader USD story are individual currencies with their own dynamics.

1. AUD

The AUD has a number of things going for it, justifying one of the largest monthly moves outside of a recovery from a large equity drawdown.

The RBA is forecast with a decent probability to hike rates, ending a cutting cycle that started in 2024 after another hot inflation print for Q4. The RBA will need some creative communication to avoid hiking rates in February.

The AUD tends to be positively correlated with gold as well (in an opposite way to how it works with the USD).

2. JPY

A “rate-check” by the MoF gave the market jitters as it assigned the worst possible inference around any possible intervention, along with a skittish 30y JGB.

Moves in 30y rates were exacerbated by the key factor during “Greenland-week” this month. The market freaked out over Trump’s Greenland comments which aligned with a US holiday and Asian market liquidity not dealing well with the volatility by this headline. I was a little surprised with how much markets panicked on that day - have we not learned yet how Trump conducts business???

By all reports intervention never occurred and the Yen appreciated anyway because that’s what everyone wants.

3. CNH

The only one that really matters when it comes to broader trade policy. Interesting to note that the appreciation of the CNY here, but this does come with a caveat.

The first is that the CNH’s appreciation has underperformed the rest of the USD basket. So, while the PBOC has allowed their currency to appreciate against the US, this has been balanced by relative depreciation against the rest of the CFETS basket.

China keeps being China.

The long-term chart above also highlights how strong the Dollar is compared to the Yuan. This is a period that saw China develop the largest current account surplus the world has seen and yet the currency continues to keep trend depreciation.

EUR and CHF will have to wait until next week.

The narrative tie-up

I haven’t mentioned the US “debasement trade” as drivers of either metals or currencies because it’s frankly not true. Neither is it the apparent threat of war or US political “instability”.

In fact, it seems likely that the main force in both gold and silver (Chinese retail buying) is prompted by local Chinese issues exacerbated by the continuing crackdown by both the US and China on metals which are the only real effect of US politics.

Concentrate on the real effects, not the wishes of those who dream about the fall of fiat.

Great examination of the PM narratives! One i missed was Indian retail buying especially silver, protecting from the declining Rupee or stock market, do you have an opinion on that? Chinese retail surely already started buying in the last years. Would wonder how the numbers compare between the two.