The loudest politics might emanate from the US, but the ramifications continue to be in Europe.

German Election

The election on the 23rd can be seen as a referendum on fiscal reform as the last government effectively fell over due to a disagreement on the “debt brake” (structural deficit limit). Changing this needs a 2/3 majority.

Changes to the debt brake are controversial, both at the party and voter level.

On base popularity I would argue changes aren’t desired, but maybe if they are used for “investment”.

A run-down of party positioning is in the table above. AfD would be willing to negotiate on the debt brake if immigration is addressed. At the moment no other party is willing to form a coalition with AfD or negotiate on immigration so a block here would require AfD to obtain more than 33% of the vote.

Betting markets are having a go at guessing how the coalitions work. Highly uncertain to say the least.

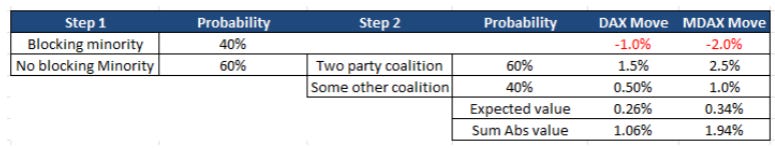

Risk neutral pricing seems to suggest a bullish outcome as long as a blocking minority doesn’t eventuate.

Fiscal stimulus scenarios (BofA summary):

Most bullish: 2-party coalition of CDU/SPD winning over 50% of vote leading to “fiscal 'bazooka”/constitutional change of German “debt break”

Bullish: Multi-party coalition and one-off fiscal stimulus in ’25

Bearish: far-right/left AfD/BSW parties win >33% of vote resulting in no stimulus/policy stalemate (as mainstream parties unlikely to vote for AfD/BSW immigration demands in exchange for fiscal stimulus)

Along with Ukraine there’s a lot riding on European outcomes in the next few weeks!

Central banks

The RBA did end up cutting with a strong consensus, but the Governor put forward a hawkish view of forward cuts. Suspicion is that the politics dominated over the economics. I would agree.

The RBNZ delivered another super-sized 50bp rate cut.

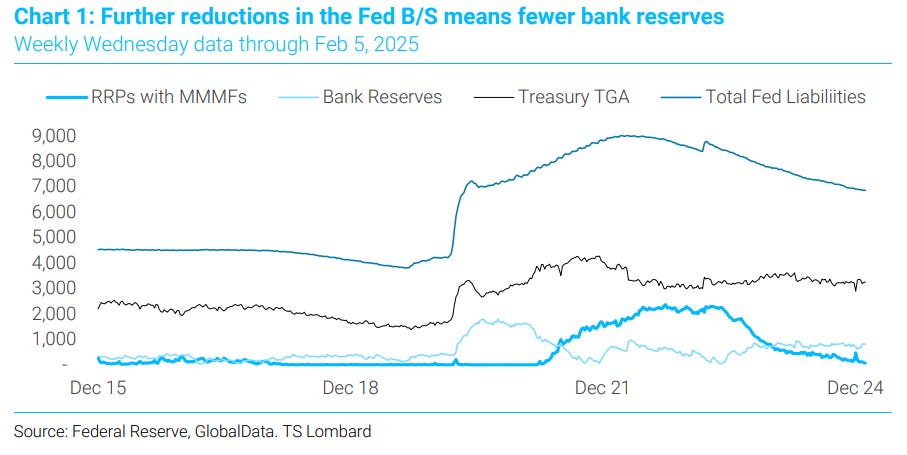

Further chatter around QT ending this week with the Fed minutes suggesting it will happen soon.

With RRP falling to zero, bank reserves, which have remained sufficient, would fall next if QT continued.

The hope is to encourage private lending which really needs a shot in the arm (chart from my next newsletter).

Tariffs

Emerging Asia not in a great position with the threat of reciprocal tariffs. Something to watch.

Ukraine

Negotiations have seemingly begun between the US and Russia (with Ukraine absent, to the disgust of many).

There isn’t enough space to write my thoughts here. Suffice to say it will be good for Europe to have this war over, and it will be good for Russia to have this war over.

How that is achieved will be interesting to say the least.

Frozen USD assets to help pay for reconstruction? At least some of them will, likely some being returned as part of a deal.

Dubai might be the only loser out of peace.

In the meantime, gas bound for Europe found a home elsewhere…

…and switching this back might give the ECB more chance to cut (despite Schnabel suggesting otherwise this week).

Trump’s adversarial nature towards Europe has got them thinking about delivering what he actually wants - bigger spending on defence. Uniting European bureaucrats is what Trump does best.

Italy is underspending a left in a tough position here with BTPs at record tights to Germany. Part of this is German maybe not resembling the AAA credit it is, with Bunds selling off pretty hard this week on issuance concerns.

Italy trading at tights with the budget position it is in, and the possibility of further spending seems at odds to me.

No DAX chat this week

Despite all of these politicking equities are unfazed. Can anything disrupt this run?!?!