Short one this week - I’m travelling and to be fair it’s a good time for anyone macro to take a break since there isn’t much data being published.

FOMC

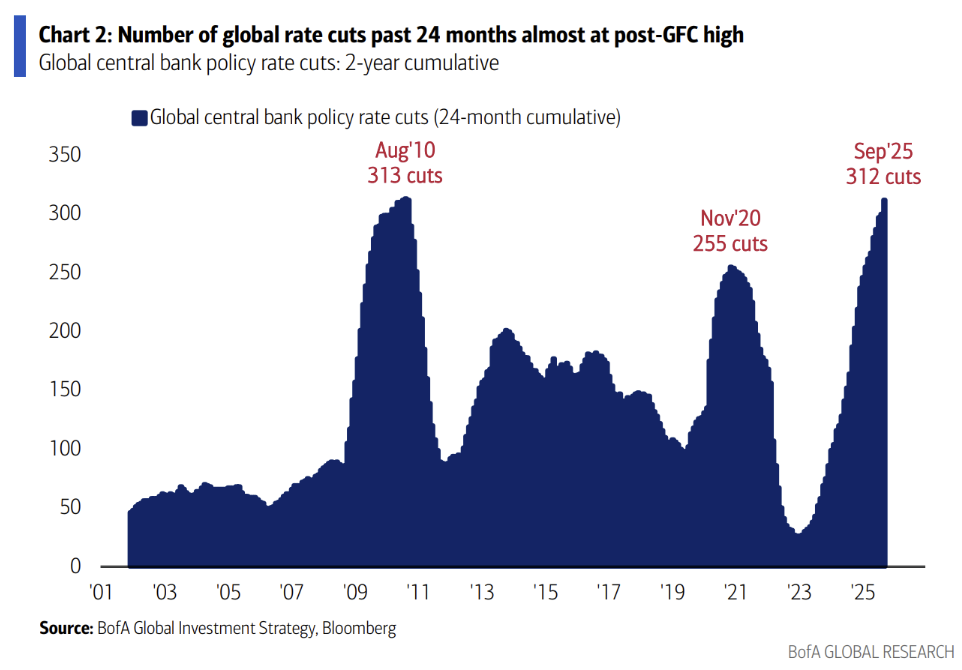

The chart above was produced before the Fed cut rates again yesterday. The 2-year window chosen by BofA above is handy for this purpose, but the point it makes still stands.

The decision yesterday was the textbook definition of the “hawkish cut”.

To quote Powell:

A December cut is not a foregone conclusion…FAR FROM IT.

Emphasis mine.

This saw a repricing of the front-end as December (as I mentioned last week) WAS a foregone conclusion. Dec-2026 rates stepped back around 20bp from the equity volatility influenced highs.

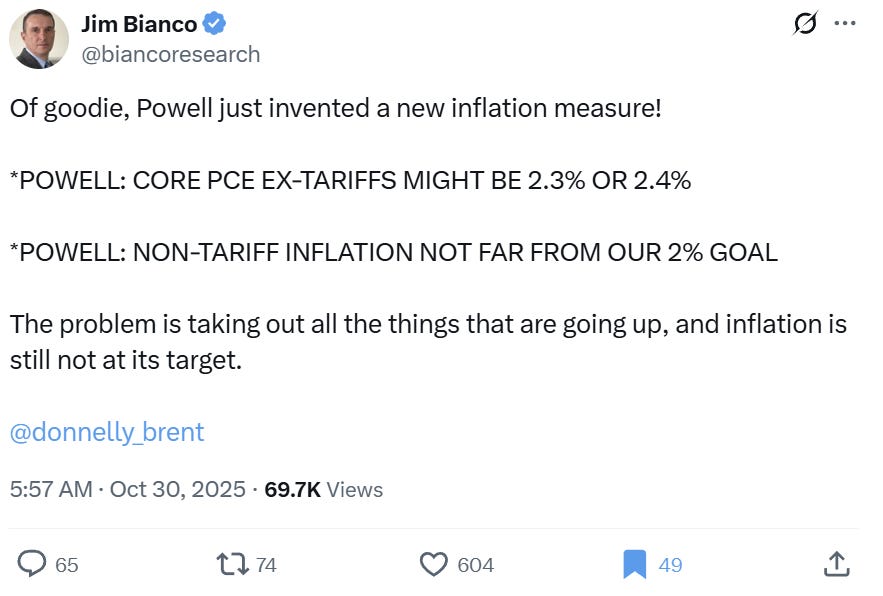

The other interesting tidbit is highlighted by Jim Bianco below.

