Charts & Notes: Quiet & confidence is risky

Quiet markets encourage the return of tariff aggressiveness

This week covers last week’s US employment data, new tariff developments, and an overview of leverage in trade of rare earth elements.

US Employment

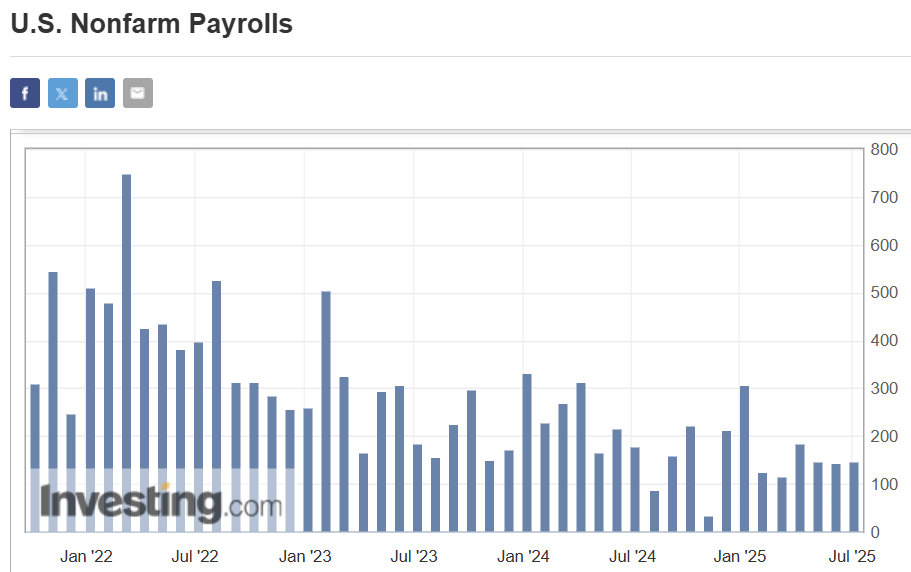

Out a day early due to the Independence Day holiday, payrolls came out stronger than the market expected, and still at a rate above breakeven.

Rates reacted strongly, with roughly half a rate cut coming out of 2025 Fed funds pricing, which is still looking for about 2 cuts this year. All eyes back to inflation out next week which has a gaggle of economists once again looking for the start of tariffs effects to come through.

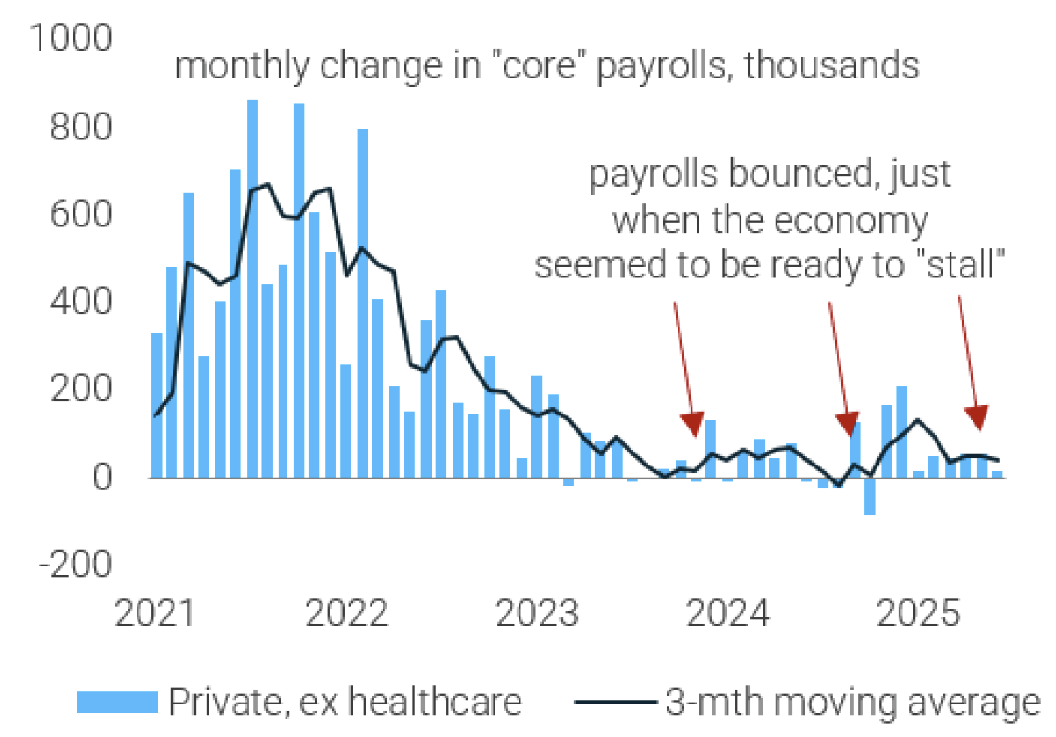

While the headline figure was better than expectations, it was easy to pick a negative narrative from the data. Namely:

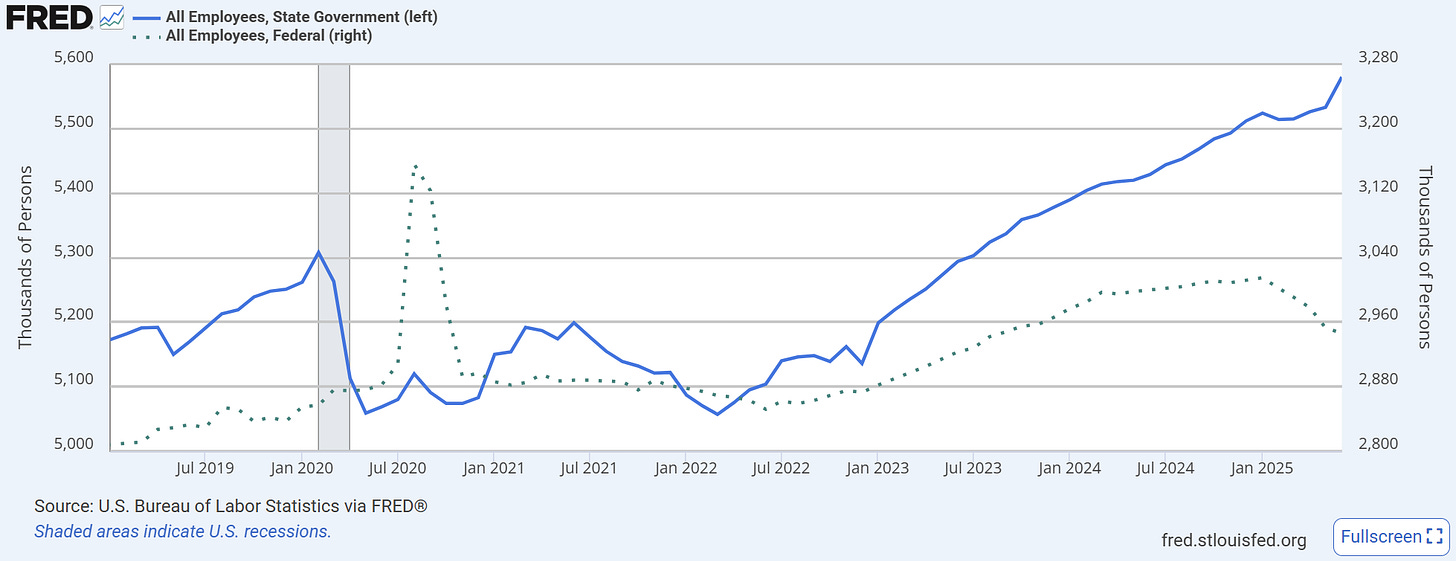

Government adding far more than the private sector;

And an even smaller ex-healthcare contribution within private (as shown above).

