Charts & Notes: Growth scare? Or hidden tech bust

Trump jitters and tech concerns more of a worry than global growth

The US growth scare narrative is bunk, in my opinion. Market jitters are related to a US Tech rollover and discontent with Trump’s aim and method.

I posted a few weeks ago on “global growth upturn” on the basis of better PMIs and this is still the data to focus on.

The invented narrative hides other weakness in US tech and general jitters about the breakneck pace Trump seems to be changing the rules and incentives of how the world works.

Growth Scare?

The US growth scare narrative originated from a combination of weaker retail sales and second tier consumer sentiment data.

Retail sales affected by autos, but even with an exclusion are still trending higher over the year.

A broader form of measures doesn’t reveal any concerning trends so far. Atlanta Fed GDP now also showing PCE growing at 1.5% for the quarter so far (chart later).

Consumer sentiment data off and inflation expectations higher. These surveys aren’t great indications of future market movement historically.

PMIs, which I highlighted in the “growth turning up” note is manufacturing related and is broadly global in nature.

Services surveys have turned down, however. Services PMIs have a much lower correlation with the global business cycle, despite developed economies having much larger service sectors. Manufacturing is just far more cyclical, and a better indicator.

This can be seen in the chart above, with the US ISM showing a strong 4-year cycle tracking the business cycle. It is notable that it hasn’t shown an uptick yet this “cycle” and highlights the difficulty of this extended deficit driven expansion.

Europe on a net basis is looking more positive than it has for a while, as I previously noted. France is the only drag here.

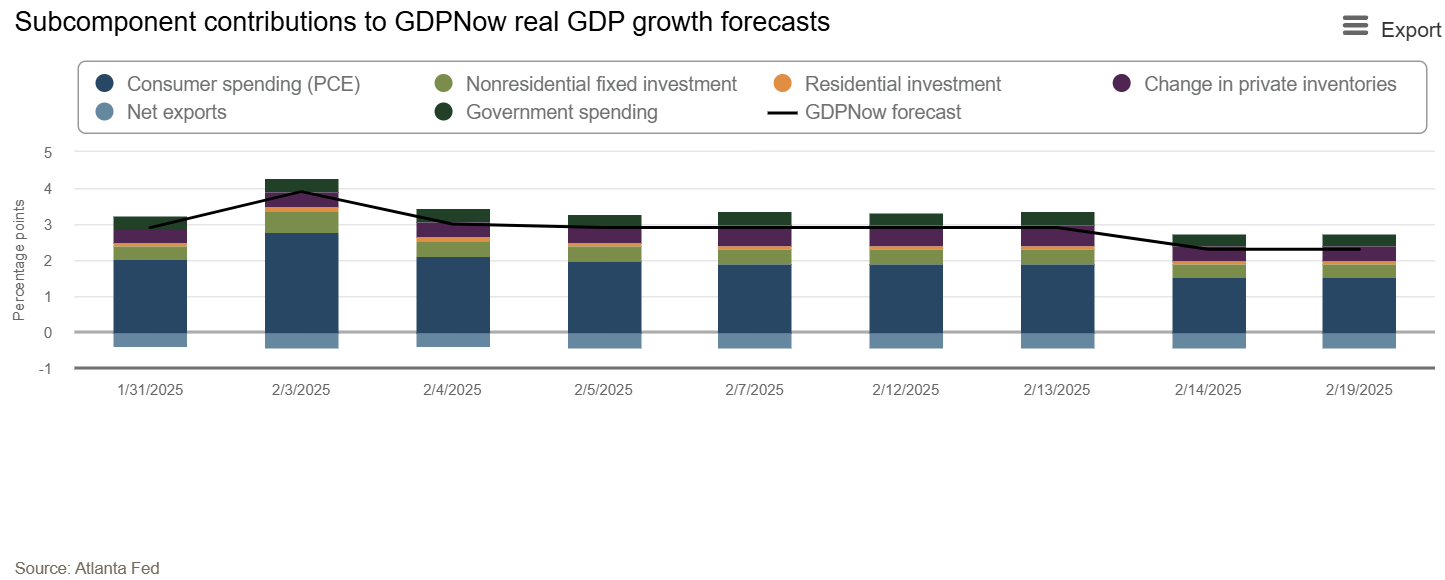

The Atlanta Fed GDPNow forecast of this quarters US GDP growth has been hit on lower retail sales data. Consumption still sits at 1.5% growth and pointing towards a 2.3% expansion of GDP in the quarter.

