Post central bank fallout

The negative tone of the ECB press conference carried through the week in pricing, with roughly another cumulative cut added to the tally and pushing the “terminal rate” under 2%. Front-end has maintained pricing but Euro long-end has languished a bit.

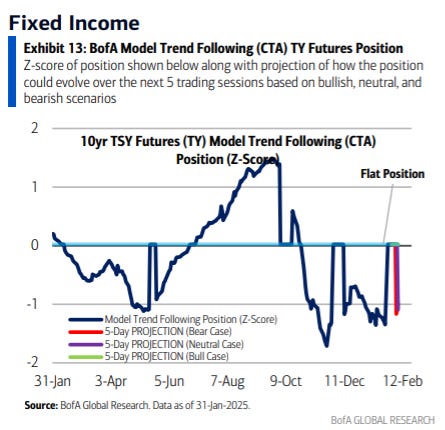

No action in the front-end of the US, but long-end has seen some buying on CTA flow (and an unchanged Treasury refunding announcement) pushing 10y yields towards 4.4%.

CTAs are flat now but will react in either direction from here.

Manufacturing surveys

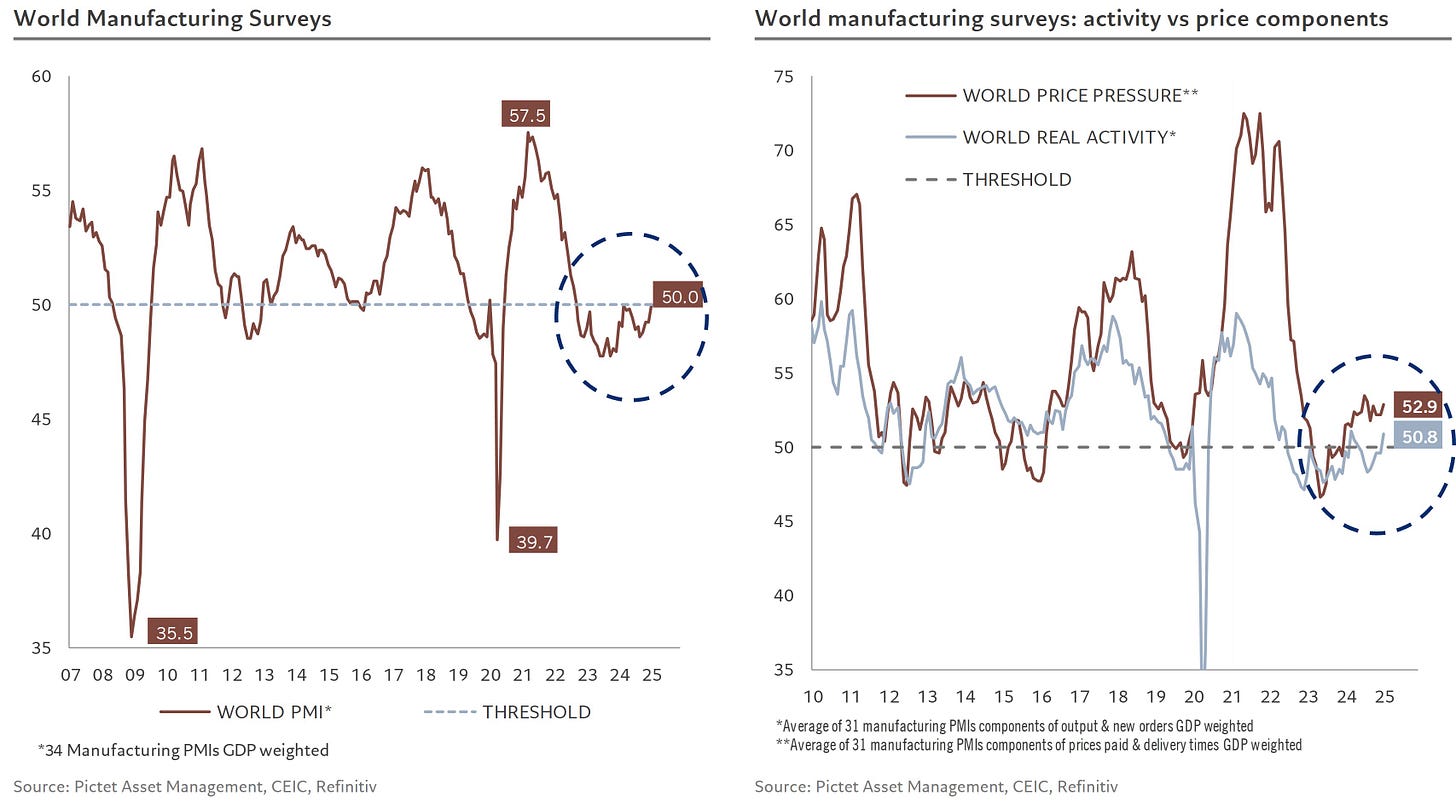

The new month sees surveys released globally, and the story is generally good for developed markets. US and globally weighted indices are showing >50 results for the first time since 2022. Growth is turning up.

MS tracks restocking-destocking as a measure and we are now in the restocking phase. Good for equities and bad for bonds.

China was a slightly different story however with a weaker headline and continual troubles regarding deflationary pressures which only help to drive their incredible bond rally.

US GDP

Another very strong result, with personal consumption and thus real final sales continuing the US exceptionalism story. Will DOGE related cutbacks slow this down? The numbers don’t seem big enough yet.

Persistently high rates continue to hurt homebuilders through static non-residential investment, but non-res is picking up the slack.

The shortest trade war ever

Not that much to talk about here. Your view on the resolution of the first round of tariffs will depend on your politics, but interesting developments have happened none the less.

Most interesting has been the Chinese refusal to start currency devaluation, setting the fix lower than where we were in January.

A generally strong dollar hasn’t really translated to a weaker Yen, causing some pullback in my favourite CNHJPY cross. The trend is still intact, however.

Mexico, with a very large trade surplus with the US, has experienced pressure through a higher USDMXN. Exports are also closely linked with domestic investment there.

Equities

DAX continues its incredible run, shaking off the tariff drawdown by surging to a new all-time high.

The crunch in volumes trades (here, the DAX future) is extremely concerning.

CTA positioning is very heavy here as well. With low volumes a turnaround could be nasty.

German election on the 23rd of February. Are polls understating AfD’s chances in a Brexit like situation?

Jim Reid put out an interesting long-term piece on equity pricing. Not particularly actionable, but some interesting charts here.

S&P 500 earnings closing the gap with nominal GDP growth.

Corporate profit growth lines up with increasing government debt…

…which seems to benefit the largest only.

Credit spreads on an adjusted basis are at historic lows for both IG and HY. There seems to be unlimited demand for credit in whatever form it comes.

Great insights as always! May I follow up on your bullish view on CNHJPY: I get the bullish CNH part, but why against JPY? Isn’t CNHCHF or CNHUSD a better choice? Thanks 🙏

Do you think the unlimited credit demand is linked to foreign investing because of the high USD? If USD would weaken, than credit spreads could widen?