Within government it has been the states rather than employment at the Federal level which seems to have been affected by DOGE.

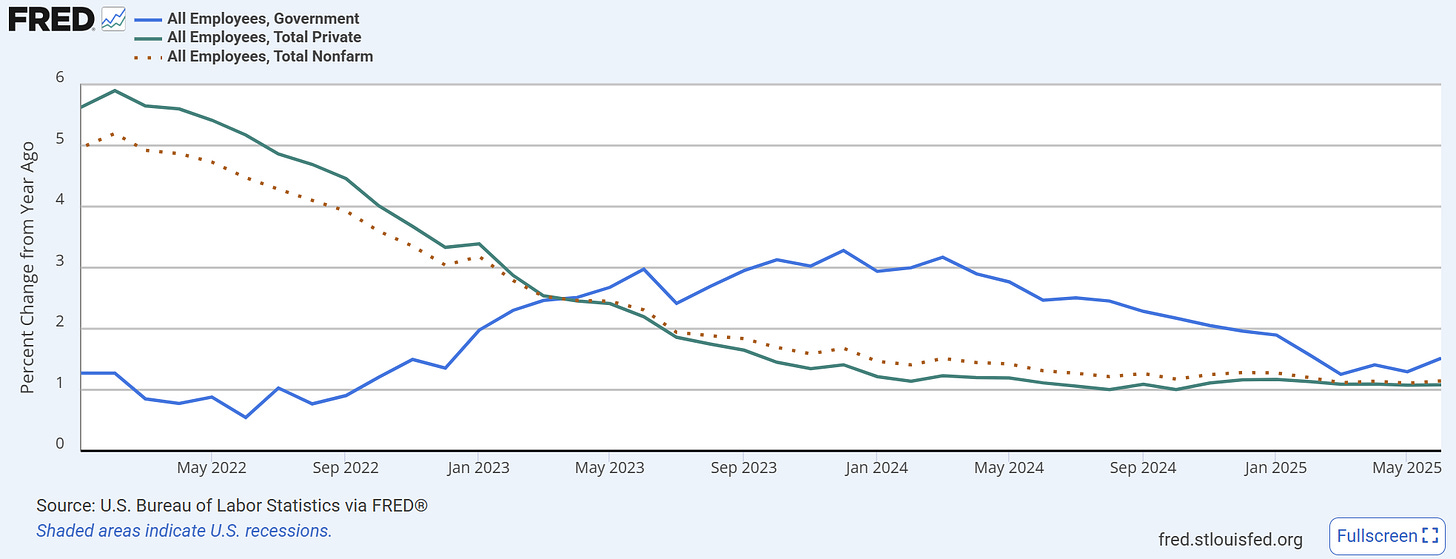

The above chart presents the year-on-year growth of government versus private. Government employment has compressed to private but is still growing at a faster rate.

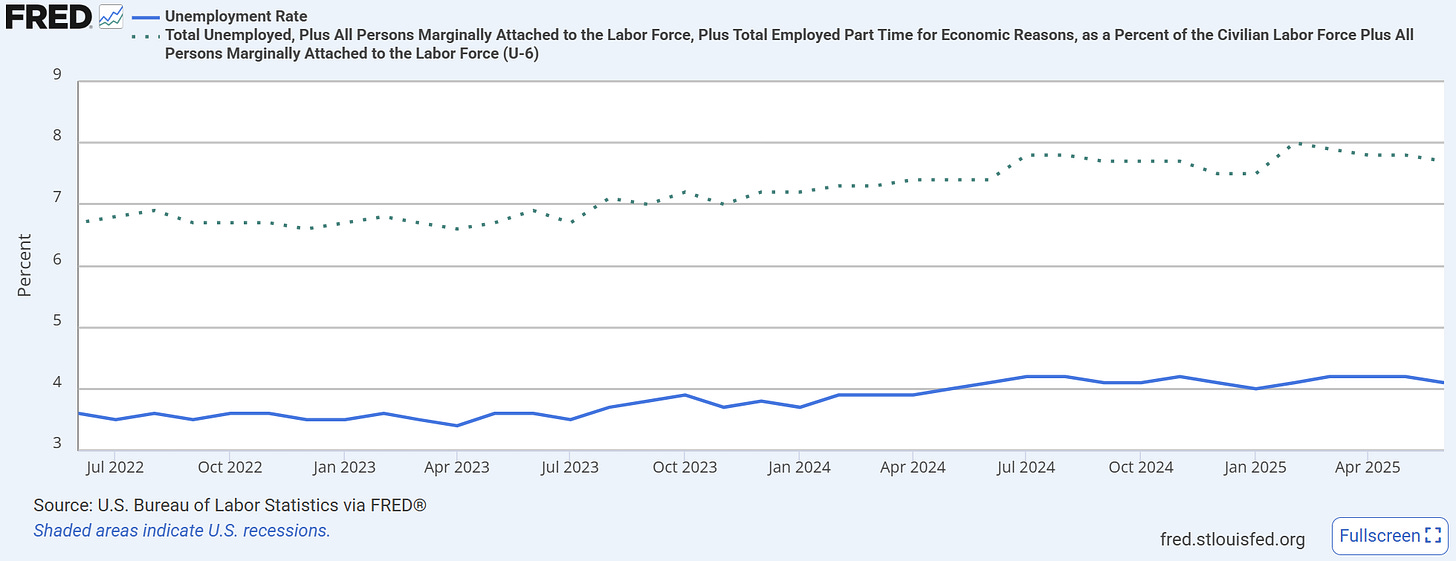

The unemployment rate also fell to 4.1%. The monthly breakeven rate has probably fallen to something closer to 50k…

…as slower net migration slows the growth in the labour force just as the participation rate declines.

“Bond vigilantes”

I had a chuckle at Liz Truss’ post below this week.

Albert Edwards was also out with a “bond vigilantes” note this week about the UK and its fiscal situation. All emotion, no fact. A political stance masquerading as market commentary.

The Gilt curve continues to trade at a sensible level, which has steepened less than most of the rest of the world…

…while it has recently traded stronger than German Bunds despite the ECB cutting rates by an extra percentage point.

Tariffs are back

Trump’s move against Brazil to slap them with 50% tariffs for political positioning is a clear sign that confidence has returned to an admin that was scared away by market volatility in April.