I can’t blame Powell for looking at this measure - I look it at the same way. There is little his monetary policy can do about the added inflation from pass-through to consumer pricing because of tariffs.

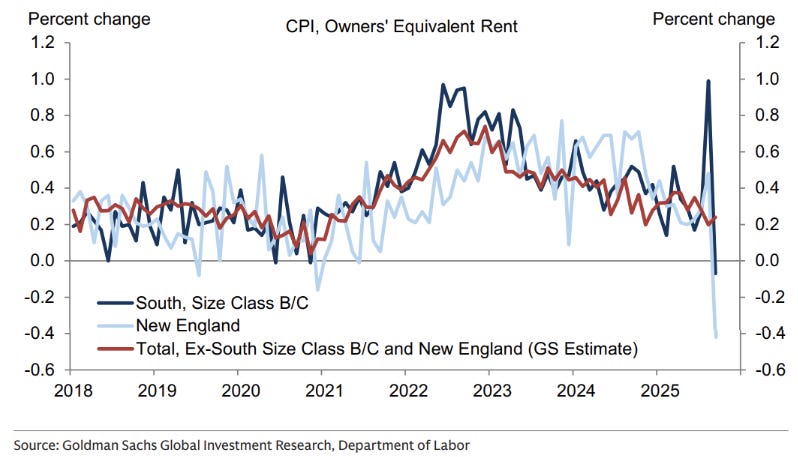

The only piece of data to emerge from the government shutdown was CPI last Friday. This report was soft, with tariffs effects being snuffed out by another low print for Owner’s Equivalent Rent (OER).

From Goldmans:

The owners’ equivalent rent (OER) component decelerated to 0.13%, its slowest pace since 2020, mostly reflecting a normalization in small Southern cities after a spike last month and a noisy drop in New England to the lowest pace on record.

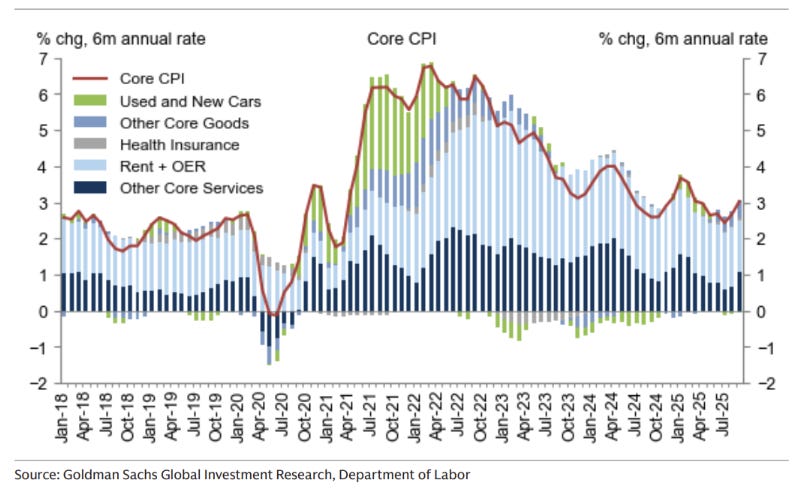

Core CPI rose 0.23% in September, below consensus expectations, and the year-over-year rate ticked down to 3.02%, continually landing pretty much where everyone expects it to be, mostly because that is where the Fed’s untold target is now.

Core goods inflation was firm at 0.22%, largely reflecting increases in apparel, recreation goods, household furnishings, personal care, and new car prices.

On a 6-month annualised rate you can really see the effect of tariffs in the purple above.

Australia

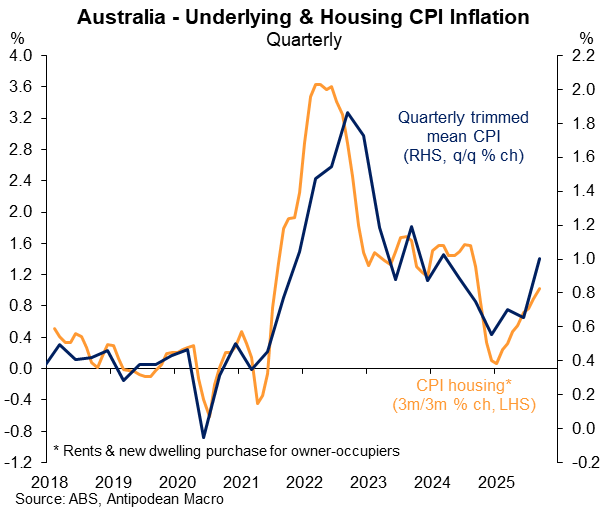

Upside down Australia saw the opposite occur, with rents picking up on very low vacancy rates which has turned a market from expecting interest rate cuts into the end of the year to now talking about hikes!