This 2.3% is also dragged by another -0.4% in net exports which continues from the December quarter and likely represents pull-forward demand because of tariffs. Other data supports this. This is expected to reverse as demand can’t be pulled forward forever.

Relative to potential the US is still running hot.

US Tech & valuations

More relevant for the risk-off sentiment is the topping of US Tech earnings expectations.

The chart above highlights a similar setup to end-2021 with downward forecast revisions (Albert Edwards).

Many ways to interpret the chart above. Does it highlight a divergence from tech dominated indices as economic drivers, or is the ISM a misleading signal right now?

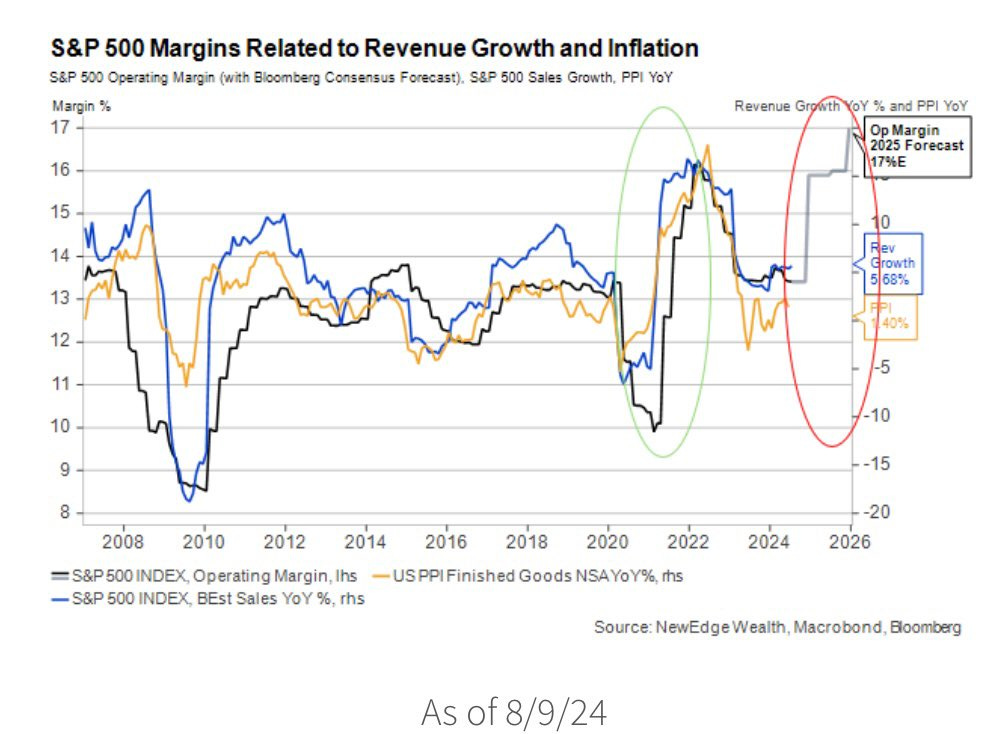

The (old) chart above (X: @carolinedawson) highlights the frothy forecasts in the S&P500 that are needed to maintain the multiple they are trading at.

More up to date negative revisions put further pressure on valuation. Note the degradation in the Nasdaq relative to others, this supports the earlier charts.

Credit hasn’t seemed to have got the memo. Since credit isn’t a thing cash-rich tech companies have had a need for, there could be a further hint here.

Markets

The Nikkei is setting on some precarious levels here, opening up significant downside.

VIX futures not fully representative of realised volatility in my opinion. We’ve held this <20 range for a while now…

…which has put a freeze on easy roll down the curve gains in VIX futures. It takes a vol shock to dislodge it and resume the carry game.

S&P500 futures are sitting just above the 200d MA with recent moves. It has outperformed the Nasdaq by ~3.5% since the highs.

Risk-off has driven the USD higher despite the announcement of more tariffs on Europe and China. AUD & NZD under pressure as risk sensitive currencies, a role which the Yen has shaken off largely with its divergent monetary policy.

The US 5y should be the most sensitive in a real growth scare but the move has been measured and hasn’t resulted in a bull steepening of the yield curve, a missing feature of the growth scare narrative.

Finally, the US front-end has priced in another ~1.5 cuts YTD. A true growth scare would see a lot more priced in here, with the terminal rate sitting at just a little over 3 cuts.