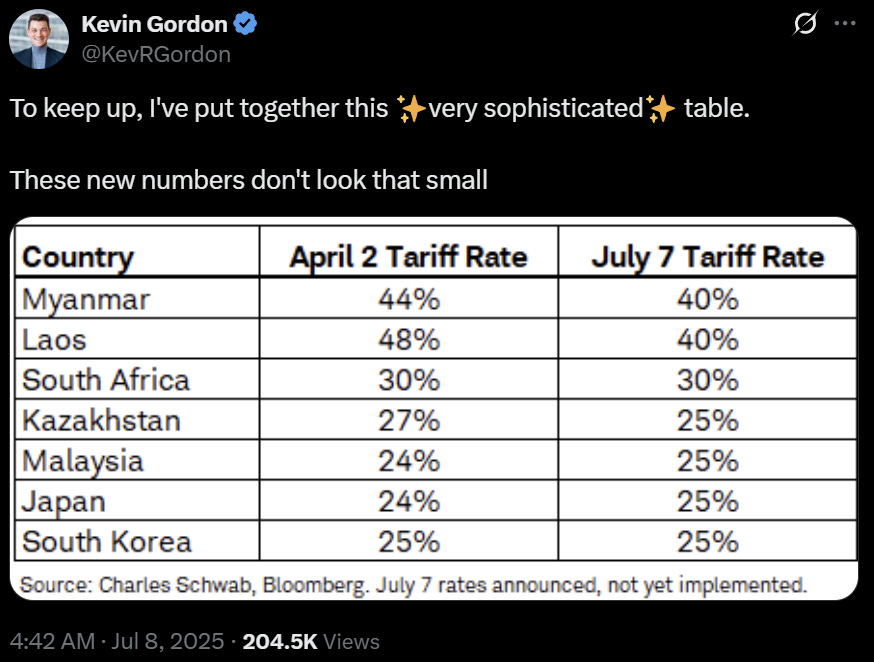

While deadlines have been pushed back to August 1, current absolute tariff levels in a lot of instances are back to what they were in April.

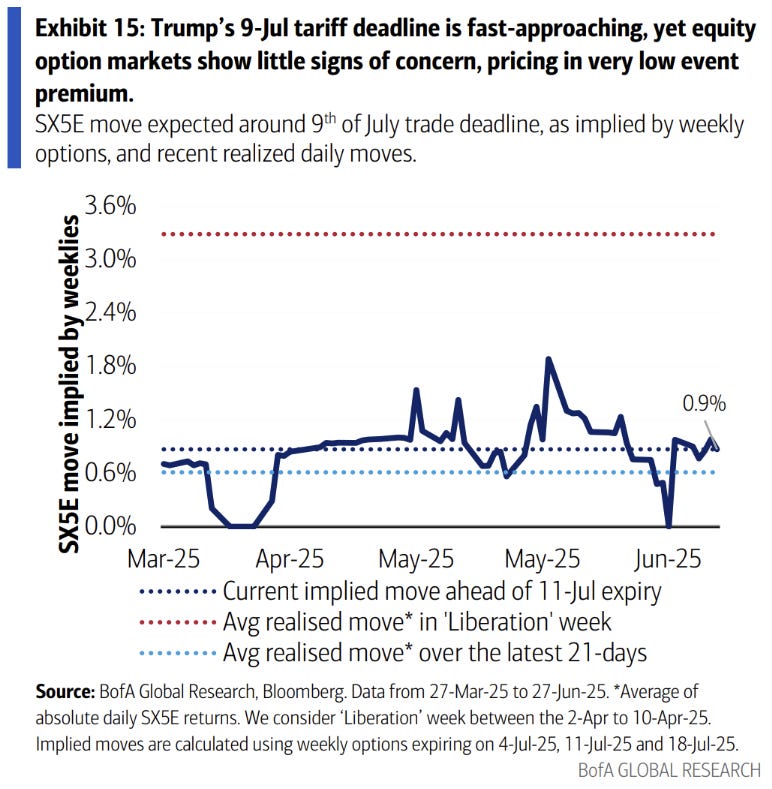

The above chart was produced before the extension was announced. It seems to indicate there was no doubt about an extension, with the market unwilling to pay protection for any closer deadlines.

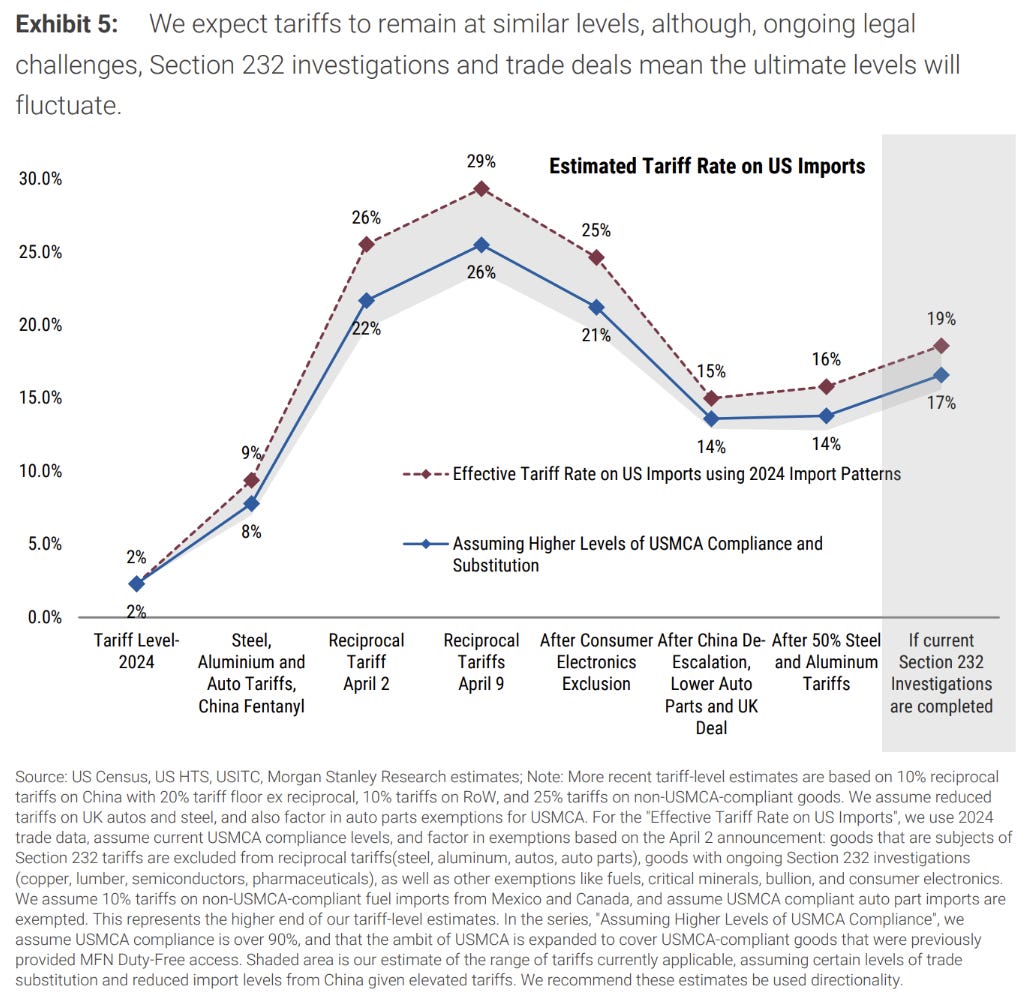

Goldman provides a more up-to-date tariff chart based on different scenarios.