The latest CPI annualised at more than 4%, putting the RBA in a difficult position when many were saying it was too early to start the cutting cycle.

DM central banks rarely deviate much when it comes to narratives. Remember the real legacy of a central banker is in the eyes of their peers and not what politicians or citizens think of them.

Engagement bait

The post below got plenty fired up on X this week.

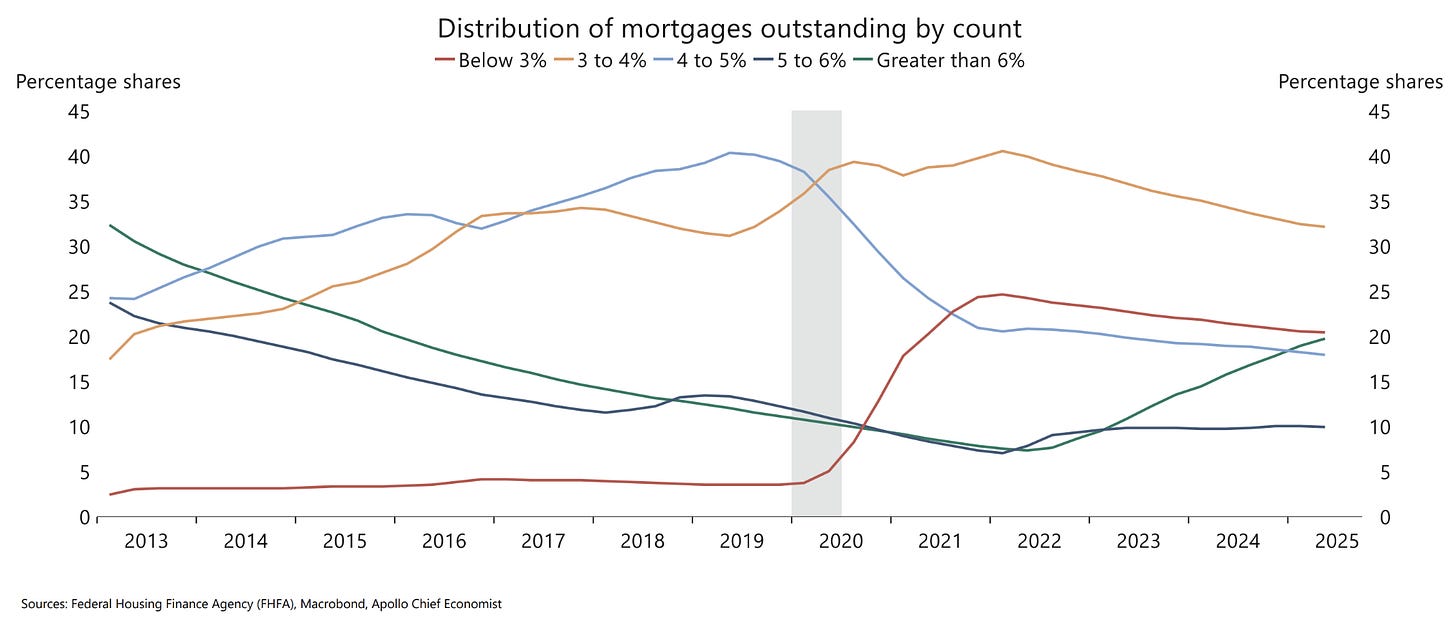

Most replied with their view that this was financial stupidity as the rate is so low that keeping a balance in your mortgage and investing it almost risk-free elsewhere makes much more sense.

On the numbers you can’t disagree with this at all.

I would argue that there is some monetary value in the psychology of being debt-free. The utility of this would differ for everyone.

I think that this is only useful in the case where you have a lot of other liquid investments, however. If things turn south in your life, holding onto that (low cost) capital can see you through a period that where you can’t earn. Once you pay it back to the bank, there is little chance you’ll get it back if life circumstances mean that you aren’t earning an income. Getting back at that rate is obviously impossible.

Many also commented on how ecstatic the bank would be seeing this mortgage paid off. That really depends on how you look at it, because banks hedge themselves against this sort of prepayment risk.

A bank would account for some prepayments by what many would deem as “irrational” customers. The further your low mortgage rate drifts from the level of the current mortgage rate, the number of people prepaying would decrease, but it’s never zero.

So, while the bank might be very happy this man decided to pay off his low-rate mortgage, they also might be seeing far fewer prepayments than their model would have otherwise predicted!

There is still a lot of those low-rate mortgages out in the wild, with current rate mortgages (>6%) still below those <3%.