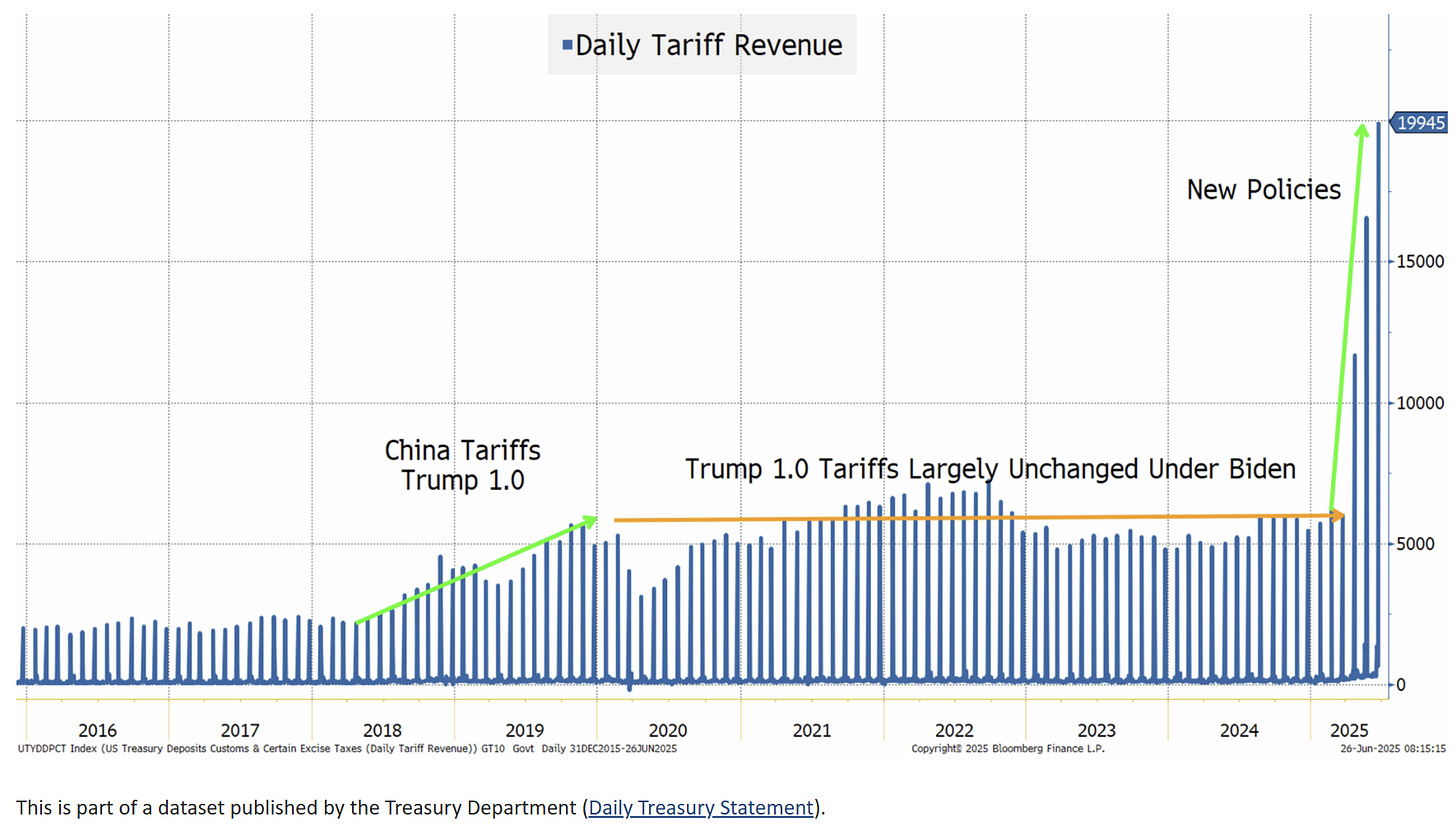

Tariff revenues (not included in CBO forecasts) have started to become meaningful…

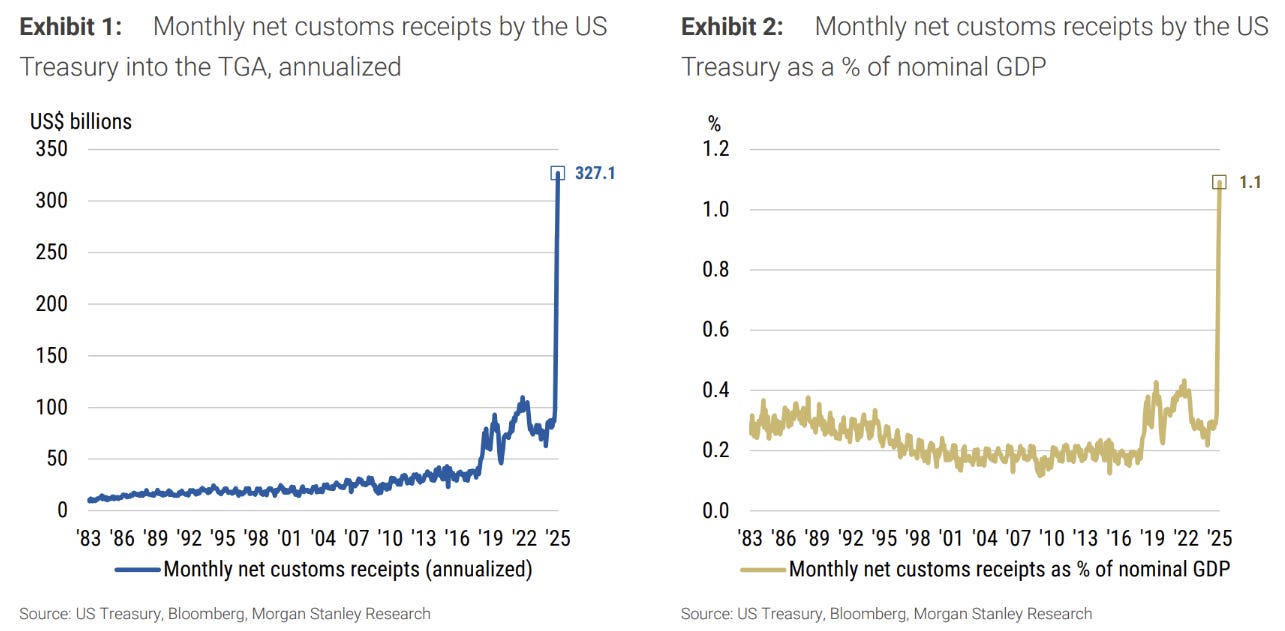

Now totalling 1.1% of GDP!

Morgan Stanley puts the current take into context in an interesting way.

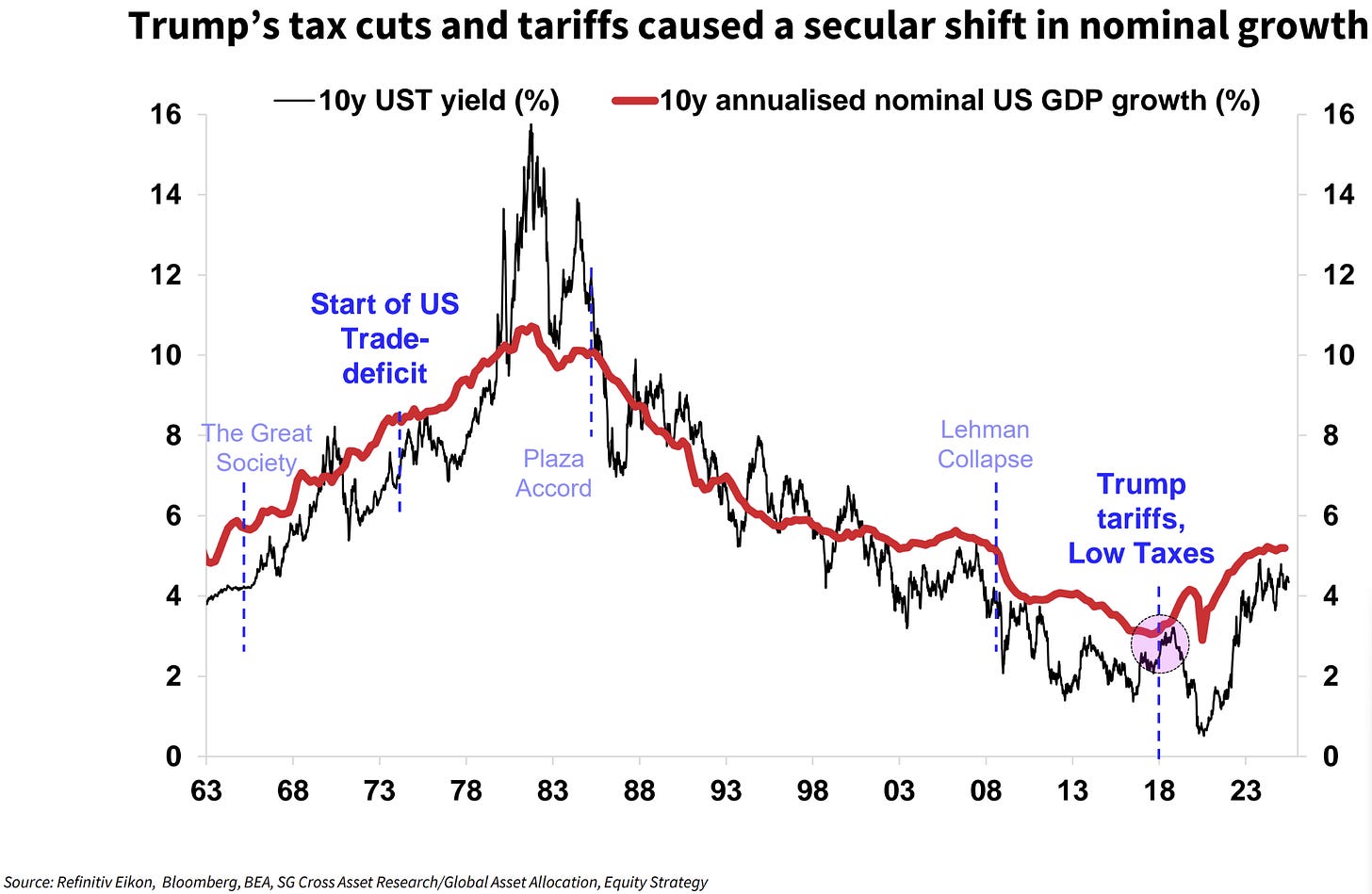

SocGen present an interesting take on the turning points in US nominal GDP growth. Using a 10-year average make some of these questionable (for example the turnaround in nGDP growth in 2018 was due to the GFC rolling off the numbers more than Trump’s actions).

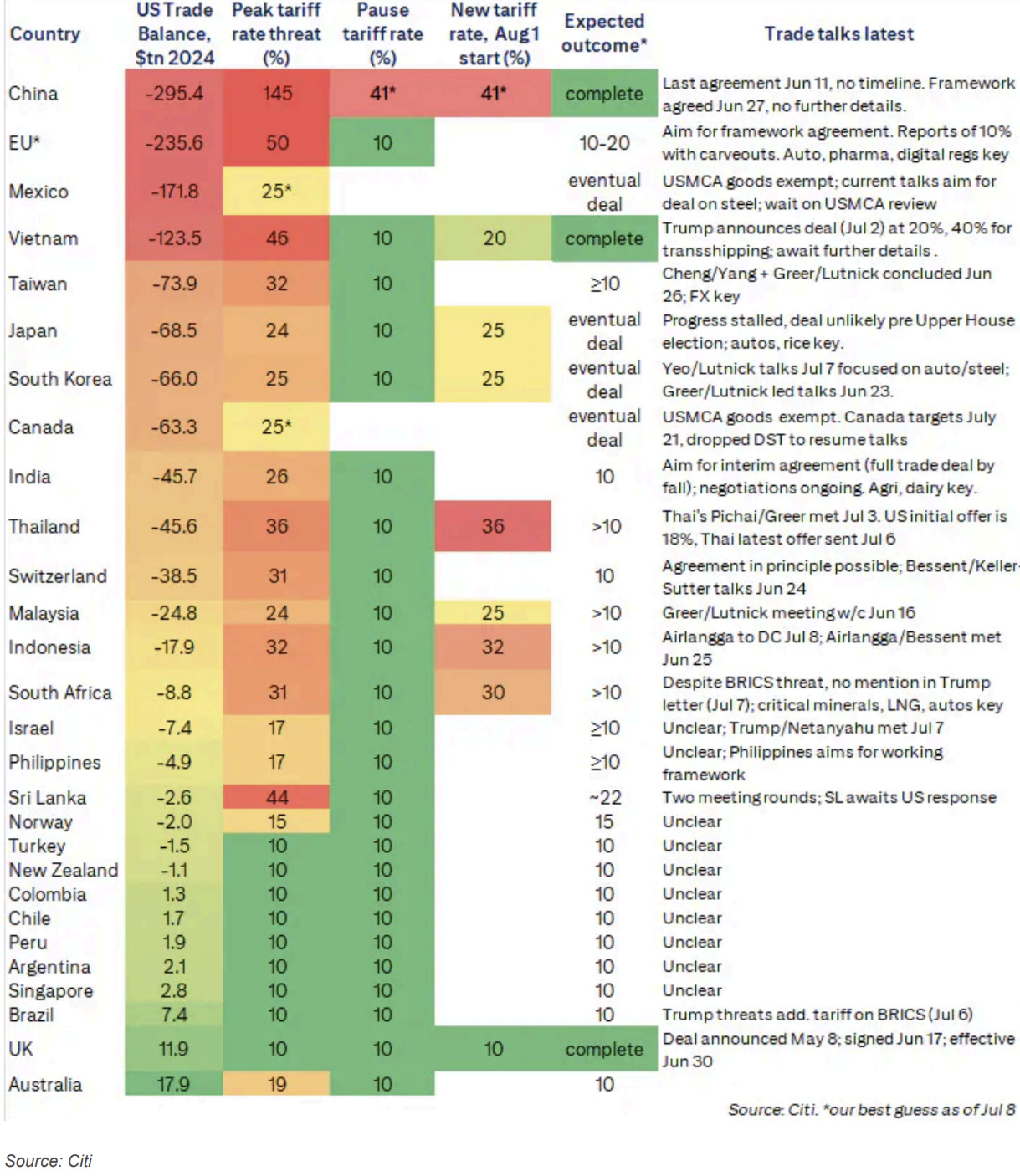

Citi maintain an updated tariff cheat sheet.

Rare Earth Elements

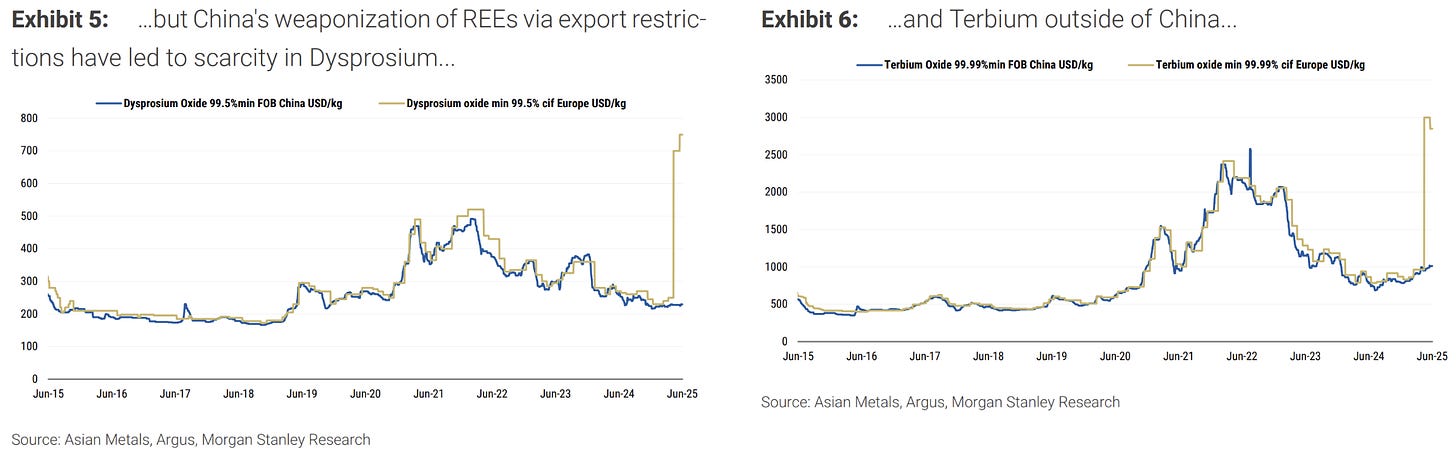

Rare earth elements (REEs) have been at the centre of these trade clashes, especially with those involving China.

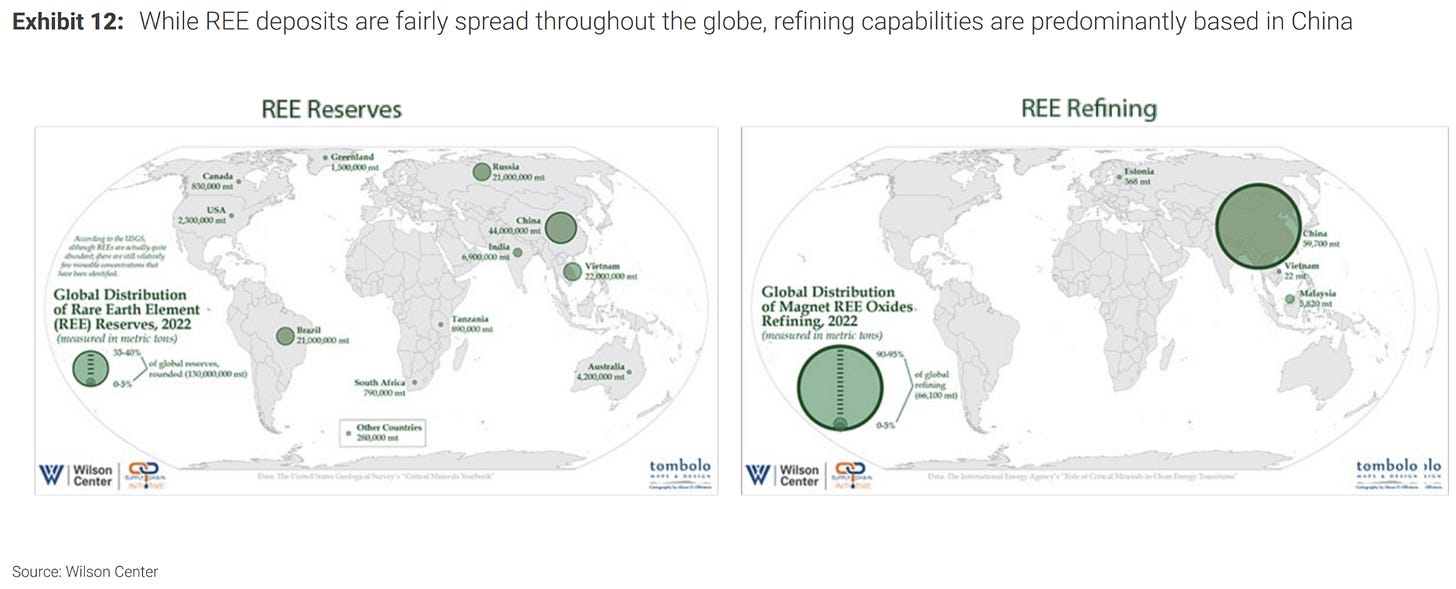

Rare earths are a group of 17 elements that are used in various clean energy, high-tech, and defence applications. Though generally as abundant as base and precious metals, these metals are not easily found in large, high-concentration mineable deposits.

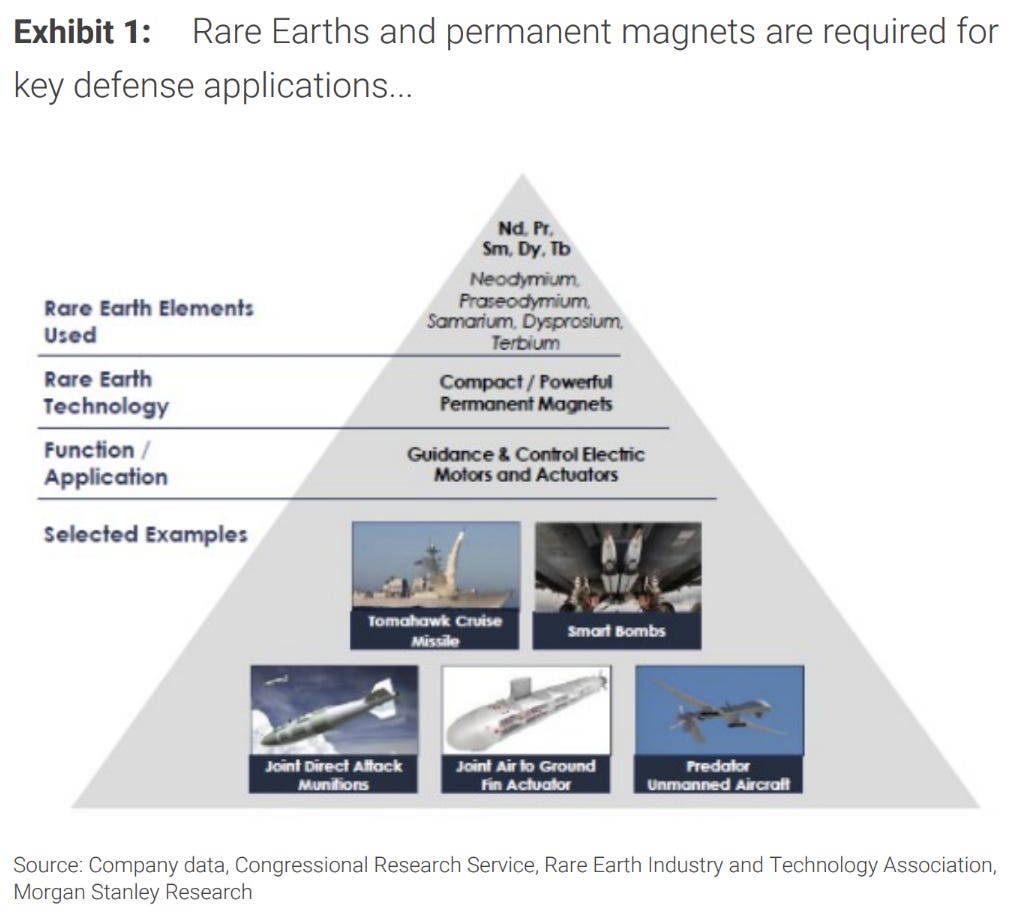

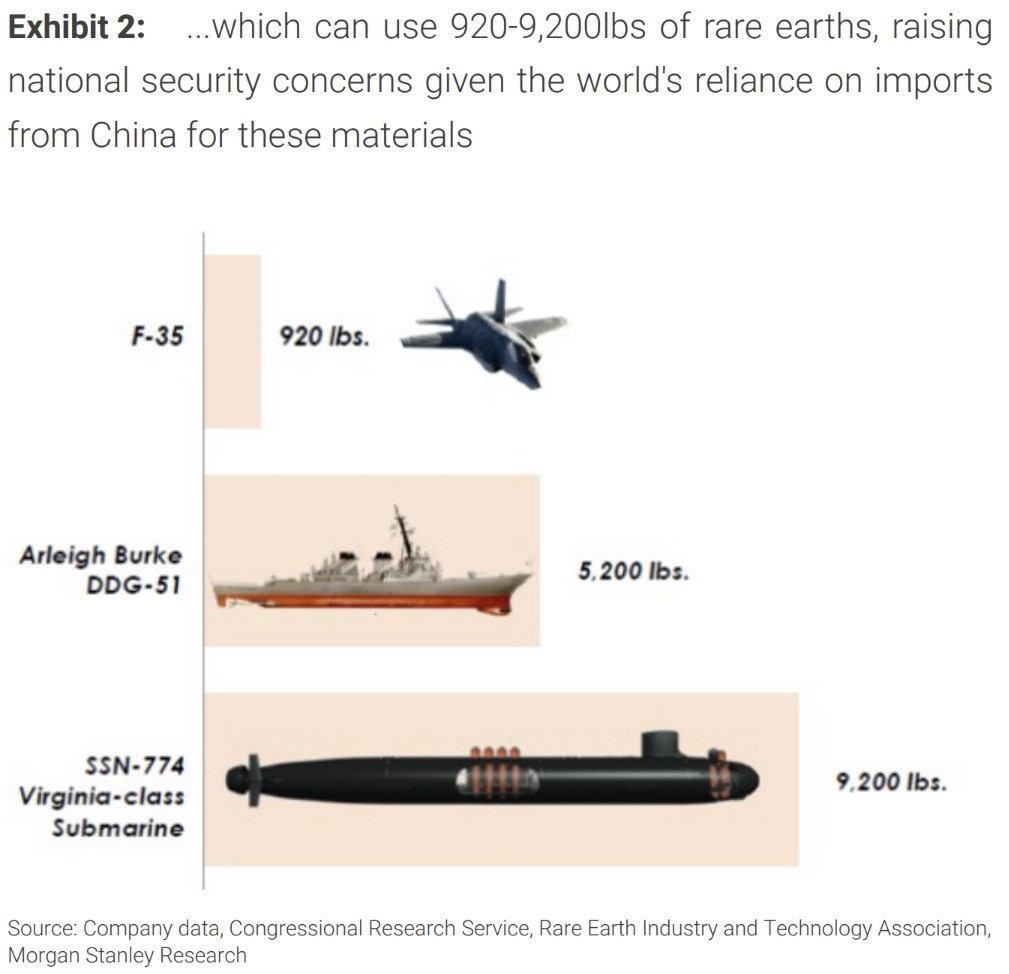

Their importance in defence applications make them a key negotiating tactic for a world that can’t easily replace Chinese supply of refined REEs.

They have unique chemical, optical, electrical, magnetic, and metallurgical properties. As these metals are found together in nature, and their properties are similar, separation into oxides is technically challenging.

So, while reserves are spread out, refining mostly occurs in China which is where the leverage arises.

The refining side is being relocated, but it produces pollution, requiring complex environmental processes in markets with stricter environmental controls, explaining the current location of most processing plants in China and Malaysia. The magnet part of the value chain is the most difficult to replace, given China's know-how, and currently only China and Japan are capable of producing magnets at scale.

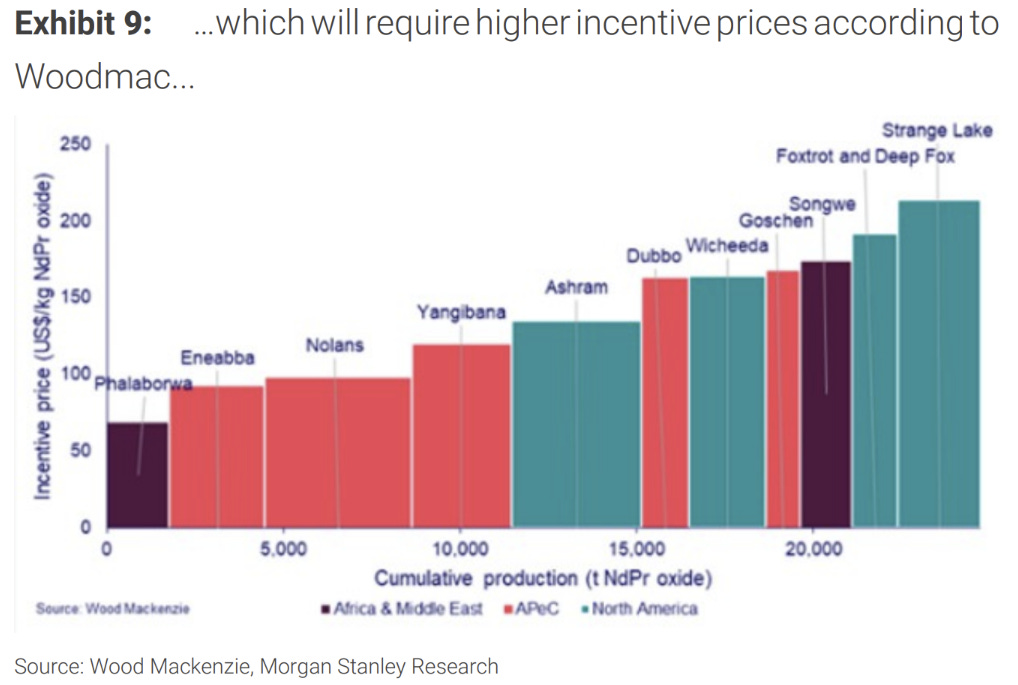

Refining capacity is coming online, but the higher cost of production in the west will likely require higher pricing.

Auto manufacturing is currently surviving on stockpiles, with only a few factories slowing down production due to shortages at the moment. While China is not exporting the REEs directly, it is allowing companies to obtain permits to manufacture what they need (e.g. EV motors) in China and export the finished good.

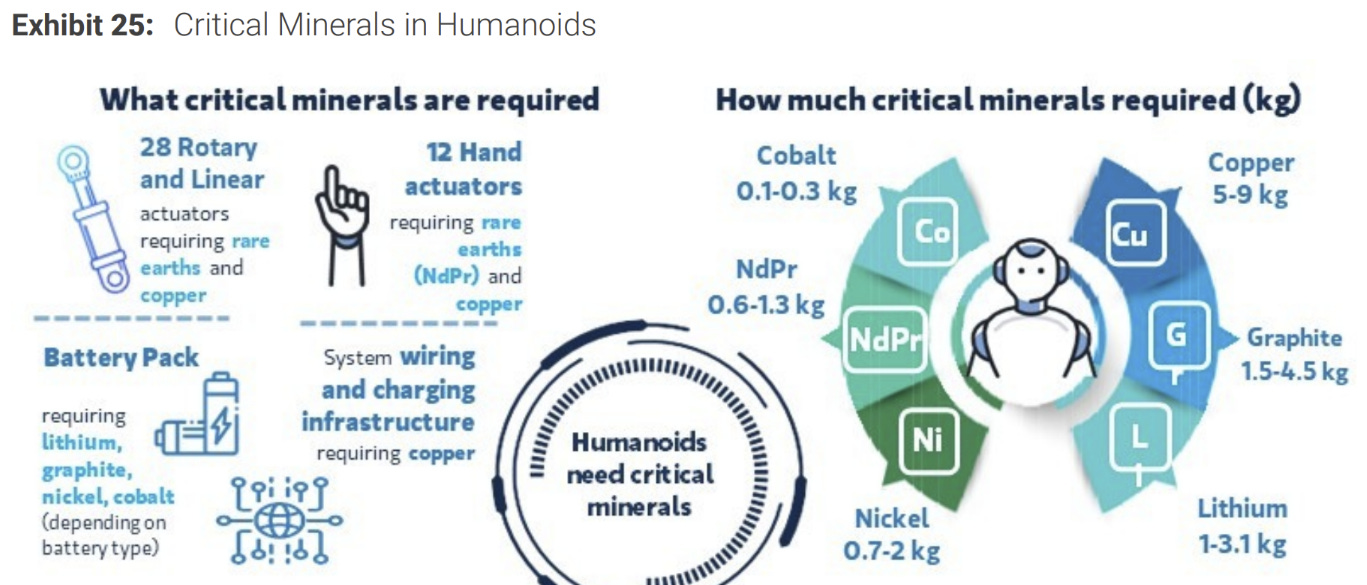

Robotics, an emerging theme, requires many of these elements.

The Dollar

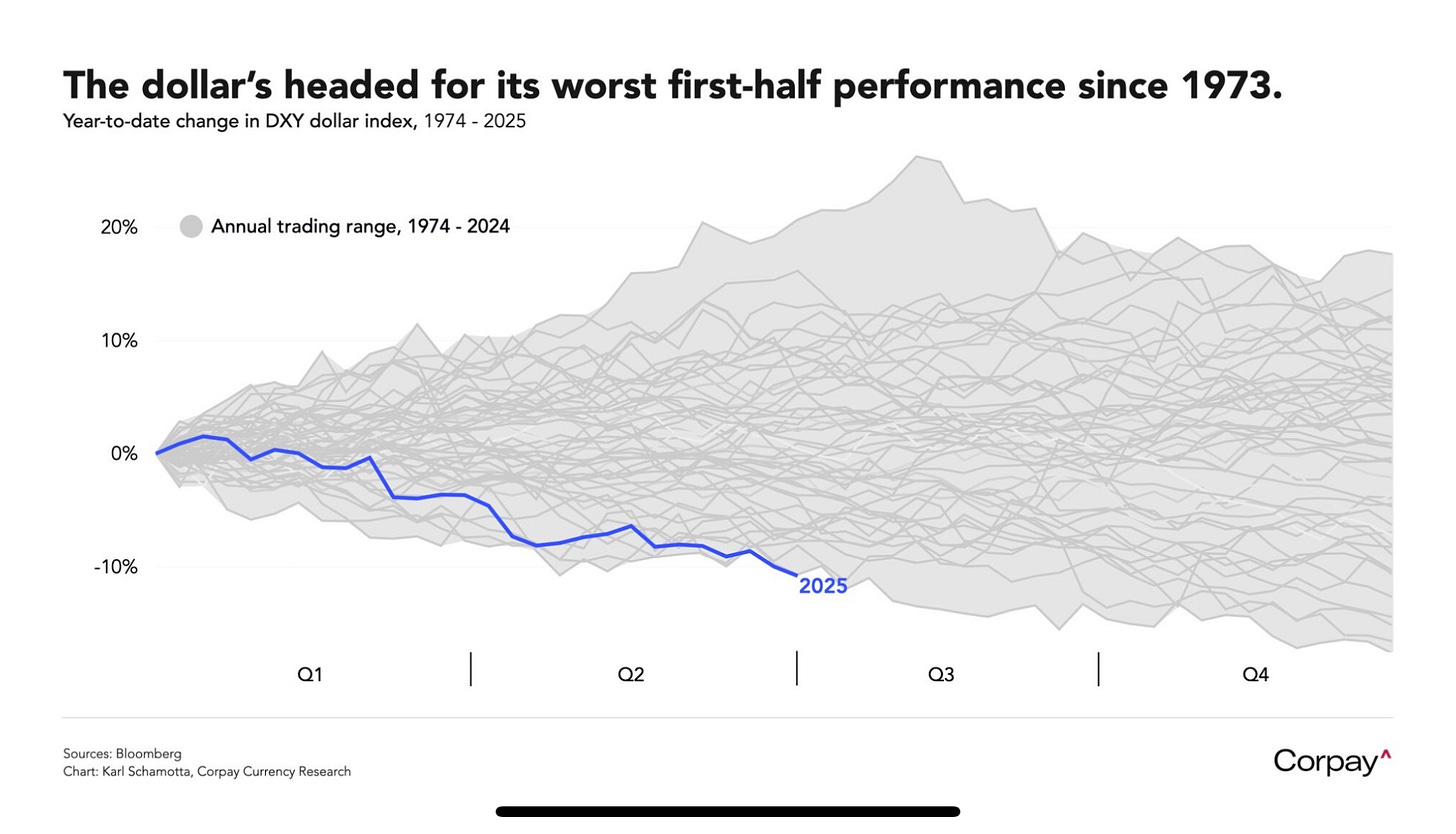

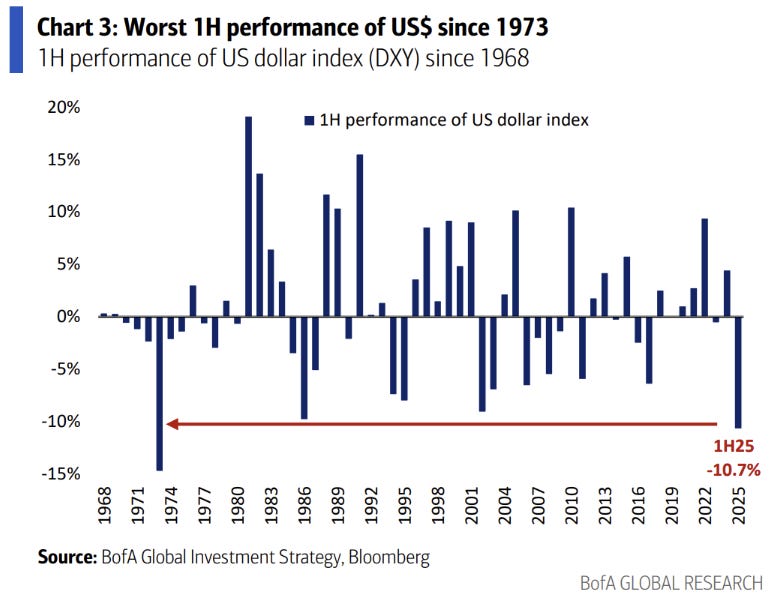

While USD charts seem to be basing a few more charts highlight the extent of the move.

The current move surpasses that of the Plaza accord but not the early 70s.

Thank you for sharing these pieces and for taking the time to write them, Mr. Farac.

Best,

Valentino